2017 RANKING & REVIEWS

TOP RANKING DEBT PAYMENT CALCULATORS

2017 Guide: How a Debt Payoff Calculator Can Help Eliminate Debt

It might be unsavory to bring up in casual conversation, but debt has become a part of life, whether it be from car loans, student loans, mortgages, or credit cards.

In fact, a recent study by Pew Charitable Trusts found that a staggering 8 out of 10 American households are in some form of debt.

Although debt can be avoidable, in many cases, it simply is not. Purchases, investments, and loans can all create greater opportunities. Consider how difficult it would be for the average American to purchase a house without a mortgage or pay for a new vehicle in its entirety.

Of course, debts eventually need to be paid off. The best way to ensure successful, long-term payment is to have a solid financial structure in place.

A debt calculator is a useful tool to organize finances and create a manageable plan for eliminating debt once and for all.

Award Emblem: Best Debt Calculators

Whether looking for an extensive debt consolidation calculator, an early debt payoff calculator, or a simple debt calculator to create a payment plan, debt payment calculators can provide essential financial guidance.

Using a debt payoff calculator is often the first step toward creating a workable and manageable financial plan. As such, our review will take a close look at the top-rated debt payment calculators to help consumers pinpoint the best debt calculator for their needs.

Most importantly, each debt repayment calculator highlighted within this review is available completely free of charge, making it easy for anyone to create their own financial plan.

See Also: Top Best Travel Credit Card Offers | Ranking | Best Credit Cards For Travel (Reviews)

AdvisoryHQ’s List of the Top 6 Best Debt Payment Calculators

List is sorted alphabetically (click any of the debt payment calculators below to go directly to the detailed review section for that debt payoff calculator):

- Accelerated Payoff Calculator by CalcXML

- Credit Card Payoff Calculator by FinancialMentor

- Debt Payoff Calculator by Bankrate

- Debt Repayment Calculator by Credit Karma

- Debt Snowball Calculator by FinancialMentor

- Simple Loan Payment Calculator by Bankrate

Top 6 Best Debt Payment Calculators | Brief Comparison & Ranking

Debt Payment Calculators | Provider | Maximum Number of Debts Calculated | Graph, Chart, or Other Visual Aid? |

| Accelerated Payoff Calculator | CalcXML | 20 | Yes |

| Credit Card Payoff Calculator | FinancialMentor | 1 | No |

| Debt Payoff Calculator | Bankrate | 19 | Yes |

| Debt Repayment Calculator | Credit Karma | 1 | Yes |

| Debt Snowball Calculator | FinancialMentor | 10 | Yes |

| Simple Loan Payment Calculator | Bankrate | 1 | No |

Table: Top 6 Best Debt Payment Calculators | Above list is sorted alphabetically

What to Look for in a Debt Calculator

Before finding a debt payment calculator, it may be helpful to have a clear picture of what features a debt elimination calculator should have.

Image source: Pixabay

While each debt calculator differs from the next, there are a few general qualities that make for the best debt payment calculators. These include:

- Ease of use. It goes without saying that a debt payoff calculator should be easy to use. This means having clear instructions, requirements, and presentation. Debt payment calculators can get complicated, but the best will put a keen focus on clarity.

- Specific value. A debt payment calculators should have specific value toward a specific financial situation. For example, those who are looking for a debt consolidation calculator will probably feel frustrated using a debt payoff calculator formatted to analyze one debt at a time. As a rule, a debt consolidation loan calculator will be much more involved than a simple debt free calculator. Make sure the debt payoff calculator you choose applies to your financial situation.

- Visual aids. Depending upon your learning style or personal preference, the importance of this feature may vary. Still, finding a debt payoff calculator that offers graphs or charts to display projected payments can be a valuable tool in understanding the impact of debt repayment.

Different Types of Debt Payment Calculators

No debt calculator is the same, and depending upon personal needs, you may find that one debt payoff calculator works better than another. Our review will look at debt payment calculators from varying areas of focus. These areas may include:

- Simple debt calculator. This type of debt repayment calculator comes with straightforward requirements and formatting. A simple debt calculator will focus on one debt to show projections for time, payments, and interest.

- Debt consolidation calculator. Just as the name suggests, a debt consolidation loan calculator will help consumers see the effects of combining multiple debts. While a debt consolidation calculator may require more time and effort, its value comes from comprehensive overviews of multiple debts.

- Debt payoff calculator. One of these debt payment calculators can also be called an early debt payoff calculator. This tool will show the effects of making larger payments to eliminate debt as quickly as possible.

As stated before, each financial situation is unique and may require a unique debt calculator. The good news is that, no matter what debt has been accrued, consumers can rest assured that there is a debt payment calculator to fit their needs.

Don’t Miss: Which Is the Best UK Mortgage Calculator? BBC? Halifax? Barclays? Nationwide?

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Accelerated Payoff Calculator Review

Created by the financial experts at CalcXML, this debt calculator is a great tool for those who need a debt payoff calculator with superior organizational skills. The Accelerated Payoff Calculator employs a “roll-over” technique to help debtors focus on tackling debts with the highest interest rates first.

How It Works

This debt payment calculator allows for up to 20 different debts to be entered in. Each debt needs to have total balance, minimum payment, actual payment, and interest rate for the debt elimination calculator to work.

Once all information has been entered into the debt reduction calculator, CalcXML shows how restructuring debts for accelerated payoff can save money over the long-term.

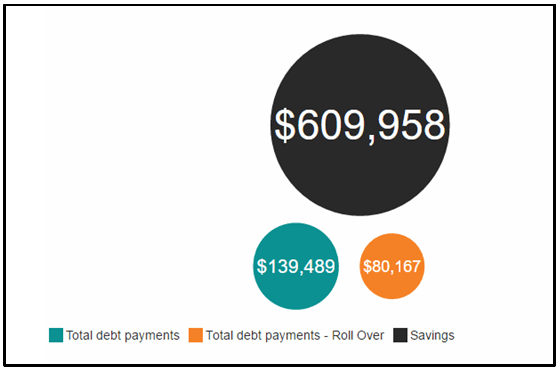

For example, a beginning debt of $48,906 would take 50 years to pay off through making minimum payments. As interest increases during that time span, it would grow to a whopping $139,489.

Image source: CalcXML

This debt elimination calculator provides comparative results based upon the roll-over method. Thus, by making additional payments on debts with high interest rates, the original debt can be paid with $80,167 in 13.3 years, rather than 50.

Estimates on savings are based upon investing the same debt payment amounts into a savings account.

Why It Makes the List

Not only is this debt reduction calculator incredibly user-friendly; it also provides expert methods to approach debt. By focusing on interest rate through the roll-over method, this debt elimination calculator provides a structured, realistic, and affordable approach to managing debt.

Another great feature of this debt payoff calculator is that it provides tons of supplemental materials. The Accelerated Payoff Calculator generates four different graphs and a PDF report to create a comprehensive overview of debt.

For its comprehensive overview, visual aids, and affordable approach, this is a great debt payoff calculator for those struggling with multiple debts.

Related: Which is the Top UK Mortgage Calculator? HSBC? Santander? NatWest? RBS?

Credit Card Payoff Calculator Review

FinancialMentor offers a wide range of free materials to assist consumers in getting out of debt and managing money wisely. Among their many calculators is their Credit Card Payoff Calculator, a valuable resource for those looking for a get-out-of-debt calculator.

Although marketed specifically as a credit card debt calculator, virtually any debt can be entered into this pay off debt calculator.

Image source: FinancialMentor

How It Works

This pay off debt calculator works by displaying the time it will take to eliminate debt in both months and years. It also allows for variations in monthly payments, making it a great debt payoff calculator to experiment and put payments in perspective.

Simply enter the total debt amount, interest rate, minimum payment percentage, and estimated monthly payment into the debt calculator. The payoff results displays the total time to pay off debt, as well as the interest and principal amounts.

Why It Makes the List

As a clear and simple debt calculator, the Credit Card Payoff Calculator is an incredibly accessible tool. The ability to experiment with various payment amounts makes it a great debt reduction calculator to help determine the most affordable way to eliminate debt.

What truly makes this debt calculator great is that FinancialMentor also includes expert tips on how to break a cycle of debt, pay off credit cards, and recognize when debt is becoming an issue.

A glossary of terms associated with credit card debt is also included, making this one of the most instructive and detailed debt payment calculators available.

Debt Payoff Calculator Review

As a debt consolidation calculator, the Debt Payoff Calculator is one of the most intricate debt payment calculators on the list. Still, this intricacy comes with good reason.

This debt consolidation calculator from Bankrate allows debtors to enter up to 19 different forms of debt, ranging from credit cards, car loans, mortgages, and personal loans.

For those who are considering combining their debts, this is a great debt consolidation calculator to use before beginning the consolidation process.

How It Works

Enter in all debts owed from each category. Include total amount owed, payments, and interest rate.

Bankrate’s pay off debt calculator will display the total amount for consolidation and estimated monthly payments for the new payment plan.

These figures are further explained by the use of two different graphs. The first graph involves a side-by-side comparison of the time (in months) it will take to eliminate debt.

The second compares monthly payments between minimum amounts and consolidation amounts to see how loan consolidation may accelerate debt payoff.

Why It Makes the List

This debt consolidation calculator allows for a huge variety of debts to be considered, making it a valuable debt calculator for those who have widespread debt. Although it requires added time, this debt consolidation loan calculator provides valuable insight into how the consolidation process can be beneficial in the long run.

What truly makes this a great pay-off-debt calculator is that Bankrate relies on visual aids, rather than facts and figures, to provide a comparison.

As an additional benefit, a printable report shows a complete payment schedule, an overview of total debt within each category, and a summary of results.

With the ability to synthesize a wide range of data into clear, helpful material, this is an entirely worthwhile debt consolidation calculator to consider using.

Popular Article: Which Is the Best Mortgage Calculator? Google vs. Trulia vs. Bank of America

Debt Repayment Calculator Review

Credit Karma is well-known for their usefulness in helping consumers to monitor and improve their credit scores. Perhaps less well-known is that they also offer debt payment calculators to encourage responsible financial habits.

Their Debt Repayment Calculator operates as a simple debt calculator to analyze one loan at a time, making it an ideal get-out-of-debt calculator for uncomplicated debts.

How It Works

This debt-free calculator uses balance, interest rate, monthly payment, and desired timeframe to estimate when debt will be repaid. Users have the option to choose either an estimated monthly payment or desired timeframe for the debt calculator.

Once all data is entered, Credit Karma provides a quick overview of how many months it will take to pay off the loan. An additional chart shows the amount of principal and the amount of interest paid.

Why It Makes the List

The best feature of this debt-free calculator comes from an additional table to show other payment options. Users can see how an increase or decrease of 30% can affect the life of the loan, which makes it a great get-out-of-debt-early calculator.

Changes in interest rates are also included, making it easy to see how refinancing debt with a lower interest rate can affect payoff time.

This supplement turns this simple debt calculator into an incredibly handy tool for those interested in learning how payments can decrease debt over time. Not only is this a great get-out-of-debt calculator; it can also be used as an early debt reduction calculator.

Debt Snowball Calculator Review

As another option for a debt payoff calculator with the roll-over method, the Debt Snowball Calculator encourages a methodical process to eliminating debt. As loans with higher interest rates are paid off, those payments simply transfer to the next loan, creating a “snowball” effect.

Image source: Pixabay

How It Works

Users put in information for up to 10 different debts, including balance, interest rate, and payments. Arrange each debt from highest to lowest, according to interest rate. At the very bottom, enter an additional monthly payment that you could feasibly make.

Once calculations are complete, this debt calculator will provide two different sets of information. The first is an estimate of remaining payments and interest costs for traditional payments.

The second shows how utilizing the snowball method can decrease the interest and the time spent paying debt.

For example, entering a starting debt of $35,000 into the debt calculator shows $29,847 in interest and a total of 213 payments. Using the debt snowball method turns the interest into $25,383 over 181 payments, saving nearly $4,500.

Why It Makes the List

One great feature of debt payment calculators from FinancialMentor is that they include supplemental information to educate and guide debtors toward better financial habits.

Beneath the debt payoff calculator, the process and methodology for the snowball approach is fully explained. There are also expert tips on the best way to use the debt calculator and how to stay out of debt.

While it isn’t technically a debt consolidation calculator, this debt payoff calculator could certainly be used as a creative — and effective — way to consolidate payments.

Read More: Tips for Finding the Top Amortization Calculators & Schedules | Guide to Loan Amortization

Free Wealth & Finance Software - Get Yours Now ►

Simple Loan Payment Calculator Review

The Simple Loan Payment Calculator is an incredibly straightforward and simple debt calculator to use. For those who want to know how interest affects a loan over time, this debt payment calculator is a great option.

How It Works

Simply add total loan amount, interest, and number of years for the loan. The debt calculator will provide an estimate of monthly payments based upon the information provided.

Why It Makes the List

While it does not come with the additional features of other debt payment calculators, the Simple Loan Payment Calculator from Bankrate provides value in its simplicity.

Users can easily change the length and amount of the loan to use this get-out-of-debt calculator to estimate how feasible each loan will be.

Before adding another debt to the list, this is a great debt payoff calculator to consider using.

Conclusion – Top 6 Debt Payment Calculators

Learning how to successfully manage debt is key when working toward financial stability. Using a comprehensive debt consolidation calculator, debt payoff calculator, or a simple estimation from a debt calculator can provide crucial guidance when managing finances.

Debt is becoming an accepted part of life. American households carrying debt average total balances of $130,922. With such steep numbers, it seems that the importance of a debt payoff calculator will only continue to flourish.

Undoubtedly, finding an efficient and instructive debt calculator is a great first step toward eliminating debt.

By utilizing the top debt payment calculators, 8 out of 10 households will find themselves well-equipped to begin chipping away at the burden of debt.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.