Overview: 6 Best Online Bill Pay Services

Most people still prefer to pay bills manually. However, the number of people using online bill pay services is steadily increasing.

With online bill pay, there is no waiting around for paper statements to come in or the possibility of missing a bill invoice in the mail. Best of all, most of these bill pay services are provided by banks for free as part of their online checking account services.

Paying Bills Online

Below is a list of 6 banks that provide great tools and methods for paying bills online.

See Also: Best Free Checking Account Banks

Banks with the Top Best Online Bill Pay Services

- Ally Bank

- EverBank

- iGObanking

- Capital One

- USAA

- Bank of Internet USA

Some of these banks are strictly online banks with no traditional brick-and-mortar outlets while others have branches across the US.

Selecting the Top Bill Pay Services

In conducting our review and analysis of banks with the best bill pay services, we took the below variables into consideration:

- Ease of use

- Cost

- Level of sophistication

- Mobile phone access

- Minimum deposit required

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Don’t Miss: Best Banks in America for Businesses, Students, Online Banking, Free Checking

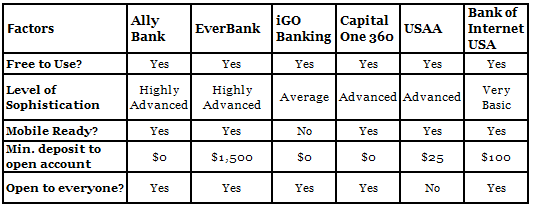

Ranking Table – Banks with Top Online Bill Pay Services

Table: Comparison of Top Online Bill Pay Services

Brief Overview – Bill Payments Solutions – Reviews

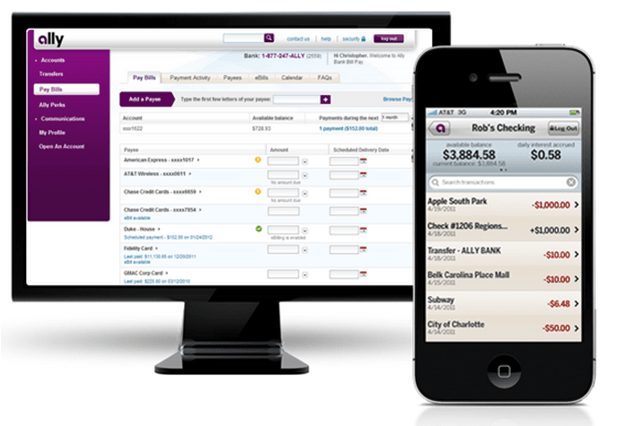

Ally Bank

Ally Bank is one of the more well-known online banks on our list. It has a very user-friendly and simple online bill payment system. You can pay your bills manually every month or set up a direct debit system.

The online system is straightforward, and the inclusion of a mobile app for both Android and Apple devices means that customers can pay bills directly through their smartphones.

- Free bill payment to those with a US postal address

- One-time or recurring payments over the course of a year

- Instant electronic payments to decrease the possibility of late fees

- Balance comparison of before and after payments

- Comprehensive bill reviews and payment history

- E-bill service that stops paper billing

Ally Bank

With no bill pay charges, no minimum deposit to open an account, an easy-to-use bill paying platform, and complete bill review, Ally Bank provides one of the best bill payment systems around.

EverBank

Similar to Ally Bank, EverBank is an online-only bank that has become quite popular as more and more people look to online options for all of their banking needs.

EverBank offers a wide range of easy-to-use services.

Paying bills through its bill pay system is a straightforward process. Its mobile app is structured to make paying bills anywhere simple.

- 24-hour and year-round service to its bill paying system

- Easy management of payees where they can be kept on record

- E-bill system where bills can be sent straight to EverBank and uploaded to your account

- No charges for paying bills online

- Instant payment options

- One-time or recurrent payments

One downside to EverBank is its minimum account opening deposit of $1500.

Related: Pros & Cons of Using Bank5 Connect

iGObanking

A relatively new addition to the world of online banks, iGObanking offers many different accounts with online payment options and easy methods to pay bills.

There are no charges to use its online bill pay service nor does it require a minimum deposit limit to open an account.

- Bills are sent electronically and uploaded to your account

- Presentment tool allows you to import bills directly to your account

- Free bill pay online with no extra or hidden charges

- No limit to the number of bills you can pay at once

- 24/7 access so you can pay bills at anytime inside the US

- Allows for one-time or recurrent bill payments on a direct debit system

One downside to iGObanking is that it doesn’t currently offer a mobile app for either iPhones or Android devices.

While you can still access the site on a mobile phone, it doesn’t have the same level of accessibility that a mobile app offers.

Capital One 360

Capital One 360’s online bill payment system eradicates the need to do any more paper bill payments. This means no more checks, stamps, letters or envelopes to send your bill payments.

- 24/7 instant access to online bill payments

- Guaranteed scheduled payment options

- E-bill system where bills are delivered straight to your online account

- Sync to Quicken for desktop bill payments and easier access

- Also syncs to QuickBooks for business financial bills and transactions

Image Source: Capital One 360

Capital One 360 also comes with a handy mobile app to further increase the efficiency of online payments.

Its free online bill payment system, no minimum deposit for opening an account, and links to desktop bill payment tools make Capital One 360 a great choice for paying bills online.

USAA

USAA provides an easy-to-use bill payment system for its personal banking customers.

However, its services are limited to US military personnel.

- Round-the-clock, 24/7 access to bill paying facilities

- Automated payments or one-off transactions

- E-bills which are sent to your bank and uploaded to your account

- Guaranteed payment if set up on direct debit with the bank, covering any late fees

- Mobile app for easier access

USAA bank might not be open to everyone, but it is building a stellar reputation as one of the best online bill pay providers.

It guarantees “on-time arrival” for recurrent payments and covers any late fees that may be charged to your account if it fails on its guarantee.

Popular Article: What Do You Need to Open a Bank Account?

Free Wealth & Finance Software - Get Yours Now ►

Bank of Internet USA

Founded in 1999, Bank of Internet USA is an online bank that provides a wide variety of financial and investment services.

The Bank of Internet USA offers a simple, “no frills” way in which to do banking online and pay bills.

Bank of Internet USA

It might not offer sophisticated tools like Capital One 360, but it is straight to the point and has a low minimum deposit rate for new customers.

- Simple and straightforward bill pay system

- No fees to pay bills online or make transactions inside the US

- One-time payments or recurrent bills can be paid

- Features an easy-to-use mobile app

Image Sources:

- https://thumb7.shutterstock.com/image-photo/stock-photo-pay-bills-key-in-place-of-enter-key-450w-75453559.jpg

- https://www.ally.com/

- https://www.capitalone.com/bank/checking-accounts/online-checking-account/

- https://www.axosbank.com/Personal

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.