2017 RANKING & REVIEWS

BEST BUDGETING SOFTWARE APPS

2017 Review: Which are the Top 6 Best Budget Apps

As one of the fastest-growing review and ranking news media for the financial industry, the AdvisoryHQ editorial staff often receives queries from users seeking the best budget apps.

There is a particularly strong level of interest among consumers in identifying the best budget app for online, desktop, Mac, iPhone, iPad, and Android devices.

The highest level of interest, however, centers around finding the top budgeting apps that are free. Free budget software is in high demand, and luckily, many of the best budget apps are also free budget apps.

Award Emblem: Top 6 Best Budget Apps

Key Questions: Top Budgeting Apps

When it comes to finding a money manager app for efficient and simple budget maintenance, it can be difficult to determine where to start. There are a few common questions that consumers are asking when looking for the best budget app. Some of these questions include:

- What are the best budget apps to use in 2017?

- What top budgeting apps are compatible with iOS and Android?

- Where can I find a budget app review of the best budget apps?

- What are the best money management tools for successful budget maintenance?

- Where can I find free budget software?

- I need a money manager app. Which money management app is best?

In response to these questions, our budget app review aims to highlight the best performing money management tools and free budget software to consider in 2017.

By using our budget app review as a guide, consumers will find themselves well-equipped to identify the best budget app or money manager app to aid them in successful budget maintenance.

See Also: Best Personal Accounting Software for Home Use

AdvisoryHQ’s List of the Top 6 Best Budget Apps

List is sorted alphabetically (click any of the budget app names below to go directly to the detailed review section for that best budget app):

Top 6 Best Budget Apps | Brief Comparison & Ranking

Best Budget Apps | Free Trial? | Best For |

| Buxfer | Free version available | Reducing unwanted spending |

| CountAbout | 15-day free trial | Clutter-free interface & no advertisements |

| Mint | Free | Creating manageable budgets |

| Personal Capital | Free | Seeing your net worth and a 360-view of your entire financial situation |

| Quicken | N/A | Integrating investments & personal budgeting |

| YNAB | 34-day free trial | Keeping track of upcoming bills |

Table: Top 6 Best Budget Apps | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Buxfer Review

Buxfer is an online money management app, and is one of the best budget apps to consider this year. Their company goals focus on providing flexible, actionable, proactive, and powerful money management tools.

Buxfer helps you see all of your accounts in one place, allowing users to create a comprehensive overview of their budget maintenance.

Their money management tools quickly track where your money is going and reduce unneeded spending, allowing users to efficiently save for future goals.

Key Factors That Led to Our Ranking of Buxfer as a Best Budget App

Aside from providing a free budget app version of their money management tools, the following list highlights why Buxfer is one of the best budget apps to consider in 2017.

Personalized Options

Simply put, this best budget app lets users create and track their budgets, making it possible to experience efficient budget maintenance. However, one of its many great capabilities is in allowing you to create tags to better categorize expenses. Set weekly, monthly, or yearly spending limits per tag.

The tags in this money manager app are free-form, meaning that users have flexibility, and can attach multiple tags for one transaction.

Additionally, this best budgeting app allows for automatic settings to be applied to tags, speeding up the process of budget maintenance. By combining flexibility and categorization, Buxfer is one of the best budget app for creating simple budget maintenance plans.

Automatic Uploading

The Buxfer money manager app is capable of automatically downloading your financial and credit transactions and updating your accounts.

Statements can be uploaded from any financial institution across the world, making it a best budgeting app for global use.

As an additional benefit, previous financial data can be easily imported from Excel, MS Money, and Quicken. This service is rare for a free budget app, which certainly makes Buxfer a competitive choice amongst the best budget apps.

The Buxfer money manager app also allows you to store your passwords and logins locally on your own personal computer or device.

Not only does this save valuable time, but it also makes for a much more fluid budget maintenance process.

Security Features

Buxfer uses the same advanced 256-bit encryption security standard used by banks. It securely protects your sensitive information stored on its servers.

This money manager app also uses industry-standard 128-bit encryption to maintain secure connections between Buxfer servers and personal devices.

Buxfer is constantly scanned and monitored by top third-party security firms which conduct rigorous daily scans. These scans comprise dynamic port scanning, network vulnerability testing, and web application vulnerability testing.

Visual Aids

When it comes to finding the best app for budgeting, visual aids can be valuable budget maintenance tools. The best budget apps come with advanced visuals, and Buxfer certainly does not disappoint.

Buxfer comes with highly advanced graphics that allow you to analyze your expenses over time through pie charts and graphs. These help users visualize their spending trends, spot irregularities, and pinpoint areas for improvement with budget maintenance.

The forecasting feature allows users to preview future expenses and account balances based on previous spending patterns.

All in all, Buxfer comes highly recommended and is ranked as a best budget app.

Don’t Miss: Best Financial Planning Software for Individuals (Ranking)

CountAbout Review

CountAbout is quickly becoming a competitor for top-rated best budget apps like Quicken and Mint.

Although it is not a free money manager app, it does come with competitive pricing, enhanced features, and useful tools to help establish strong budget maintenance skills.

Key Factors That Led to Our Ranking of CountAbout as a Best Budget App

Aside from providing a free trial of their money management tools, the following list highlights why CountAbout is one of the best budget apps to consider in 2017.

Affordable Pricing

Compared to other best budget apps, CountAbout has an incredibly affordable price structure. Users can choose between Basic or Premium accounts at $9.99/year or $39.99/year, respectively.

For those who aren’t sure about investing in a money manager app, CountAbout offers a free 15-day trial that includes Premium features.

Easy Import of Previous Data

CountAbout is the only money manager app that allows for data to be imported from two major competitors: Quicken and Mint. Not only does this save time, but it also creates an efficient process for those who are trying out a new form of budget maintenance.

Aside from importing data from Quicken and Mint, CountAbout will also automatically sync information from checking, savings, credit cards, and retirement accounts for a complete financial picture.

Customizable Tools

When it comes to creating custom-made tags and categories, CountAbout has got you covered. Tags and categories for spending can be added, deleted, and changed at will.

This best budget app also allows users to generate reporting for:

- Tag activity

- Category activity

- Account balances

- Income

- Spending

Founded in 2012, CountAbout is a fully-functional, seamless, and efficient money manager app. With millions of users and positive reviews flooding in left and right, this is one of the best budget apps to consider in 2017.

Mint Review

Mint is another free budget software that made it into this year’s top budgeting apps. From money and budgeting to customized tips and more, you can easily get a clear view of your total financial life with Mint.

Key Factors That Led to Our Ranking of Mint as a Best Budget App

Not only is Mint a free budget app, but it is also one of the best budget apps overall. Listed below are the factors which caused Mint to rank as a best app for budgeting in 2017.

Simple Enrollment Process

It’s very easy to get started with Mint. All you have to do is enter your email, zip code, and set a password. After this, a screen pops up to help you sync your financial information with Mint’s free budget maintenance tools.

Mint is connected to nearly every financial institution, so adding financial accounts to the money management app is a breeze.

By adding as many accounts as you can, you’ll be able to better utilize Mint’s advanced free budgeting and planning tools.

Alerts & Reminders

Mint is one of the best budget apps because it comes with advanced bill tracking tools. Once due dates are uploaded into the money manager app, users can receive the following alerts and reminders:

- Bill pay reminders

- Due date alerts

- Low funds notifications

- Unusual spending alerts

Part of keeping successful budget maintenance means keeping an eye on bills. The notifications and alerts available through the Mint app ensure that users never have to worry about missed bills, late payments, or overdraft fees.

Mint Bills also allows users to issue payments directly through their money management app, eliminating the need to constantly be logging into different sites or payment platforms.

Enhanced Budgeting Tools

Through various graphs and charts, you can quickly see a complete picture of how much is coming in and what you are spending money on. Additionally, you can see this in a year-to-year or month-to-month view.

This best budget app works by focusing on attainable goals for budget maintenance. Users create budgets based on their real spending patterns.

By using the forecasting feature, you can also plan ahead and experiment with reducing expenses in any given category.

Free Credit Check

For some users, budget maintenance and credit maintenance go hand-in-hand. As one of the best budget apps, Mint allows users to get free credit checks.

Credit scores are displayed along with budget maintenance reports, creating a more comprehensive view of overall budget, payment history, and how credit score can be impacted.

Not only can you monitor your credit through the Mint app, but you can also get guidance and tips on how to improve your credit score.

With Mint, you can effectively create and adjust your personal budget as you go based on actual realities.

Related: Best Quicken Alternatives | Ranking | Top Alternatives to Quicken

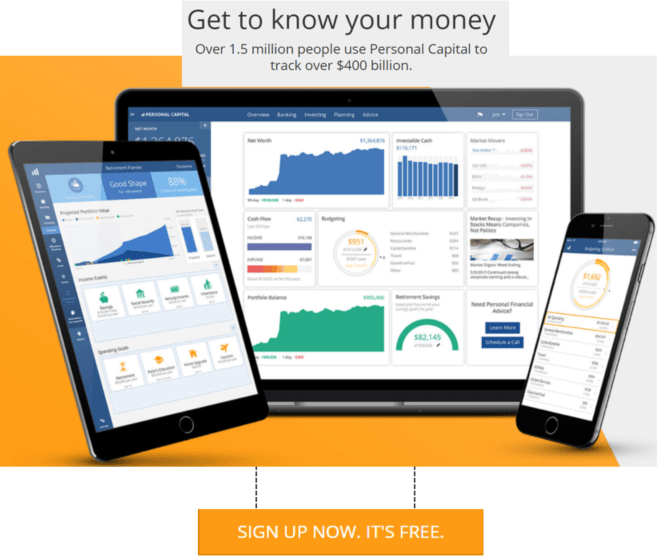

Personal Capital Review

While money management tools are certainly useful, what’s ultimately important is that people have a sense of their overall budget at any point in time. That’s what makes Personal Capital one of this year’s top budgeting apps.

Personal Capital is an all-in-one budgeting and money management app that can be used via a wide range of devices and platforms.

Even better, their budget maintenance software is being offered free of charge, making it a compelling choice for a money manager app.

Join Personal Capital Today – Free Budget App!

Key Factors That Led to Our Ranking of Personal Capital as a Best Budget App

Below are the factors which caused Personal Capital to rank amongst the best budget apps this year.

National Recognition

Personal Capital has been making huge waves in the financial industry since it first began in 2009. In 2015, it was ranked on CNBC’s Disruptor 50 List in recognition of forward-thinking, innovative businesses.

This list also included Uber, Airbnb, SpaceX, and Dropbox. Airbnb has disrupted the hotel industry. Amazon has disrupted retail. Uber has disrupted taxi services.

And now, Personal Capital is disrupting personal finance, budgeting, and money management.

Real-Time Evaluation

Personal Capital allows you to link your accounts and effectively manage and monitor your financial portrait. This includes money management tools for budgeting, savings, financial planning, investment, debt, and monthly expenses.

With Personal Capital’s dashboard application, you can plug in all accounts–checking, savings, credit card, 401(k), college fund, college loans, mortgage, car loans, insurance, utility bills, investments, or home equity.

This money manager app allows you to get a real-time view of your transactions at every point in time.

Click to Join Personal Capital!

Award-Winning Dashboard

Quick and intuitive when used as a checkbook register, Personal Capital’s dashboard is based on professional accounting principles to ensure balanced books and accurate reporting. The Personal Capital dashboard puts “Money-In vs. Money-Out” stats on the top of the dashboard when you log in.

You can flip back and forth between “view income” and “view spending,” and dive in deeper by clicking whichever slice of the pie you want for a more detailed view of your transactions.

You can even add your own descriptions of each transaction, simplifying the process of budget maintenance.

If you are interested in having more control over your budget maintenance, the Personal Capital dashboard allows you to easily categorize your transactions.

Free Analytics Tools

For those who want more than a simple numerical display, Personal Capital is the best budget app for detailed reporting and analytics.

Best of all, these budget maintenance tools are completely free of charge. This money manager app offers the following tools:

- Fee Analyzer: Discover hidden broker’s fees in mutual funds, investing, and retirement accounts.

- Investment Checkup: Analyze your portfolio to discover ways to improve and reach your financial goals

- Dashboard: Evaluate spending and saving habits and assses the potential impact of life events

- Cash Flow Analyzer: Create a budgeting plan and highlight problem areas

Personal Capital is an expert money manager app that comes with budget maintenance tools to tackle a wide array of budgeting needs.

Net Worth

Having many income avenues and investments is great, but keeping track is a major pain point for most individuals. Using the Personal Capital dashboard, you can quickly access a consolidated view of all of your accounts in one place.

Whenever you log into your Personal Capital dashboard, on a desktop or mobile, you’ll see a complete view of your net worth.

Over time, you’ll see if your net worth is trending positively, which allows you to take the necessary steps to make adjustments in your spending and savings habits.

Quicken Review

No review of best budget apps would be complete without including Quicken, an industry leader in financial apps and software.

Quicken was one of the first budgeting apps and software to hit the market, and the firm has continually innovated and improved upon its many budgeting platforms over the years.

However, note that Quicken is not free; it has three versions: Starter Edition ($39.99), Deluxe ($74.99), and Premier ($104.99).

Key Factors That Led to Our Ranking of Quicken as a Best Budget App

Listed below are the features which allowed Quicken to be ranked as a best budget app to consider in 2017.

Comprehensive Overview

With Quicken, you can easily see all of your money in one place. Your income flows and fund outflows (expenses, utilities, taxes, etc.) are securely and automatically downloaded from your online bank accounts and credit card statements into one place.

This money manager app downloads transactions and sorts them into categories, helping users stay on track with their budget maintenance.

Realistic Budgeting Plans

With the budget app, you can easily connect to your banks and create realistic, personal budget plans to help you get out of debt.

Should you spend or should you save? With Quicken’s forecast balances, it is now very easy to know which decision to make.

Quicken will also use your synced data to create a manageable budget based on past spending habits. Goals are completely customizable, making it easy to successfully maintain a budget through this best budget app.

With Quicken, you can easily sync your data and financial transactions across your devices (iPad, iPhone, Android, Mac, Windows, etc.), check balances, manage accounts, and track purchases.

Image Source: Best Budget Apps

Business & Personal Spending

One of the biggest reasons why Quicken is a popular money management app is because it allows users to separate between personal and business spending.

Small business owners or property owners will benefit from the following features:

- Gauge success with profit and loss snapshots

- Create custom reports for tax season

- Generate invoices

- Track rental income, lease terms, rental rates, and deposits

The ability to differentiate between business and personal expenses makes Quicken the best budget app for small businesses, entrepreneurs, or property owners.

Investment Management

Quicken offers a wealth of options to manage investments throught their money manager app. Data from portfolios, 401k, 403b, and IRA accounts can easily be imported and tracked.

Performance graphs and charts are available for all investments, including specific tools to improve future profitability, like their What-If tool.

For those who are looking for the best budgeting app that also includes investments, Quicken is a solid choice for the best money manager app.

Popular Article:Best Banking Apps | Ranking | Best Online & Mobile Banking Apps

You Need A Budget (YNAB) Review

The YNAB budget app is built on four basic rules that are designed to help the user stop living paycheck to paycheck and get out of debt faster.

- Rule One: Give every dollar a job

- Rule Two: Save for a rainy day

- Rule Three: Roll with the punches

- Rule Four: Live on last month’s income

These four basic rules are the cornerstone of YNAB, and have helped propel this best budget app into lists of top budgeting apps across the country.

Key Factors That Led to Our Ranking of YNAB as a Best Budget App

Listed below are the features which allowed YNAB to be ranked as a best budgeting app to consider in 2017.

Planning Ahead

As a true budget app, YNAB is built to let you efficiently set aside funds for larger and infrequent bills. For example, remember that $500 auto insurance premium that is due in six months? Well, budget $100 each month into your auto insurance category, and watch the balance grow.

When the time comes to pay the premium, you can do so with the click of a button. What used to send you into financial “crisis mode” doesn’t even make you blink now.

Setting YNAB’s budgeting interface to show you what needs to happen now so that you can handle what happens in the future is one of the biggest strengths of this best budget app.

Global Support

For those who are constantly traveling, or who have multiple accounts across the world, the YNAB app is one of the best budget apps to consider.

The YNAB app supports all major global currencies, including dollars, pounds, euros, reals, rupees, rands, and just about every other currency in the world.

Constant Syncing

Due to YNAB’s cloud syncing capability, you can easily stay focused on your personal budget and will always be up-to-date by syncing all of your various mobile or desktop devices. Why exactly is this important to you?

Because your personal budget is automatically kept up-to-date. Whether on your spouse’s Android, your iPhone or iPad, at home on your Mac, or at work on your PC, you’ll know in a moment whether you can afford to go out to eat or shop.

The constant syncing capabilities of this best budget app are supported by two different views:

- Unified Account View: Since you have all of your financial and credit accounts in one view, it is much easier to see all of your transactions or find specific ones.

- Spending Quick-View: With the YNAB app, you can easily click on any “outflow” amount in your budget and get a list of all of the transactions that made up that number and edit them if needed.

Affordable Cost

YNAB is not necessarily free budget software, but it is still one of the best budget apps around. To keep using this budgeting software over the long-term, there is a $60 one-time cost.

YNAB has a free trial–a 34-day, full-featured demo–so you can try it out and see if you like it before making your purchase: Try YNAB–Free.

After you purchase, YNAB will send you an activation key to unlock the YNAB app. Just enter the key to continue where you left off in the trial.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – The Best Budget Apps

So, which of these top budget apps is your personal best app for budgeting? It depends.

If you want a free budget software that is the top of the line, highly sophisticated and allows you to manage your overall net worth (assets, expenses, debt, income, etc.), then you’ll want to go with Personal Capital or Mint.

If you are looking for a free budget app that offers the basics, then you’ll want to go with Buxfer.

If you seek a budget app that you can download to your computer (vs. an online-only budget tool), then you’ll want to consider Quicken.

If you are a Mac user and seeking a top Mac budget software, then you’ll want to consider Personal Capital.

Ultimately, no matter what you choose, integrating a best budget app into your daily life represents an important investment. It’s an investment in keeping your finances secure, spending sensibly, and working towards better budget maintenance.

Best FREE Finance & Money Management Software

(Click below and read more….)

Image Source: Personal Capital

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.