RANKING & REVIEWS

TOP RANKING INVESTMENT APPS FOR BEGINNERS

Intro: Finding the Best Investing Apps for Beginners

A few decades ago, a first-time investor would have to find a broker and pay exorbitant fees each time they wanted to buy or sell their investments.

Today, investment apps have completely changed the financial world, making investing for beginners a skill that can be learned from the comfort of your very own home.

Of course, not all money investment apps are created equal—and if you don’t have experience investing, you’ll want to make sure you have access to an investment app for beginners.

Everyone deserves a fair shot at letting their finances grow, despite their level of investing experience. Thankfully, there are plenty of top-rated investment apps that feel the same way.

The best investment apps for beginners will have easy-to-use interfaces, flexible terms, affordable account minimums, and more.

Some of the top investing apps for beginners on our list even do away with complicated financial jargon, making investing for beginners much easier to latch onto.

If you’re curious about investing but aren’t sure where to start, our list of the best investing apps for beginners is a great place to explore top-rated investment apps to consider using this year.

Award Emblem: Top 5 Best Investment Apps for Beginners

AdvisoryHQ’s List of the Top 5 Best Investment Apps for Beginners

List is sorted alphabetically (click any of the app names below to go directly to the detailed review section for that investing app for beginners):

Top 5 Best Investment Apps for Beginners | Brief Comparison & Ranking

Investment Apps for Beginners | Price | Minimum Investment | Best For |

| Acorns | -$1 per month for accounts under $5,000 -0.25% for $5,000 or more | -$5 | College students and young investors |

| Betterment | -Digital: 0.25% -Premium: 040% | -No minimum -$100,000 minimum | Users that want access to tax-advantaged retirement accounts |

| Personal Capital | -Financial tools: $0 -Investment management: 0.49%-0.89% | -$0 -$100,000 | High net worth or investors with existing accounts |

| Stash | -$1 per month for accounts under $5,000 -0.25% for $5,000 or more | -$5 | Users that want a creative, unique approach to choosing investments |

| Wealthfront | -$0 for first $10,000 -0.25% for over $10,000 | -$0 | Investors that want comprehensive college planning tools |

Table: Top 5 Best Apps for Investing | Above list is sorted alphabetically

Why Choose Investing Apps for Beginners?

Investing for beginners can be tricky. Although there are plenty of investment apps to choose from, the sheer volume of choices can quickly become overwhelming if you don’t know what you are looking for.

Investment apps offer the benefit of on-the-go access, monitoring, and support. Thus, money investment apps are often considered the most convenient investing platform.

As a new investor, however, it’s important to look for money investment apps that take lack of experience into consideration. Not only should investment apps make investment accounts accessible, but they should also make the process uncomplicated.

Depending on your financial needs, your personal best investing app for beginners may look much different than your neighbor’s.

Investing for Beginners

For that reason, we have included a range of best apps for investing with varying fee structures, minimum investment amounts, and product offerings.

As you look through the best investing apps for beginners, consider both your current finances and your goals for the future. You’ll also want to think about how much involvement you want to have while using investment apps.

Some of these money investment apps are robo-advisors, meaning that your investments are automatically managed by the investment apps themselves.

Conversely, some of these best investment apps for beginners provide a mix of robo-advisement—and a few are not robo-advisors at all. For some users, the overall efficiency of investing for beginners may depend on whether the money investment app or the investor has more control.

No matter what your financial needs and goals, the best apps for investing put financial stability and growth within arm’s reach—even investing for beginners.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Investment Apps for Beginners

Below, please find a detailed review of each app on our list of best investment apps for beginners. We have highlighted some of the factors that allowed these investing apps for beginners to score so high in our selection ranking.

See Also: How to Find the Best Finance Apps For iPhones | Tips to Finding the Best Budget Apps For iPhone

Acorns Review

Acorns is one of the most popular investing apps for beginners because it operates on a very simple premise: your spare change from everyday purchases is rounded to the next dollar and then applied towards Exchange-Traded Funds (ETFs).

While micro-investing may not yield immediate results, it certainly creates affordable and accessible investment apps. Additionally, Acorns is a robo-advisor, meaning that your investments will be automatically rebalanced as the market fluctuates.

This means that you’ll get the most out of your money investment app without constantly monitoring the market, making investing for beginners a largely hands-off process.

Best Investing Apps for Beginners – Acorns

Ultimately, investing for beginners with Acorns is simple—the money investment app requires little maintenance, and the fee structure makes it one of the best investment apps for beginners on a budget.

Free investment apps are available on iTunes and Google Play, and both versions consistently receive positive reviews from users.

Additional Considerations

- College students get four years free

- Found Money® program rewards users for shopping with certain brands

- Can access via app or desktop

- No options for retirement savings accounts

- Cannot invest in individual stocks or bonds

Don’t Miss: iBank Review – What Is iBank? (Banktivity & iBank 5 Review)

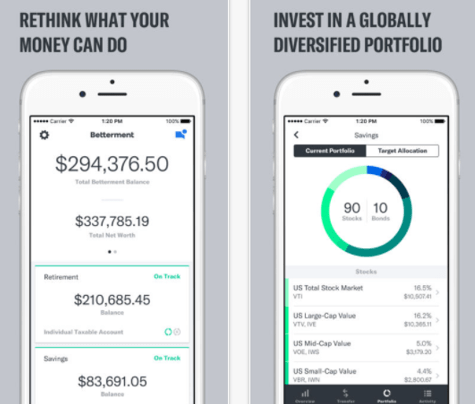

Betterment Review

Betterment is a great investing app for beginners that want to focus on a long-term investing approach using a mix of stocks and bonds held in ETFs.

In fact, through lowering fees, lowering taxes, diversifying portfolios, and encouraging best investment practices, Betterment claims to help investors earn up to 2.66 percent more on average.

Client portfolios are optimized for tax returns through Tax Loss Harvesting+, where securities are automatically sold to offset taxes.

With automatic rebalancing and reinvestment, Betterment is a great option for effective, tax-advantaged, and hands-off investing for beginners.

Best Investment Apps for Beginners – Betterment

For those that still want the personalized attention of a financial advisor, this is one of the best investment apps for beginners to consider.

The Digital plan includes personalized financial advice and unlimited access to financial experts, making Betterment one of the best apps for investing across the board.

As one of the top investment apps for beginners, the Betterment app comes highly recommended by users on both iTunes and Google Play.

Additional Considerations

- Can access via app or desktop

- Access to retirement tools and accounts

- Create and manage trusts online

- No additional fees for deposits or withdrawals

- Deposits must be at least $10

- Educational resources available to make investing for beginners easier

Related: LearnVest Reviews – What Is LearnVest & Is LearnVest Safe? (Worth It? Free? & Secure?)

Personal Capital Review

With $5 billion in AUM and over 1.4 million users, Personal Capital is one of the top-rated investment apps available on the market today.

Their free financial tools make Personal Capital one of the best investment apps for beginners to consider, including:

- Net Worth—View a complete financial picture

- Fee Analyzer—See how investment fees are impacting your retirement funds

- Investment Checkup—View investment performance

- Retirement Planner—Realistic and effective retirement calculator

Although investment services through this money investment app do require a significantly higher minimum balance, it’s worth noting that Personal Capital offers a ton of value.

Their strategy applies award-winning technology and modern theories to each investment plan, creating highly customized portfolios to match unique financial goals.

Additionally, personal advisors offer a healthy mix of individual attention and robo-advisement, making Personal Capital one of the best investment apps for beginners that want professional guidance and sophisticated technology.

As one of the best investment apps for beginners, Personal Capital is available for free on iTunes and Google Play.

Additional Considerations

- Advisors available by phone, email, chat, or web conference

- Free financial tools provide the best investing for beginners to monitor and analyze previously-established investments

- High minimum investment requirement may be difficult to meet for some new investors

- Budgeting and spending analysis through the Dashboard

- Free insurance guide for complete financial wellness

Popular Article: Level Money Review – Is Level Money Safe? (Level Money App Review)

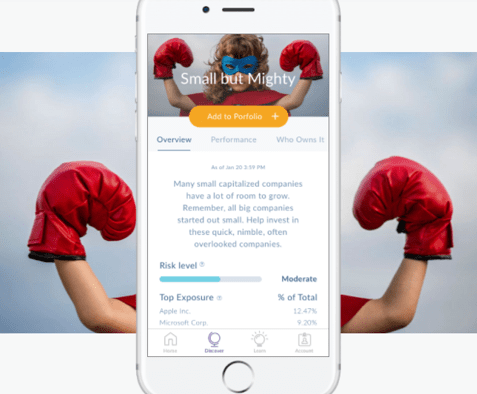

Stash Review

Founded in 2015 and backed by over $78 million in funding, Stash offers investing products and advice to an often-overlooked market—smaller, individual investors.

This top investment app for beginners provides access to over 30 Exchange-Traded Funds (ETFs) through unique, value-based investing for beginners.

This unique categorization makes one of the best investment apps for beginners—rather than complicated financial jargon, all ETFs have nicknames for their respective industry focus.

A few examples include:

- American Innovators

- Blue Chips

- Clean & Green

- Defending America

- Global Citizen

- Water the World

Although Stash is one of the top investment apps for beginners, potential users should know that this money investment app is not considered a robo-advisor.

Instead of automatically assigning investing for beginners’ options, Stash will provide recommendations and advice, which users must choose to either follow or disregard.

Additionally, this investment app for beginners is only available through iTunes or Google Play—Stash does not currently provide desktop access for their investment apps.

Money Investment Apps – Stash

Additional Considerations

- Elimination of complicated jargon is ideal for investing for beginners

- Customized portfolios based on personas like The Activist and The Trendsetter

- $1 monthly fee (first month is free)

- Use Stash Retire to invest in retirement accounts

- Cannot invest in individual stocks or bonds

Read More: Mint vs. Quicken – Rankings & Review

Wealthfront Review

Wealthfront has long been considered one of the best investment apps for beginners and one of the best apps for investing overall.

Not only does this investing app for beginners manage the first $10,000 for free, but investors can use the money investing app to access a wide range of tools and products.

Their portfolio strategy encompasses a collection of features called PassivePlus®, which includes tax-loss harvesting, direct indexing, and advanced indexing to promote tax-advantaged investments.

As a top robo-advisor, Wealthfront is one of the top investment apps for beginners that don’t have the time—or desire—to monitor their investments on their own.

With a focus on helping users reach specific financial goals, this investing for beginners app is uniquely positioned to help users plan for retirement, set aside college savings, and accrue interest through the following offerings:

- Traditional IRA, Roth IRA, SEP IRA, 401(k) Rollover

- 529 College Savings

- Individual, Joint, Trust accounts

As one of the best investment apps for beginners, Wealthfront comes highly rated on iTunes and Google Play.

Additional Considerations

- College planning with Path builds unique college savings plans

- Best for tax-advantaged, long-term investing

- Accessible on mobile and desktop

- Automated investing software backed by PhDs

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Choosing the Best Investing for Beginners App

Investing for beginners can be a challenging and complicated process. It isn’t easy getting used to financial jargon, and it takes time to understand each individual investment product.

Luckily, many of the best investment apps for beginners are uniquely positioned to make investing for beginners into a seamless, worry-free process.

With so many top investment apps to choose from, investing for beginners is no longer dominated by expensive, time-consuming meetings with a financial advisor.

When choosing between one of the top investing apps for beginners, make sure to consider your personal financial goals, asking questions like:

- Do I want access to tax-advantaged retirement accounts?

- Does my financial plan include college savings?

- Do I need both desktop and mobile access?

- How much can I afford to invest each month through investment apps?

By examining your current personal finances and future financial goals, you will be well on your way to finding the best investment apps for beginners that match your unique needs.

Image sources:

- https://www.pexels.com/photo/woman-wearing-white-v-neck-shirt-using-space-gray-iphone-6-225232/

- https://www.acorns.com/

- https://itunes.apple.com/us/app/betterment-online-financial-advisor/id393156562?mt=8

- https://www.stashinvest.com/

- https://www.wealthfront.com/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.