2018 RANKING & REVIEWS

TOP RANKING OKLAHOMA CITY BANKS AND CREDIT UNIONS

Looking for Better Banking? Check Out the Top 7 Best Credit Unions & Best Banks in OKC (+1 to Avoid)

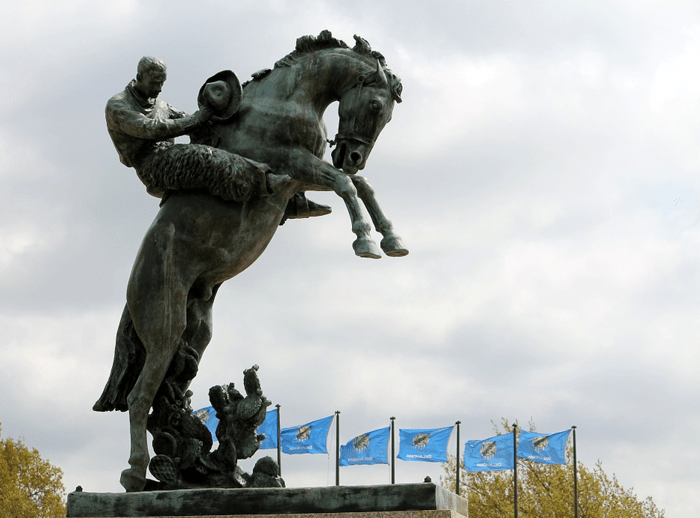

Oklahoma City, OK, known as OKC for short, sits in the Great Plains region and is one of the largest cities in that area. Besides having a livestock market that is among the biggest in the world, it’s also on a primary North/South travel route, the I-35 Corridor.

People living and working in the OKC area, gravitate towards no-nonsense Oklahoma City banks and credit unions they can trust. Whether looking for a mortgage loan or checking and savings accounts, they like a small, local touch when seeking the best bank in Oklahoma City.

Award Emblem: Top 7 Best Banks & Credit Unions in Oklahoma City

We’ve found 7 of the top Oklahoma City banks and credit unions for our 2018 ranking that all are local and provide that community banking touch. Below, we’ll highlight the types of rates they offer on savings and auto loans in OKC, plus tell you how they ranked and why.

In our FAQ, we’ll touch on a few ways that a bank and credit union in OKC will differ, and what they have in common. We’ve also got one financial institution to warn you to avoid for the time being and we’ll tell you why.

Top 7 Best Credit Union or Best Bank in Oklahoma City (& 1 to Avoid) | Brief Comparison & Ranking

| Best Credit Union or Best Bank in OKC | 2018 Ratings |

| Bank of Oklahoma | 5 |

| First Enterprise Bank | 5 |

| MidFirst Bank | 5 |

| Tinker Federal Credit Union | 5 |

| Weokie | 5 |

| Oklahoma’s Credit Union | 3 |

| True Sky Credit Union | 3 |

| The First State Bank | 1 |

Table: Top 7 Banks & Credit Unions in Oklahoma City (& 1 to Avoid) | Above list is sorted by rating

Best Bank in OKC FAQ Review | What’s the Difference Between Banks & Credit Unions in Oklahoma City?

These days, there is not a lot of difference between using one of the best credit unions or banks in Oklahoma City. They both offer many of the same services, like checking/savings accounts, loans and investment, and credit cards. You can also find depositor insurance of up to $250,000 offered at both.

However, while most people find it hard to see any difference in banking with a bank or a credit union in OKC, there are a few key differences you should be aware of.

- Oklahoma City credit unions are non-profit, banks are for-profit

- Oklahoma City credit unions have membership requirements, banks do not

- Oklahoma City credit unions can be part of CO-OP shared branches, banks don’t typically do this

- Oklahoma City credit unions often offer better interest rates because they’re non-profit

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed AdvisoryHQ Review – Top Ranking Best Banks & Credit Unions in Oklahoma City, OK (& 1 to Avoid)

Below, please find a detailed review of each firm on our list of top credit unions and banks in Oklahoma City. We have highlighted some of the factors that allowed each bank or credit union in OKC to score so highly in our selection ranking

Click on any of the names below to go directly to the review section for that firm.

- Bank of Oklahoma

- First Enterprise Bank

- MidFirst Bank

- Tinker Federal Credit Union

- Weokie

- Oklahoma’s Credit Union

- True Sky Credit Union

- The First State Bank

Bank of Oklahoma Review

Bank of Oklahoma is over a century old and prides itself on being a best bank in OKC that supports the local community. They’re part of larger parent company, BOK Financial, which is one of the top 25 U.S.-based banks.

Below are the highlights that make Bank of Oklahoma stand out on AdvisoryHQ’s 2018 Ranking of the Best Oklahoma City Credit Unions & Banks.

Bank of Oklahoma Services at a Glance:

- 17 branch locations in Oklahoma City, Oklahoma & surrounding areas

- ATMs at local 7-11® stores

- Open an account in 5 minutes or less

- New auto loan as low as 3.58% APR

- Better Business Bureau A+ rating

Community Focused

If the thought of using a big bank that doesn’t give back to your community turns you off, then you’ll love Bank of Oklahoma. This is a bank in Oklahoma City that supports the local community in a number of ways. They give to local charities, participate in community service, and do community reinvestment.

Rating Summary

Bank of Oklahoma scored a 5 on our 2018 Ranking of the Best Banks and Credit Unions in Oklahoma City. Customers give high marks to their straight forward checking & savings accounts and excellent customer service.

From their website navigation to their “5 minutes or less to set up” checking accounts, everything this bank in Oklahoma City does is geared toward making your banking easy. They also have an excellent support structure behind them, being part of BOK Financial.

See Also: Washington Federal Ranking & Review

First Enterprise Bank Review

First Enterprise Bank was founded in 1907 and is a locally-owned community bank in Oklahoma City. While this best bank in OKC may not have as many locations as others, it’s solely dedicated to serving the residents of Oklahoma City, OK.

Below are the highlights that make First Enterprise Bank stand out on AdvisoryHQ’s 2018 Ranking of the Best Oklahoma City Credit Unions & Banks.

First Enterprise Bank Services at a Glance:

- 4 branch locations in Oklahoma City, Oklahoma & surrounding areas

- Partners with Transfund to offer surcharge-free ATMs at 7-11® locations

- 15-month CD with 1.35% APY

- No fee personal checking accounts

- Better Business Bureau A+ rating

Excellent CD Rates

If you’ve been held back on investing for retirement because you don’t have a lot of money to tie up for years, then this is one of the Oklahoma City banks you’ll want to consider. They have excellent short-term CD rates of 1.35% APY for 15-months or 1.60% for 27 months.

Rating Summary

Being a small, local bank in OKC, First Enterprise bank has a lot to offer. They may be small, but their services are mighty. We rated them a 5 as one of the best financial institutions in Oklahoma City.

They’ve got several checking account options with or without interest to fit everyone’s needs. They also offer the same types of business accounts and commercial lending as larger banks in Oklahoma City. So, if you like banking with a locally owned bank, they’re a great option.

Don’t Miss: US Bank Review & Ranking | What You Should Know About US Bank

MidFirst Bank Review

You don’t often see large banks stay private, and MidFirst Bank is a rare breed. They’re one of the largest privately owned financial institutions in the U.S. Their primary markets include Oklahoma City, Tulsa, western Oklahoma, Denver, and Phoenix.

Below are the highlights that make MidFirst Bank stand out on AdvisoryHQ’s 2018 Ranking of the Best Banks and Credit Unions in Oklahoma City.

MidFirst Bank at a Glance:

- 5 branch locations in Oklahoma City, Oklahoma & surrounding areas

- Auto loans as low as 3.25% APR

- 0% introductory rate credit card

- Tiered level benefit checking accounts

- Better Business Bureau A+ rating

Flexible Commercial Banking

No matter your size of business, MidFirst Bank is dedicated to providing commercial banking options for any size company. From checking accounts, to commercial lending, to merchant services, this is one of the banks and credit unions in Oklahoma City you can count on for support.

Rating Summary

Convenient locations, consistent service, and no hidden fees are a few of the reasons people stay with MidFirst Bank for years (even generations). They earned a 5 on our ranking as one of the best banks in OKC, with customer loyalty being a big reason.

No matter what type of loan you may be looking for in Oklahoma City, you can probably find it here. They finance everything from boats and RV’s to commercial energy improvements. They’re also big on sustainability.

Related: Great Banks & Credit Unions in Indianapolis, IN | Ranking

Tinker Federal Credit Union Review

Tinker Federal Credit Union is the largest in the state of Oklahoma. It’s been serving members for over 70 years and is headquartered in Oklahoma City, OK. Its 31 branches serve Tinker Air Force Base, Vance Air Force Base, and employees of over 700 area businesses.

Below are the highlights that make Tinker Federal Credit Union stand out on AHQ’s 2018 Ranking of the Best Banks and Credit Unions in Oklahoma City.

Tinker Federal Credit Union in OKC at a Glance:

- 14 branch locations in Oklahoma City, Oklahoma & surrounding areas

- Member of the CO-OP network with over 5,000 branches in the U.S.

- Credit cards with a 4.99% APR intro rate

- Auto loans as low as 2.99% APR

- Better Business Bureau A+ rating

Military Rewards Program

This is one of the credit unions in Oklahoma City that serves two Air Force bases, so if you’re in the military, you’ll want to check out Tinker Federal Credit Union’s Military Rewards Program. It’s open to active duty members and offers free perks and discounted services.

Rating Summary

Tinker Federal Credit Union earned a 5 rating as one of the top credit unions in Oklahoma City. Their members mention how they go out of their way to help them save money and have great auto loan rates too.

While they are geared toward military members, they also serve civilians affiliated with over 700 companies with the same great products and services. It’s one of the reasons they’re the largest credit union in Oklahoma.

Popular Article: Best Banks & Credit Unions in Columbus, OH | Ranking

Weokie Review

Weokie is a credit union in Oklahoma City started in 1969 by employees of Western Electric of Oklahoma. Today, if you live, work, worship, or attend school in the counties of Oklahoma, Canadian, Cleveland, Grady, Lincoln, Logan, McClain or Pottawatomie, you qualify for membership.

Below are the highlights that make Weokie stand out on AdvisoryHQ’s 2018 Ranking of the Best Banks and Credit Unions in OKC.

Weokie Credit Union in Oklahoma City at a Glance:

- 10 branch locations in Oklahoma City, Oklahoma & surrounding areas

- Auto loans as low as 2.49% APR

- 15-month CD for 1.76% APY

- Investment and financial services

- Better Business Bureau A+ rating

Financial Education

Looking for a quick video on identity theft or a free in-depth money management class? You can find both at Weokie. They also partner with the FoolProof Financial Literacy Initiative to bring members even more online educational resources.

Rating Summary

Weokie scored a 5 on our ranking as one of the best credit unions and banks in Oklahoma City. Their members praise their exceptional customer service and even those that moved out of the area, say they’re very easy to do business with long-distance.

They have excellent CD rates along with other investment options to help you grow your money. Their financial education resources go the extra mile to provide multiple different options. They’re a great choice for a local credit union in Oklahoma City, OK with excellent support for their members.

Read More: Best Banks & Credit Unions in Fort Worth | Ranking

Free Wealth & Finance Software - Get Yours Now ►

Oklahoma’s Credit Union Review

This financial institution decided to brand themselves for the whole state. Oklahoma’s Credit Union (OKCU) was started over 60 years ago and anyone that lives, works, worships, or attends school on the Oklahoma City Metro Area can bank here.

Below are the highlights that make Oklahoma’s Credit Union stand out on AdvisoryHQ’s 2018 Ranking of the Best Banks and Credit Unions in Oklahoma City.

Oklahoma’s Credit Union in OKC at a Glance:

- 4 branch locations in Oklahoma City, Oklahoma & surrounding areas

- Member of the CO-OP network with over 5,000 branches in the U.S.

- Auto loans as low as 3.24% APR

- CD terms ranging from 6 to 60 months

- Better Business Bureau Not listed

Rewards Debit Account

Do you like getting rewarded with points and travel perks whenever you use your debit card? Then you’ll like the Rewards Debit Account at Oklahoma’s Credit Union. You earn a point for every $5 spent and can use them at multiple merchants in their online network or mobile site.

Rating Summary

We scored Oklahoma’s Credit Union a high 3 on our list of the top Oklahoma City banks and credit unions. They have a few mixed reviews about their customer support, some praising it and others not. Overall, however people enjoy their helpful service.

Their website is fairly easy to navigate, but it’s geared to have you call them for personal assistance, which just shows that they care about giving a personal touch. Another bonus is being one of the credit unions in Oklahoma City in the CO-OP network, which greatly expands branch and ATM locations.

Related: Best Austin Credit Unions & Banks | Ranking

True Sky Credit Union Review

True Sky Credit Union was started by eight co-workers at the Civil Aeronautics Administration in OKC. Today, they serve members from eight different counties in the Oklahoma City Metro Area, making them one of the easiest to join credit unions in OKC.

Below are the highlights that make True Sky Credit Union stand out on AdvisoryHQ’s 2018 Ranking of the Best Banks and Credit Unions in Oklahoma City.

True Sky Credit Union in OKC at a Glance:

- 7 branch locations in Oklahoma City, Oklahoma & surrounding areas

- Member of the CO-OP network with over 5,000 branches in the U.S.

- Personal loans as low as 7.00% APR

- Save up to $750 on home loan closing costs

- Better Business Bureau Not listed

Checking with Interest at 1.50% APY

It’s hard enough to get a decent rate on a savings account, but with True Sky Credit Union, you can earn as much as 1.50% APY on checking. Their Optimum Checking gives a great interest rate plus up to $10 in ATM fee refunds per month.

Rating Summary

We rated True Sky Credit Union a 3 on our 2018 Ranking of the Best Oklahoma City Banks and Credit Unions. They get praise for their great savings and loan rates, but some members mention poor customer service, especially at the drive-thru window.

Being a member of the CO-OP network is a big plus in the convenience department. Their rates on everything from interest-bearing checking to credit cards are also some of the best you’ll find. So, if you’re looking to earn or save on interest, this is one of the Oklahoma City credit unions, you’ll want to check out.

Don’t Miss: Wells Fargo vs. Chase – Compare Checking Accounts, Mortgages & Banks

The First State Bank Review

The bank in Oklahoma City we found that we recommend avoiding for the time being is The First State Bank. Being founded in 1902, you would expect there to be more information about them online, but there is a curious lack of positive customer reviews.

Below are some of the improvements we feel would help The First State Bank have another chance at being considered a best bank in OKC in AdvisoryHQ’s future ranking.

Add More Locations

The First State Bank has just a single branch location in Oklahoma City and one in nearby Midwest City, OK. For most people, a lack of branch options is very inconvenient. If they want to attract more clients, more locations would definitely help.

Rating Summary

As the bank in Oklahoma City, OK that we recommend bypassing, we rated The First State Bank a 1 in our 2018 Ranking of Best Credit Unions and Banks in Oklahoma City.

Their lack of locations and even online reviews (good or bad) give the impression that they’re not looking to grow or even compete to become a best bank in Oklahoma City.

They look to have the same account and other services as other banks in the area, so it may just be that they want to remain small and relatively quiet as far as an online presence.

Popular Article: Webster Bank Review & Ranking | What You Should Know About Webster Bank

Conclusion – Top 7 Best Credit Unions & Banks in Oklahoma City

If you like banking local in Oklahoma City, you have no lack of awesome options. From incredibly low auto loan rates to generous interest-bearing checking, you can find the perfect bank or credit union in OKC to fit your financial style.

If you’re considering a credit union in Oklahoma City, just remember to check their membership requirements. Although these days, most are very easy to qualify for just by living in the area.

Whichever type of financial institution you choose, your deposits will have a similar type of protection. And it should be good to know that many of the banking services are identical at both Oklahoma City banks and credit unions.

Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the rate table(s) displayed on this page.

Image sources:

- https://www.freeimages.com/photo/downtown-okc-4-1510948

- https://pixabay.com/en/oklahoma-city-oklahoma-building-101926/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.