2017 RANKING & REVIEWS

TOP RANKING BEST BANKS IN LONDON

Intro: Opening an Account at One of the Top Banks in London

There are several reasons you may be searching for the best London bank. You may be an expat who’s moving to the UK and hoping to open your first account at one of the best London banks. Or you may be a city native simply looking for a new bank in London. Whatever the case may be, finding the right one can be a challenge.

It’s critical to understand what differentiates the top banks in London and what exactly to look for when selecting a new bank.

When choosing from the banks in London, you’ll want to first consider the types of accounts they offer and whether they fit your requirements.

Some of the most common accounts provided by the top banks in London include current accounts to manage day-to-day spending and money, as well as packaged accounts, which can include added perks and benefits some customers might find beneficial.

Award Emblem: Top 10 Banks in London

Another important factor when ranking London banks is whether it is going to charge high fees. Fees are one of the primary differentiating factors that set top banks in London apart from less desirable options.

An additional consideration to keep in mind when comparing banks in London is how accessible and easy they make it for customers to do business with them.

Some customers may prefer only utilising in-branch banking, whereas other people may want the convenience afforded by the availability of phone, online, and mobile banking.

The following list of banks in London highlights the top London banks that excel in many ways, from offering an extensive portfolio of available products and accounts to delivering accessibility paired with low fees.

See Also: Best Building Societies in the UK | Ranking & Reviews

AdvisoryHQ’s List of the Top 10 Banks in London

List is sorted alphabetically (click any of the bank names below to go directly to the detailed review section for that bank):

- Barclays

- Halifax

- HSBC

- Lloyds Bank

- NatWest

- RBS

- Santander

- Standard Chartered

- The Co-operative Bank

- Virgin Money

Click here for 2016’s Top 10 Banks in London

Top 10 Best London Banks | Brief Comparison

London Banks | Highlighted Products & Services |

| Barclays | Contactless Payments |

| Halifax | Clarity Credit Card |

| HSBC | Personal Loans for non-customers |

| Lloyds Bank | Save the Change |

| Natwest | Cashback Mortgages |

| RBS | Account Switch Service |

| Santander | Student & Graduate Accounts |

| Standard Chartered | Total Relationship Rewards |

| The Co-operative Bank | Switching Bonus |

| Virgin Money | Travel Money |

Table: Top 10 Best Banks in London | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Banks in London

Below, please find the detailed review of each card on our list of best banks in London. We have highlighted some of the factors that allowed these London banks to score so high in our selection ranking.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Barclays Review

Barclays is a well-known name in the international personal finance world. It is also one of the top banks in London offering personal and business banking solutions. Barclays has a history of being a leading bank in London that spans more than 325 years, with beginnings on Lombard Street in London.

Barclays is a London bank that has consistently been an innovator in the banking and financial services industry, having launched the first ATM in the world. Key to Barclay’s strategy as one of the top London banks is building their strength as a transatlantic bank for consumers, corporate clients, and investment customers.

Image Source: Best Banks in London

Key Factors That Enabled This to Rank as a Top Bank in London

When comparing London banks, the following are some of the primary reasons Barclays is on this list of banks in London.

Barclays Blue Rewards

An important consideration that weighed heavily into which names were selected for this list of the best banks in London were those financial institutions offering reward programs or benefits for consumers.

Barclays offers the Blue Rewards program, which is designed to reward loyal customers through the provision of monthly cash rewards. This program also provides members of this top London bank with cashback whenever they make a purchase through one of Barclay’s partners.

The top London bank offers a bonus of £7 a month just for banking with Barclays as well.

Members of the program can track their earnings through their digital wallet simply and conveniently. Other perks include insurance and mortgage rewards when members open these accounts, and there are rewards when members take out a personal loan as well.

SmartSpend Shopping

Another popular and valuable rewards program from this top London bank that is separate from Blue Rewards is the SmartSpend Shopping program, which offers cashback from top retailers.

This program lets customers shop at retailers like Boots, Gap, Waterstones, and more, and they can also buy online at the SmartSpend Shopping site.

Then, when they shop at participating retailers, they receive their cashback rewards. For customers who are members of the Blue Rewards program, there is an additional bonus of 1% cashback when using SmartSpend.

Barclays Bank Account

One important reason Barclays was selected for this ranking of the best banks in London is because they have many different account options, designed to fit diverse banking and financial needs.

For consumers who want a flexible, convenient current account, this best bank in London offers the Barclays Bank Account. This account can be personalised with the add-ons you need to simplify your life.

You can open the Barclays Bank Account online, and you’ll receive your sort code and account numbers right away. There is also a wide variety of services, tools, and products you can select from the Features Store.

This account is also eligible for potential overdraft coverage of up to £5,000.

Contactless Payments

Image Source: BBC News

Throughout its long history, Barclays has consistently been an innovative London bank, and they continue that reputation today. Barclays offers the option to pay with an Android phone with Contactless Mobile. This program offers a fast, easy, and secure way to make payments.

Customers of this London bank can link their Barclays debit card or BarclayCard to their phone and use it to pay wherever there’s a contactless symbol, which includes 400,000 locations across the UK.

All customers do is hold their mobile device over the reader, and payments are completed in seconds. Contactless Mobile can be used to make payments from £30 to £100. Additionally, customers can use their phone as their travel ticket as well.

Don’t Miss: Top Credit Unions in London and Other UK Cities | Ranking & Comparison Review

Halifax Review

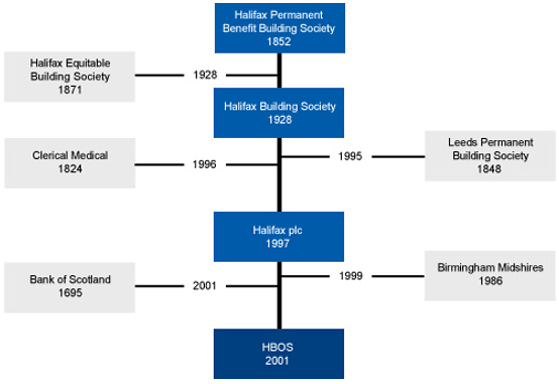

Halifax is part of the larger Lloyd’s Banking Group, and this London bank has roots that go back to the Industrial Revolution. In 1852, a small group of people gathered at an inn in Halifax to create an investment and loan society. The first iteration of Halifax was as a building society.

In 1997, the members of Halifax voted to transition from a building society to what would become one of the best banks in London. Since that time, there have been many acquisitions that led to the parent company of Halifax, Lloyd’s Banking Group, to become the largest retail bank in the UK.

Image Source: Lloyd’s Banking Group – Halifax History

Key Factors That Led Us to Rank This as a Top 10 Bank in London

Distinctive features offered by Halifax that led to its inclusion on this list of banks in London are cited below.

Current Account Switch Service

Halifax is a top bank in London that offers unique options like the Current Account Switch Service, designed to help customers quickly and easily transfer and close their old accounts they hold at other banks or financial institutions.

With the Current Account Switch Service, customers receive £100 just for moving their accounts to this London bank.

This service is available when a new customer is opening a Halifax Reward Current Account, Current Account, or Ultimate Reward Current Account at this top London bank.

Ultimate Reward Current Account

This bank in London offers several different convenient current account options, one of the most popular of which is the Ultimate Reward Current Account. This account features a broad range of benefits and additional perks, although it does carry a small monthly fee.

Some of the benefits available to Ultimate Reward account holders include:

- Worldwide multi-trip family travel insurance

- Mobile phone insurance

- AA Breakdown Cover including Home Start

- Home Emergency Cover

- Card Cancellation for lost or stolen cards

- An overdraft buffer that helps customers avoid fees on the first £50 overdrawn

- Earning opportunities with Cashback Extras

- A VISA debit card that includes contactless payment options

Online Loan

An exclusive offering available to customers of this bank in London is the Online Loan. This loan is designed to be convenient and easy to apply for if you’re an existing Halifax bank customer for at least a month and are registered for online banking.

It takes only a minute to get a loan quote online from this London bank, and there are no credit searches. For those customers who are approved, they may receive money into their Halifax bank account in a matter of minutes.

If additional payments are made, there is no charge, and customers can manage their loan online with Online Banking. Loan amounts from this bank in London range from £1,000 to £50,000, and different rates and various terms are available. Loans range from one to seven years. The interest rate is fixed, and repayments can be made by direct debit.

Clarity Credit Card

This London bank features credit card options including the signature Halifax Clarity Credit Card. This card has a simple rate, and it doesn’t carry usage fees, regardless of how it’s being used.

For this card, this London bank charges no fee to transfer a balance, no cash withdrawal fee, and there’s also no fee to use it anywhere around the world, making it an excellent option for frequent travelers.

There is no annual fee, and the card includes online fraud protection for online shopping.

The card can be managed online through Online and MobileBanking, it’s accepted anywhere MasterCard is, and faster payments can be made to the card, delivering a higher level of financial control and flexibility.

Related: Union Bank Reviews—What You Will Want to Know! (Mortgage, Credit Card, & Reviews)

HSBC Review

HSBC is one of the largest banking and financial services organisations in the world, with more than 45 million retail customers who are served by four separate international businesses. The HSBC network includes 71 countries in Europe, Asia, Africa, the Middle East, North America, and Latin America.

This expansive bank has about 4,400 international offices and is listed on stock exchanges in London, Hong Kong, New York, Paris, and Bermuda. The UK headquarters of HSBC is located in Canada Square in Canary Wharf, London.

Key Factors That Enabled This to Rank as One of the Top Banks in London

Some of the reasons this London bank is one of our selections for a best bank in London are highlighted below.

Low-Rate Personal Loans

Important to the process of selecting the best banks in London is not just deposit accounts, but also the selection of lending products available to customers. As one of the best banks in London, this insititution makes personal loans available not only to HSBC clients but to non-HSBC borrowers as well.

This personal loan carries an interest rate of 3.3% for loans between £7,000 and £15,000. That rate may vary based on the individual circumstances of the person applying for a loan from this London bank.

When current HSBC customers apply, they may receive an instant decision, and even non-HSBC current account holders will get a fast answer within about two to five business days.

Additionally, if a current account customer applies and receives funding, it may be deposited directly into their account once they’re approved.

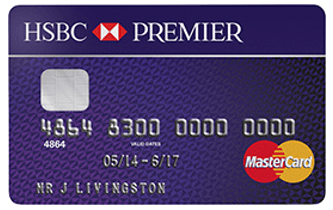

Credit Cards

This London bank offers a variety of diverse and flexible credit card options, designed to suit a wide range of consumers. The signature card offered by this bank in London is the HSBC Credit Card, which has benefits like 0% interest on balance transfers for 32 months and 0% interest on purchases for three months. It also has no annual fee.

Another option is the Premier World Elite MasterCard, which is for Premier bank account customers. Cardholders receive 40,000 reward points when they spend £2,000 in their first three months of card membership. This card does have an annual fee of £195, but it does come with additional reward point bonuses.

The Premier Credit Card is another credit product from this London bank that has a variety of rewards options with a points-based system. Cardholders can redeem points for everything from shopping vouchers to frequent flyer miles.

Image Source: HSBC Premier UK – Premier Credit Card

Online Bonus Saver

The Online Bonus Saver is a convenient savings account with a competitive interest rate, particularly for account holders at this London bank that don’t make any withdrawals during the month. If there are no withdrawals made for a statement month, bonus interest is earned. Interest is calculated daily and paid monthly on the full balance of the account.

All that’s needed to open an Online Bonus Saver is £1. Only one of these accounts is allowed per customer.

This account is entirely online, which is ideal for customers of this London bank that want something accessible for managing their money and growing their savings. The Bonus Saver account from this bank in London allows customers to apply online and manage all of their balances and transactions online as well.

Ways to Bank

HSBC is one of the top banks in London not only because of their actual product offerings and their reputation, but also for their ability to deliver cutting-edge technology and innovation that simplifies life for all of their customers.

When a customer joins this London bank, they can manage their personal accounts in many ways, including from their mobile device. The HSBC Mobile Banking App has a secure digital key, touch ID, and features like Fast Balance that let customers see their live balances in up to three accounts without logging in.

Online banking, telephone banking, and branch banking are also options available to customers of this bank in London.

Popular Article: Best Banks in Georgia | Ranking | Top Banks in Atlanta, Savannah, Augusta, and across Georgia

Lloyds Bank Review

Lloyds Banking Group is a financial services company that serves communities throughout the UK, as well as millions of customers. Lloyds Bank has been in business for more than 250 years, and there are more than 1,000 high street branches available to clients. This London bank also has online, mobile, and telephone banking.

Products and services range from current accounts and savings accounts to mortgages, loans, private banking, and wealth management. This pick for one of the best banks in London is also the biggest provider of start-up financing for businesses in the UK.

Key Factors That Allowed This to Rank as One of 2017’s Best Banks in London

When reviewing and ranking London banks to include on this list of banks in London, the below criteria were important for Lloyds Bank.

Save the Change

When considering the options for our list of the best banks in London to include on this review and ranking, something that was prioritized was finding unique and distinctive offerings. One of these available from Lloyds Bank is the Save the Change program.

With Save the Change, every time a customer of this bank in London uses their Visa Debit Card, the amount is rounded up to the nearest pound and automatically deposited into their designated Lloyds Bank savings account the customer selected.

The rounded up amounts can also be added to a family member’s account.

The Save the Change program from this top London bank is available for most Lloyds Bank savings account, and it can be turned on or off. The nominated savings account can also be changed through Internet banking.

This program available from this leader among London banks makes it effortless to save more money and strengthen your financial life.

Club Lloyds

Club Lloyds is a current account program from this London bank that offers up to 2% AER variable credit interest to account holders, as well as a range of other valuable benefits. Club Lloyds requires no monthly account fee if the customer contributes £1,500 per month. Even if you do not meet that requirement the fee is only £3 per month.

Account holders earn credit interest on the entirety of their balance up to $5,000. Nothing is earned on the amount over that. This account from this London bank also offers lifestyle benefits that can be selected every month ranging from cinema tickets to annual Gourmet Society memberships.

Members of Club Lloyds also receive discounted mortgage rates, exclusive savings rates, discounts on home insurance, and special credit card options.

Personalised Balance Transfers

This selection for one of the best banks in London features personalised balance transfer options for customers who move existing credit card balances to a Lloyds bank credit card account.

Lloyds will provide a personalised offer that can be valuable to customers if they’re paying high interest on their other credit cards, or want to consolidate their balance to one primary account. The offer will feature a low initial interest rate, and as long as the customer stays within their credit limit and makes their payments on time every month, they will remain eligible for promotional offers.

Benefits include not only a low-interest rate, but if the customer is a Lloyds Bank Choice Rewards credit card account holder they can build up their Choice Points, or their total Avios if they are an Avios Rewards credit card holder.

Hassle Free Mortgages

For customers seeking London banks that offer not only accounts but also loan products, Lloyds is an excellent option.

Popular from this bank in London is the Hassle Free Mortgage program. The Hassle Free Mortgage program is designed to take the stress out of buying a home, and Lloyds pays basic legal and valuation fees for customers, as well as arranging the mortgage.

This mortgage product from one of the top banks in London offers free standard valuation, no mortgage account fee, and clients who are obtaining a mortgage through this London bank will have access to Mortgage and Protection Advisors, delivering support and service throughout the process.

Read More: Best Banks for Small Business Banking | Ranking | Reviews & Comparison

NatWest Review

NatWest is part of the Royal Bank of Scotland Group, and this top London bank has a long history. NatWest started with a merger between National Provincial Bank, which was established in 1833, and Westminster Bank, founded in 1836. In 2000, the Royal Bank of Scotland Group acquired what had become NatWest in a deal that was the largest takeover in British banking history.

As a result, NatWest is now part of one of the largest financial services groups in the world. Today, NatWest offers a range of personal, private, business, and international banking products and solutions, and is often selected as one of the top banks in London.

Key Factors That Enabled Us to Rank This as One of the Top London Banks

When comparing London banks, below are some reasons NatWest was ranked as a best bank in London.

Cashback Mortgages

Uniquely, this leader among London banks features cashback mortgages, and the current offer provides first-time buyers £500 cash back. Buyers simply have to take out a first-time mortgage with Lloyds, and as long as they select a qualifying mortgage, they qualify for the program.

The residential property must be based in the UK, and the qualifying mortgages are marked with “cashback” on the website of this London bank.

Customers can also go online to compare mortgages from this London bank, including the ones with cashback deals, and compare their monthly payments on varying mortgage products and with different interest rates.

Arranged Overdrafts

NatWest is one of the London banks offering overdraft flexibility and options, which many customers are likely to find beneficial. An overdraft from NatWest provides the account holder with a little more flexibility in how they manage their money if they withdraw more than they have available in their bank account.

The arranged overdraft option lets customers borrow up to an approved limit if they do overdraw their account. This option carries interest and fees online if it’s used.

On the other hand, the unarranged overdraft option from this London bank requires a daily usage fee, although that is capped at £90 per charging period, which runs from month to month.

Mobile App

As part of the process of comparing the top banks in London and narrowing it down to a list of banks in London representing the very best, technology, convenience, and accessibility were important. NatWest excels here, in large part thanks to the mobile app this London bank offers customers.

Users can log into their app securely using their fingerprint or set up their own passcode. They can track their spending at a glance, withdraw money even if they don’t have their card, and make instant payments of up to £250, even without a card reader.

The mobile app available from this best bank in London also features the option to create, view, or cancel Direct Debits, and money can be sent to other people using only their mobile number.

Life Moments

As one of the top banks in London, NatWest strives to deliver value-creating, relevant, and customer-driven service. One of the ways they do this is by offering not only products but also support and service based on what they call “Life Moments.”

For example, customers of this bank in London can visit the NatWest website and find information on the products and services they need whether they’re buying a car, getting married, or getting ready for retirement. There are also solutions from this top London bank to help consumers struggling with hardships, including separation and divorce, changes at work, and being a caregiver.

Some of the tools and guides include overdraft calculators, loan calculators, and budget calculators.

Royal Bank of Scotland (RBS) Review

A well-respected and long-standing bank in London, Royal Bank of Scotland (RBS) is headquartered in Edinburg, providing service and support to customers across the top international markets including Europe, North America, Asia, and the Middle East.

RBS strives to provide service that they hope is “stronger, simpler, and fairer.” To do this, this London bank strives to be number one in customer service, trust, and advocacy, and also be as efficient and easy as possible to do business with. RBS also supports enterprise and economic growth and invests in necessary technologies and processes to strengthen all that they do for the customer. It’s these commitments that serve as a big reason they’re ranked as one of the best banks in London.

Key Factors Leading Us to Rank This as a Top London Bank

When researching and comparing RBS to other London banks, below are some reasons it was selected as a best bank in London.

Free Account

Consumers often vary pretty significantly in what they’re looking for when selecting banks in London. Some customers may want a premium account that carries a small fee for upgraded services and perks, while other London bank customers might instead want a free, basic account that will help them meet their daily needs.

RBS was included on this list of banks in London because they provide both. For London bank consumers searching for a free account, they offer the Select Account.

The Select Account has no monthly account fee and includes mobile banking, overdraft options, and other features like a Visa debit card and the ability to bank online. For the utmost in convenience, London bank customers who choose the RBS Select Account can also apply online. It’s the only one of the RBS accounts that provides that option.

Current Account Switch Service

One of the conveniences available to customers of this bank in London is the Account Switch Service. With this service, customers can move their accounts from one UK bank or building society to RBS quickly and easily. It takes only seven working days, and on the switch date, payments including Direct Debits, Standing Orders, and Bill Payments all transfer to the new account.

Credit balances from old accounts are transferred, the old account is closed, and the new account with this London bank becomes ready to use.

Any payments made to the former account after the switch date are automatically sent to the new account for 36 months.

As one of the leading banks in London, RBS handles the entire process for the customer, and it’s all backed by the Current Account Switch Guarantee.

My Rewards

For consumers searching for banks in London offering rewards programs, RBS has excellent options through the MyRewards program. These accounts are available to UK residents over the age of 18. Rewards are automatically earned on seven types of household bills, paid by direct deposit.

Rewards can also be earned on purchases made at partner retailers.

There is no limit to the amount of rewards a customer of this London bank can receive, and on average, current customers earn on average £120 per year in rewards. Once the Rewards balance becomes £5 or more, it can be converted to money. This money can be transferred into an RBS bank account, or can be put toward credit card balances.

Image Source: RBS UK – MyRewards

Instant Saver

As one of the leading banks in London, RBS offers a variety of savings account options including Instant Access ISA, Fixed-Rate ISA, and Fixed-Term Savings. Also available from this bank in London is the Instant Saver, ideal for anyone who wants simplicity and an effortless way to save money.

The Instant Saver offers flexibility, and account holders can save as much as they like. They earn interest monthly, and the account includes a cash card with ATM access.

The minimum deposit required to open this account is only £1, and the account is free.

Related: Best Banks in Indiana | Ranking of Banks in Indianapolis, Fort Wayne, Evansville

Free Wealth & Finance Software - Get Yours Now ►

Santander Review

Santander currently has nearly five million customers and ranks well among not only banks in London but global financial institutions regarding customer satisfaction. Along with offering general retail banking, this London bank also is a primary mortgage lender.

Santander has provided gross mortgage lending to UK homeowners totaling £19.5 billion. Santander helped 18,600 people purchase their first home in the past year.

Key Factors That Enabled This to Rank as One of the Top Banks in London

In terms of comparing Santander to the top banks in London, the following are some reasons it’s included in this ranking of the best banks in London.

Cashback Accounts

For customers of London banks seeking cashback options, Santander offers several through their current account products.

One is the 123 Current Account, which offers cashback on select household bills. Account holders can also earn interest on their balance, and the monthly account fee is only £5.

Another option is the 123 Lite Current Account, which features cashback on certain household bills when the account holder uses the online or mobile banking options. This account fee is even lower at £1, but there are eligibity requirements.

London bank customers can visit the Santander website and use their calculators to see how much they can earn by signing up for these current cashback accounts.

Student and Graduate Accounts

Many London banks feature account options specifically designed for students enrolled in higher education, and Santander’s are among the best. Their student and graduate current accounts are for students aged 18 and older.

One option, the 123 Student Current Account, includes a free 4-year, Santander 16–25 Railcard. The 123 Student Current Account also features interest earned on balances, and an interest and fee-free Arranged Overdraft.

Also available from this pick for one of the best banks in London is the 123 Postgraduate Current Account. This account features in-credit interest, and an interest and fee-free Arranged Overdraft.

Other options are the 123 Graduate Current Account, and the International Student Current Account.

All in One Credit Card

Santander offers a number of credit card options. One of the credit products from this top London bank is the All in One Credit Card. This credit card comes with 0% on balance transfers for 41 months from when the account is opened, 0% on purchases for 6 months, and no foreign transaction fees on spending abroad.

Your Loan, Your Choice

As one of the banks in London providing a broad range of lending products, Santander also offers personal loans for its customers. Personal loans from this London bank range in amounts from £1,000 to £20,000 for both new and existing customers.

Interest rates are low, and payback ranges from 12–60 months, with no prepayment penalty.

Applicants will receive a fast decision, possibly in a matter of minutes. Being one of the top London banks, Santander’s application is quick and straightforward, making this an excellent option for someone who wants rapid, flexible funding for any reason.

Don’t Miss: Best Banks in Colorado (Ranking & Review)

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Standard Chartered Review

Standard Chartered was formed in 1969 when the Standard Bank of British South Africa and the Chartered Bank of India, Australia, and China came together. The Standard Bank has a history in London dating back to 1862, while the Chartered Bank was founded by a Royal Charter by Queen Victoria in 1853.

A long-time leader among banks in London, Standard Chartered focuses on building a brand that is guided by the highest standards and a dedication to core values including openness, innovation, and collaboration.

Key Factors That Led Us to Rank This as One of the Best Banks in London

Critical reasons Standard Chartered is ranked among the leading banks in London are detailed in the following list.

Global Reach

For some London bank customers, having a global network and presence may not be important, while other consumers may be exclusively searching for a bank in London that offers this kind of connectivity. For consumers seeking banks in London with global resources, Standard Chartered is an ideal option.

This bank in London has a widespread network of international offices and capabilities, which can be perfect for the consumer who’s searching for services and products that aren’t confined to London or even the UK.

At the same time, this London bank also strives to bring their services together with local knowledge and expertise for comprehensive service.

Priority Banking

Certain customers of this leader among banks in London may have the ability to take advantage of Priority Banking services, which are designed to offer customised benefits that reward loyalty and the relationship a customer has with Standard Chartered. Some of the benefits of Priority Banking from this leading bank in London include:

- Privileged Pricing: This features the best value on banking products and services from this bank in London including special fee waivers, discounted prices on deposits and loans, and free overseas cash ATM withdrawals.

- Household Recognition: This includes Priority Banking membership for the customer’s spouse and children, family access to Priority Banking Centres, and invitations to lifestyle events.

- Total Relationship Rewards: There is a rewards scheme based on factors such as how much the customer spends on a card, their bank deposits, their investments, and their home loans held with Standard Chartered.

Savings Accounts

This bank in London leads the way in terms of diversity of products and types of accounts, and this holds true with their savings account options.

Some of the savings accounts a customer of this selection for a best bank in London can open include:

- My Dream is an account to help parents start saving for their children’s future

- Payroll is a banking solution for companies and employees that helps with the management of salary payments

- Women’s Account is specifically designed to meet the financial needs of female consumers

- eSaver is an account that’s designed for convenience and flexibility, and it also offers the most competitive interest rate

- Marathon Saving is an account with an attractive interest rate and the flexibility to withdraw funds anytime

Islamic Banking

Something unique available from Standard Chartered not available from many other banks in London, even the best banks in London, are their Saadiq Islamic Banking products and services. These options are designed to provide what they call innovative banking solutions that are in line with the beliefs of customers.

Islamic banking services from Standard Chartered include Personal Banking with Saadiq accounts. These Saadiq accounts from this London bank include current accounts, savings accounts, and term accounts which serve as a short- to medium-term investment solution. There are also Saadiq financing options.

These offerings can be beneficial not only to local residents searching for top banks in London, but also for people interested in carrying out international business or transactions.

Free Wealth Management for AdvisoryHQ Readers

The Co-operative Bank Review

Among one of the best banks in London, The Co-operative Bank specialises in High Street and Internet banking, including a lineup of current accounts, mortgages, savings accounts, credit cards and loans. The history of the Co-operative Bank dates back to 1872 when it was the Loans and Deposit Department of CWS.

The Co-operative Bank strives to work in a way that’s ethical and both community-focused and environmentally conscious. They are guided by a distinctive ethical policy, which is one of the many ways they are a best bank in London.

Key Factors Considered When Ranking This as One of the Best Banks in London

After comparing London banks, the following are some of the specific reasons the Co-Operative Bank was included on this list of banks in London.

Ethical Policy

One of the biggest ways the Co-Operative Bank is different from other London banks and most banks around the world is their signature Ethical Policy, which guides their products and service delivery.

The Co-Operative Bank is the only high street bank in London with a customer-led Ethical Policy, and it’s been in place since 1992. Since that time, more than 320,000 customers have contributed to the direction of the Ethical Policy, which serves as the foundation for everything the London bank does.

Switching Bonus

To attract new customers to this London bank, they offer a bonus to switch to a no-monthly-fee current account. New customers receive £110 when they successfully switch to this current account, based on status and qualifying criteria.

This bonus is only available with a full switch and more than four active Direct Debits to a qualifying current account.

In addition to providing money for switching, this leader among London banks also makes the process simple for the customer. All payments are automatically transferred, including Direct Debits, standing orders, and bill payments. Payments to your old account, and if there are any problems during the switch, this London bank guarantees coverage, including reimbursement for financial loss.

Everyday Rewards

A signature program from this selection for a best bank in London is called Everyday Rewards. With Everyday Rewards, customers receive up to £5.50 a month on their current account if they meet certain criteria. Participants in this program available from this London bank can also receive an additional 5p per debit card transaction each month if they meet the below criteria. This includes:

- Paying in £800 or more

- Staying within the credit limit and the agreed-upon overdraft limit

- Utilising online or mobile banking

- Opting in to receive paperless statements

- Payout four or more Direct Debits

The Co-Operative Members’ Credit Card

Essential to being selected as one of the best banks in London is having a selection of consumer-friendly credit cards. One of the cards that helped the Co-Operative Bank be included as part of this list of banks in London is the Co-Operative members’ Credit Card, exclusively for Co-Operative Members.

Image Source: The Co-operative’s Member’s Credit Card

This card features not only a competitive interest rate but also 1p cashback for every £2 spent at the Co-Operative Food Stores. There is an available 1p cashback for every £3.33 spent anywhere else the Visa symbol is shown.

Additionally, this card carries no annual fee and no transfer fee.

Popular Article: Best Kentucky Banks | Ranking | Top Banks in Kentucky

Free Money Management Software

Virgin Money Review

A respected name among the top banks in London, Virgin Money strives to offer an alternative to many other London banks. Instead of offering expensive or complicated products and services, Virgin Money offers simplicity and easy banking. Products available from this London bank include savings, pensions, credit cards, investments, and more.

Virgin Money is part of Virgin Money Holdings (UK) plc, which became part of the Official List of the UK Listing Authority, and was trading on the main market of the London Stock Exchange in November 2014.

Key Factors That Led to Our Ranking of This as One of the Best Banks in London

Leading reasons Virgin Money was included on this list of banks in London and ranked as a best bank in London are detailed below.

Essential Current Account

This London bank account is designed for consumers searching for simplicity along with the banking essentials they need. This account is managed through Virgin Money Stores, and it can also be managed at any post office. Some of the services associated with the Essential Current Account can be maintained online and by phone.

There is no overdraft facility, and free withdrawals are available at almost any high street cash machine.

This account earns 0.75% Gross/AER (variable) interest on the balance held in the account, up to a maximum balance of £100,000, with interest paid monthly. This account also includes fair charges and all the standard perks that come with being a customer of Virgin Money.

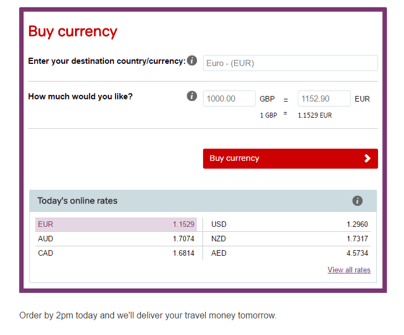

Travel Money

Available from this leader among London banks is Virgin Money Travel Money, which is commission-free currency with highly competitive exchange rates. Taking advantage of Travel Money is simple.

Customers select their currency from a choice of 55 foreign currencies and then choose how they’d like it to be delivered. Options include Click and Collect service and Virgin Money Stores, or free home delivery on certain orders. Customers can also pay for their travel money by card.

Image Source: Virgin Travel Money

Stocks and Shares ISAs

Some of the top banks in London will offer not only deposit accounts but also investment options. Virgin Money features an array of investment product and services including Stocks and Shares ISAs. This London bank offers options so that investors can combat low interest rates on savings.

These accounts are also tax-efficient, so the account holder doesn’t have to pay tax on income earned from the investment, and there are no hidden fees.

Account holders can access funds at any time, and they can maintain full control over their account by stopping, starting, or changing payments.

Specific options range from the Bond and Gilt Fund, which is the lowest risk and puts money in UK Government-issued bonds and reputable companies up to the Global Share Fund, which allows account holders to invest in shares across countries and regions for diversity.

Virgin Money Discounts

When consumers become customers of this leader among London banks, they receive access to not only the best banking products but also unique perks affiliated with the Virgin name. Some of these perks are related to available discounts on various products and services.

These discounts include 5% off Virgin Holidays and Virgin Holidays Cruises, as well as 10% off selected advance fares on Virgin Trains.

Customers can be eligible for £25 cashback on Virgin Money Travel Insurance, discounts on selected car park deals, and 10% off at Cottages.com.

Banks in London have a complicated history and reputation in the eyes of the consumer. Many London banks may be seen as unfair to the consumer because of the fees they charge, the red tape they put in place to prevent people from getting the products, and services they want, or a simple lack of choices.

This review and ranking of the best banks in London cuts through those issues consumers commonly complain about. Instead, these London banks excel in many areas. In fact, many of the names on this list of banks in London excels in almost every area often ranked as relevant to the consumer.

These London banks are among the best banks in London because they offer fair fees, transparency, strong reputations, and a consumer-driven approach.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.