2017 RANKING & REVIEWS

TOP RANKING BEST EQUITY MUTUAL FUNDS

2017 Guide: Grow Your Portfolio with Top Equity Mutual Funds

Are you finally at the stage in your financial development where you can let your money make money for you? If so, congratulations! Not everyone makes it to the point where they have enough money stowed away that they can take a serious look at investing.

So, where should you invest? Fixed income funds, money market accounts, bonds, or the stock market? Have you ever considered an equity mutual fund?

Diversified equity funds are actually one of the most popular investment strategies over the past few years. If you choose the top equity mutual funds correctly, you might have your financial future paved out nicely.

Award Emblem: Top 6 Best Equity Funds

The trick is then finding the best equity fund or funds to invest in. Each investor has their own preferences and qualifications, which is why you need to analyze each equity fund carefully.

Do you want an equity REIT, or a diversified equity mutual fund? These are personal questions and things to sort out through in your decision-making process.

When going through the process of looking for the best equity funds, chances are that you have many questions, including:

- What is an equity REIT?

- What are diversified equity funds?

- What type of equity funds are there?

- Where do you find the best equity-oriented mutual funds?

- Do top equity mutual funds come with a lot of risk?

- What are the best equity mutual funds?

Throughout this 2017 guide, we will answer the questions you have surrounding equity mutual funds. We will explain what equity funds are and what to look for in top equity mutual funds. Finally, we will provide a detailed review of the six best equity mutual funds.

See Also: Top Best HSBC Credit Cards & Business Cards | Ranking & Reviews

Advisory HQ’s List of Top 6 Best Equity Funds

List is sorted alphabetically (click any of the equity-oriented mutual funds below to go directly to the detailed review section for that equity fund):

- Fidelity® Contrafund® Fund

- Oppenheimer SteelPath MLP Select 40 Fund

- Parnassus Core Equity Fund

- T. Rowe Price Institutional Mid-Cap Equity Fund

- T. Rowe Price QM U.S. Small-Cap Growth Equity Fund

- Vanguard Tax Managed Small Cap Fund

Top 6 Best Equity Mutual Funds | Brief Comparison & Ranking

Top Equity Funds | Type of Investment | Rate of Return (1-year) | Risk |

| Fidelity® Contrafund® Fund | Large Growth | 5.02% | Above Average |

| Oppenheimer SteelPath MLP Select 40 Fund | Energy Limited Partnership | 6.31% | Average |

| Parnassus Core Equity Fund | Large Blend | 5.84% | Above Average |

| T. Rowe Price Institutional Mid-Cap Equity Fund | Mid-Cap Growth | 12.07% | High |

| T. Rowe Price QM U.S. Small-Cap Growth Equity Fund | Small Growth | 7.36% | Above Average |

| Vanguard Tax Managed Small Cap Fund | Small Blend | 15.92% | High |

Table: Top 6 Best Equity Funds / Above list is sorted alphabetically

Detailed Overview: What Are Equity Oriented Mutual Funds?

There are so many different types of financial investments that it can be difficult to keep track of them all. From stocks and treasury notes to fixed income and equity mutual funds, there are many options. It can be confusing to keep them all in line or even know what some are.

Source: Advisorkhoj

An equity mutual fund is a fund that primarily invests in stocks. You may even hear equity funds referred to as stock funds in some areas.

Diversified equity funds can be actively or passively managed, and which type you choose is simply a matter of preference and how much control you would like over your investments.

The great thing about equity-oriented mutual funds is that there are so many options available. Throughout the last year, equity funds were the top mutual funds for investors, and there are over 4,500 equity mutual funds available.

With many options available, it can be difficult to choose the best equity fund for you. It is also important to note that the top equity funds for someone else might not be the best equity fund for you. It is important to know what to look for in the top equity mutual funds.

Detailed Overview: Features to Consider in an Equity Fund

Many factors come into play when trying to determine the best equity mutual funds for your portfolio. There are several things to consider when comparing top equity mutual funds, including:

- Performance: Performance is generally gauged by the returns that funds provide. You can generally see them in 1-year, 3-year, 5-year, 10-year, and since-inception frequencies.

- Risk: Risk is how susceptible the equity fund is to swings in the market. When you are investing in stocks, you are generally tied to the volatility of the market. Some equity mutual funds can hedge against this better than others can.

- Charges & Fees: Top mutual equity funds make money by charging investors fees. Know what fees come with the fund you are considering.

- Type of Management: Some funds are actively managed, while others are passively managed. Look into the fund manager and their record of success.

As you can see, there are many different factors to consider when deciding where to invest. The trick is choosing the best equity mutual funds for your financial situation and preferences.

Don’t Miss: Top Best TD Credit Cards | Ranking & Reviews | TD Bank Travel, Rewards, Business, Cash Back Cards

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Advisory HQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Equity Mutual Funds

Below, please find the detailed review of each equity mutual fund on our list of top equity funds. We have highlighted some of the factors that allowed these diversified equity funds to score so highly in our selection ranking.

Fidelity® Contrafund® Fund Review

The Fidelity® Contrafund® Fund is one of the best equity funds on the market. This fund is one of the largest and most actively managed funds. It is readily utilized in 401(k) and other retirement plans, and it is focused on U.S. stocks.

Over the YTD, three-year, five-year and ten-year periods, this top equity fund has seen returns of 5.02%, 7.11%, 13.10%, and 7.83%, respectively. This consistent, positive growth is why this fund finds itself on our list of best equity funds.

We love the management consistency of this fund, as manager William Danoff has been at the helm for years. His team looks for companies whose market value has not been realized by the public, which enables them to buy low. This investment strategy puts the Fidelity® Contrafund® Fund at the top of our list of best equity mutual funds heading into 2017.

Bottom Line

Overall, this slightly above average risk equity fund is a great pick. It has consistently performed well, and there is no change in management in foresight.

Oppenheimer SteelPath MLP Select 40 Fund Review

The Oppenheimer SteelPath MLP Select 40 Fund is also one of the top equity mutual funds. Their strategy is to invest at least 80% of net assets in master limited partnerships (MLPs), with the majority being invested in at least 40 MLPs. Most of the MLPs in this top equity fund are either in energy infrastructure or energy-related assets.

If you are not looking for an extreme amount of risk, this might be one of the best equity mutual funds for you. The risk is average compared to other funds in the same category. However, it is still tied to the stock market, so there is always risk.

This fund also has been fairly consistent in earning performance. Last year, there was a 6.31% return. Over three years, the return drops to a negative 2.23%, but since inception, the fund has seen positive growth of 5.41%. What slid this on the best equity funds list is the 10.08% YTD return.

Bottom Line

If you are looking for the best equity mutual funds, the Oppenheimer SteelPath MLP Select 40 Fund appears to be primed for the future. With terrific YTD gains, now might be a good time to hop on this fund.

Parnassus Core Equity Fund Review

The Parnassus Core Equity Fund is categorized as a large-cap growth fund and focused on socially responsible investments. As of October 2016, the fund had invested in 39 different holdings, for combined fund assets of $14.29 billion. The holding of this equity mutual fund are generally large, domestic companies.

This fund is actively managed, and with managers who strive to outperform benchmarks, it easily makes our list of top equity mutual funds. YTD, this fund has seen an 11.23% return, with 1-year, 3-year, 5-year, and 10-year returns of 5.84%, 8.16%, 14.07%, and 9.20%, respectively.

This equity mutual fund has an above average risk factor, so with the high returns comes higher risk. It carries large U.S. stocks, and there is always a risk that the manager’s selections may not perform as well as anticipated.

Bottom Line

The Parnassus Core Equity Fund is one of the top equity mutual funds, especially for those looking for a socially responsible fund that performs consistently well. You will take on some risk, but it could be a good option for you.

T. Rowe Price Institutional Mid-Cap Equity Fund Review

The T. Rowe Price Institutional Mid-Cap Equity Fund is a fund that aims to provide long-term capital appreciation. It invests a minimum of 80% in a diversified portfolio of mid-cap companies and common stocks that are predicted to grow faster than the normal company will.

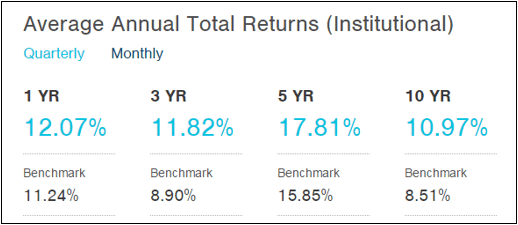

We love that this company has such impressive, consistent returns. With 1-year, 3-year five-year, and 10-year returns of 12.07%, 11.82%, 17.81%, and 10.97%, respectively, you can see that this fund provides consistent results.

Source: T. Rowe Price

It is important to note that this top fund comes with high risk when compared to others of its kind. This may not be the best equity fund for risk-adverse investors. However, with lower than average fees, there is another incentive.

Bottom Line

This is one of the top equity mutual funds when it comes to performance. This fund consistently provides returns higher than the benchmark, as shown in the chart above.

Popular Article: Top Best Store Credit Cards for Bad/Poor/Fair Credit | Ranking | Department Store Cards for People with Bad-Fair Credit

T. Rowe Price QM U.S. Small-Cap Growth Equity Fund Review

The T. Rowe Price QM U.S. Small-Cap Growth Equity Fund is a fund that has seen some recent changes, for the better. By taking a quantitative approach, fund manager Sudhir Nanda keeps sector weightings in line with benchmarks. This is what led this top equity fund to see a big turnaround and larger returns.

With a 1-year return of 7.36%, when it comes to small-cap growth funds, this is one of the best equity funds. The fund performs consistently well, which is why it makes our list of the best equity mutual funds. It has 3-year, 5-year and 10-year returns of 7.28%, 14.70%, and 10.06%, respectively.

There is some risk that comes with this fund. Small-cap stocks can be more volatile than the stock market as a whole, which is something to consider when analyzing whether this fund is a good fit for your portfolio.

Bottom Line

If you are looking for the best equity funds to provide consistent returns, the T. Rowe Price QM U.S. Small-Cap Growth Equity Fund is one to consider. There is a slight risk, but manager Sudhir Nanda seems to have a good grasp of the fund holdings.

Free Wealth & Finance Software - Get Yours Now ►

Vanguard Tax Managed Small Cap Fund Review

The Vanguard Tax Managed Small Cap Fund aims to offer a tax-efficient investment return that centers on long-term capital appreciation. By purchasing stocks from the S&P Small Cap 600 Index, it looks to improve tax efficiency.

The returns are fairly consistent over broader time periods, though the 1-year return of 15.92%, is a bit higher. This is one of best equity mutual funds due to those consistent returns. It has 3-, 5-, and 10-year returns of 8.79%, 16.03%, and 8.73%, respectively.

If you are a risk-adverse investor, then the Vanguard Tax Managed Small Cap Fund may not be a good investment decision for you. It has high risk compared to other diversified equity funds, so keep that in mind. However, fees are low, with an expense ratio of .11%.

Bottom Line

If you are looking for the best equity funds with low fees and impressive, consistent returns, then the Vanguard Tax Managed Small Cap Fund is one to consider. If you are willing to assume some risk, it could be a good fit.

Conclusion – Top 6 Best Equity Funds

Equity funds can be a great investment vehicle if you are looking for higher returns than a savings account, money market account, or CD can provide. Though you accept more risk, the best equity funds can help your portfolio grow over time.

The difficult task is choosing the best equity funds for your financial situation. Everyone has different preferences, and the best funds for someone else might not be the best equity funds for you.

Do you like the equity REIT option? Do you want the best equity fund with lower risk? These are questions that you need to ask yourself when going through the process.

Source: Politico

When looking for the top equity mutual funds, these are some features to consider:

- Performance

- Risk

- Charges & fees

- Type of management

Make sure that you consider these factors when comparing the top equity funds. It is important to choose the equity funds that align with your preferences and financial goals.

Read More: Top Bank of America Rewards Cards | Ranking & Reviews | Bank of America Travel, Cash, Rewards Cards

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.