2017 RANKING & REVIEWS

TOP RANKING BEST ONLINE & MOBILE BANKING APPS

Finding the Best Online Banking Apps in 2017

Smartphones and mobile devices have changed the way that the average person does banking. Online banking apps can now give you access to services that were once only available in person at a bank branch.

The best mobile banking apps bring the bank branch to your fingertips and let you bank on your own time. But are all banking apps created equal? What does your current bank have to offer in terms of mobile banking software? What are the best banking apps? And is mobile banking safe?

For some of us, finding the best mobile banking apps is a main factor when determining with which bank to open an account. Others are simply curious about the online banking apps their current bank has to offer.

Award Emblem: Top 5 Best Banking Apps

Whatever your needs, this list provides a breakdown of the mobile tools and options provided by the best banking apps in 2017. Hopefully, we can lead you to the information you’re looking for and help you determine which online banking app is the best for you.

See Also: How to Find the Best Finance Apps For iPhones | Tips to Finding the Best Budget Apps For iPhone

AdvisoryHQ’s List of the Top 5 Best Banking Apps

List is sorted alphabetically (click any of the bank names above to go directly to the detailed review section for that bank’s mobile app)

Click here for 2016’s Ranking of the Top 5 Best Banking Apps

Features to Consider When Evaluating Banking Apps

Before evaluating different mobile banking apps, it’s important to understand the varied features that online banking apps offer.

Image Source: BigStock

1. Fees

Most banks offer mobile banking software free of charge. That means the bank itself won’t charge you any extra fees for use of the app, but your phone carrier will charge standard data and messaging rates.

Although most banks offer free online banking app downloads, be sure to check with your specific bank to be clear about rates. They may offer the free download, but some services within the app, such as transfers, may come with a fee.

2. Deposit Limits

All the mobile banking apps on this list provide mobile check deposits, meaning that you can deposit checks using only your mobile phone.

However, banks have particular deposit limits depending on timeframes, account type, and other factors. Be sure that you’re aware of the deposit limits before you start making plans to use the service heavily.

3. Technology Requirements

All online banking apps have specific technology requirements. One iPhone banking app may run on iPhone iOS 7, but another may equire iOS 8 or higher. Same thing with Android: one Android banking app may require OS 4.1, while another may need OS 4.4.

If you’re looking for an iPhone banking app or an Android banking app, there are a few online banking apps that feature tools for Apple or Android watches.

4. Easy to Use

The best mobile banking apps will be easy to use. Apps are apps for a reason; they should have an interface that is easy to use with your fingertips.

If you can’t manage your banking with taps and swipes on your phone, you may as well skip the app and use your browser. You’ll want to be sure that the online banking app you choose is designed with an easy–to-use interface.

5. Functionality

Apps with multiple functions are the easiest to use. Some users may prefer the best mobile banking apps for easy navigation between multiple accounts.

Some banking apps also send email notifications when you make mobile deposits or other changes to your account, which can offer valuable peace of mind and assist with organization.

You may also want to verify that the app offers the ability to customize features such as automatic bill pay, account alerts, and budgeting plans.

Don’t Miss: Top Small Business Apps | Ranking of Best Productivity Apps

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated firms, products, and services.

Detailed Review – Best Mobile Banking Apps

Below, please find the detailed review of each firm on our list of best banking apps. We have highlighted some of the factors that allowed these mobile banking apps to score so highly in our selection ranking.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Ally App Review

Ally is a branchless bank that you access only on the web or through the mobile banking software. You can access cash at any ATM and use Allpoint ATMs for free.

Ally has seen over $55 billion in account deposits and strives to be not only a new bank, but an entirely different type of bank. Ally explains that they built their bank on three simple ideas: do right, talk straight, and be obviously better.

Key Factors That Enabled This App to Rank as a Best Mobile Banking App

Below are primary reasons we selected the Ally app to be rated as one of 2017’s best banking apps.

As a branchless bank, Ally was built to serve the online and mobile market, resulting in one of the best mobile banking apps. Some of its features are:

- Ally eCheck Deposit: Users can deposit checks by taking a picture with their mobile phone. You can also set up direct deposit, receive incoming wire transfers, or opt to mail in deposits with postage-paid envelopes.

- Transfers: As a best banking app, it allows users to manage transfers between multiple Ally accounts or send and receive money using an email address with the Popmoney service. You can also make typical transfers to accounts at other financial institutions.

Additional services include:

- Account overview and activity

- Bill pay

- ATM and cash locator

- Ally Assist (Customer service function, only available for iPhone users)

- Touch ID (Not available through the banking app for Android)

Apple Watch and Android Wear Users

For Apple Watch and Android wear users, Ally offers some limited features. For example, the Android banking app and the iPhone banking app allow users to search ATM locations.

Capital One Banking App Review

Capital One has created an easy-to-use app that places a number of features and tools at your fingertips. The application is available for iPhone, Android, Apple watch, and iPad.

Key Factors That Enabled This App to Rank as a Best Mobile Banking App

Below are primary reasons we selected the Capital One Banking App to be rated as one of 2017’s best mobile banking apps.

The Capital One online banking app provides users with banking features previously only available at a physical branch. Some of these are:

- Pay a Bill: With just a few swipes and taps, you can manage your bill payments using the Capital One app. You can make one-time payments or customize your auto-pay to make monthly payments. The app offers payment posting scheduling to keep you on track.

- Transfers: You can make transfers to other Capital One accounts or accounts at other financial institutions. First, you’ll need to set up an account on a desktop or laptop and then you’ll be able to make transfers or receive funds on your mobile device.

- Mobile Deposits: By taking a photo of the front and back of personal, business, or federal checks, you can make deposits into your account using your mobile device with no extra fees. Uploading before 9 p.m. on Monday-Friday means funds are generally available on the next business day.

Additional features include:

- View multiple account balances

- View account details such as recent activity and other information

- ATM/Branch locator

- Open new checking accounts

- Contact Capital One customer service

Secure Connection

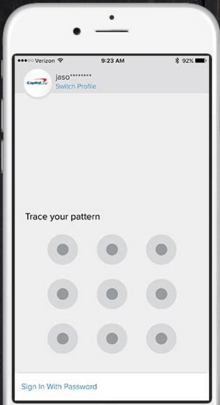

Capital One has created Sureswipe, a function that allows you to securely sign into your mobile account without having to enter all of your information every time.

In order to use Sureswipe, you simply create a pattern password using their interface and swipe the pattern each time you sign in. This saves you time and is easy to use on a smartphone screen.

Image Source: Capital One Mobile App

Easy-to-Use Application

This best mobile banking app allows you to easily navigate between accounts and features. You can drag your accounts so that they appear in whatever order you please. You can also easily access different accounts within your profile by simply swiping right or left to view a particular account.

You can easily switch between different profiles, personal accounts, or business accounts by using Sureswipe and TouchID. These time-saving functions make this one of the best mobile banking apps to consider in 2017.

Related: Best Small Business Accounting Software | Ranking | Online and Business Accounting Tools

Chase Mobile App Review

The Chase Mobile app provides Chase account holders with easy access to their multiple accounts and general banking needs. The app is free to download and available for iPhone, iPad, Android, or Windows phone users.

If for some reason the app is not available on your phone, you can access the app features by going to the Chase website on your phone’s browser.

Key Factors That Enabled This App to Rank as a Best Mobile Banking App

Below are primary reasons we selected the Chase Mobile App to be rated as one of 2017’s best banking apps.

Wide Range of Options and Tools

With the Chase mobile banking software, you can handle most of your banking needs from your phone. Many account holders will be able to avoid almost all trips to a physical branch because of the large selection of tools and options offered through the app.

Here’s a breakdown of what the app offers:

- Bill Pay: For those who are enrolled in Chase Online Bill Pay, bill payments can be scheduled according to your needs.

- Check Deposit: This service allows users to virtually deposit checks simply by taking a picture of the check and submitting through the app. The service allows you to deposit personal, business, and U.S. Treasury checks. Deposit limits are viewable within the banking app for Android, iOS, or Windows.

- Credit card payments: Chase online members can connect their accounts to the app and make credit card payments to your Chase credit card.

- Money Transfers: The app offers you the ability to transfer funds between approved Chase accounts. You can also make transfers to your accounts at different banks.

- Chase QuickPay Access: You can use Chase QuickPay through the Mobile App so long as the payment is between two U.S. bank accounts and one of the accounts is a Chase checking account.

- Customized Alerts: You can set your preferences to receive alerts regarding the status of your accounts. Since expectations regarding when an alert is necessary varies among users, it’s convenient that the app allows you to set your own preferences for this tool.

Some of the other tools available through the Chase Mobile App are:

- Ability to wire money, with a few limitations

- View account balances

- View statements

- Set and adjust paperless preferences

- View rewards status

- View current and past transactions

- Find a branch/ATM

- Receive answers to FAQs

Security Features

The Chase Mobile app uses a 128-bit Secure Socket Layer (SSL) that encrypts users’ personal information, making it one of the best mobile banking apps for secure transactions.

The system protects your username, password, and account information. Any information sent to you will be encrypted and then decoded by the mobile app.

The app also uses a multi-factor authentication that ensures the app is accessing accounts by verified account holders. To log in to the app the first time, users must request an identification code that will be retrieved via email, phone, or text message.

Ease of Use

As one of the best mobile banking apps, the Chase Mobile app is user-friendly. The app allows you to navigate through tools by using easy swipes and clicks on your phone screen. You can also find FAQs on both the app itself and by going to the Chase website.

Popular Article: Best Payroll Software for Small Business Firms | Ranking & Reviews

Simple App Review

Simple is a branchless online bank that offers detailed budgeting features and mobile access. Simple has partnered with STARsf®, which provides ATM access with no withdrawal fees.

Because the system is branchless, Simple is different than the traditional banking model and appeals to users who appreciate the functionality of a purely online bank.

Key Factors That Enabled This App to Rank Amongst Top Online Banking Apps

Below are primary reasons we selected the Simple app to be rated as one of 2017’s best banking apps.

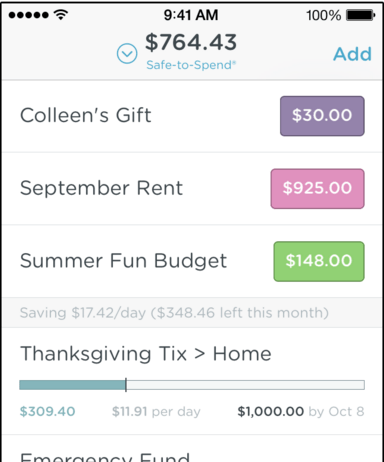

Goals Saving System

Simple allows you to set specific saving goals. You label a goal, like “Trip Home,” and Simple will deduct money according to your customization to save for that goal. You can set a number of goals at one time.

Image Source: Simple App

Technology and Other Requirements

Most of the Simple features are available through the web application, but you can get more out of the service by using the banking app for Android or iOS. For example, check deposits are only accessible via the mobile app.

Accounts are only available for people who are permanent members of the United States, are 18 and over, and have a social security number. IPhone mobile devices must run iOS 8.0 or higher and an Android needs OS 4.1 or higher.

Simple Features

Aside from the budgeting features, this best banking app offers a wide range of banking services, which include:

- Photo check deposits: Use your phone to take a photo of your check and deposit with your phone. No need to get to an ATM; the app is all you need.

- Bill pay and transfers: Use online banking apps to set up bill payments or transfers. In most cases, the system will send the payee a check, but for some larger businesses, the payment will be sent electronically.

- Simple Instant: You can move money between separate Simple accounts instantly. You can do the same to other users’ Simple accounts as well.

- Account and routing: Easily locate bank account numbers and routing numbers with the Simple app.

- Card activation: Debit cards can be activated with the app. You can reset your PIN as well.

- Customer support: Simple offers customer support via the mobile app, phone, or web. Customer support is available 365 days a year and makes a concerted effort to avoid “jargon” and use plain English when assisting account holders.

Security Features

Simple offers Mobile Unlock code, which is a code you create to access the app, adding a further level of security.

The app also provides the extremely convenient block and unblock service. If you fear that you’ve lost your card, you can get into the app and easily block your card. Then, if you find you card, you can just as easily unblock the card with the app and spend as normal. If you don’t find the card, you can order a new one.

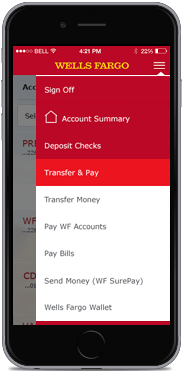

Wells Fargo Banking App Review

Wells Fargo offers a mobile app that provides quick access to your account information. The app also offers tools you can use to manage your banking and financial needs without having to head over to the local branch.

Wells Fargo provides online banking apps with no added fees, downloadable on iPad, Android tablets and phones, and Windows phones.

Key Factors That Enabled This App to Rank Amongst Top Online Banking Apps

Below are primary reasons we selected the Wells Fargo app to be rated as one of 2017’s best banking apps.

This best banking app provides a wide selection of features and options. Some of those options are:

- Check deposit — Mobile deposit requires Android OS 4.4+, iPhone and iPad iOS 7.0+, and Windows phone 8.1+

- Pay bills

- Send and receive money by email address or mobile number

- View account history

- See your balance

- Find ATMs and branch locations using GPS

- Quick access to sign-in screen

Image Source: Wells Fargo Mobile App

Wells Fargo “At a Hand” App

Wells Fargo also offers the At a Hand app, an iPhone banking app made specifically for Apple watch users. This app offers fewer features than the Wells Fargo Mobile app. With At a Hand, you can view your balance for most accounts, and you can choose one account that will display at a glance.

Text Banking

Text banking from Wells Fargo allows users to text specific commands to receive banking information. For example, texting the command ACT will send you the account activity of your primary account.

Security Features

Security for online banking apps is a major factor for many users. Wells Fargo keeps text banking secure by labeling your accounts with “nicknames” that you set and memorize—not by your account number. Furthermore, no detailed personal information is sent via text.

The mobile app and website are secured via a 128-bit encryption that covers your personal information. Also, when you close the app or your browser on the mobile website, your session immediately ends.

Read More: Stash Invest App Review | What You Need to Know (Fees, Pros, Cons, Services)

Conclusion—5 Best Banking Apps

While many of these online banking apps offer similar features, each app does have at least one unique feature that may appeal to you. The best mobile banking apps for you depend on your particular banking needs as well as your level of comfort with technology.

The larger banks offer somewhat similar features, but you may be surprised by what the online-only banks have to offer in terms of online banking apps. For example, the budgeting features from Simple may appeal to you because you can view your account balance as well as your entire budgeting system in one place on the go.

This list has outlined the major features and requirements of the best banking apps of 2017. Hopefully we have helped you decide which app lines up best with what you’re looking for from a mobile bank.

With such a large selection of banking features available at the swipe and tap of your screen, it seems that the days of driving to the bank and speaking with a bank teller are essentially over.

The modern lifestyle can be extremely hectic, and online banking apps are simple, invaluable ways to save time.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.