2017 RANKING & REVIEWS

TOP-RANKING BEST BOND FUNDS

Finding the Best Bond Funds in 2017

Finding the best high-yield bond funds requires a large amount of research and financial planning. High-yield bond funds have the potential to be very risky investments, so it is important to find the best for your financial needs.

Many investors find themselves asking questions like:

- What is a bond fund?

- What are the risks of investment?

- How can I be sure to reduce these risks without losing value?

Award Emblem: Best Bond Funds with High Yields

To find the best high-yield bond funds, it is important to have a clear understanding of your finances and investment goals. Individuals seeking slow, steady, long-term investment growth may want to explore different investment options. However, individuals seeking to boost their portfolio yield or those interested in higher risk and reward investments have come to the right place.

To answer these questions and more, the following rankings and reviews will lay out the best high-yield bond funds for inspection. Armed with the best information, you can weigh the needs of your business and choose from the best bond funds available.

See Also: Top Credit Card Sign-Up Bonus Offers | Ranking | Best Sign-Up Bonus Credit Cards Reviews

AdvisoryHQ’s List of the Top 6 Best Bond Funds

List is sorted alphabetically (click any of the best bond fund names below to go directly to the detailed review section for that bond fund):

- BlackRock High-Yield Bond Fund

- Eaton Vance High Income Opportunities

- Federated Institutional High-Yield Bond Fund

- Fidelity Capital & Income Fund

- Lazard US Corporate Income Portfolio

- Vanguard High-Yield Corporate Fund Investor Shares

Image Source: Pixabay

Top 6 Best Bond Funds| Brief Comparison & Ranking

Best | Current | Abbreviation | Average Annual Return Rates |

| BlackRock High-Yield Bond Fund | BHYIX | ||

| Eaton Vance High Income Opportunities | ETHIX | ||

| Federated Institutional High-Yield Bond Fund | FIHBX | ||

| Fidelity Capital & Income Fund | FAGIX | ||

| Lazard US Corporate Income Portfolio | LZHYX | ||

| Vanguard High -Yield Corporate Fund Investor Shares | VWEHX |

Table: Top 6 Best Bond Funds | Above list is sorted alphabetically

Commonly Asked Best Bond Fund Questions

What Is a Bond?

A bond is a kind of debt investment. Investors are able to loan money to borrowing entities, like corporations, for a particular amount of time with attached interest rates. Borrowers can get funding to finance new initiatives or projects, and investors can gather income through their investment.

What Is a Bond Fund?

A bond fund bundles different bonds and other debt investments. Investors can purchase shares in bond funds that pay out periodic dividends. This allows individuals or organizations the opportunity to profit from investments without having to manage their own bonds.

Bond funds can also alleviate some investment risks by investing in a wide range of organizations, sectors, and funds. Because it is less likely for a huge number of bonds to fail, there is less risk of high levels of loss.

What Are High-Yield Bonds?

High-yield bonds offer investors higher yield rates. However, these kinds of bonds have lower credit rating, which can make them a risky investment. The best bonds to buy like this will have a balance of risk and reward.

High-yield bonds are also called junk bonds, non-investment grade bonds, or non-rated bonds. However, these terms can be misleading. These bonds are used by a wide range of investors and can be profitable.

The Risks

Bond value can change over time, which means that some bonds have the potential to be risky investments. To determine the level of risk in an investment, the credit quality and duration of a bond must be examined.

A bond issuer, or borrowing entity, with a poor credit rating is more likely to default on their loan. This makes low-rated bonds cheaper. Bond duration can be between less than a day or decades. The longer a bond will be in the market, the greater the risk of losing value, which gives them higher interest rates.

The value of even the best high yield bond fund can change directly proportional with its price. If prices are high, bonds are valuable. If they drop, the value of the bond drops. High-yield bond prices can drop if interest rates increase, if the bond issuer has deteriorating finances, or depending on a number of other market factors.

Working Around Risk

The best way to work around the risks of high-yield bond investment is to diversify. This can be done by investing in a number of different issuers, industries, and market sectors. This will cause the bond portfolio to take fewer losses in the event that one issuer or industry suffers a loss.

Investors should also keep an eye on bond credit ratings and the financial health of bond issuers to minimize the change of losses. The best bond mutual funds often invest in a wide range of issues and sectors to offer investors risk protection. When choosing the bond mutual funds it is important for investors to ask: what is a bond fund composed of? If a fund does not offer a lot of diversification, it may be a less stable choice.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Don’t Miss: Top Best Chase Credit Cards | Ranking | Compare Best JPMorgan Chase Offers and Rewards

Detailed Review—Top Ranking Best Bond Funds

Below, please find the detailed review of each card on our list of best bond funds. We have highlighted some of the factors that allowed these top bond funds to score so high in our selection ranking.

BlackRock High-Yield Bond Fund Review

The BlackRock High-Yield Bond Fund is abbreviated as BHYIX. This high-yield bond fund is offered by BlackRock. It is intended to serve investors seeking high investment returns and income. Like many other best bonds to invest in, it relies on diversification to combat investment risk.

According to the Blackrock website, this fund has also experienced consistent growth over a long period of time and through changing market conditions, which helps propel it into standing as one of the best bonds to buy for stability.

Features

The BlackRock High-Yield Bond Fund has a net asset value or NAV of $7.63 as of December 16, 2016.

This is a contender as one of the best bonds to buy with an average annual total return rate of 9.21% over one year. This is above the Morningstar category average, which clocks in at 9.13% over the same period of time. Morningstar is an independent bond analyst, which offers unbiased statistics and information about available bond funds.

As one of the best bonds to buy, this fund has cumulative performance of 262.52%. This means that an investment of $10,000 in the BlackRock High-Yield Bond Fund could have a hypothetical growth up to more than 35,000.

Eaton Vance High Income Opportunities Review

Eaton Vance High Income Opportunities is a high-yield bond fund offered by Eaton Vance Investment Managers. This fund is identified with the symbol ETHIX.

This fund offers investors the opportunity to enjoy high-yield bonds with a history of high income levels and a low correlation to the fluctuation of interest rates. The bonds that make up this fund have a relatively high average credit with 42.40% holding a rating of B and 35.44% with a rating of BB, which reduces the risk of default.

Features

As of December 16, 2016 this fund had a NAV of $4.47. This fund has a historical returns rate of 8.80% over one year. This is higher than the Morningstar category average, which was 8.70% over the same time. Both of these figures are based on findings as of November 30, 2016.

As of November 30, 2016, this fund consisted of:

- 87.32% corporate bonds

- 7.68% floating-rate loans

- 1.74% cash

- 1.54% other investments

- 1.38% common stocks

- 0.35% preferred stock

Greater levels of diversity help make the best bonds to buy more stable. This fund is comprised of 302 separate issues for added risk protection.

Related: Top Business Credit Cards For New Business | Ranking | Best Startup Business Credit Cards For New Businesses

Federated Institutional High-Yield Bond Fund Review

The Federated Institutional High-Yield Bond Fund is abbreviated in the market as FIHBX. This top bond fund is offered by Federated Investors. Like most of the best high-yield bond funds, it is designed to offer investors a high level of income through low rated securities. However, through portfolio diversification, it may be one of the best bonds to invest in because it offers this high-yield performance and low risk to investors.

Features

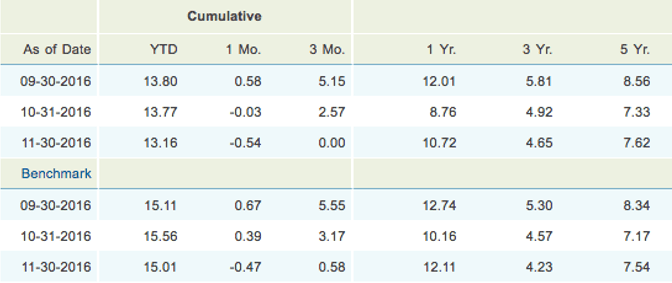

As one of the top bond funds, this option has an average annual total return of 10.72% over one year as of November 30, 2016. These high-yield bond funds are performing in this category slightly below the benchmark (which is the Bloomberg Barclays U.S. Corporate High-Yield 2% Issuer Capped Index), which is 12.11%. However, when returns are measured over a longer period of time they begin to exceed the standard.

Image from Federated Investors

This top bond fund has a very high level of diversification and investments higher than 10.5% of the fund have not been made in any one sector. This may be one of the best bonds to buy because it offers relatively high average returns, with an average expense ratio and a huge amount of diversification and stability.

Fidelity Capital & Income Fund Review

The Fidelity Capital & Income Fund is abbreviated as FAGIX. This high-yield bond fund is offered by Fidelity. This is one of the best bonds to buy because it offers an excellent balance of profitability and risk. As one of the best high-yield bond funds, it has a great rating from Morningstar, an independent financial analyst. According to Morningstar, this top bond fund has very high returns, below average expenses, and slightly below average risk, as of November 30, 2016.

Features

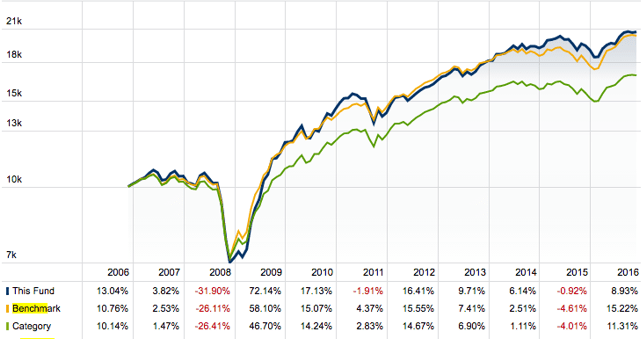

As of September 30, 2016, investors could enjoy an average annual total return rate of 9.14%, making this one of the best bonds to invest in for returns. Based on an assumed investment of $10,000 made in 2006, this high-yield bond fund has a hypothetical value of $20,717 on November 30, 2016.

Image from Fidelity

As one of the best high-yield bond funds, it offers growth higher than the Morningstar category average which was $16,880. This might be one of the best bonds to buy because it offers investors higher-than-average growth and above-average stability to protect that growth.

Popular Article: Top Barclays Credit Card Offers | Ranking | Reviews of Barclays Bank Cash, Travel & Other Cards

Lazard US Corporate Income Portfolio Review

The Lazard US Corporate Income Portfolio is a high-yield mutual fund offered by Lazard Asset Management. This portfolio’s institutional fund is represented with the symbol LZHYX. This option strives to be one of the best bond mutual funds by focusing on higher quality high-yield investments usually ranked between B+ and BB-. This allows the bond mutual funds to benefit from higher returns, and enhances the protection already provided by diversification.

Features

According to Morningstar, the high-yield bond funds considered here offer investors below-average risk and average return rates. This may be one of the best bond mutual funds because it offers investors the stability of low-risk investments without cutting into profitability.

Over the course of 10 years the bond mutual funds here have a hypothetical value of a $10,000 investment totaling at $17,965. As one of the best bond mutual funds, this is above the category average for high yield bonds, which would have been worth $17,085.

Vanguard High-Yield Corporate Fund Investor Shares Review

The Vanguard High-Yield Corporate Fund Investor Shares are issued by The Vanguard Group, Inc. This group offers on of the best bonds to buy for consistent income. These bond mutual funds include high, medium, and low corporate bonds that are recommended for investors who already have a well-diversified portfolio. This is because high-yield bonds are subject to a larger range of volatility.

Features

According to Morningstar, this may be one of the best high-yield bond funds because it offer below-average risks to investors, but maintains average return rates. As an option for the best high-yield bond funds, this fund has a higher hypothetical growth rate than the average high-yield bond. A $10,000 investment made in 2005 could have a value of $18,407 while the category average is only $17,085.

Volatility often accompanies even the best high-yield bond funds. This option is no different; it exhibits higher growth, but increased volatility when compared to the benchmark fund, which is the Bloomberg Barclays US Aggregate Bond TR USD. However, it did not experience increase volatility when compared to the average high-yield bond rates calculated by Morning Star keeping it in the running for best high-yield bond funds.

Read More: Top Charge Cards and Best Business Charge Cards | Ranking & Reviews

Free Wealth & Finance Software - Get Yours Now ►

Conclusion—Top 6 Best Bond Funds

The performance of high-yield bonds is based on a number of different factors. These contributing factors will be slightly different for each of the best bond funds available. Because investment needs can vary depending on each investors portfolio, finances, and expectation, finding the best bond funds will be relative to each individual. Though some will mesh better than others, each of the high-yield bond funds ranked here has a solid history of performance and could serve the right investor well.

To find the best bond funds for your investment needs, keep in mind the highlights from our comparison:

- BlackRock High-Yield Bond Fund: Cumulative performance of 262.52%

- Eaton Vance High Income Opportunities: High average bond credit rating standards

- Federated Institutional High-Yield Bond Fund: Highest average annual return rate

- Fidelity Capital & Income Fund: Below-average risk assessment

- Lazard US Corporate Income Portfolio: Average bond credit ranking between B+ and BB-

- Vanguard High-Yield Corporate Fund Investor Shares: Above average hypothetical returns

To find the best bonds to buy for your investment needs, it is important to consider your financial needs. For example, an investor who is close to retirement might benefit from choosing high-yield bond funds with a best history of stability. However, a younger investor can afford to take more risks and might be better served by a more volatile option for the best bonds to invest in long-term. With the information provided in our comparison, you can dive into the search for the best high-yield bond funds armed with top-notch information.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.