Uncovering the Average Cost of Pet Insurance

Spending money on our beloved pets has become an incredibly commonplace thing as we treat them more and more like family members than animals.

Billions of dollars are pouring into the pet industry for everything from food to grooming to vet services. But what if there was something more you could do for your pet?

Pet insurance offers owners a way to shield their furry friends (and their own finances) from the plights that may come along life’s path. Accidents, illnesses, and routine medical checkups can all be covered under the right pet health care plan. Finding low-cost pet insurance can be a challenge, though.

How do you know how much is too much to spend on pet insurance prices?

Knowing what to expect from the cost of pet insurance puts you one step ahead before you sign up for any pet health care plan. You should know exactly what your pet insurance offers for the cost to determine if it is a valuable form of protection.

AdvisoryHQ wants to help you go deeper into discovering the average pet insurance cost. We’ll take a look at key questions consumers are asking about the average cost of pet insurance and how you can save more money.

How much is pet insurance, really?

If you’re ready to give your furry friend some extra protection, let’s take a closer look at what you can expect your pet insurance prices to be.

See Also: Top USAA Credit Cards | Ranking & Reviews | USAA Rewards, Secured, Travel, Cash Back Cards

Factors Affecting Pet Insurance Prices

Unfortunately, there’s no such thing as a universal pet insurance cost. It will vary depending on so many different factors that it’s difficult to estimate exactly what you could expect your pet health insurance cost to be. Many of these factors will be out of your control if you already have a pet at home.

For others, these factors may help them to make wise decisions at the pet store. Take a look at a few of the top ways consumers can alter their average pet insurance cost:

- Coverage: Coverage is one of the biggest determining factors when it comes to the cost of your pet health care plan. You can opt for accident-only protection (the least expensive option) all the way up to a comprehensive coverage for accidents, illnesses, injuries, and wellness plans. The easiest way to change the cost of pet insurance is to reduce the amount of coverage you have on your pet.

- Deductible: Much like any other type of insurance plan, pet insurance prices are highly affected by your deductible. The higher your deductible, the lower your pet insurance prices are likely to be. However, this does mean that you will be paying more upfront in the event of filing a claim, which should be weighed into your overall pet health insurance cost.

- Age of the pet: Some providers refuse to provide low-cost pet insurance to cats or dogs over a certain age. As your pet ages, it becomes more likely that they will suffer from illness, injury, or chronic disease. All of these items can significantly raise the average pet insurance cost.

- Health history: Finding low-cost pet insurance plans that specialize in animals that have pre-existing conditions can be difficult. If you’re searching for pet insurance for pre-existing conditions or have had extensive veterinary work done in the past, pet insurance prices are likely to be higher.

- Type of pet: The species and breed of your pet can make a big difference in the pet health insurance cost as well. Cheap pet insurance is easier to find for cats than it is for dogs. Similarly, certain breeds (including “bully breed dogs”) may not be covered or could qualify for higher pet insurance prices.

- Location: This isn’t one of the factors that you can do much about, but it certainly can have an effect on the cost of pet insurance. If you live in an area that naturally has a higher cost of living, it is likely that the average pet insurance cost will also be higher in your area. Your pet’s health care will cost more and so will the pet health insurance cost.

Don’t Miss: Northwestern Mutual Reviews | What you Need to know about Northwestern

Prices for Dog Insurance

Ultimately, the average pet insurance cost will vary, even from dog to dog. As we saw in the previous section, there are a number of important factors that are weighed into the decision to issue you and your pet a policy.

Each and every one of these variables can affect the average pet insurance cost for dogs.

Image Source: FreeImages.com

Dog care generally does cost more than the same type of veterinary attention given to cats. As a result, the pet insurance prices for dogs are higher than they are for their feline counterparts. The cost of pet insurance for dogs can range anywhere from $11 per month to almost $100 per month depending on the coverage level.

According to Nationwide Insurance’s Veterinary Pet Insurance, the average monthly cost for a canine covered under one of their plans is roughly $38.58.

In order to consider the prices in the right context, we have to keep in mind that 81% of all these policies are for accident and illness plans for dogs. Just a couple of years ago, this type of coverage had an average pet health insurance cost of $473 annually ($39.41 monthly).

It’s not a secret that your pet insurance prices are also likely to be greatly influenced by the breed of dog you have. For instance, a mixed breed dog typically comes with the lowest pet insurance prices. Purebreds are prone to more hereditary conditions that can be costly in comparison.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

You can also find cheap pet insurance by opting for an accident-only policy instead of full coverage (accidents and illnesses). Dogs with this type of protection can expect an annual fee around $158.

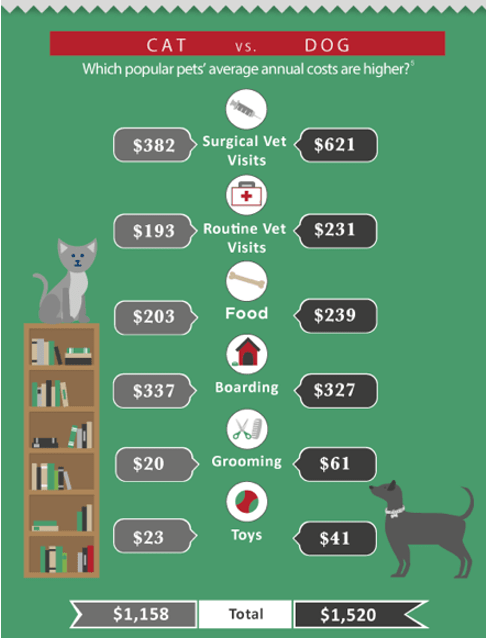

How much is pet insurance in comparison to what your vet bills will cost you each year? The statistics show that dog owners are likely to pay a whopping $1,520 each year to own their dog, with $852 of that spent on routine and surgical procedures. Maintaining a low monthly cost with a pet insurance policy can help offset those numbers.

Related: Average Life Insurance Cost | Average Cost Of Whole Life and Term Life Insurance

Prices for Cat Insurance

Pet insurance prices for felines tend to be lower than those for dogs. Consumers who are hunting for a furry companion that won’t be as high maintenance when it comes to finances may prefer to purchase a cat instead. Cats are less susceptible to illness and injury, which plays a role in their lower average pet insurance cost.

Only 14.6% of all the policies in the United States provide coverage for accident and illness for cats and other animals. Dogs still hold the majority of the market when it comes to pet insurance health plans. In 2014, you could get the best value pet insurance for cats at an average of $285 annually ($23.75 monthly).

Depending on the breed of your cat and your location, the cost of pet insurance is likely to vary. One source compiled the average pet health insurance cost for every state to come up with a likely range that owners could expect. They estimated that the pet health insurance cost would come in somewhere between $27 and $38 per month.

Of course, Nationwide’s Veterinary Pet Insurance lists the average cost of their cat policies at $27.58, which puts them at the lower end of that range.

It is estimated that consumers who own a cat are likely to spend approximately $1,150 each year on their care. While some of this will be allocated toward food, toys, and other miscellaneous items, a significant portion of it represents routine healthcare, medications, and surgical procedures. After all, emergency care is required for some pet somewhere every 2.5 seconds.

Image Source: Nationwide

Consumers who want to save money on the usual pet health insurance cost may want to consider opting for an accident-only policy. While this doesn’t cover illnesses or routine wellness needs, it does come in with a lower annual cost. A cat can be covered under accident-only protection for an average pet insurance cost of $132 per year.

Popular Article: Top Life Insurance Companies | Ranking | Term Life & Whole Life Insurance Comparison

Companies for Cheap Pet Insurance

With so many different companies on the market, deciding which one can offer the best value pet insurance can require a lot of research. However, unlike auto insurance or homeowner’s insurance, there aren’t nearly as many companies advertising a potential pet health care plan.

In fact, there are only approximately twelve different companies available to offer low-cost pet insurance, and not all of them will offer pet insurance for pre-existing conditions. You’ll have to research each company individually to discover whether or not they offer the type of coverage you want for your beloved companion at a price your monthly budget can handle.

Many of these companies are associated with well-known associations dedicated to keeping your animals healthy. You may recognize some of them as you scroll through this list of popular choices:

- ASPCA

- American Kennel Club Pet Insurance

- 24 Pet Watch

- Nationwide

- Embrace

- Pet First

- Healthy Paws

- Pet Plan

Of course, there are other top companies available to offer low-cost pet insurance that can provide a great value to you and your animal. These are just a few of the best and most often recognized companies to jumpstart your search for pet insurance.

You can also consider using a third-party website to investigate the pet health insurance cost. Websites such as these allow you to see quotes from all of these providers in one convenient location and they can sometimes offer discounts as well. Two of the better websites for a pet health insurance cost comparison in the United States are Policy Genius and Value Penguin.

Image Source: Policy Genius

Both allow you to request a quote for cheap pet insurance without entering any of your personal contact information. You can shop informally without dealing with the hassle of telemarketing phone calls or spam emails after the fact. It takes only a few minutes to enter all of the necessary information into their application, and then you can narrow down to which type of policy best suits your beloved animal.

Read More: Best Life Insurance Rates & Charts | Tips to Get the Best Life, Term, and Whole Life Rates

Ways to Save Money on Pet Insurance Cost

Now that you can anticipate what to expect from the average pet insurance cost, we can take a closer look at how to find the best value pet insurance. Many companies will offer ways to save money on premiums and annual rates — if you know how to look for them.

We’ll cover four of the easiest methods to lower your average pet insurance cost even more:

- Change your deductible: If you want to maintain a comprehensive pet health care plan on your pet, the easiest way to find a cheap pet insurance option is to raise your deductible. While you will certainly need to pay out more money in the event of an accident or illness, you can save money on a monthly or annual basis. This savings could easily be stashed away into an account to cover the cost of a higher deductible.

- Adding multiple pets: Many consumers have already discovered that adding just one animal companion to their family wasn’t enough. When you have multiple pets, adding them onto the same policy can help you save money on the cost of pet insurance. Companies are usually happy to give discounts for giving them extra business.

- Bundling pet insurance: Chances are, you might already be with a company that offers cheap pet insurance in addition to your auto insurance and homeowner’s insurance. If you are lucky enough to belong to one of these companies, you may be able to request a discount and lower the average pet insurance cost by bundling all of your business with one specific company.

- Pay upfront: Many companies will consider lowering their pet insurance prices if you choose to pay your annual premiums upfront. When you spread payments out over the year, companies tend to charge more for the convenience.

Keep in mind that these aren’t the only ways to save some money on the pet insurance prices you’ve come to expect. You may also be able to find discounts through pet insurance comparison websites, such as Policy Genius, just for searching for quotes. Sites like this one boast savings of up to 15% for using their services over buying directly from the provider.

Conclusion: Preparing for the Pet Insurance Cost

How much is pet insurance? This is a natural and valid question that many consumers ask shortly after bringing their new pet home. Pet insurance offers a level of security and peace of mind for you as the owner, but it’s important to know the cost.

While pet insurance prices can differ drastically depending on your desired level of coverage, location, and details about your pet, the average pet insurance cost is fairly easy to predict. You’ll find other prices for pet insurance for pre-existing conditions, though. Take a look at the common monthly and annual pet health insurance cost to determine whether you can afford to take on this expense.

Purchasing the best value pet insurance for your beloved pet can fill you with a sense of accomplishment and financial peace of mind. It isn’t hard to figure out that the cost of pet insurance can easily put you ahead in the long run if your cat or dog has a major accident, injury, or illness.

Can you afford not to purchase some form of low-cost pet insurance? Consider what your monthly budget will allow for before signing up for protection for your pet. With the average pet insurance cost so readily available, you should be able to figure it out in no time at all.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.