2017 RANKING & REVIEWS

TOP RANKING BEST SALARY CALCULATORS

How Much Do You Really Make?

How much money do you make? The question arises on everything from tax returns to mortgage and loan applications. Most people have a difficult time calculating salary without the assistance of a salary calculator.

With the internet at our fingertips, it has become possible to find both a net salary calculator and a gross salary calculator with just a few clicks and certain key pieces of information at your disposal. With just a few minutes to spare, you can easily find out your salary with a salary & income calculator.

Award Emblem: Best Salary Calculators

How do you know which of the salary calculator choices is the best one around?

Here at AdvisoryHQ, we believe that understanding your current financial status allows you to make wise decisions for your future. We compiled a ranking of our top net salary calculator and gross salary calculator options to give you a great starting point.

When you’re ready to fill out those applications and forms with accuracy, it’s time to turn to one of these top online salary calculator choices.

See Also: Top Hotel Rewards Programs & Hotel Credit Cards | Ranking and Reviews

AdvisoryHQ’s List of the Top 5 Best Salary Calculator Options

List is sorted alphabetically (click any of the salary calculator names below to go directly to the detailed review section for that salary calculator):

- ADP Salary Paycheck Calculator

- Bankrate Net-to-Gross Calculator

- CNN Money AGI Calculator

- Paycheck City Payroll Calculator

- The Salary Calculator Hourly Wage Tax Calculator

Top 5 Best Salary Calculator Options | Brief Comparison & Ranking

Salary Calculators | Format | Highlights |

| ADP Salary Paycheck Calculator | Chart/ Report | -Customizable deductions -Various printing options |

| Bankrate Net-to-Gross Calculator | Graph | -Easy-to-read and colorful graph -Calculates gross pay |

| CNN Money AGI Calculator | Report | -Detailed deductions to calculate adjusted gross income |

| Paycheck City Payroll Calculator | Chart | -Quick read and short report to see net salary at a glance |

| The Salary Calculator Hourly Wage Tax Calculator | Chart | -Ability to work from hourly wage knowledge only |

Table: Top 6 Best Salary Calculator Options| Above list is sorted alphabetically

What Information Does a Salary Calculator Need?

If you plan to make use of a salary calculator, you will need to have a few pieces of information handy. Most individuals couldn’t spout off information regarding their tax witholdings or IRA contributions from memory. Having a paystub from a recent paycheck or two will definitely assist you in obtaining the information you may be missing.

Image Source: Pexels

What information will you need to calculate your salary with increased accuracy?

On your paystub, you’ll need to take a close look at your current salary information. Most gross salary calculator options will request your year-to-date salary, along with the frequency of your paychecks. This gives them a good estimation of how much you will make through the remainder of the year.

You may need to look closely at your witholdings. Your filing status, federal allowances, and federal witholdings will all play into your salary calculator and its calculations. The state witholdings and information regarding the state you reside in will play a part in calculating salary as well.

Additional information will be necessary for your online salary calculator. You may need to access information including:

- HSA deductions

- 401(k) deductions

- IRA deductions

- Health insurance deductions

- Any other voluntary deductions

A salary calculator USA may require some or all of this information. For the most accurate calculation of your income, you will need to provide as much detail and accuracy as possible regarding your withholdings, deductions, and current pay rate. It will make your process and calculations go more smoothly to have the information handy before you begin using a salary calculator USA.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Salary Calculator

Below, please find the detailed review of each calculator on our list of net salary calculator and gross salary calculator choices. We have highlighted some of the factors that allowed these online salary calculator choices to score so highly in our selection ranking.

Don’t Miss: Top UNSECURED Credit Cards to Rebuild Credit | Ranking | Unsecured Cards to Build Credit for Bad, Poor, & No Credit Individuals

ADP Salary Paycheck Calculator Review

The ADP Salary Paycheck Calculator provides an employee salary calculator chockfull of detailed questions to give you a fairly accurate assessment when you calculate your salary.

Features

This online salary pay calculator will require you to have one of your most recent paystubs in order to calculate your salary. In fact, it even goes so far as to request your check date as the very first item, alongside your gross pay year-to-date. For individuals who do not keep their paystub information handy, the ADP Salary Paycheck Calculator is going to be difficult to use overall.

The ADP Salary Paycheck Calculator is designed to help you calculate your take-home pay, making it one of the best net salary calculator choices. In order to evaluate your net pay, you must know what your gross pay is on each paycheck. Several of their questions relate to the gross salary amount.

It may be useful to maintain a copy of your W-4 along with your recent paystub. Instead of asking specific questions regarding your withholding amounts, it can calculate them for you based on your federal filing status and number of allowances. This net salary calculator does the same for your state withholdings.

Ease of Use

The ADP Salary Paycheck Calculator does have a few features that make it easier to use than some. For example, their deductions section comes preloaded with two of the most common deductions that consumers make: their 401(k) contributions and their HSA contributions. You can choose whether those deductions are calculated based on:

- Percentage of gross pay

- Percentage of net pay

- Hourly rate

- Fixed rate

All of the choices are easily selected using a dropdown box, with no calculations necessary on your part. Of course, this does require you to know how your deductions are calculated in order to make the most use of their net salary calculator.

It even comes equipped with several different printing options for your convenience. Their income salary calculator allows you to print the reports and earning records, and it checks with a variety of choices for how the report should be laid out.

Bankrate Net-to-Gross Calculator Review

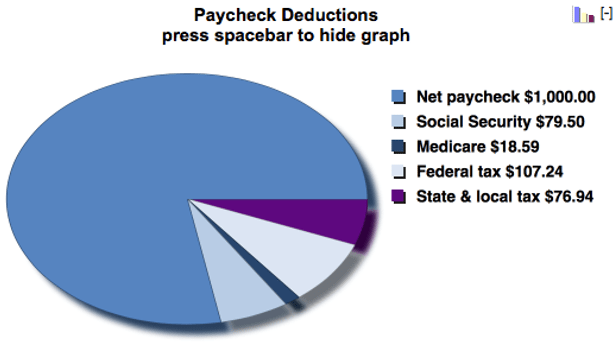

Bankrate Net-to-Gross Salary Calculator gives you a visual representation of your gross salary with clear definitions, assistance, and easy changes to make.

Image Source: Bankrate

Features

At first glance, the Bankrate Net-to-Gross Calculator doesn’t seem to offer as many detailed questions as the ADP net salary calculator. This could be in part because it is doing the reverse calculation: taking a look at your take-home pay in order to determine your gross pay.

In order to fill out the questionnaire, you will still need your most recent paystub. It asks just a handful of questions regarding your year-to-date income, required net pay, and your pay period. For those who prefer not to type the numbers, there are even sliding scales that you can drag to match the appropriate numbers.

The other main benefit of their employee salary calculator is the clear access to their “dictionary” of terms. At the bottom of the calculator, users can find detailed definitions to describe all of the pertinent terminology. For those who are unclear what pieces of information the salary calculator USA may be requesting, this terminology can be convenient and allow you to access your gross salary calculator more efficiently.

Ease of Use

To determine your gross pay, you will fill out your filing status and allowances before moving onto the deductions. Unfortunately, the deductions are where this gross salary calculator tends to fall short in comparison to its competitors.

Their salary pay calculator allows you to fill out your 401(k) withholding, but it only allows you to select a specific percentage of your pay. If your contributions are set on a fixed-rate schedule, this does not allow you to accurately mark your contributions.

The ADP online salary calculator allowed users to customize their deductions and label them appropriately. The Bankrate Net-to-Gross Salary Calculator only provides one blank space entitled “other pre-tax deductions.” It doesn’t give you a visual of what those deductions are for.

Reading the report is easy, with a colored graph that represents the various percentages of your pay that are allocated to deductions and withholdings. At the top of the questionnaire, you can see your estimated gross pay while the bottom presents a chart that adds up all of your withholdings and net pay to create a gross salary calculator.

Related: How to Find the Best Personal Loan Calculator to Calculate Payments & Interest (USA)

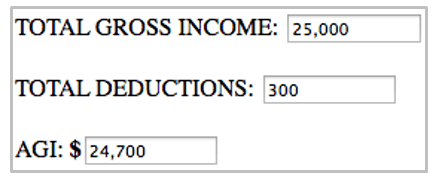

CNN Money AGI Calculator Review

The CNN Money AGI (adjusted gross income) calculator lacks the neat features and colorful interface of its competitors and gets right down to business. It features a detailed analysis of every aspect of your income for an accurate net salary calculator.

Features

This income salary calculator from CNN Money incorporates a wide range of income sources that aren’t accounted for in many of the other income salary calculator options. Apart from income that is earned via your wages, salary, or tips, it also includes a specific line for other income. This can include but isn’t limited to taxable income consisting of:

- Alimony

- Child support

- Unemployment

- Farm income

- Taxable Social Security

- Rental real estate

It will not calculate your salary or be a gross income calculator for non-taxable income, such as gifts or non-taxable Social Security benefits.

The deductions included on the CNN Money free salary calculator are more extensive than those provided on many of the other top salary & income calculator options. For example, it becomes simple to include deductions for items such as IRA contributions, student loan interest, and moving expenses. You can also include these deductions:

- One-half of self-employment tax

- Self-employed health insurance contribution

- Contributions to SEP, SIMPLE, and qualified retirement plans for yourself

- Alimony paid

- Archer Medical Savings Accounts contributions

- Penalties paid on early withdrawals of your retirement accounts

Ease of Use

The CNN Money salary & income calculator lacks the colorful and more modernized user interface of the other top choices. Instead, it opts for strict black and white text with traditional fonts and fill-in-the-blank style questions.

Instead of generating a report or graph that prints easily and is visually interesting, the CNN Money net salary calculator places your adjusted gross income in a new space created at the bottom of the report. Users can print the entire page, but it doesn’t make your finances look particularly appealing.

Image Source: CNN Money

Aesthetics aside, the CNN Money net salary calculator does provide a solid solution for calculating salary with contributions and deductions not accounted for on other employee salary calculator choices.

Popular Article: The Best Retirement Calculators | Guide | Top Retirement Savings & Income Calculator

Paycheck City Payroll Calculator Review

The Paycheck City Payroll Calculator gives users the ability to calculate salary with just a handful of questions. This net salary calculator gives you all the information you need to find out what your take-home pay is based on your gross salary.

Features

This employee salary calculator offers a simple and basic option to users who have much of their payroll information readily available. To begin, you are immediately asked to enter your most recent paystub date along with your state so it can calculate state withholdings as well.

From there, it delves into information regarding your gross pay, with your choice to enter it just for this pay period or for the entire year. The salary pay calculator asks basic questions about your federal filing status and the number of federal allowances that you have filled out on your W-4. Any additional federal withholding is also calculated on their salary pay calculator at this stage.

Deductions can be easily customized with designated locations for a custom name, an amount, and a type of deduction (percentage of gross pay or net pay, fixed amount, or an hourly rate). Mark whether these deductions are subject to any exemptions before moving forward with the report.

Ease of Use

The income salary calculator comes in an easy-to-read format that breaks down the numbers and demonstrates where your net salary calculator answer comes from. In a chart, it lists your gross pay, federal withholding, Social Security, Medicare, and state taxes, with a separate line item listing your final net pay.

For users who want to see all of their numbers at a quick glance, the Paycheck City Payroll calculator makes this a possibility. You can even print this page, along with the original numbers inputted for your calculation. This is a great thing to store in your records for when questions regarding your net salary arise.

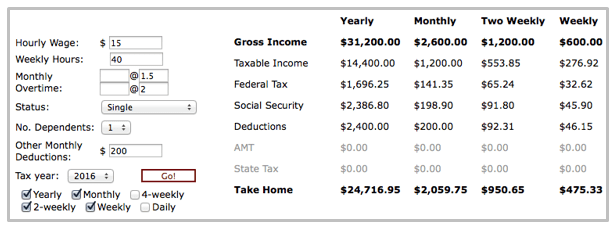

The Salary Calculator Hourly Wage Tax Calculator Review

For users who only know their hourly wages without their annual salary, The Salary Calculator Hourly Wage Tax Calculator features a two-in-one option to determine your income easily (a net salary calculator and a gross salary calculator).

Features

For those who need an employee salary calculator that can work backward from the little bit of information they have, the Salary Calculator Hourly Wage Tax Calculator can figure out the numbers. All you need to have access to is a few tidbits of information:

- Hourly wage

- Number of hours worked weekly

- Number of hours that qualify for time and a half or overtime

- Federal filing status

- Number of dependents

- Other monthly deductions

It is unfortunate that the “other monthly deductions” forces you to lump all of your deductions into one category. It doesn’t allow you to see the breakdown of what percentage is contributed to a 401(k) plan or a health savings account. However, this salary calculator already does more of the math than many of the net salary calculator or gross salary calculator choices available.

Ease of Use

The Salary Calculator Hourly Wage Tax Calculator is relatively easy to use. It asks users only a handful of questions (seven) and then can calculate your salary for both gross and take-home pay.

Not many of the free salary calculator choices will be able to perform the tasks that this salary calculator specializes in. Most require you to know your annual salary upfront. This net salary calculator is a great tool for those who want to compare potential jobs that offer hourly wages to weigh annual salaries.

Even the chart where the data is presented is relatively easy to read. Their free salary calculator displays your annual income, monthly income, biweekly income, and weekly income for both categories, net and gross. No matter what your pay period looks like, the Salary Calculator Hourly Wage Tax Calculator can show you what your net pay and gross pay will be.

Image Source: The Salary Calculator

Read More: The Best UK Mortgage Payment Calculators | Lloyds vs TSB vs Tesco vs Woolwich

Conclusion—Top 5 Best Salary Calculator Options

Knowing your salary, whether it is your take-home pay or your gross pay, is important for any number of financial activities. It can be requested on loan applications or credit card applications, and it just makes sense to know how much money you make so you can budget appropriately. A good salary calculator can make determining your overall income a whole lot easier.

These top choices for the best salary calculator choices feature a variety of options, based on what you most need to figure out: net salary calculator choices, gross salary calculator choices, and a combination of the two. No matter what information you have available, there should be a salary income calculator that will work for you.

Using this guide to the best resources available for a salary calculator will help you to make decisions and figure out the numbers faster than ever. Take a look at your records to determine which of the free salary calculator options can help you calculate your salary with ease.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.