Need to Calculate Debt to Income Ratio? Use a Debt to Income Ratio Calculator

Whether you are searching for a mortgage big enough to get you your dream house or you are simply trying to figure out how to rearrange your finances, calculating debt to income ratio is important.

This year’s guide will help you understand this ratio and answer your questions, like “How is debt to income ratio calculated?” But we want to make the calculations as easy as possible, so we recommend the best debt ratio calculator options you can find online.

Debt to Income Ratio Calculator

Read on to learn more about:

- What is an income to debt ratio calculator?

- Why use a debt to income ratio calculator?

- How to calculate debt to income ratio (AKA: How is debt to income ratio calculated?)

- What debt to income ratio is considered low enough to get a mortgage?

- A list of the top debt to income ratio calculator choices you can find on the internet

- Ways to improve your ratio after calculating debt to income ratio and realizing it is too high

This will all be important – especially if you are looking to buy a house. So read through the guide, and then choose the right income to debt ratio calculator for you.

See Also: How to Become a Mortgage Broker

Debt to Income Ratio Calculator Definition

Your debt to income ratio is the number you get when you divide your monthly debt (example: auto loan payment, minimum credit card payment, minimum student loan payment, etc.) with your gross monthly income.

There are two main types of debt to income ratio: front end and back end.

- Front End Ratio: This ratio includes your housing costs

- Back End Ratio: This ratio looks at non-housing debt (like credit card or auto loans)

An income to debt ratio calculator is an online tool that does all that math for you. It will calculate debt to income ratio as soon as you punch in your numbers. Using a debt ratio calculator is faster and easier than doing the math yourself.

Why Use an Income to Debt Ratio Calculator

Before we get into how to calculate debt to income ratio or the top income to debt ratio calculator options, let’s take a look at why you will need to try calculating debt to income ratio.

Many times, this number will determine whether or not you can buy a home. Lenders will want to use their own debt to income ratio calculator to make sure you do not overextend yourself with a mortgage that is too high.

This is important because income levels do not tell the whole story.

- One person who makes $100,000 may spend $5,500 each month in debt payments. A debt ratio calculator shows their ratio would be 66%.

- But a person who makes $65,000 and spends only $500 a month in debt payments has a debt to income ratio of 6%.

You may think the person who makes $100,000 a year would have a better chance of getting a mortgage, but the person who makes less money and spends less on debt payments will probably get the better mortgage option.

Another reason you may want to use a debt ratio calculator is simply to better understand your own finances. If your ratio is too high, you can rearrange your budget to help bring it down faster.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Use a Debt to Income Ratio Calculator to See Where You Want to Be

While the primary reason to use a debt ratio calculator is to figure out your current ratio (like we talked about above), you can also use it to figure out what you will need to have the ratio you want.

As you will see below, there comes a point with a debt to income ratio that lenders will not want to give you a mortgage.

By using an income to debt ratio calculator, you can punch in potential numbers to see how much you would need to make or how low you would need to drop your debt before you can qualify for a mortgage.

How to Calculate Debt to Income Ratio

You’re probably wondering, “How is debt to income ratio calculated?” Here are the basics on how to calculate debt to income ratio:

- Figure out your monthly debt: This number is how much you pay monthly toward any debt you may have.For example, if your auto loan payment is $200 a month, your credit card minimum payment is $150, and your student loan payment is $100, your monthly debt is $450.

- Figure out your monthly gross income: This is your income before you pay any taxes.If you are not sure your monthly income, simply divide your yearly income by 12 and call that your average.

For calculating debt to income ratio, you simply divide the first number by the second number.

Now that you know how to calculate debt to income ratio, let’s talk about the easier method: using a debt ratio calculator.

Don’t Miss: Roth IRA Income Limits & Roth IRA Eligibility

What Is a “Good” Debt to Income Ratio?

Before we dive into the best debt ratio calculator and you start calculating debt to income ratio – let’s talk about the number you are aiming for.

While it would always be great if you had no debt at all, that is becoming less and less feasible in our modern world. So the question then becomes: what debt to income ratio will allow you to qualify for a mortgage?

- Typically, the highest debt to income ratio you can have and still get a mortgage is 43%.

But this does not necessarily mean that all lenders will want to give you a mortgage when your debt to income ratio is that high.

- Many lenders are looking for a front end ratio of 36% or less.

- When it comes to your back end ratio, many lenders will not want it to be higher than 28%.

Keep these numbers in mind when you calculate debt to income ratio with the debt ratio calculator choices below.

The Three Best Debt to Income Ratio Calculator Choices

Now it is time to go over different debt to income ratio calculator options. These debt ratio calculator choices are some of the easiest and most accurate calculators you will find online.

You may know how to calculate debt to income ratio on your own, but you may just be surprised how quick and helpful an income to debt ratio calculator actually is.

Go through the list, see which one will help you the most, and start calculating debt to income ratio.

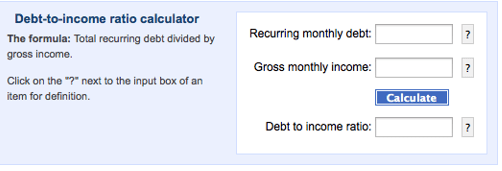

Debt to Income Ratio Calculator #1: Bankrate

This is a basic income to debt ratio calculator from Bankrate. All you do is type in your monthly debt and your gross monthly income.

This is a good debt ratio calculator for people who already know exactly what their recurring debt is each month and don’t need help figuring it out.

How to Calculate Debt to Income Ratio

Debt to Income Ratio Calculator #2: Wells Fargo

The nice thing about this debt ratio calculator from Wells Fargo is it allows you to itemize all your debt.

- Monthly rent payment

- Monthly mortgage payment

- Monthly home equity loan or line of credit payment

- Minimum monthly credit card payment

- Monthly auto loan or lease payment

- Monthly student loan payment

- Monthly personal loan or line of credit payment

- Other monthly debt payment

Then, this income to debt ratio calculator gives you a visual chart that shows if you have a good ratio, the opportunity to improve, or if you should take action immediately.

This is an ideal debt ratio calculator for somebody who does not know their total recurring monthly debt amount off the top of his or her head.

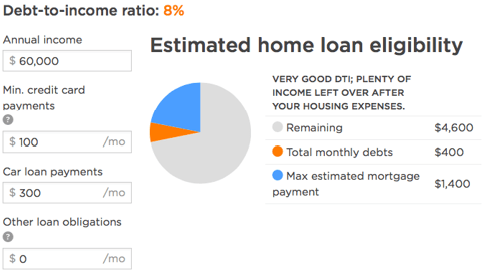

Debt to Income Ratio Calculator #3: Zillow

The benefit of choosing this debt to income ratio calculator from Zillow is it will not only calculate debt to income ratio, it will also tell you your “max estimated mortgage payment.”

Debt Ratio Calculator

This income to debt ratio calculator also helps you determine what mortgage you could potentially afford with your income and debt ratio.

Related: Top Bonds for Fixed-Income Investors

Need to Lower Your Debt to Income Ratio?

Once you calculate debt to income ratio with a debt to income ratio calculator above, you may realize that you need to lower your ratio. Here are a few tips to get you started:

- Pay off the debt you can afford: You may not be able to pay off your entire auto loan, but you may have a lingering credit card or the very last of your student debt that you could pay off now.Even making extra payments on your credit card will drop your minimum payment and therefore help your debt to income ratio.

- Increase your income: Take a part-time job for a little while or try freelancing in the evenings.Once you boost that income, your ratio drops. Plus, you will have some extra money for housing costs.

- Refinance your loans: If you can refinance your auto or student loans to give you a smaller monthly payment, your debt to income ratio will automatically drop.

After you have done one or two of these options, try calculating debt to income ratio again with an income to debt ratio calculator. Sometimes even small adjustments can be the deciding factor of whether or not you can buy a house.

Conclusion – How to Calculate Debt to Income Ratio

Now you should have all the answers to your main debt to income ratio questions, like “How is debt to income ratio calculated?” and “Which income to debt ratio calculator is best for me?”

Plus, you know which debt ratio calculator may be best for you.

Now all you have to do is punch in your numbers in the income to debt ratio calculator.

- If you calculate debt to income ratio and it’s low – congratulations! You should be able to get a mortgage immediately.

- If you calculate debt to income ratio and it’s high – don’t worry! Follow our three steps to lowering your ratio.

You will see how helpful a debt to income ratio calculator can really be as you prepare to apply for a mortgage (or even try to get a hold on your finances).

Popular Article: What are Income Bonds? Definition

- https://britewrx.com/blog/how-ready-are-you-to-build-a-business

- https://www.bankrate.com/calculators/mortgages/ratio-debt-calculator.aspx

- https://www.zillow.com/mortgage-calculator/debt-to-income-calculator/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.