Thinking about Using Android Pay? Read Our Android Pay Reviews and Guide First

Smartphones do just about everything. Not only do they make calls and texts, guide us with a GPS, manage our lives with business tools, encourage fitness, and help us manage a budget, but they are also a virtual wallet. The Android Pay app is an option for the latter.

If you are interested in using Android Pay to quickly and conveniently pay for all your purchases, you should read through Android Pay reviews first—which is exactly what we have created for you.

Image Source: Pexels

In this year’s guide to using Android Pay, we are going to fill you in on absolutely everything you need to know about this app, including:

- What it is

- How it works

- Whether or there is an Android Pay limit

- Where you can find Android Pay locations

- What companies and apps have Android Pay support

- Whether you belong to Android Pay banks

- If you can rely on Android Pay security

- An overview of the Google Play Store Android Pay reviews

- A look at other online Android Pay reviews

By the end of this guide, you will know if downloading and using Android Pay is the right choice for you.

See Also: Payable Through and Pass-By Accounts | Definitions

What Is the Android Pay App?

Before we get into any of the Android Pay reviews, let’s take some time to go over the details. We will start with the basics: What is the Android Pay app?

The Android Pay app lets you pay for your purchases both online and at Android Pay locations without pulling out your debit card or credit card.

Not only can you add your credit cards and debit cards to the Android Pay app, you can also add loyalty cards and gift cards. This means anything you need to do for your consumer transactions can all be done by using Android Pay.

As the name suggests, using Android Pay is specifically for Android phones. Apple phones are not compatible.

The Android Pay app is free to download.

There is no Android Pay limit specifically in the United States. The only limit would come from your own debit or credit card. In this case, the Android Pay limit would hit whenever you hit your credit limit or run out of funds in your bank account.

How to Use the Android Pay App

The process of using Android Pay is extremely simple:

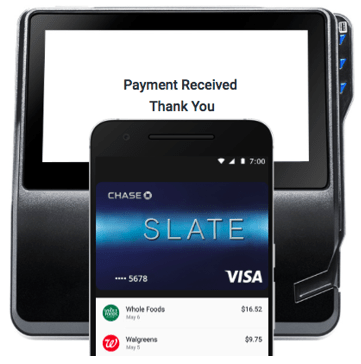

Image Source: Android

- First you download the Android Pay app from the Google Play Store

- Then you add your credit or debit card from a participating Android Pay bank

- Then you can pay at any of the Android Pay locations (see below)

- Make sure your phone is unlocked

- Hold it to the paying terminal

Downloading the Android Pay app is all you have to do. You do not even have to open it as you are using Android Pay.

Don’t Miss: Best Online Bill Pay Services | Banks with Top Bill Pay Tools

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Where Can You Use the Android Pay App?

All around the world there are millions of stores that are now set up as Android Pay locations.

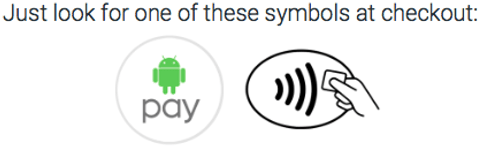

To know whether you can be using Android Pay for your transaction, look for either one of these symbols, which mark Android Pay locations:

Image Source: Android

When you see one of these symbols, it means you are now in one of the Android Pay locations and can begin using Android Pay.

There are more and more stores turning into Android Pay locations all the time. The Android Pay app highlights some of the most popular companies now offering this service.

Here are some businesses with Android Pay support:

- Best Buy

- BJ’s Wholesale Club

- Bloomingdales

- Coca-Cola

- Dunkin’ Donuts

- Express

- Foot Locker

- GameStop

- Jamba Juice

- KFC

- Macy’s

- McDonald’s

- Meijer

- Panera Bread

- Peet’s Coffee

- Petco

- Staples

- Subway

- Toys R Us

- Trader Joe’s

- Walgreens

- Wegmans

- Whole Foods

Using Android Pay App Online

Aside from Android pay locations, you can also use the Android Pay app online. Using Android Pay is possible through many apps and through Chrome.

This way you do not have to type in your credit card information each time. All you have to do is choose Android Pay at checkout.

Here are some of the most popular apps you may use that now have Android Pay support:

- Airbnb

- Chick-fil-A

- Doordash

- Dunkin’ Donuts

- Groupon

- Grubhub

- Instacart

- Jet

- Lululemon

- Lyft

- Open Table

- Overstock

- Postmates

- Seamless

- Ticketmaster

- Uber

- Yelp Eat24

- Etsy

Which Android Pay Banks Are Accepted?

Since you are connecting your credit card and bank account information to the Android Pay app, you will want to see which Android Pay banks and credit card companies are approved.

To see a complete list of all Android Pay banks with Android Pay support, see the website’s comprehensive list. In the meantime, here are some of the most common institutions that are now Android Pay banks:

- American Express

- Bank of America

- BBVA Compass

- Capital One

- Chase

- Citi

- Discover

- Navy Federal Credit Union

- PNC

- Regions

- TD Bank

- US Bank

- USAA

- Wells Fargo

Android Pay Security

No Android Pay reviews could be complete without addressing the number one concern most people would have about using Android Pay: Is it safe?

Since it deals with your bank accounts and credit card information, it is imperative that the Android Pay security measures are top notch.

Here are some of the Android Pay security measures you can expect by using this app:

- Virtual account numbers: Whenever the Android Pay app sends money to one of the Android Pay locations or an online vender, it sends a virtual account number instead of your actual account number.This way your personal information is never being sent electronically.

- Lock feature: If you lose your phone or if it has been stolen, you can immediately lock it from absolutely anywhere using the Android Device Manager.Not only can you create a new password to prevent anybody from using it, you can also clear it of personal data entirely.

- Payment confirmations: See where your money has gone for an extra layer of Android Pay security.

The Huffington Post wrote an article on the Android Pay security and discussed its many security features. However, it does remind users there is no fingerprint scanning like there is with Apple Pay.

Fortunately, a fingerprint integration is being added in 2017 to boost Android Pay security.

Related: Samsung Pay vs. PayPal vs. Google Wallet | Guide | Comparison Reviews

Android Pay Reviews: Google Play

So what type of Android Pay reviews are actual app users leaving? One of the best places to read these reviews is at the actual Google Play Store.

Out of a total of 5 stars, here is the current breakdown of Android Pay reviews:

- 5-star Android Pay reviews: 99,672

- 4-star Android Pay reviews: 28,427

- 3-star Android Pay reviews: 10,745

- 2-star Android Pay reviews: 5,971

- 1-star Android Pay reviews: 23,948

The average rating is 4 out of 5 stars. As you can see there are far more happy users than disgruntled ones. When you read through the low Android Pay reviews, most people have phone glitches, update glitches, or incompatibility with their credit or debit card.

Here is a small example of real people using Android Pay:

- A 5-star Android Pay reviews says, “Love it! Very simple to use. I have a Samsung galaxy S5.Just handed my phone over to scan like pay wave and waaalaaa. Instantly paid. Great for when you forget your wallet or have unplanned trips.”

- A 4-star Android Pay reviews says: “I find the most useful feature is being able to store the dozens of loyalty cards that I’ve acquired over the years, and stop my wallet bursting at the seams.”

- A 3-star Android Pay reviews says, “Just ok so far. Can’t do my debit card.”

- A 2-star Android Pay reviews says, “Hit but mostly missed. Tried it 3 times at Fairway; worked once. Will see if update helps.”

- A 1-star Android Pay reviews says, “Android Pay will not accept a single debit/credit card I have.”

Android Pay Reviews: Other Online Reviews

Before we move on to our wrap-up of this virtual wallet app, let’s take a quick look at other online Android Pay reviews:

- Top Ten Reviews has a positive look at Android Pay support and Android Pay security, calling it a “great mobile wallet for Android phone users.”Though they do caution it may be a good idea to carry a backup card or some extra cash.

- Trusted Reviews compared Android Pay with Apple Pay and came to the conclusion that they were quite similar.It really boils down to what type of phone or browser you prefer.

- PC Mag has not updated their Android Pay reviews since the end of 2015.In this review they only gave Android Pay 3.5 out of 5 stars for “limited use cases and online-payment partners.” Obviously this has expanded greatly since then.

Android Pay Reviews: Our Review

If you have an Android phone or if you use Google Chrome as your web browser, using Android Pay may be a great decision for you.

With their added Android Pay security, you have very little to lose in trying it out. And since so many companies and apps have Android Pay support now, it makes it more realistic to use on a frequent basis.

But this does not mean you should never travel without your wallet ever again. There are plenty of opportunities for glitches or lost phones. But the Android Pay app is a solid choice for saving you time.

Popular Article: Top Mobile Payment Apps | Ranking | Best Mobile Payment Systems

Conclusion—Android Pay Reviews

With all this information and the Android Pay reviews, you now have an overview of everything you need to know before using Android Pay.

If you are still not sure if it is right for you, you can download the app for free to see how you like it. Also try looking into the Android Pay banks to make sure they can support your debit and credit card information.

If you do like the idea of using Android Pay, simply download the app for free and give it a try.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.