Guide: How & Where to Get the Best Home Mortgage Loan Rates

Putting yourself in the home buying market means you’re now privy to the stress of investigating who has the best mortgage rates. Your bank mortgage rates can have a huge impact on the actual cost of your home throughout your loan term.

Obtaining low mortgage rates is imperative in making sure you aren’t just throwing your money away each month. After all, what will you really have to show for your home mortgage rates when it’s all said and done?

Image Source: BigStock

Image Source: BigStock

AdvisoryHQ wants you to be able to obtain the best mortgage rates around, but how do you know what those are? With our help, you’ll know how and where to find the best home mortgage rates for your pending purchase.

Whether you’re searching for fixed mortgage rates or adjustable-rate mortgages, this comprehensive overview will let you know exactly what the lowest mortgage rates are for your purchase.

See Also: Ways to Find the Best IRA Calculator for IRA Distributions, Withdrawal, and Retirement Calculations

Beef up Your Credit Score

We all know that financing is heavily subject to our credit score, and obtaining the best mortgage rates around is really no different. You have a much greater chance of finding low mortgage rates if your credit score is higher than the average person.

Banks have a lot more incentive to offer their lowest mortgage rates to consumers who are completely trustworthy to repay their loan amount.

What do you need to do to improve your credit score? First, you should already be taking a close look at your credit report annually. This doesn’t cost you a thing and can help you prevent major mistakes from showing up under your name. By going to annualcreditreport.com, you can receive a free copy from all three of the major credit reporting agencies to review them for inconsistencies or inaccuracies.

After this, check with your actual credit score to see how it’s faring. Most lenders will review your FICO credit score, which is difficult to gain access to from home. Credit card companies will sometimes include a free copy of your FICO credit score at the bottom of your monthly statement for you to review. You can also view alternate versions of your score through sites like Credit Karma which then offer suggestions and recommendations for areas of improvement.

Experts recommend aiming for a credit score that is 760 or higher in order to see the best mortgage rates around. It’s at this level of creditworthiness that you tend to see low mortgage rates appear with more consistency.

Lower Your Debt

It isn’t just your credit score that allows a lender’s best mortgage rates to come forward. A big factor in approval for any mortgage (much less the lowest mortgage rates around) is your debt-to-income ratio. Knowing that your debt doesn’t exceed a certain percentage of your income will help lenders feel confident that you can make your monthly mortgage payment.

Tallying up your debt-to-income ratio means taking inventory of all your debt. Auto loans, student loans, and credit card debt are added in with your projected mortgage and divided by your income. Multiply that number by 100 and you’ll quickly see whether or not lenders will qualify you for their best mortgage rates.

For example, if you bring home $2,000 per month, and your only debt is your auto payment (valued at $200 per month) and your projected mortgage payment (estimated at $800 per month), your debt-to-income ratio would be approximately 50 percent – too high to qualify for most home mortgage rates.

To qualify for a lender’s best mortgage rates, your debt-to-income ratio should not exceed 36 percent. This number can fluctuate or vary depending on the specific lender that you select. The maximum debt-to-income ratio is typically 43 percent (often seen on Federal Housing Administration loans).

Don’t Miss: Construction Loans & Rates | Guide | How Do Construction Loans Work?

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Compare the Rates

Don’t naively assume that a lender is automatically offering you low mortgage rates without checking to see what else is around. US mortgage rates are in a constant state of flux, depending on factors outside of a lender’s control. Home mortgage rates are subject to economic indicators, including slowdown or growth of the economy, market forecasts, the country’s money supply, and even the current mortgage market.

Since the definition of “best home mortgage rates” is constantly changing, it’s important to not just conduct a mortgage rates comparison but to do so within the same time period. If possible, you should try to compare home mortgage rates all in the same day or across the span of just a few days.

Anxious over how checking with multiple lenders would impact your credit score? Don’t worry too much. Window shopping for a lender’s best home mortgage rates has some grace when it comes to your credit report. The credit agencies would expect you to be looking for a lender’s best mortgage rates instead of blindly accepting the first offer.

To accommodate this, they give you a 14-day time frame during which you can make multiple inquiries and compare bank mortgage rates to one another. Just be certain that what you’re comparing is apples to apples. You’ll see quite a difference between fixed mortgage rates and adjustable mortgage rates as well as between different loan terms. Shop around, but be smart about what you’re seeing.

ARM of Fixed Mortgage Rates

You think you’re getting a lender’s best mortgage rates, but are you really getting the best deal for what you need? You need to consider whether an adjustable-rate mortgage could be the right fit for you. Often, they feature low mortgage rates for an introductory period ranging from three years all the way to ten years. After this time period, the bank mortgage rates typically are readjusted on an annual basis.

Adjustable-rate mortgages force you to take a gamble on whether or not the US mortgage rates will still be low when your introductory rate expires. However, if you know that you will not be in this same home when the introductory period ends, this is a great way to find low mortgage rates upfront.

In contrast, fixed mortgage rates are just that – interest rates that will remain the same over the entire loan term. You will know what to expect from each of your monthly payments over the next ten, fifteen or thirty years. This is a good way to make sure that your payments will be manageable indefinitely, without the risk of rising home mortgage interest rates in the future.

Getting the best fixed mortgage rates is no different than rate shopping for any other type of loan. The goal is to find the lowest mortgage rates available to you at the time that you close on the loan. Are the rates at historic highs? Then it might be worth waiting a few months to see what the market will do. This will ensure that you get the best fixed mortgage rates. After all, you’ll be stuck with them for up to three decades if you don’t plan on refinancing.

Related: Average Closing Costs for Sellers | Guide | Typical Home Closing Costs for a Seller

Paying for Points

Can you pay your lender to lower your home mortgage rate? It might sound a little shady, but it’s actually a fairly common practice known as paying for “points.” When you have a little bit of extra money that you can add to the principal of your loan, you can often lower your home mortgage rate just a touch to get the absolute best home mortgage rates available.

A point will usually cost you approximately one percent of your overall loan value. You can typically get your low mortgage rates even lower by an additional 0.125 percent. This may not really sound like much, but the truth is that these slightly lower home mortgage rates can really make a difference over the course of the loan.

Image Source: What Affects My Rates?

Is it worth it to pay your lender for points to get the best home mortgage rates? The answer usually lies in how long you believe you’ll be living in the home. Utilize a great home mortgage calculator to determine how you will save in interest over the course of the time that you will be living in the anticipated home. If the savings is less than the cost of the point itself, then it would be preferable to just pay the low mortgage rates that a lender offers upfront.

The concept here is opposite to that of an adjustable-rate mortgage (ARM). If you don’t believe that you will live in the house long enough, paying for low mortgage rates isn’t likely to do you much good.

Popular Article: Finding the Best 10-Year & 15-Year Mortgage Rates Today | This Year’s Guide

Scrape Together your Savings

Your down payment can mean the difference between good home mortgage interest rates and not so good ones. On a conventional mortgage product, lenders will usually expect a 20 percent down payment. Down payments that come in at less than this percentage will usually bring you higher home mortgage rates, and they usually come with the additional cost of private mortgage insurance (PMI). Overall, your monthly payment is likely to be much higher with a lower down payment.

Certain programs (such as Veteran Affairs loans and Federal Housing Administration loans) do qualify you for low mortgage rates as well as low down payments. These programs typically aim to help first-time home buyers with possibly the largest purchase of their lifetime. However, if you don’t qualify for these federal programs, a conventional mortgage may mean you need to scrape together more savings.

Evaluate how much money you could potentially put down on your next home purchase. When you’ve selected a lender, ask if the additional monetary value of your down payment will have any effect at all on whether he or she can offer you the best mortgage rates. If the additional savings you can scrape up lands you over the 20 percent mark, it may allow for some wiggle room regarding your lender’s home mortgage interest rates.

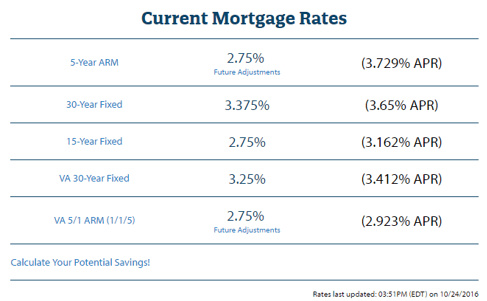

Image Source: Mortgage Rates – Quicken Loans

Where to Go for the Best Home Mortgage Rates

You need to find the best home mortgage rates, and now you know how to go about it. The question is, where should you look first? Some places are more likely than others to hand out the best home mortgage rates, and knowing where to go is half the battle when it comes to finding low mortgage rates you can afford to pay for the length of your loan.

Here are a few considerations for the types of lenders that frequently offer some of the best home mortgage rates:

- Credit unions: Utilizing smaller local banks or credit unions could definitely be in your favor when it comes to finding a lender’s best mortgage rates. While smaller local banks may have more flexibility in the terms and conditions of their loans (and, therefore, their bank mortgage rates), credit unions have a different specialty. They are often not for profit, which means they don’t have to inflate home mortgage rates in order to pay their bills. As a result, you can typically find the best home mortgage rates at a credit union.

- Online lenders: Since online lenders don’t have the overhead associated with maintaining brick-and-mortar locations, they can feature low mortgage rates that are more competitive than those of major brick-and-mortar financial institutions. Not only can you find low mortgage rates through these avenues, but you also have the added convenience of being able to handle everything from the application to the approval from the comfort of your own home. Popular online lenders include Quicken Loans and PNC Bank for the largest selection of low mortgage rates.

- Mortgage brokers: If you want to compare home mortgage rates in a snap, you may want to consider utilizing a mortgage broker. Services, such as LendingTree, allow you to input your personal information just once, and then they match you with potential lenders. It allows you to see a mortgage rates comparison in just minutes, all in one convenient location. Not only that, but they are able to prequalify you for programs, terms, and lenders that work for you based on the information you already provided.

- Banks: If you qualify for any of the federal programs to assist first-time homebuyers, you may have more success finding these programs in full swing at large-scale financial institutions, such as Bank of America or Wells Fargo. It is always a good idea to do a mortgage rates comparison between banks and online lenders as well.

These are by no means a conclusive source of all the resources available for a lender’s best mortgage rates. However, it should provide you with an excellent starting point for the type of lender and programs that suit your needs the best.

Read More: What Is a Second Mortgage? How Does a Second Mortgage Work? Get the Details

Free Wealth & Finance Software - Get Yours Now ►

Conclusion

Qualifying yourself for the best home mortgage rates can be a difficult and tedious task. However, the arduous work pays off when you know that you won’t be overpaying for home mortgage rates throughout the length of your loan term. After all, the only one who really benefits from excessively high home mortgage rates is your lender.

Consider evaluating where you stand regarding some of the tips and tricks mentioned in this article. The information in this review will also assist you in maintaining a financial reputation that will qualify you for some of the best mortgage rates out there.

Beyond that, you’ll need to figure out whether you’re searching for the best fixed mortgage rates or adjustable mortgage rates. Much of the search for low mortgage rates is dependent upon your personal financial situation and how long you intend to be in your current home.

US mortgage rates are constantly fluctuating, and you never know where you’ll find a lender that offers some of the best mortgage rates. With this guide in hand, you’ll have a clearer start to the path you need to follow.

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.