2017 RANKING & REVIEWS

TOP RANKING BEST INSTALLMENT LOANS

Installment Loans Online to Help Your Next Purchase

Occasionally, we all desire to make a purchase that is outside of our current financial ability. When that new roof or the computer you need for your new job is just a hair out of your financial grasp, it’s time to start looking for long-term installment loans.

Online installment loans allow consumers to receive a large lump sum payment upfront. This gives you fast access to the cash you need without much delay. From there, payment terms can vary with consumers finding monthly installment loans, long-term installment loans, and payday installment loans, to name a few.

A lot of companies advertise having the best installment loans on the market, but how can you be sure that you aren’t falling prey to a loan with predatory interest rates and unfavorable terms? AdvisoryHQ knows how prevalent online installment loans are on today’s market, and we’re here to help.

Award Emblem: Best Installment Loans Online

In our detailed ranking and breakdown, we’ll cover some of the best installment loans and the companies behind them. You’ll find out information such as:

- Loan amount

- Terms

- Minimum payments

- Approval requirements

If you know that you have an upcoming purchase to make without the necessary funds, online installment loans might be the best choice. Find out which ones made our ranking of the best installment loans in the sections below.

See Also: Top Store Credit Cards | Ranking | Best Department Store & Retail Cards (Reviews)

AdvisoryHQ’s List of the Top 6 Best Installment Loans

List is sorted alphabetically (click any of the installment loan names below to go directly to the detailed review section for that installment loan company):

Top 6 Best Installment Loans | Brief Comparison & Ranking

Installment Loan and No Credit Check Loan Companies | Loan Amount | Loan Term |

Avant | $2,000 to $35,000 | 2 to 5 years |

Lending Club | $1,000 – $40,000 | Varies |

NetCredit | $1,000 – $10,000 | 6 months to 5 years |

OneMain | $1,500 – $25,000 | Varies |

Prosper | $2,000 – $35,000 | 3 years or 5 years |

Wells Fargo | $3,000 – $250,000 | 1 to 5 years |

Table: Top 6 Best Installment Loans | Above list is sorted alphabetically

What Are Online Installment Loans?

There are a multitude of misconceptions surrounding online installment loans and what consumers can expect from them. To ensure that you understand exactly what an installment loan is, we’re going to first cover the installment loan definition before diving into the companies and loans that we consider some of the top choices.

Image Source: Pixabay

The easiest way to describe an installment loan definition is to use a synonym: a personal loan. Many people believe that online installment loans are equivalent to a payday loan for people with bad credit. This is a common misconception that is important to dispel by providing an installment loan definition.

Long-term installment loans allow consumers to receive a lump sum payment when they need it most. From there, a fixed interest rate is typically set, along with regular intervals for repayment. The most common type is monthly installment loans with a specific percentage or portion of the principal being paid on a monthly billing cycle.

In order to get installment loan choices, you don’t necessarily have to have a well-polished credit score. A higher credit score would allow you to qualify for more installments loans with lower rates and more favorable terms, but people with bad credit may also qualify for installments loans.

Much like a credit card, long-term installment loans come in both secured and unsecured varieties. Secured installments loans allow lenders to use some collateral in the event that you default on your payments. This allows lenders the flexibility to issue higher installment loans or to be able to fund online installments loans for individuals with bad credit.

When you’re searching for online installment loans, you should keep an eye out for deals that involve excessive fees. While it is possible to find long-term installment loans with low interest rates, it is equally easy to encounter lenders with exorbitant APRs and hidden fees. Steer clear of any lenders who feature these things in the fine print of their contracts.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Installment Loans

Below, please find the detailed review of each loan on our list of online installment loans. We have highlighted some of the factors that allowed these installment loans to score so highly in our selection ranking.

Don’t Miss: Best Small Business Grants and Loans for Women Starting a Business

Avant Reviews

Avant offers a range of flexible online installment loans for consumers looking for loans of $2,000 or more. You’ll want to take a close look at their potentially low APRs and relatively low (but upfront) administration fees.

Image Source: Avant

Loan Terms

Avant has a number of long-term installment loans available for consumers who need flexibility. Their short-term installment loans range from a period of 24 months to 60 months. The variability in the repayment of their online installment loans makes it ideal for a variety of consumers.

Not only that, but borrowers can find small installment loans as well as those with a higher balance. Avant’s long-term installment loans can range in prices from $2,000 all the way to $35,000. Whether you’ve wanted to touch up your home, purchase a new television, or fund a luxury vacation, Avant’s payday installment loans can cover you.

The drawback to their loan amounts is that Avant has nothing to offer consumers searching for loans for just a few hundred dollars.

Interest rates will run the gamut with relatively low APRs and those that start to accumulate rather quickly, depending on your creditworthiness. Most of their online installment loans are accompanied by rates ranging from 9.95% to 35.99% APR.

Additional Fees

As with many of the best installment loans, there are a handful of additional fees that you can anticipate when it comes to their long-term installment loans. First to consider are the administration fees. At Avant, you’ll pay a flat 4.75% of your total loan amount for these fees.

These are relatively low administration fees in comparison to some payday installment loans available.

Furthermore, you are also charged a late fee if your payment isn’t made within ten days of the due date. Late fees are set at $25 per instance. In a similar vein, a dishonored payment fee that leaves your bill unpaid will come in at $15 each time.

Lending Club Reviews

With some of the lowest APRs available among online installment loans, Lending Club has much to offer consumers looking for high-value, long-term installment loans.

Loan Terms

Consumers do have flexibility in the amount that they can borrow through Lending Club’s payday installment loans. Similar to the loans issued by Avant, the minimum installment loan they will issue comes in at $1,000. This does leave out consumers who were looking for small installment loans instead.

However, they do feature some of the highest possible installment loans online. Consumers could find themselves with the ability to borrow up to $40,000 through Lending Club. This tops even Avant’s maximum long-term installment loans.

Interest rates will vary based on your creditworthiness, similar to most other installment loans online. They will range from a low and very reasonable 5.98% to 35.89% APR. This makes Lending Club one of the most competitive choices when it comes to interest rates among online installment loans.

How It Works

Lending Club works in a slightly unconventional way compared to the funding methods of traditional brick and mortar banks. After you fill out your incredibly short application, taking less than five minutes, you’re presented with several different offers for online installment loans if you qualify.

You can watch as various investors fund your loan, based on the credit score and risk determined by Lending Club’s application process. Your loan can be funded by individuals or institutions, but it’s up to them whether or not your loan will be funded. Investors are hit with service fees based on the amount of the loan and the timeliness of your payments.

As a result of their innovative lending platform, Lending Club can present loans to consumers that cost approximately 30% less than those that accompany a consumer’s current debt or credit cards.

Related: Tips for Getting Business Loans

NetCredit Reviews

Consumers in need of small installment loans may prefer the options available from NetCredit. Be aware that they can come with higher interest rates, though.

Loan Terms

Individuals who opt for the best installment loans available through NetCredit are signing up for monthly installment loans that have relatively low availability. Loans will range from $1,000 up to $10,000 depending on your need, creditworthiness, and other factors.

Eligibility is determined by the personal information you provide when filling out the application for rates. Loans can range in length from six months up to five years, depending on the amount issued and your credit score.

Keep in mind that the interest rates that accompany NetCredit monthly installment loans are going to be higher than those for companies such as Avant or Lending Club. Interest rates vary by state; using South Carolina as an example, rates could be as high as 155% APR. Consumers with a more pristine credit score could see lower rates around 34% APR.

It may take up to three business days to secure your approval, but funds can be deposited into your bank account as soon as the next day. This allows for quick cash when you need it with these installment loans online.

Fees

The main advantage to online installment loans issued through NetCredit is their lack of hidden fees. Their ClearCost for Me program promotes no additional fees, including application fees, origination fees, late fees, non-sufficient funds, or prepayment fees.

Transparency when it comes to additional fees that are paired with online installment loans through NetCredit qualifies their products as some of the best installment loans. They are ideal for consumers who are in the habit of making late payments and would ordinarily face higher interest rates.

Alternatively, because there are no prepayment fees, their long-term installment loans (or short-term installment loans, if you prefer) can be repaid quickly to cut down on the interest costs.

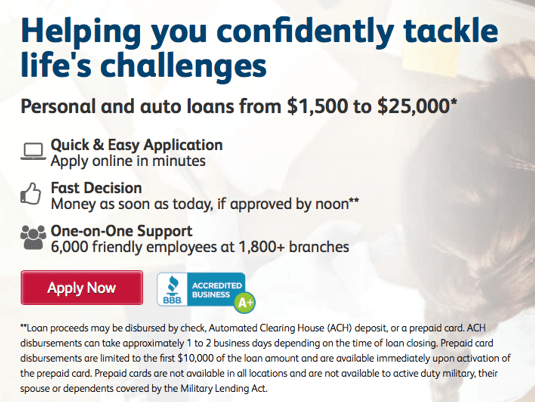

OneMain Reviews

If you prefer to do things the old-fashioned way with real people and a physical location, OneMain may be the right fit for your next installment loan.

Image Source: OneMain

Loan Terms

The installment loans available through OneMain allow you to a get an installment loan via the internet or through one of their branch locations. Branches are available across 44 states, making it easy to find one in an area near you. If the trip to the retail location is too prohibitive for you, you can always get installment loan choices from the comfort of your home and make use of branch locations on an as-needed basis.

The long-term installment loans available through OneMain come in amounts ranging from $1,500 to $25,000. You can get installment loan funds to be used for personal loans or auto loans, depending on your specific needs.

The interest rates possible through OneMain are not readily apparent. However, they do offer both secured and unsecured long-term installment loans to help all consumers. Individuals with poor credit may get a lower APR with secured long-term installment loans than they otherwise could.

Process

One of the major draws that makes OneMain one of the best installment loans is the ease of obtaining your money. Completing that application should take less than ten minutes. The whole process could be finished in just one day, depending on how quickly you return your documents.

By the next business day, you could sign your agreements and receive funds in your bank account.

Generally, you are able to pay off your installment loan with no prepayment penalties. You can make an additional payment on your set schedule (due in monthly intervals) or pay it off all in one lump sum.

Late payment fees are discussed on a case-by-case basis with their customer service representatives. Adjusting your due date is done under similar circumstances, with customer service attempting to provide flexible solutions in every scenario. OneMain provides a relatively easy process for individuals who don’t have many extenuating circumstances such as these.

Popular Article: Best Private Student Loan Providers – Best Place for Student Loans

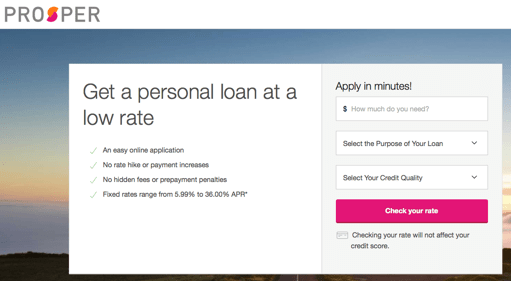

Prosper Reviews

Prosper installment loans online are ideal for individuals who want fixed-rate personal loans with low interest rates and clear fees.

Image Source: Prosper

Loan Terms

Prosper provides a great option for individuals who prefer long-term installment loans. You can choose from a loan term of either three or five years. This is a decrease in flexibility from companies like Avant or Lending Club, but it still provides one of the best installment loans for individuals who wanted to borrow for a longer term.

Loans can be used for babies or adoption, debt consolidation, home improvements, small businesses, vehicles, and more. The interest rates on these fixed-term installment loans range from 5.99% to 36.00% APR. Competitive rates such as these are a contributing factor to what allowed them to qualify as some of the best installment loans.

There are no small installment loans available through Prosper, either. In comparison to other companies that have minimums at just $1,000, Prosper offers long-term installment loans with higher values. Their funding will range from $2,000 per loan to $35,000 per loan.

Prosper also allows consumers the peace of mind of knowing there are no hidden fees or prepayment penalties.

Process

Prosper makes online installment loans available primarily to super-prime and prime customers. This means that most of their best installment loans will require a good to excellent credit score. As of January 2016, the average credit score for users who borrow through Lender is 703.

They require a few stringent criteria that all borrowers must meet in order to borrow:

- Minimum credit score of 640

- Debt to income ratio of 50% or less

- Income greater than $0

- Fewer than seven inquiries in the last six months

- Minimum of three open trades on credit report

- No bankruptcies in the last year

When your loan is fully funded, you’ll face an origination fee that is based on the loan amount. It is a percentage based on the amount of the funds. Your percentage will range from 1% to 5% depending on your loan.

Read More: LendingClub Reviews – Is Lending Club Safe for Borrowers? (Fees, Complaints, & Investor Reviews)

Free Wealth & Finance Software - Get Yours Now ►

Wells Fargo Reviews

This brick-and-mortar option from Wells Fargo for long-term installment loans gives you some of the highest loans available on the market today, especially when compared to the other online installment loans.

Loan Terms

This bank offers unsecured long-term installment loans with no required collateral in order to proceed. Wells Fargo offers unsecured long-term installment loans in amounts ranging from $3,000 to $100,000 depending on your banking relationship, creditworthiness, and other factors. For a secured installment loan with collateral, you can obtain loan amounts from $3,000 to $250,000.

These extreme upper limits leave the personal loan amounts from other lenders far behind. Individuals who need a large sum of money upfront will prefer the lending program available from Wells Fargo for this reason alone.

The length of the loan term is flexible as well, ranging from one to five years. This allows you to choose between short-term installment loans and long-term installment loans based on your needs.

Installment loans feature a fixed rate, fixed term length, and fixed monthly payments. Even better, your unsecured loan is processed without origination or early prepayment fees. Secured loans have a $75 origination fee.

Process

Applications for the Wells Fargo online installment loans are relatively simple to complete. In less than fifteen minutes, you can have a credit decision and know whether or not you qualify for their best installment loans. Many individuals even find themselves with same-day access to the funds they need.

For individuals who already bank with Wells Fargo, their best installment loans will feature relationship discounts for those who maintain a checking account without automatic payments. The APR on the installment loans online varies based on your creditworthiness but will remain at a competitive and fixed rate throughout the duration of the loan.

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Conclusion—Top 6 Best Installment Loans

Finding personal loans or online installment loans can help you to make the next right decision for your finances. You can finally make the purchase that has been in the back of your mind for the past few weeks, months, or years. Whether you need to make a home repair, to pay off medical bills, or to purchase a new car, these best installment loans can help.

You’ll need to decide exactly how much money you will need to borrow. This can often help you to begin narrowing down the playing field among the various online installment loans and long-term installment loans. From there, your credit score might assist you in determining where and how you’ll receive the best interest rates.

AdvisoryHQ understands how much information you have to process before you can make wise decisions regarding your long-term installment loans. Our detailed review and ranking is here to equip you with the pertinent information necessary to choose the best installment loans.

Which online installment loans will best suit your needs? Evaluate your current financial status to determine the best option for your lifestyle.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.