SigFig Review – What Is SigFig? Pros and Cons of Using This Wealth Management Platform

Not long ago, artificial intelligence was the stuff of science fiction. However, today we have personal assistants in our phones and computers competing on quiz shows. Even driverless cars seem just around the corner.

The SigFig app and the kinds of services offered by SigFig Wealth Management are part of an emerging group of financial advisors that are sometimes called “robo-advisors.”

Robo-advisors bring artificial intelligence to personal finance, managing portfolios, and optimizing investments using computer algorithms and very little human intervention.

While many SigFig reviews focus on investment returns and service fees (areas we’ll also cover), our SigFig review will also include how the company works to make investors feel in control, even as they allow computer intelligence to make decisions for them.

See Also: Top Day Trading Tools (Review of the Best Trading Software and Apps)

What Is SigFig? Quick Overview

SigFig is a financial advisor that provides most of its services through the SigFig app (available on Android and iOS devices) or online via a web browser. Since its portfolio management services are automated, it is available without the need of an office visit or phone call and offers a low-cost alternative to a traditional financial advisor.

Sig Fig reviews praise the simplicity of its easy-to-use app. Attractive graphs and quick-access breakdowns convey a lot of information without overwhelming a user. Intuitive controls make management tasks simple – the app computes value projections and makes portfolio recommendations in real-time.

The name “SigFig” comes from the mathematical concept of significant figures. Significant figures help scientists and statisticians represent large results from complicated computations in easy-to-understand ways. They also help to make sure that people viewing those results aren’t confused about how precise the results actually are.

This doesn’t seem to be just a name for SigFig – a typical SigFig review from its users praises the presentation of the data and its usability. One user called the app “very logical and intuitive” and another commented it as “a pleasure to use.”

SigFig can act as a management tool for a portfolio at another brokerage, or you can create a new account directly through the SigFig app. For new investors, SigFig offers a series of questionnaires to help identify your goals and risk tolerance and then creates a set of recommendations tailored to your preferences. From there, an algorithm monitors your investments and makes automatic adjustments whenever the formula recognizes a more optimized allocation.

For simplicity, SigFig Wealth Management boils these services down into six succinct steps on what it calls “the investment path”:

- Plan by sharing your investment goals

- Review the resulting recommendations

- Fund your portfolio

- Maximize with daily automated optimizations

- Minimize costs with low fees and tax-aware choices

- Monitor your investments with transparent reporting

Don’t Miss: Best Asset Tracking Software and Systems – Top Reviews

Trusting the Machine

Some investors wonder: is SigFig safe? Can I trust my financial decisions to a computer program?

Using mathematics to maximize return for a certain level of risk is nothing new. Nobel prize-winning economist Harry Markowitz introduced modern portfolio theory in 1952, and human financial advisors have been using formulas like these for some time.

Software using these algorithms has been a popular choice among advisory firms for more than a decade, so it’s likely that computer intelligence is already playing a role in your portfolio management.

The SigFig app makes that intelligence available to individuals and is particularly attractive to new and young investors. Users who “grew up online” are accustomed to personal, data-driven services, and so it’s no surprise that Millennials are often among a robo-advisor’s clientele.

The kinds of investments made by robo-advisors also help build confidence. Computer algorithms are often associated with high-frequency trading. This short-term strategy works by timing the market and attempting to profit from daily fluctuations.

This isn’t the same kind of artificial intelligence employed by robo-advisors (including SigFig). Instead, robo-advisors typically use a buy-and-hold strategy, focusing on long-term yield that essentially ignores day-to-day market volatility.

This is an important difference that should be noted in any Sig Fig review: passive investing models work well with low-risk tolerance. Combining this with fees and account minimums lower than traditional investment managers, robo-advisors attract even the most risk-averse users.

Still, there is understandable uneasiness to taking a completely hands-off approach to portfolio management and handing all of your decision-making to a robo-advisor like the SigFig app.

Many economists point out that robo-advisors have not been tested during periods of economic downturn and wonder if ever-changing market patterns might put stress on the algorithmic backbone of these services.

It’s also important to remember that the investors themselves are human, and traditional financial advisors often provide guidance when human emotions – particularly fear and greed – threaten to undermine a long-term strategy. And some investors, whatever their tolerance for market risks, will never be comfortable with the idea of a predetermined algorithm making changes on their behalf.

To answer these concerns, SigFig also offers support and advice from human advisors.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

The Human Touch

As mentioned, no SigFig review would be complete without some attention paid to the blend of human advice alongside the data-driven automation. Product support is available through a robust knowledge base on SigFig’s website. Support staff is accessible via phone, email or live chat, so questions about your SigFig app can be answered right away (product support is available from 6am–6pm PT, Monday through Friday).

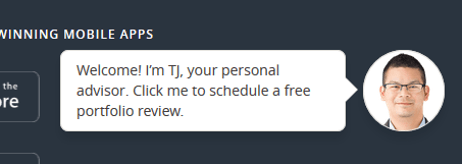

Image Source: SigFig

SigFig offers access to actual financial advisors as well. SigFig’s site and app include what the company calls “concierge service.” A portrait of an advisor hovers near the bottom of the screen. With a click, you’re immediately offered scheduling options to arrange a time to have this advisor answer questions or offer advice.

This service is evident even through the app store – a Sig Fig review that mentions a problem with the app gets a response directly from the developer.

Investors should not expect the kind of accessibility or in-depth knowledge about individual portfolios that comes with traditional brick-and-mortar firms.

Still, there are qualified advisors on staff and their availability is deliberately showcased as part of the user experience. This indicates that SigFig is aware that investors may not be entirely comfortable managing their experience on the SigFig app and could require the occasional person-to-person conversation.

The SigFig app also presents an impressive amount of data. The company’s mission statement celebrates transparency. This distances SigFig from traditional Wall Street firms, which have a lot of ground to make up in the area of consumer trust.

SigFig counteracts the complexities of its computer decision-making by presenting data openly and with intuitive visualizations. This gives discerning users the ability to audit the decision-making.

While the future of investing may be in robo-advisors, the investors themselves remain flesh-and-blood humans. SigFig’s focus on transparent data allows its human investors to monitor their computer partners every step of the way.

Related: Best Financial Apps | Financial Planning Software Reviews

Returning to Return on Investment

Automated innovations, advanced algorithms, data visualizations, and concierge service all mean very little if SigFig Wealth Management doesn’t provide a good return. SigFig’s own materials claim that, over a 20-year investment, a combination of its services adds 4% to the returns of a traditional investor. These services include:

- Commission-free trading

- Tax-aware allocations, migrations, and sales

- Automated reinvestment and rebalancing

- Funds with historically higher net returns

SigFig’s real advantage comes in the form of its low-cost services. While its account minimum of $2,000 is not the lowest on the market (a drawback mentioned in Sig Fig reviews from some users), low-balance accounts don’t pay fees, so the service is effectively free for beginning investors or those looking for a trial period.

Accounts over $10,000 are subject to an annual management fee of 0.25%. Forbes cites an industry average of approximately 1.1%, over four times greater.

Note that SigFig Wealth Management portfolios typically include ETFs (exchange-traded funds), which come with their own expense ratio. These average around 0.44%, according to the Wall Street Journal – well below the traditional index fund average of 0.74%.

By combining low management fees with services optimized to reduce other investment costs and minimize taxes, the SigFig app generates more return on investment. This is, of course, the bottom line for most users evaluating a portfolio manager. Most analysts agree that robo-advisors can use these advantages to compete directly on ROI with traditional portfolio managers.

Significant Factors for Choosing SigFig

With its data-driven DNA and a user experience that’s earning accolades, SigFig could easily become a go-to choice for the next generation of investors. In particular, SigFig reviews well for investors who are:

- New to investing

- Risk-averse or looking for long-term investments

- Plan to manage a portfolio of $10,000 or less

- Comfortable with technology and automation

- Willing to trade hands-on management for lower fees

The current iOS version of the SigFig app averages 5/5 stars from user reviews, and the Android version comes in at an average of 4.4. The app has earned “editor’s choice” and “top developer” honors from Google.

It also takes advantage of the latest features offered by mobile platforms, including 3D touch (for the iPhone 6S) and support for smart watches.

Not long ago, the only way your phone could help you manage your investment portfolio was by calling your broker or portfolio manager. However, just like in the areas of fitness, entertainment, productivity, and medicine, technology is rapidly emerging among financial advisory firms.

The SigFig app certainly isn’t the only option for automated portfolio management, but if your personal financial picture is like the one spelled out above, SigFig could be one of the least costly and easiest to use tools available. We hope this SigFig review has been a helpful resource as you put together your wealth management tool belt.

Popular Article: Top 5 Best Personal Accounting Software for Home Use

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.