2017 RANKING & REVIEWS

TOP 10 LIFE INSURANCE COMPANIES

The Importance of Finding the Best Life Insurance

Why is life insurance valuable? What is the importance of finding the best life insurance for the average individual or family?

The concept of finding the best life insurance and comparing life insurance policies and top life insurance companies isn’t necessarily something everyone wants to think about, but it’s an essential component of a strong financial plan and strategy.

Having a life insurance policy will not only provide protection to your family in the event of your death, but it can also give you and your entire family peace of mind throughout your life.

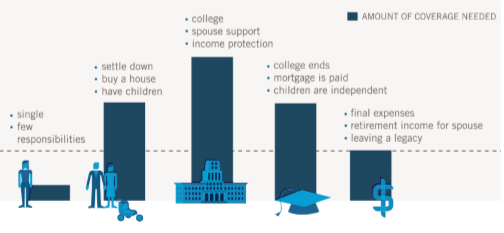

Life insurance policies can be used not only to pay for the costs associated with final expenses, but life insurance plans can also be used to create a form of inheritance for your spouse and children.

Award Emblem: Top 10 Best Life Insurance Companies

If you have a life insurance policy it can be used as a way to pay off any debt you have so that your spouse or estate isn’t responsible, and it can be utilized to replace your income if you were an earner in your family. A life insurance policy can also be used to help your family pay for necessary expenses, such as a mortgage or education costs.

Another use for a life insurance policy is to make a contribution to charity after your death, or to cover the cost of potential estate taxes your loved ones may have to pay.

With all of the advantages of a life insurance policy, it’s important for consumers to not only have a life insurance policy but also make sure their policy is with one of the top-rated insurance companies.

The following ranking covers the best life insurance options, as well as the specifics of the top 10 life insurance companies.

See Also: Top Military Credit Cards | Ranking | Best Credit Cards for Military (Active & Veterans)

AdvisoryHQ’s List of the Top 10 Best Life Insurance Companies

List is sorted alphabetically (click any of the life insurance company names below to go directly to the detailed review section for that life insurance company):

- AIG

- Guardian Life

- Haven Life

- John Hancock

- MassMutual

- Nationwide

- New York Life

- Northwestern Mutual

- Prudential

- Voya Financial

Top 10 Best Life Insurance Companies | Brief Comparison

Top 10 Life Insurance Companies | Unique Feature | Life Insurance Products |

| AIG | Features innovative policy options such as options available while a policyholder is still alive | Range of policy options including Quality of Life Insurance |

| Guardian Life | Offer exclusive tools like The Living Balance Sheet | Whole, universal, and term life |

| Haven Life | InstantTerm is a process that lets qualified and healthy applicants purchase a policy online without a medical exam | Only offers term life insurance |

| John Hancock | Well-established since 1862 | Term and permanent life (includes universal, indexed, and variable) |

| MassMutual | Policyholders are also dividend-earning shareholders | A variety of life insurance options including universal, term life and variable universal life |

| Nationwide | Company offers variable insurance that includes professionally managed investments | Term, whole, universal variable |

| New York Life | Affordable and flexible term life options | Term life, whole life, long-term care, annuities, mutual funds |

| Northwestern Mutual | Pays industry-leading annual dividends | Permanent life insurance, term life, accelerated care benefit solutions |

| Prudential | Flexible and customizable term life options | Term, universal and indexed universal life, survivorship universal life, variable universal life |

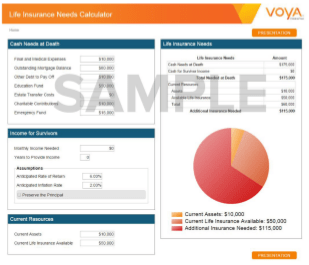

| Voya Financial | Signature tools available like the Life Insurance Needs Calculator | Universal and indexed universal life insurance, variable universal, survivorship life insurance |

Detailed Overview Comparing the Top Rated Life Insurance Companies

Considering the fact that most people don’t necessarily want to think about life insurance companies or comparing life insurance policies, it can be difficult to get into the details of what makes a good life insurance policy, but it’s important to know.

Image Source: Pixabay

A few things to consider when you’re comparing the top life insurance companies and searching for the best life insurance include the below points:

To find the best life insurance companies, you need to ensure that you’re considering their financial stability.

If you have a great life insurance policy but the life insurance company that’s providing it isn’t financially sound or isn’t well-rated from an industry organization such as A.M. Best, then there may be doubt as to whether or not that policy will be paid to your beneficiaries after your death.

Another thing that a lot of consumers look for when they’re comparing the top life insurance companies is a concept called guaranteed renewability. What this means is that once you get a life insurance policy, you can renew that policy beyond the initial term limit without the need for another medical exam.

This means that if you were to become sick and your term limit was about to expire, you would still be eligible for coverage, which can be extremely important. With that being said, even if you were to find a life insurance policy with guaranteed renewability, this doesn’t mean your premiums won’t increase over time.

When you’re searching for top-rated life insurance companies and the best life insurance plans, you might also want to have plenty of options to customize your policy. Some of the customization options offered by many of the best life insurance companies include different term lengths, a Guaranteed Level Premium (which means the cost of your policy won’t rise), and no conversion restrictions.

Also important to think about as you look for the best life insurance and create a list of life insurance companies is whether or not the company you’re considering offers disability protection, which would protect you if you became unable to pay your premiums for a period of time without eliminating your insurance.

Also relevant to many consumers is an Accelerated Death Benefit Rider. This feature lets policyholders’ death benefits cover end-of-life-costs, such as expensive treatments or hospice care.

Don’t Miss: Citi® Double Cash Card vs. BankAmericard Cash Rewards™ vs. Spark Cash Select vs. Blue Cash Everyday® Card

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top 10 Best Life Insurance Companies

Below, please find the detailed review of each of the best life insurance companies on our list of the top 10 life insurance companies. We have highlighted some of the factors that allowed these top-rated life insurance companies to score so well in our selection ranking.

AIG Review

One of the top-rated life insurance companies, AIG is ranked as one of the top 10 commercial insurance carriers, and this company is also the world’s largest nonlife insurer by market capitalization, although of course, they do offer life insurance products in addition to their commercial insurance products.

AIG is also one of the world’s top personal insurance companies and holds the distinction of being the insurance provider of nearly half of the Forbes 400 Richest Americans.

AIG strives to be an innovator in the insurance industry, and they serve more than 90 million clients in 100 countries around the world. Some of their key priorities include transparency, better value, and increased efficiency.

Key Factors That Led to Our Ranking of This as One of the Best Life Insurance Companies

Details of AIG and why it’s included in this ranking of the top 10 life insurance companies are detailed below.

Fast Quotes

In today’s fast-paced world, convenience and accessibility are incredibly important in everything we do, and that includes how we select the best life insurance and compare life insurance rates and life insurance plans.

AIG understands this, and they offer the opportunity for consumers to visit their website, fill out a brief snippet of information, and receive a free quote for life insurance plans within about two minutes.

These free, no obligation quotes are personalized, and it’s easy to complete and submit the necessary information. Consumers can also call a direct quote hotline to see which life insurance plans they may be eligible for and may be able to afford.

Broad Product Options

Many consumers make the mistake of thinking all life insurance policies and life insurance plans are the same, but this isn’t the case. There is a range of product options designed to suit different needs and requirements, and AIG offers an incredibly wide range of life insurance policy options.

Some of the life insurance plans available from AIG, one of the top 10 life insurance companies, include:

- Term life insurance that can be customized to fit consumers’ needs and budget as well as their timeline.

- Quality of life insurance is a unique product that can help families who want to ensure they can protect their current quality of life and also plan for the future.

- Universal life insurance from AIG offers flexibility and affordability, as well as lifelong coverage.

- Guaranteed Issue Whole Life policies from AIG are designed to be simple and straightforward as well as affordable. This type of life insurance policy from AIG requires no medical exam or health questions and provides coverage for things like credit card debt or medical bills.

- Variable Universal Life Insurance provides permanent coverage and the ability to accumulate cash value.

- Accident and health insurance is coverage related to accidental deaths, and it’s a good complement to health insurance coverage that has a high deductible. It also requires no medical exam.

Guardian Life Review

Guardian Life is a company that’s more than 150 years old, is owned by policyholders and has paid yearly dividends every year since 1868.

Through its long history, Guardian Life has gone through many economic cycles and challenging situations and has continued to grow and thrive. At Guardian Life, the interest of clients and policyholders is the central concern even over market demands.

Guardian Life also emphasizes their balanced approach to financials, which allows them to maintain a strong capital base. It’s that strength that ensures they are strong in other areas as well as able to meet their commitments to policyholders. Guardian ended 2015 with $7.3 billion in capital and $82.0 billion in assets under management.

Key Factors That Led to Our Ranking of This as One of the Top 10 Life Insurance Companies

Guardian is part of this ranking of the top 10 life insurance companies and a provider of the best life insurance products for reasons including the ones below.

Universal Life Insurance

Guardian offers a full range of life insurance products, but one of their most appealing that’s worth focusing on are their Universal Life insurance plans. Universal Life insurance from Guardian is flexible and lets the policyholder decide what’s important to them.

It also accumulates cash value, and there are options to vary payments depending on your current requirements and situation while having the potential to grow the cash value of your policy. This is a great life insurance policy for someone who wants the flexibility to alter their policy as they go through changes in their lives.

Benefits of Universal Life insurance plans from Guardian include lifetime protection, the ability to save money through accumulation, and options to change your premium payment amount.

Tools and Resources

Guardian is unique among most life insurance companies and providers of life insurance policies. The reason is because, as part of their goal to put the needs of clients first, they offer a wide variety of educational and informational resources. As one of the top life insurance companies, Guardian also features exclusive tools such as their Living Balance Sheet Platform.

Available only from Guardian, The Living Balance Sheet is meant to simplify financial management and future planning.

Policyholders can use this platform to see all of their accounts and assets in one location, and they simulate scenarios to see the impact they could have on their financial life. This is just one tool available from Guardian that’s designed to help clients have a better financial future.

Related: Top Credit Unions Credit Cards | Ranking | Best CU Secured & Unsecured Credit Card Offers

Haven Life Review

Haven Life is a modern, digital and technologically-driven life insurance company. The company was started by co-founder Yaron Ben-Zvi after he decided to purchase life insurance.

He felt the experience wasn’t satisfying, and he wanted the opportunity to quickly and easily buy a life insurance policy online, rather than waiting weeks for a decision. Haven Life Insurance is his relatively new company, having been launched in 2015.

The ultimate goal of this pick for one of the best life insurance companies is to offer simplicity and affordability. Haven Life also partnered with MassMutual, which is another name on this list of the top 10 life insurance companies, to power their future as a leading startup in the life insurance industry.

Key Factors That Led to Our Ranking of This as One of the Top-Rated Life Insurance Companies

Key reasons Haven Life is included in this ranking of the top 10 life insurance companies are highlighted below.

Efficiency

As mentioned, a key goal at Haven Life is to offer consumers the opportunity to use technology to find and buy a life insurance policy quickly and easily. Rather than being complicated and time-consuming, the process at Haven Life is all online, and the decision is immediate.

The online application process is straightforward, no medical exam is required for qualified, healthy applicants, and the policy is commission-free and presented in direct, plain language.

Haven is also included on this list of the top-rated life insurance companies because of their commitment to transparency, and how easy they make it to compare policies and prices.

Need Calculator

Something that’s unique about Haven Life, one of the top 10 life insurance companies on this ranking, is the fact that they offer a Life Insurance Calculator. This is derived from the fact that not everyone’s life insurance needs are the same, and it’s important to find not only life insurance rates that work for your budget but also life insurance policies that meet your needs and the needs of your family.

This is something Haven Life takes seriously, and they offer an exclusive Life Insurance Calculator that’s free to use and lets consumers understand and determine their needs.

The Life Insurance Calculator available from this top life insurance company includes questions on date of birth, annual income, family structure, existing debt and more. It’s a valuable, user-friendly tool that’s great for anyone searching for the best life insurance.

John Hancock Review

John Hancock is not only one of the leading life insurance companies, but also a provider of retirement plans, college savings tools and services, and investment products. John Hancock started in 1862, and the core focus of business in the U.S. is on providing financial solutions tailored to the needs of clients at every stage of their life. Products are primarily distributed through licensed financial advisors, and also through Signator Investors, Inc., which is a network of independent firms in the U.S.

One of the many benefits of obtaining a life insurance policy through John Hancock is the long history and the established reputation of the company. This life insurance company has often been cited by media organizations like The New York Times as being one of the most powerful brands in the world.

Key Factors That Led to Our Ranking of This as One of the Top 10 Life Insurance Companies

Key reasons John Hancock is listed as one of the top-rated insurance companies on this list of life insurance companies are highlighted below.

John Hancock Vitality Program

As a leader among the best life insurance companies, John Hancock often has innovative and exclusive products and services available to policyholders.

One such program is called John Hancock Vitality. The goal of this life insurance program is to provide reliable protection, lower premiums, and personalized health goals. As part of this program, clients of this top life insurance company can also get health tips, a free Fitbit to track their progress, and even discounts for entertaining, shopping, and travel.

The healthier the lifestyle of policyholders, the more money they can save and the more rewards they earn.

Types of Life Insurance

As one of the top-rated life insurance companies on this list of life insurance companies, when a client opts to obtain a life insurance policy with John Hancock, they have ample options.

For example, John Hancock offers both term life insurance and permanent life insurance. Within the category of permanent life insurance, there are more specific options. These include Universal Life Insurance, Indexed Universal Life Insurance, and Variable Universal Life Insurance.

Each of the product categories from this leader among life insurance companies features a survivorship product that goes along with it. This is designed to cover the policyholder and one other person, which helps the policyholders save money compared to buying two separate life insurance policies.

Clients of John Hancock can also opt to add a long-term care rider to a permanent life insurance policy.

MassMutual Review

MassMutual is one of the most recognized financial brands in the U.S., with more than 160 years of experience helping customers, even during challenging economic situations and environments. This mutual company is owned by policyholders, which is how they always operate: with client interests at the forefront of everything. Since the 1860s, Mass Mutual has not only been providing excellent insurance products to clients; it has also been paying dividends to policyholders.

In fact, Roger Crandall, the Chairman, President, and CEO of MassMutual recently announced an approved estimated $1.6 billion dividend payout for policy owners. Along with being owned by policyholders, MassMutual is a well-established and reliable life insurance company on this list of the top life insurance companies.

Key Factors That Led to Our Ranking of This as One of the Best Life Insurance Companies

Listed below are some of the key advantages of MassMutual leading to its ranking on this list of the top 10 life insurance companies and the best-rated life insurance companies.

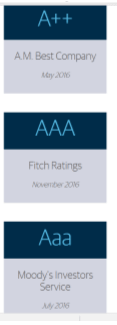

Financial Strength Ratings

As was mentioned at the start of this ranking and review of the top 10 life insurance companies and the best life insurance options, financial strength is an extremely important consideration. As one of the most established and long-standing life insurance companies in the world, MassMutual excels in this area.

Financial strength ratings show how well equipped a life insurance company is to meet financial obligations, including life insurance payouts. MassMutual has among the highest financial strength ratings in the industry, including the following:

- A++ (Superior) from A.M. Best Company

- AA+ (Very Strong) from Fitch Ratings

- Aa2 (Excellent) from Moody’s Investors Service

- AA+ (Very Strong) from Standard & Poor’s

Types of Life Insurance

Along with advantages such as a robust self-service online customer portal that makes buying and managing a life insurance policy easy, as well as comprehensive educational and information resources, MassMutual is also one of the top-rated life insurance companies because they offer many different types of insurance.

The types of life insurance policies and life insurance plans available from MassMutual include:

- Whole Life Insurance: Designed to be a flexible way to achieve your financial goals and protect your family in the future.

- Guaranteed Acceptance Life Insurance: This type of life insurance policy is to cover final expense costs.

- Term Life Insurance: The primary objective of this is to offer affordability.

- Universal Life Insurance: Features of Universal Life Insurance from MassMutual, one of the best life insurance providers, includes flexible premiums and optional guarantees.

- Variable Universal Life: This features a variety of investment options.

Popular Article: Top Best Prepaid Credit Cards | Ranking | Prepaid Credit Cards That Build Credit

Nationwide Review

Along with being one of the top life insurance companies, Nationwide also provides a wide variety of other insurance and financial products as well as retirement and investment products and services. Nationwide began more than 85 years ago as an auto insurer, and since that time it has grown to become one of the largest insurance and financial services companies in the world.

Nationwide is owned by Policyholders and is a Fortune 100 company today. Some of the companies that are also affiliated with Nationwide include Nationwide Bank, Riverview International Group, Registered Investment Advisors Services, Inc., and Nationwide Life and Annuity Insurance Company.

Key Factors That Led to Our Ranking of This as One of the Top 10 Life Insurance Companies

When looking for the best life insurance, the following are some ways Nationwide excels and is one of the top-rated life insurance companies.

Customizable Insurance Options

The best life insurance and the best life insurance companies are going to include options for customization. Nationwide puts a lot of focus on encouraging consumers to do research and figure out how much life insurance they really need.

The goal is to help clients ensure they’re neither paying too much nor lacking coverage to protect their family.

Nationwide offers information and methods to help people determine how much insurance they need based on either the lump sum need, which calculates the amount required to pay things such as outstanding debts, funeral expenses, taxes, and educational costs, or based on the income replacement method.

Nationwide also offers tools such as the Life Insurance Coverage Calculator to help people find the best life insurance for their needs and their budget.

Image Source: Nationwide

Variable Life Insurance

One of the products available from Nationwide, one of the best life insurance companies on this list of life insurance companies, is Variable Universal Life Insurance.

Variable universal life insurance is life insurance paired with the features of an investment product so that policyholders gain the advantage of having access to professional investment management that helps them not just protect their family but also accumulate money.

These life insurance policies can be used for things such as supplemental retirement planning, business planning options, long-term care, and education expenses.

The specific Nationwide variable universal life insurance policies available include Nationwide YourLife Protection, Nationwide YourLife Accumulation, and Nationwide YourLife Survivorship.

New York Life Review

New York Life is the largest mutual life insurance company in the U.S., and they provide investment and retirement solutions along with insurance, including some of the best life insurance options. New York Life has a long history of more than 170 years, and they are a Fortune 100 company.

Some of the best life insurance product options available from New York Life include Whole Life insurance policies that provide guaranteed protection and growing cash value, simple and affordable Term Life insurance, and annuities that can be set up for retirement to ensure a steady income stream.

Key Factors That Led to Our Ranking of This as One of the Top 10 Life Insurance Companies

Specifics of why New York Life is included on this list of the top-rated life insurance companies are cited below.

Financial Strength and Stability

As with many other companies named on this ranking of the top 10 life insurance companies, New York Life excels in terms of financial strength and stability. New York Life has a cash reserve of $22.7 billion, which leads the industry and means this life insurance company would be able to meet commitments to clients and beneficiaries.

New York Life is owned by policyholders, and this life insurance company has paid dividends since before the Great Depression — and has continued to do so every year since then.

Finally, New York Life has the highest ratings for financial strength awarded to any insurer from all four of the major credit rating agencies.

Affordable and Flexible Term Life Insurance

As one of the most reputable life insurance companies and a provider of excellent and varied life insurance plans, Nationwide offers plenty of options to clients. One of the most popular is their Term Life Insurance, which is an inexpensive way to lock in the lowest available rates for a set period of time ranging from 10 to 20 years.

What’s unique about Term Life Insurance from Nationwide is the fact that holders of these life insurance policies can add more coverage or upgrade to a permanent policy later on.

There are also add-ons, including riders that are designed to help policyholders meet both their short and long-term objectives. Term Life Insurance from Nationwide, one of the best-rated life insurance companies, is used to replace income, tax-free, in the event of the policyholder’s death.

Read More: Top Credit Cards for Good & Average Credit | Ranking & Reviews

Northwestern Mutual Review

With a motto of helping clients live life differently, Northwestern Mutual is one of the nation’s top providers of some of the best life insurance. This pick for one of the top life insurance companies has more than 4.3 million customers and paid $3.9 billion in insurance claims in 2015. As with most of the names on this ranking of the best life insurance companies and the best-rated life insurance companies, Northwestern Mutual pays dividends, which are estimated to be in the billions for 2016.

This leader among life insurance companies has been part of the financial industry for almost 160 years, and they have some of the highest financial strength ratings, which will be detailed more below.

Key Factors That Led to Our Ranking of This as One of the Top 10 Life Insurance Companies

Detailed reasons as to why Northwestern Mutual is included on this list of the top-rated life insurance companies offering the best life insurance products are below.

Financial Ratings

There are several third-party organizations that determine the financial strength and stability of life insurance companies, and the best life insurance companies are well-rated by these organizations. This holds true for Northwestern Mutual.

Some of their ratings include the following:

- A.M. Best gave Northwestern Mutual an A++ in May 2016, which is a superior rating based on their level of risk-adjusted capitalization, strong liquidity, and position as a leader in the market of whole life insurance.

- Fitch Ratings gave Northwestern Mutual an AAA at the end of 2016 based on their distribution system, their large and stable block of life insurance, and their competitive expense advantage.

- Moody’s gave this leader among the best life insurance companies an AAA based on its leading positions and focus on participating whole life insurance, as well as strong underwriting skills.

- S&P Global Ratings gave this life insurance company an AA+ for strong capital and liquidity.

Image Source: Northwestern Mutual

Dividends

Along with having some of the industry’s top financial strength and stability ratings, Northwestern Mutual is also one of the best-rated life insurance companies on this list of the top 10 life insurance companies because they consistently pay policyholders yearly dividends.

As with many of the names on this list of the top 10 life insurance companies, Northwestern Mutual is owned by policyholders, who are also shareholders.

While earning annual dividends isn’t guaranteed, the company has paid one every year since 1872. Northwestern Mutual leads the industry in terms of consistent yearly dividend payments. That money can then be used by policyholders to increase the value of their policy or pay premiums. Dividends can also be taken as cash.

Related: Top Starter, First, Beginner Credit Cards for Beginners | Ranking | Good First Credit Cards

Prudential Review

Prudential has been operating for more than 140 years and has a presence as a leading insurance and financial services provider not only in the U.S. but also internationally. As well as offering some of the best life insurance and competitive life insurance rates, Nationwide also offers retirement services, mutual funds, annuities and investment management.

Nationwide describes their mission as helping customers achieve peace of mind and financial prosperity, and core values include trustworthiness, a focus on customer needs, and winning with integrity.

Key Factors That Led to Our Ranking of This as One of the Top 10 Life Insurance Companies

Benefits of obtaining life insurance policies from Nationwide are highlighted in the following list.

Customizable Policy Options

Nationwide is one of the top-rated life insurance companies, and they put a lot of emphasis on helping consumers compare and contrast various life insurance rates and life insurance plans.

They also put a lot of focus on providing options so that clients can customize their life insurance plans to their particular needs, or they can change their life insurance policy later on if their life changes or they go through transitions.

For example, Nationwide offers clients the opportunity to buy a policy now, and then a supplemental policy later, or start with a term life insurance policy and later convert it to a permanent life insurance policy.

There are also optional features called riders which can be used to broaden the coverage of a policy even more.

Image Source: Prudential

Awards and Recognition

Prudential, like so many of the names on this list of the top 10 life insurance companies, has a long history and has been consistently recognized as an industry leader over the years.

For example, Fortune magazine ranked Prudential Financial as number one on their 2016 World’s Most Admired Companies ranking for the insurance category.

Prudential has also received the following recognitions recently:

- DiversityInc. Named it a Top 50 Company for Diversity

- Military Times named it a Best Vets Employer

- National Association for Female Executives named Prudential as one of the Top 50 Companies for Executive Women

- Prudential was named as a Forbes Best Brand in the life insurance category for Prudential of Korea

Additionally, Prudential has excellent financial strength ratings. A.M. Best gives The Prudential Insurance Company of America an A+, and Moody’s gives it an A1 rating.

Don’t Miss: Top Credit Cards to Build Credit | Ranking & Reviews | Credit Cards for Building Credit

Voya Financial Review

An American-based financial services and life insurance company, Voya Financial offers retirement solutions as well. Regarding life insurance, the goal of the products available from Voya, a selection for one of the best life insurance companies, is to provide the ability to help both individual Americans, as well as Americans through their workplace.

Insurance products with Voya can help policyholders accumulate, protect, and distribute their assets, and Voya works with distribution partners, which can help policyholders see better returns and more readiness for their retirement years. The specifics of their life insurance policies and plans will be detailed a bit more below. Regarding employee benefits, they feature stop loss, group life, voluntary benefits, and group disability.

Key Factors That Led to Our Ranking of This as One of the Top 10 Life Insurance Companies

Advantages of obtaining life insurance policies from Voya are detailed below, as are reasons they’re ranked as one of the top life insurance companies on this list.

Survivorship Life

One of the products available from Voya, one of the best-rated life insurance companies, is called Survivorship Life. The objective of this particular life insurance policy is to insure two individuals, with the death benefit being paid upon the death of the second person.

It’s an ideal life insurance product for people who have a large estate that needs protection, and it also tends to cost less than other policy options. It’s included on this list because it’s not always available from every life insurance company.

Key features of this policy include:

- Income tax-free death benefit is paid to beneficiaries

- Helps money grow tax-deferred

- Generally less expensive than purchasing two separate policies with similar levels of coverage

- The proceeds from the death benefit allow for immediate access to cash to pay estate taxes

- Policy loans are available

Life Insurance Needs Calculator

Several of the top 10 life insurance companies included on this list of life insurance companies offer various calculators and tools to help guide consumers to make the right decision, but the Voya Life Insurance Needs Calculator is actually one of the most in-depth available.

The calculator asks a few simple questions, such as cash needs at death, income for survivors based on certain assumptions, and current resources.

It then provides results that allow the user to see their cash needs at death and cash for survivor income for the total amount of insurance needed at death and the additional insurance required.

Once the user of this helpful calculator knows how much insurance coverage they need, they can then get a fast, free quote using the Voya life insurance quote calculator.

Image Source: Voya Financial

Voya is also part of this ranking of the best life insurance companies because, in addition to their calculator tool, they offer a guide to help people decide the policy that is best for them based on factors including whether they want to build cash value in their policy, how long they want coverage, and where they are in their life.

Read More: Top MasterCard Credit Cards | Ranking | MasterCard Rewards, Cash Back, Benefits and Offers

Conclusion—Top 10 Best Life Insurance Companies

To sum up this ranking of the best life insurance companies and the top-rated life insurance companies, the following are some key considerations that were not only used to create this list of life insurance companies but are also important as you compare options to find the best life insurance:

- The best life insurance companies should have financial strength and reliability as determined by how long they’ve been in business, and also how third-party financial organizations rate them.

- Top-rated life insurance companies offer not only competitive life insurance rates, but also multiple options, flexibility, and customization features for policies.

- Customer service is extremely important as you search for the best life insurance and the best life insurance companies.

All of the above names on this ranking of the top-rated life insurance companies have a strong reputation in terms of customer service.

Choosing the best life insurance is an important decision. It’s not just essential to make sure your family is protected, but it can also be part of a healthy overall financial strategy, it can be a valuable investment, and it can provide you with peace of mind throughout your life.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.