Overview: Bank5 Connect

Bank5 Connect is an online bank, meaning that it has no physical bank locations, though it is part of a Massachusetts bank named BankFive, located in Fall River. Because Bank5 Connect is an online-only bank, they have very low overhead costs and can offer highly competitive rates to customers.

Although based online, Bank5 Connect still offers all the traditional services of a brick-and-mortar bank, such as savings and checking accounts and CDs. Bank5 Connect also offers popular modern online banking services such as online bill pay, free mobile banking, and eStatements.

Image Source: Bank5 Connect

This Bank5 Connect Review will provide you with a comprehensive overview of the online bank’s services, features, and customer testimonials to help you determine if Bank5 Connect is the right fit for your financial needs.

See Also: Barclays Review – What Is Barclays & What You Need to Know! (Online Banking & Savings Account)

Behind the Scenes: Who is Bank5 Connect?

Bank5 Connect was created in July of 2013 as an online-banking extension of BankFive. BankFive was founded in 1855 in Fall River, Massachusetts. From its early days through today, BankFive has been dedicated to serving the personal and business needs of its customers. They accomplish this by providing exceptional customer service, investing in communities, and enriching the lives of their employees.

A quick glimpse of their company website reveals a strong emphasis on service. Nearly every page of the website hosts a window prompting users to chat with a live representative through an online chat. Also, each page clearly lists telephone contact information to speak to a representative of Bank5 Connect.

Image Source: About Bank5 Connect

Features and Services

As an online-only bank, Bank5 Connect has a solid set of main features incorporated into their services. In this Bank5 Connect review, the following main features will be explored:

- Checking accounts

- Savings accounts

- Certificate of deposit

- Online banking features

- Online financial resources

Don’t Miss: Woodforest Bank Reviews – Should You Use Them? (Second Chance Checking & National Bank Reviews)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

High-Interest Checking Accounts

Image Source: Bank5 Connect High-interest Checking Account

Bank5Connect offers a high-interest checking account to their customers. As an online-only bank, Bank5 Connect can offer their services at better rates because they lack the overhead of many brick-and-mortar banks. This checking account offers a highly competitive interest rate of 0.76% APY. Bank5 Connect’s high-interest checking account offers standard checking services as well as debit cards, online shopping, and bill pay.

Like most modern banking institutions, this checking account offers easy access to your money for day-to-day and monthly expenses. Along with common checking account features, customers also receive:

- Free online banking/billpay/eStatements

- Free mobile banking

- No monthly maintenance fee

- Free first check order

- Free ATM withdrawls

- UChoose Debit Rewards Program

Image Source: Bank5 Connect Rewards Program

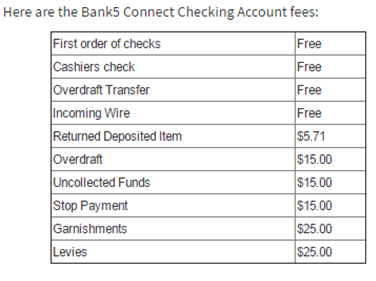

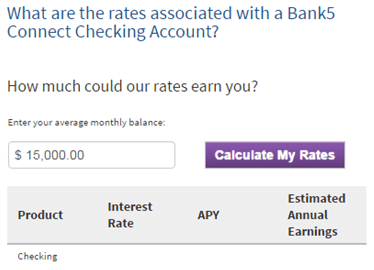

Bank5 Connect’s high-interest checking account can be opened with a starting balance of $10. Customers can earn interest on their funds with a balance of more than $100. The Bank5 Connect website also displays a rate calculator to illustrate how much customers can earn using their current rates. Their checking accounts also offer very low fees for common banking transactions and procedures such as overdraft, transfers, and stop payments.

Image Source: Bank5 Connect Checking Account Fees

High-Interest Savings Accounts

Image Source: Bank5 Connect High-interest Checking Account

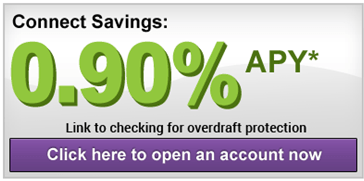

Bank5 Connect also offers a high-interest savings account to their banking customers as one of their major services. In this section of our Bank5 Connect review, we will discuss the features of the bank’s high-interest savings account to help you determine if this service fits your needs. This savings account offers a highly competitive interest rate of 0.90 APY. The high-interest savings account functions like a standard savings account, allowing the customer to save their money while accumulating interest.

The high-interest savings account also offers the following features:

- Free online banking/eStatements

- Free mobile banking

- Overdraft transfer from checking account

Similar to the high-interest checking account, customers need only invest $10 to start a savings account. When a customer has a balance of over $100, they can take advantage of the 0.90% APY and earn money to add to their balance. Bank5 Connect offers a savings account that is 100% insured as the account is FDIC-insured up to $250,000 and DIF-insured (Depositors Insurance Fund) over $250,000.

Also, the website provides a rate calculator for their customers to determine how much they could potentially earn using a Bank5 Connect high-interest savings account. The online nature of this bank allows the company to offer very low fees for savings account services such as overdraft protection and overdraft transfer, stop payments, and cashier’s checks.

Related: Best Free Checking Account Banks – No Fees, Best Yields

Certificates of Deposit

Image Source: Bank5 Connect Deposits

Bank5 Connect offers high-yield certificates of deposit (CDs) to their customers at highly competitive rates to insure a solid return on investments. This section of the Bank5 Connect Review details the services provided with their CDs. The high-yield CDs offer the following features at a rate of 1.50% APY:

- No monthly maintenance fees

- $500 minimum deposit

- A variety of terms (6, 12, 18, 24, and 36 months)

- FDIC-insured for up to $250,000

- DIF-insured for over $250,000

The standard Bank5 Connect CD requires the customer to make a one-time deposit and maintain the deposit in the bank until the end of the term. If the customer withdraws money from their CD, fees are assessed against their investment.

Bank5 Connect offers a special type of CD called an Investment CD. This account is a great resource for those looking to invest their money over an extended period of time with a solid return. With the Investment CD, customers earn a rate of 1.30% APY while having the ability to transfer funds into the CD from a checking account at any time.

Image Source: Bank5 Connect Investment CDs

Banking in the Digital Era: Online Banking

When the concept of an online-only bank is discussed, potential customers may wonder how they will access their account. The Bank5 Connect website offers users web tutorials on how to use a variety of bank services including:

- How to make deposits

- How to transfer money between accounts

- ATM usage and how to get cash

- Online bill pay

- How statements are delivered

- Mobile banking

Testimonials and Customer Reviews

There are plentiful sources of customer reviews and testimonials on Bank5 Connect’s banking services and online operations. Bank5 Connect reviews can be found across major financial review websites throughout the web.

According to GO Banking Rates, Bank5 Connect’s checking account has won the award of Best Checking Account of 2016. GO Banking Rates rates Bank5 Connect’s checking account number one because they combine technological conveniences with one of the best rates available, while still providing one-on-one relationships with customers. GO Banking Rates also praises Bank5 Connect’s rewards and offerings through their Visa debit card. Not only does the customer receive a debit card for ATM withdrawals and purchases, but the Visa card also accrues rewards points that can be redeemed for items such as gift cards.

The website titled Magnify Money gives Bank5 Connect’s services an A grade, with a Magnify Transparency Score of 4.38/5. Magnify Money writes that the positives of their checking accounts are the lack of monthly fees, no ATM fees, and overdraft protection. However, they point out that the bank does charge multiple NSF (insufficient funds) fees daily or charges fees for extended overdraft.

Among the Bank5 Connect reviews available to consumers, the customer reviews on the website depositaccounts.com offer the most interesting range of experiences. Comments on this site also discuss how the Live Chat feature of the website is a great positive web tool and users report prompt customer service through the website.

On the other hand, many customers submitted a Bank5 Connect review stating that they attempted to open an account with the bank but were denied, regardless of their credit or professional status, for unknown reasons. Some had even been told they have been approved to later have their account denied. It sounds as though Bank5 Connect’s process of approving customers and opening accounts could use some streamlining and transparency.

Another one of the drawbacks of Bank5 Connect’s banking services is that they do not extend loans or provide customers with credit cards.

However, all research shows that Bank5 Connect’s checking online checking account is a strong option for consumers with its low fees and high interest rate. Research reveals that Bank5 Connect’s saving’s accounts are tied with Discover Bank for the third highest interest rate among online banks. TopTen’s Bank5 Connect review gives the bank a 7.9/10, stating that they are a good choice for online-only banking because of their competitive interest rates for checking and savings accounts.

Popular Article: Best Banks to Bank With – No Fees, High-Yield Savings, Largest Banks, and Credit Unions

The Bottom Line: Is Bank5 Connect for Me?

This Bank5 Connect review has provided a detailed description of the main services provided by the bank. Of these main services, it appears that the checking and savings account features are the most appealing services for consumers looking for an online-only bank. Bank5 Connect reviews reveal that the customer service and ease of online banking combined with their highly competitive interest rates make the checking and savings accounts a great deal for consumers.

The ease of using online-only banks can attract particular challenges. For example, many Bank5 Connect reviews stated that customers experienced challenges when attempting to open accounts and reported a lack of transparency in the application process. Some customer service challenges were reported due to the online format of communication.

The bottom line? If you are looking for an online-only bank with highly competitive interest rates for checking and savings accounts, then Bank5 Connect may be a good fit for your banking needs.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.