Funding your small business with loans and grants (female entrepreneurs)

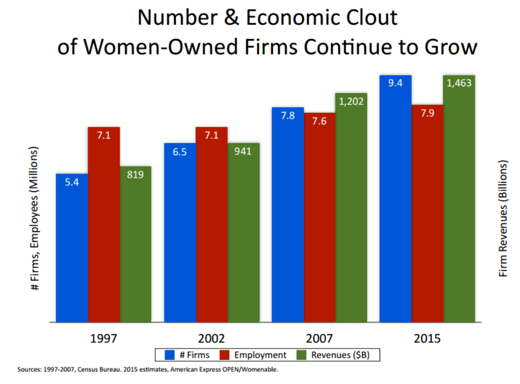

In 2015, there were approximately 9.4 million women-owned businesses in the U.S., with 887 new women-owned businesses opening daily. According to the “State of Women-Owned Businesses Report,” the number of companies started by female entrepreneurs will continue to grow into 2016 and 2017.

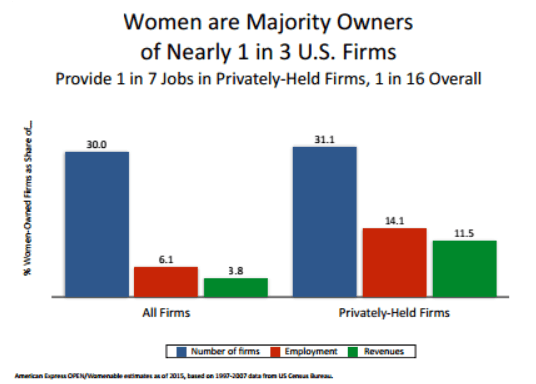

According to the report, “women are the majority owners of 33% of all U.S. companies.”

With women-owned businesses on the rise, there is an increased demand for funding, and competition is fierce.

Luckily, small business loans for women are widely available through the federal government, banks, and online lenders. There are also many business grants for women starting a business. These “women business grants” are available through government, non-profit, and private programs specifically aimed at awarding women-owned business grants.

See Also: How to Get VA Small Business Loans for Veterans

Overview: The Various Categories Presented in this Article

To help answer many of the “loans/grants for women business owners” questions that female entrepreneurs frequently ask, AdvisoryHQ has published this article to present an overview of the best small business loan programs for women and the top grants for women starting a business.

Click any of the categories below to be taken directly to that section.

- Best Small Business Loans for Women

- Small Business Grants for Women (Govt. & Private Grants)

- Combining Small Business Loans and Grants

Where Can You Find the Best Small Business Loans for Women?

The U.S. Small Business Administration (SBA) is a federal resource that provides a wealth of knowledge and financial assistance for women starting a small business. You will find that the SBA has an entire office dedicated to women-owned businesses called the Office of Women’s Business Ownership (OWBO).

The OBWO provides information on writing a business plan, licensing and permits, general support and advocacy, and information on small business loans for women.

The SBA has long been a resource for those looking to secure financial assistance in starting a small business, but today there is a variety of banks and online small-business lenders to choose from. Lenders will generally require established businesses to have good credit, a solid business plan, and, in many cases, a certain level of revenue and past success.

Start-up businesses are more difficult to fund, but having a high personal credit score and a solid business plan will give a female entrepreneur a competitive advantage.

Recently, female entrepreneurs have turned to crowd-sourcing sites like Kickstarter and online lenders specializing in seed money, like Prosper, to get their businesses up and running.

List of the Best Business Loan Programs for Women

Here is a list of the most popular online lending options for small business loans for women available today. This list is followed by an overview of these loan platforms:

- OnDeck

- Dealstruck

- Prosper

- Kabbage

- LendingClub

Brief Overview – Top Small Business Loan Platforms for Women

OnDeck: Using the OnDeck lending platform, women business owners can secure loans up to $500,000. However, to use OnDeck, your business should have been operational for at least a year and have a gross annual revenue of at least $100,000, while you need to have a personal credit score of at least 500.

Dealstruck: Businesses that have been in operation for at least one year, have a credit score of at least 600, and have a profitable monthly revenue of at least $12,500 are eligible for loans through Dealstruck. Borrowers can apply for loans up to $500,000 and can be approved online in a matter of minutes.

Prosper: Prosper is a peer-to-peer lender that connects individual investors with borrowers. Their claim is that they “cut out the middleman to connect people who need money with those who have money to invest…so everyone prospers.”

The advantage with this

marketplace model is that people looking to start a business can obtain a personal loan for business purposes. Those looking to qualify should have a credit score of at least 640.

Kabbage: Kabbage is a popular choice for borrowers with low credit scores as there is no minimum credit score required to be eligible. Businesses do have to have been in operation for at least a year with revenue of at least $60,000 annually.

LendingClub: To qualify for a loan through LendingClub, borrowers must have been in business for at least two years, have at least $75,000 in annual sales and, as with most lenders, have no recent bankruptcies or tax liens.

Popular Article: All You Need to Know About Disability Loans

Conclusion: Top Business Loan Platforms for Female Business Owners

The platforms reviewed above are some of the most popular platforms for getting a loan for your business.

Remember, it is important to research and apply for loans responsibly.

To make informed decisions, research prospective lenders on sites like Trustpilot. Trustpilot is an online review community people can use to avoid scams and untrustworthy businesses and lenders.

Small Business Grants for Women

Many prospective business owners seek funding from grants because, unlike loans, grants never have to be paid back.

Yes, you read that right, grants are gifts of money! However, it is important to understand how grants work before applying. Grants typically require more preparation, work, and research than the loan application process.

The first step in applying for a grant is researching to find what grants you are eligible for.

Luckily, there are many organizations committed to awarding grants for women to start a business. Once you have found a grant that gives to businesses like yours, you must begin collecting information to complete the strict guidelines put forth by the grantee.

As with loans, it is important to demonstrate to potential grantees that you are a low-risk investment.

Related: Best VA Loans | How to Find & Get Best Military Loans for Veterans

Government Grants for Small Businesses

The SBA is quick to alert readers to the fact that the federal government does not award grants for the purposes of starting or growing a small business. The federal government will offer grant opportunities to eligible non-profits, educational programs, and research organizations; however, even those vary from year to year.

Connecticut, for example, has the Small Business Express Program to provide grants and loans to small businesses. To find information about obtaining a grant from your state government, try researching your state’s business website.

Another place to look for grants is through your city’s government and local non-profits. Many large cities have small business or arts and culture grants that are available to women looking to fund their small business.

In Atlanta for example, the city’s Office of Cultural Affairs awards grants to artists and art organizations. In 2013, a non-profit in St. Louis offered startup businesses across the nation $50,000 to move their startup to the city. Check out your city government’s website and local non-profits to see what grant opportunities are available in your area.

Private Business Grants for Women

If you find that your business is ineligible for grants from your city or state, or if they do not have business grants for women available, you might consider seeking a private grant.

There are a number of grants for women in business available through private organizations. To get you started, we have collected a list of some of the most popular small business grants for women.

List of Popular Women Business Grants

- Cartier Women’s Initiative Awards

- EILEEN FISHER Women-Owned Business Grant Program

- Amber Grants for Women

- IdeaCafe’s Small Business Grant

- FedEx Small Business Grant Contest

Brief Overview

Cartier Women’s Initiative Awards: This grant is geared toward female entrepreneurs who are in the initial stages (operating for less than three years) of business development.

Applicants from any country, of any nationality, and in any industry are encouraged to submit an application. Winners receive a trophy, designed by Cartier of course, a year of business coaching, and $20,000.

EILEEN FISHER Women-Owned Business Grant Program: To be eligible for this grant the business must be over three years old, at least 51% women-owned and led, and committed to creating environmental and social change.

If your business meets these requirements, you might just be eligible for a minimum of $10,000 and three days of shared learning with the EILEEN FISHER community in New York City.

Amber Grants for Women: Unlike many grants that are awarded annually, the Amber Grant awards a $500 Qualifying Grant each month, then selects one of the 12 monthly winners to be awarded $1,000. This grant is open to any woman with a great business idea but does require a $7.00 application fee.

IdeaCafe’s Small Business Grant: This grant is available to both women and men but is open to anyone who has an idea for a business that provides a simple yet creative solution to an everyday problem. The business with the most innovative idea will receive a $1,000 grant.

FedEx Small Business Grant Contest: Again, this grant is for both women and men. First place winners will receive a $25,000 grant, second place winners receive $10,000, and eight runner-ups receive $5,000. Eligible businesses will have been operating for at least six months and have no more than 99 employees.

Don’t Miss: How to Qualify for a VA Loan

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Applying for a Business Grant for Women

While there are some grants for women-owned businesses that require little more than a compelling essay, the majority of grant applications are more complicated.

High dollar business grants for women almost always require a slew of supporting documents, bank statements, and a carefully crafted business plan. Though you will not be paying back the money you receive, grantees want to make sure they are giving their money to a successful venture, so providing a sound business plan is usually required.

Competition is tough. It is important that you read the grant application very carefully and provide all of the information asked for in the grant guidelines, lest you be passed up for someone who had all of their ducks in a row.

Preparing and completing a grant is time-consuming and meticulous, so it is important to stay organized and submit your grant before the deadline set by the grantee. Grants submitted late will almost never be considered.

Receiving a Business Grant for Women

If, after meticulously gathering information, preparing, and submitting a grant proposal, you are awarded a women-owned business grant–congratulations! But the work is not over yet!

Many women-owned business grants, once awarded, will require one or more reports updating the grantee on how you have used the money. If, for some reason, you are not able to use all of the awarded funds for the purpose proposed in your application, many grantees will require you to return the leftover funds._

Read More: How to Find & Get Loans with Poor, No Credit History

Combining Small Business Loans and Grants

Large grants are often competitive and difficult to secure, so it may not be wise to depend on grant money alone to fund your business venture. Combining grants and loans by choosing to both seek grant funding and apply for small business loans for women is the best way to fund your small business.

Today, there is no shortage of ways for women to fund their small business. With both public and private grants available from cities, states, corporations, and non-profits, women looking to own their own small business are eligible for a number of grant opportunities.

Thanks to resources like the SBA and the OWBO and the growing number of online lenders, borrowers have a huge selection when it comes to obtaining a small business loan. Just be sure to do your homework to make sure you select a lender that matches your needs and can help you reach your goals.

Image Sources:

- https://ctbythenumbers.news/ctnews/tag/women+owned+businesses

- http://static2.bigstockphoto.com/thumbs/3/0/1/small2/103058057.jpg

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.