RANKING & REVIEWS

TOP RANKING HOME BUDGET SOFTWARE & APPS

Intro: Creating a Personal Budget with Home Budget Software & Apps

Everyone has been there at least once or twice—your car unexpectedly needs a significant repair, or maybe the water heater breaks in the middle of winter, and you’re stuck without enough money set aside to cover the cost.

If you don’t have a home budget, how can you be sure that you have enough money stored away for the unexpected? Even further, how can you protect yourself from the stress and frustration of living from one paycheck to the next?

Sticking to a personal budget is challenging enough, but sometimes the simple process of creating that budgeting plan is the biggest hurdle.

For those who want to manage their household finances but don’t know where to start, home budget software and home accounting software provides crucial framework and support to create a manageable and effective personal budget.

With the best personal budget apps and home accounting software, creating a financial plan can be as easy as opening an app or logging into an Internet browser.

Award Emblem: Top 5 Best Home Budget Software

But before you start downloading one home budget app after the other, how do you know which is the best home budget app for you? Which home budget software can best suit your individual financial needs?

Everyone has different financial plans, spending habits, and savings goals—and no matter where you fall, there is a personal budget app or a home budget software program that can help you succeed at managing your money.

In this article, we’ll look at the best home accounting software and personal budget apps to help you narrow down the right home budget app for you.

AdvisoryHQ’s List of the Top 5 Best Home Budget Software

List is sorted alphabetically (click any of the software names below to go directly to the detailed review section for that home accounting software):

Top 5 Best Home Accounting Software | Brief Comparison & Ranking

Best Home Budget Software | Price | Highlighted Features |

| Mint | Free | Create a personalized budget and pay bills |

| Mvelopes | $4-$59 per month 30-day free trial | Interactive courses help users learn budgeting skills |

| Personal Capital | Free | See a holistic view of your financial health |

| Quicken | $39.99-$119.99 | Progress tracking based on specific budget goals |

| YNAB | $50 per year, | Based on four simple, effective budgeting rules |

Table: Top 5 Best Home Accounting Software | Above list is sorted alphabetically

Budgeting 101: What Should You Look for in a Home Budget App?

There are plenty of personal budget apps available, but each personal budget app can be drastically different from the next.

Some home accounting software is meant to help you save money, while other home budget software can help you put your spending into specific categories to promote responsible spending.

No matter what kind of personal budget app you choose, there are a few common features that the best home budget software has in common.

When evaluating the best home budget software, keep these five characteristics in mind to determine whether each home accounting software is worth your time.

Ease of Use

Unless you’re a professional accountant, it’s likely that creating a personal budget and managing money is not one of your favorite activities.

A home budget app should not make your life more complicated—it should turn the process of creating and maintaining a budget into a simple, uncomplicated process.

Using home accounting software shouldn’t be confusing, and each step should be easily identified and plainly explained.

Automatic Importing

All personal budget apps rely on using information from your bank accounts to create a manageable and accurate personal budget.

Having a home budget app that automatically imports information from your bank accounts creates a seamless, effortless foundation.

Not only does this save time, but it also reduces the likelihood of errors, making for more accurate personal budget software.

Visual Aids

Learning how to create and maintain an effective personal budget means gaining a complete understanding of how your incoming and outgoing charges impact your overall finances.

Few things are more effective at helping novice budgeters understand their finances than visual aids like charts and graphs.

Looking at a chart is a lot more enjoyable than poring over numbers and percentages on a spreadsheet—and it’s usually much easier to understand, too.

Mobile Access

While it isn’t a requirement for home budget software to include a mobile personal budget app, it certainly helps.

Having mobile access means that you can constantly access your personal budget and know exactly where your finances stand, even when you are away from home.

With the popularity of personal budget apps increasing by the day, the best home budget apps come with streamlined interfaces and easy-to-use features, making it possible to stay on top of your personal budget at all times.

Price

Just as everyone has different spending and savings goals, an acceptable price for home budget software or a personal budget app will vary.

There is free personal accounting software available, as well as free personal budget apps—some of which we will cover in this article—but there are also plenty of paid home accounting software options.

Deciding between free personal budget software or paid home budget software largely depends on what you are willing to pay for the features you need.

Luckily, many of the best free budget apps and best free personal accounting software comes with all the features that you’ll need to successfully maintain a personal budget.

However, there may be some paid home accounting software that has unique budgeting or accounting features that are worth paying for.

How do you decide between paid or free personal budget software? It all boils down to understanding the unique features of each type of home accounting software and what will provide the most substantial benefit to your personal budget.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Home Budget Software

Below, please find a detailed review of each software on our list of best home accounting software. We have highlighted some of the factors that allowed these personal budget apps and home budget software to score so high in our selection ranking.

See Also: Personal Capital vs. Quicken – Rankings & Review

Mint Review

Mint is a simple and convenient home budget software that lets users make budgets, pay bills, and gain control over the health of their finances.

Two years after its creation, Mint was acquired by Intuit for $170 million, the maker of industry-leading home accounting software like Quicken, QuickBooks, and TurboTax.

As a free personal budget software, Mint is widely considered to be one of the best free budget apps available on the market today.

Key Factors that Led to Our Ranking of This as a Best Personal Budget Software

Below, please find a detailed list of the features which led to our selection of Mint on this list of the best personal budget apps and top home accounting software.

Free Home Budget Software

Users can create a personal budget completely free of charge through Mint’s free personal budget software.

Not only is Mint free to use, but it also comes with highly advanced, effective, and valuable home accounting software that easily rivals high-priced versions of best home budget software.

Dynamic Mobile App

With compatibility across multiple devices, Mint is one of the best free budget apps to consider using.

This best home budget app comes with high recommendations from iTunes and Google Play, with many users applauding the personal budget app for helping them create manageable and effective household budgets.

Mint is also available through a web browser, making it easy to use this free personal accounting software no matter where you are.

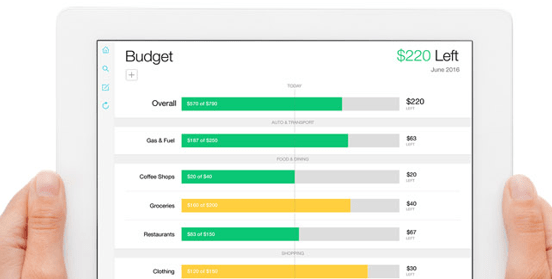

Photo courtesy of: Mint

Customizable Categories

Part of creating an effective personal budget means gaining an understanding of exactly where your money is going.

Mint’s home budget software provides automatic categorization of every transaction, allowing users to see total spending across hundreds of categories.

Even better, users can create their own categories within the personal budget app to customize their spending patterns.

Mint will then use these spending categories to identify spending trends, identify areas for improvement, and suggest a budget based on those patterns.

Users can create their own personal budget and see how cutting back spending on certain categories could affect their overall budgeting and savings goals.

Pay Bills

As a best personal budget app, Mint goes beyond simply showing you how to budget. It can actually help you maintain that budget by paying bills directly through their free personal budget software.

Mint Bills keeps all your bills in one place, consolidating upcoming payments in one convenient place. Even better, you can process payments from your bank account through Mint, eliminating the hassle of logging in and out of multiple websites.

Automatic bill reminders for upcoming due dates and alerts for low accounts help users stay on top of their personal budget and avoid late fees.

Is Mint the Best Personal Budget Software for You?

Not only is Mint intuitive and user-friendly, but it is also a free personal budget software, making it one of the best home budget software options.

This home budget app and home accounting software comes with powerful budgeting tools and is designed to be accessible by anyone, regardless of budgeting experience.

If you’re creating a personal budget for the first time, Mint is a great option. Not only is it effective, but as a free personal budget app, it also offers a no-risk way to begin using home budget software.

Don’t Miss: Qapital Review – What Is Qapital? Everything You Must Know! (App Review)

Mvelopes Review

Mvelopes is a part of financial company Finicity, which has been helping clients achieve better financial health since 1999.

This home budget software focuses on helping users better manage their spending by using digital envelopes to track current spending and assign future spending amounts to specific categories.

Over 400,000 users have found success using Mvelopes to create a personal budget, with an average debt payoff of $3,225 and an average savings of $2,175.

Key Factors That Led to Our Ranking of This as a Best Personal Budget Software

Below, please find a detailed list of the features which led to our selection of Mvelopes on this list of the best personal budget apps and top home accounting software.

Affordable Home Budget Software

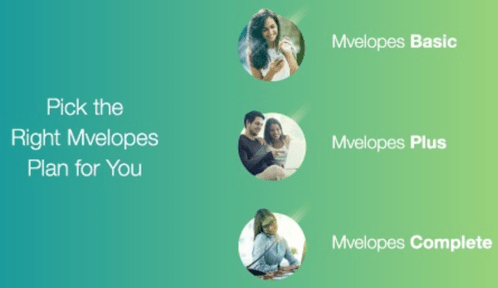

While this free personal budget software is not free, there are multiple versions of this software that users can choose from to align with their personal budget.

Mvelopes Basic costs $4 per month, and comes with the following benefits:

- Connect unlimited accounts, including bank accounts and credit cards

- Download the personal budget app for on-the-go monitoring

- Automatic syncing to see a real-time picture of your finances

- Create envelopes to help you manage your spending

Mvelopes Plus costs $19 per month, and allows users to:

- Access interactive tools to learn about creating a personal budget

- One-on-one startup support

- Customize a rapid debt reduction plan

- Expert guidance and feedback every 3 months

Mvelopes Complete costs $59 per month, and includes the following:

- Monthly one-on-one personal budget guidance

- Customized financial plan with your Personal Finance Trainer

- Financial goal tracking

- Access to all budgeting tools and guides

Depending on your personal budget needs, you may find that paying for the home budget software pays off in the long run.

Photo courtesy of: Mvelopes

Unique Approach

Mvelopes offers a classic, yet unique approach to creating an effective personal budget—simply pre-assign envelopes (categories) with a specific dollar amount to spend.

If you overspend in one envelope, you’ll have to pull money from another to make up for the difference. Their personal budget method is a modern twist on an old method of planning ahead for each spending category.

Using this personal budget app means employing four key steps to financial freedom:

- Give Your Money A Purpose—Spend your money on what matters to you

- Avoid Debt—Pay off existing debt and save to avoid future debt

- Simplify—Use the home budget app to see all your finances from one dashboard

- Plan For Tomorrow—Be prepared for expenditures like accidents, home repairs, car trouble, or vacations

Interactive Learning Center

For users who want to educate themselves about different ways to succeed at creating a personal budget, Mvelopes is one of the best home budget software programs to consider.

Their Learning Center is filled with interactive, online courses that can help you learn how to better manage your money and create a successful personal budget. Courses range between 4-14 lessons, and include topics like:

- Create an Emergency Fund

- Eliminate Debt

- Finance for Couples

- Raising Financially Successful Children

It is important to note here that the courses within the Learning Center will only be available for those with Plus or Complete membership. Access to financial literacy courses may be a great way for users to justify the cost of a paid home budget software.

Is Mvelopes the Best Personal Budget Software for You?

Mvelopes will likely be the best home budget software for users who prefer planning out specific amounts for individual categories ahead of time.

Their personal budget strategy relies on reinventing a classic method of budgeting. While this may be a perfect fit for some, the lack of flexibility may be an issue for others.

It’s also worth noting that Mvelopes is one of the most expensive personal budget apps and home budget software options on our list, but that cost may be offset by the opportunity for a one-on-one consultation and financial education through the Plus and Complete memberships.

Related: QuickBooks Online Review – What Is QuickBooks Used for? (Online Features & Reviews)

Personal Capital Review

Personal Capital is one of the most talked-about and positively reviewed personal budget apps in recent years, offering expert home accounting software for budgeting, investing, and personal finance.

Founded in 2009, this free personal accounting software seeks to make managing personal finances simple, accessible, and efficient.

Available via desktop or mobile app, Personal Capital has 1.4 million users, resulting in $350 billion in tracked accounts and $4.9 billion in assets under management.

Key Factors That Led to Our Ranking of This as a Best Personal Budget Software

Below, please find a detailed list of the features which led to our selection of Personal Capital on this list of the best personal budget apps and top home accounting software.

Free Personal Budget Software

All financial tools within this home budget software are available completely free of charge, making Personal Capital one of the best home budget software options on the market.

Users have free access to personal budget tools, investment monitoring, and even retirement planning when signing up for this free personal accounting software.

The only exception is for those who choose to use personal investment advisory services through Personal Capital, which comes with a low annual management fee.

Cash Flow Tool

As one of the best home budget software, Personal Capital can offer users valuable insight into how much money is coming in—and how much money is going out.

The Cash Flow tool highlights weekly, monthly, and yearly income to show how much money you have to work with when creating a personal budget.

From there, transactions are categorized to help you see exactly where your income is going, allowing you to see spending patterns and areas for improvement.

Monthly Spending Targets

Using Personal Capital as a personal budget tool means creating monthly spending targets to identify areas for improvement.

Personal Capital’s free personal accounting software lets you view spending and savings by date, category, or merchant, making it easy to look at specific areas of your monthly budget.

Retirement Planner

Part of creating a sustainable personal budget means effectively planning for the future—and for many budgeters, this means planning for retirement.

Personal Capital’s free Retirement Planner will analyze your current budget and assess how ready you are for retirement by a certain age.

You can also add changes to income, a home purchase, starting a family, and projected Social Security distributions to see how your retirement can be affected.

For users who want to create a solid personal budget to plan for the future, the Retirement Planner is an excellent tool to use.

Is Personal Capital the Best Personal Budget Software for You?

There’s no doubt that Personal Capital’s free personal accounting software is making huge waves in the industry of personal finance. This home accounting software offers the chance for users to see a holistic view of their finances, including investments, savings, income, and overall net worth.

If monitoring investments and saving for retirement are part of your personal budget plan, Personal Capital will be the best home budget software for you.

For users that simply want to create a manageable personal budget, however, the extra investment and net worth features in Personal Capital may not be helpful.

Still, as a free personal accounting software, the benefit to using Personal Capital is that you truly have nothing to lose and everything to gain when making a personal budget.

Popular Article: SigFig Review – What Is SigFig? (Wealth Management & Review)

Quicken Review

Quicken has been in the business of personal finance since 1982, providing a strong foundation for home accounting software.

Although it is not a free personal accounting software, Quicken continues to be considered as one of the best home budget software options on the market.

Key Factors That Led to Our Ranking of This as a Best Personal Budget Software

Below, please find a detailed list of the features which led to our selection of Quicken as one of the best personal budget apps and top home accounting software.

Affordable Home Budget Software

Quicken is the best home budget software for users who want a wide range of options for home accounting software.

There are six different versions of Quicken available for purchase, but the best versions for creating a personal budget include:

- Quicken Starter Edition 2017—$39.99

- Quicken for Mac 2017—$74.99

- Quicken Deluxe 2017—$74.99

Quicken also has home budget software for business owners, making it a great option for those who want to combine business and personal financial management into one application.

Personal Budget Tools

After syncing your spending and saving accounts, Quicken’s home budget software automatically identifies spending patterns and areas for improvement.

Users will be given a realistic, manageable budget, although the personal budget app makes it easy to customize a personal budget to fit your unique financial needs and goals.

Over time, Quicken will track progress based on specific goals, making it one of the best home budget software programs for long-term budgeting goals.

Updated Personal Budget App

The ability to access your personal budget on-the-go is an important feature of the best home budget software, and Quicken has introduced plenty of updates for their home budget app.

Available for iPhone, iPad, and Android devices, this personal budget app comes with powerful syncing capabilities, allowing users to connect their checking, savings, credit card, and investment accounts to show a complete picture of financial health.

The Quicken personal budget app also lets users snap photos of receipts, making it much easier to prepare for tax season throughout the year.

Automatic Categorization

Quicken makes establishing a personal budget into a simple, hands-off process by automatically sorting purchases into categories.

The home budget software and personal budget app will assign categories like Bills & Utilities, Cash & ATM, Health & Fitness, and Entertainment to help you keep an eye on where your money is going.

As an additional benefit, this home accounting software will take that data and create visual aids like charts and graphs to help users better understand how to create a personal budget.

Is Quicken the Best Personal Budget Software for You?

Quicken is a long-standing, trusted name in home accounting software, and its high-level security features are right on par with that of major banks.

This top personal budget app also has the advantage of importing financial data to TurboTax, since both home accounting software products are owned by Intuit.

While Quicken is certainly one of the best home budget software, it’s worth mentioning that the budgeting tools from Mint or Personal Capital are just as powerful—and much more affordable.

If, however, you like the idea of combining a personal budget with quick import to TurboTax during tax time, Quicken is a standout option among personal budget apps and software.

Read More: Stash Invest App Review | What You Need to Know (Fees, Pros, Cons, Services)

You Need A Budget Review

You Need A Budget (YNAB) is an award-winning personal budget app and top home accounting software that continues to help users improve their financial awareness and create manageable personal budgets.

This top home budget app was founded in 2004 by a young married couple, Jesse and Julie Mecham, who found themselves struggling to balance their living expenses with their college debt.

As a group, users of this personal budget app and software save $600 by their second month, and over $6,000 by their first year, making YNAB one of the best home budget apps to consider using.

Key Factors that Led to Our Ranking of This as a Top Personal Budget Software

Below, please find a detailed list of the features which led to our selection of YNAB on this list of the best personal budget apps and top home accounting software.

Affordable Home Accounting Software

YNAB uses a simple and affordable pricing structure for their home accounting software, with the goal of making an effective personal budget accessible to everyone.

Their home budget software is available for $50 per year, which includes a free 34-day trial. YNAB also holds a no-risk, 100 percent satisfaction guarantee, which will provide a refund if you are dissatisfied with their personal budget software.

For students, YNAB offers their personal budget software for free during the first year, and at a 10 percent discount for the next.

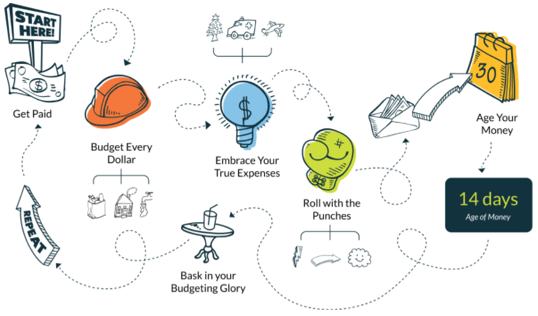

Personal Budget Principles

YNAB’s personal budget software operates on a unique set of personal budget principles to help users succeed. These include:

Rule One: Give Every Dollar a Job

Rather than arbitrarily spend money on impulse purchases, Rule One creates a strong foundation for a personal budget by actively prioritizing each dollar spent.

Rule Two: Embrace Your True Expenses

Rule Two addresses larger, less frequent expenses—like car insurance premiums and holiday shopping—and breaks them down into smaller, more manageable amounts over time.

Rule Three: Roll With The Punches

It’s easy to stress over creating a personal budget, especially if you accidentally overspend in a category. Instead of falling prey to guilt or feelings of failure, Rule Three encourages flexibility in a personal budget.

Rule Four: Age Your Money

The ultimate goal of YNAB’s personal budget app and software is to maintain a personal budget where money spent has been in your account for at least 30 days.

According to Rule Four, this is the best way to escape the paycheck-to-paycheck cycle and establish a reliable, manageable personal budget.

Photo courtesy of: YNAB

User Support & Financial Education

As a best personal budget app, YNAB does an outstanding job at promoting financial literacy while creating a manageable personal budget.

Users can take advantage of free online workshops to learn about making an effective personal budget. For those who are inexperienced with managing their finances, this is a great opportunity to ask questions and get advice from financial experts.

This personal budget also stands out for their dedication to providing enhanced user support through webinars, newsletters, videos, podcasts, and detailed guides on the best practices for creating a personal budget.

Is YNAB the Best Personal Budget Software for You?

You Need A Budget is an all-around great home budget app for users who are genuinely invested in learning to create an effective personal budget.

Not only does this personal budget software invest heavily in user education and support, but they also provide a welcoming and risk-free process for those who might be wary about using home budget software.

With a free trial period and special discounts for students, the cost of YNAB matches its value, making it a great option for young or new budgeters.

Related: The Best Mobile Banking Apps | Guide | How to Find the Top, Free, or Best Internet Banking Apps

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Which Personal Budget Software Should You Choose?

Choosing personal budget software can be an intimidating process, particularly if you have never made a personal budget before.

With the help of top personal budget apps and home budget software, however, creating an efficient and manageable personal budget can be fun and simple.

When selecting a personal budget software, make sure to ask yourself the following questions:

- Does it come with a high-performing personal budget app?

- Do I have any unique or specific budgeting goals?

- Would charts and graphs be helpful when making a personal budget?

- Are learning tools and user support important?

- What are my greatest challenges when creating a personal budget?

- Can I get the same benefits from free personal budget software as I can from paid home budget software?

The top personal budget software on this list represent the best home budget software, both paid and free, providing an excellent starting point when searching for the best personal budget app.

No matter what type of home budget app or software you choose, you can rest assured that using one of these top-rated programs can do wonders to make your financial life productive, organized, and stress-free.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.