2017 Guide: Construction Loans & Rates | How Do Construction Loans Work?

Building the home of your dreams is something that many people only fantasize about.

It could be because they could never afford to build a home as lavish as the one in their mind’s eye, or it could be the result of the confusion surrounding construction loans.

Home construction loans function so differently than traditional mortgages and short-term loan options that some people throw in the towel before they even break ground.

But what if you had the knowledge you needed about owner builder construction loans, a construction to permanent loan, and the construction loan rates all in one place?

We’ve seen lot of interest surrounding new home construction loans lately. Consumers are rightly beginning to ask, how do construction loans work?

In an attempt to make the house of your dreams a reality, we’re going to break down the home construction financing process from start to finish so you know what it takes to obtain to residential construction loans for your project.

What Are Construction Loans? How Do Construction Loans Work?

The best place to start answering questions about new home construction loans might be to simply define what they are.

What are construction loans?

Construction loans can be known by a variety of different names, and they all vary slightly in definition. At their very core, home construction loans are defined as simply short-term loans used to cover the costs of building your home, office building, or any other real estate venture you’re considering.

Image Source: Construction Loans

Within the broader category of “home construction loans” are several subcategories: owner-builder construction loans, a construction to permanent loan, or stand-alone construction loans.

- Owner-builder construction loans: These types of construction loans are awarded to individuals who are acting as both the builder and the owner of the property. This is a risky type of financing for banks to offer, as most owner-builders do not have years’ worth of construction experience under their belt. It might be more difficult to find a financial institution that will offer this type of loan.

- Construction to permanent loan: Of all the construction loans available, this is the most popular option. A bank or lender will agree to pay up front for the home construction and then roll the balance of the loan over into a new conventional mortgage product after the project’s completion. Many banks will allow there to be just one single closing on this type of construction to permanent loan.

- Stand-alone construction loans: New construction loans can sometimes be stand-alone loans, meaning that the bank has not agreed to a long-term mortgage at the project’s completion. Some individuals opt for this type of loan if it will require a smaller down payment or if they could find more favorable construction loan rates at one lender and a better conventional mortgage product at another. The disadvantage to stand-alone home construction loans is that you will pay two sets of closing fees—one on the initial home construction loans and another at the closing of your mortgage.

See Also: ConsumerDirect Mortgage Reviews—What You Need to Know! (FirstBank Mortgage & Review)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How Do Construction Loans Work?

If new home construction loans cover the cost of your real estate project, how do construction loans work in practice? Many individuals would be wary of supplying their builder with all of the funds that they need to complete the home up front, and rightly so.

Horror stories abound of contractors who never complete their contracted work. The finer details of your construction loans will be between you, your builder, and the bank, but we will give you an overview of how most situations work.

The builder does need some money up front in order to begin work on your new property. Your lender will likely cut them a check for a certain percentage of your residential construction loans.

This may be ten or twenty percent, enough to get your builder started on the construction process. Initial payment for new home construction loans is often issued out of the down payment money required by the lender. This places the majority of the initial risk squarely on the shoulders of the homeowner.

After this point, the builder will be issued draws from your construction loans. These may come at set times in the building process (after the foundation is poured, after walls have been covered with sheetrock, etc.) or after a certain percentage of the work has been completed.

Common practice typically requires that the bank issue an inspection of the work before dipping into the funds of your home construction loans.

When a builder requests a draw on new construction loans, an inspection helps the bank to ensure that the money is being spent appropriately and that the project is on track according to the initial submitted timeline required to be approved for financing.

How do construction loans work? Quite simply, the builder is funneled money through draws as they pass through the home construction process and their progress is inspected and monitored by the lender.

Don’t Miss: Freedom Mortgage Reviews—Get All the Facts! (Customer Service, Complaints & Review)

Construction Loan Rates

When lenders issue home construction loans, the original loan is typically set up as an adjustable rate loan.

Similar to a home equity line of credit, construction loans will require you to pay interest on the portion that has already been withdrawn from your account. You typically pay interest-only during this phase of the loan process, making the principal borrowed exactly the same on your final mortgage.

As your builder requests more draws and moves further along in the home construction process, the interest bill you receive each month will increase drastically.

Image Source: TD Bank – Mortgages

Thus, in the beginning of the process your monthly payments will be more affordable than those requested toward the end of your loan as most of the funds within your approved owner-builder construction loans or construction to permanent loan have been paid out.

How do you know if you’re receiving the best construction loan rates? These are typically based off the prime rate issued by the Wall Street Journal. In many instances, construction loan rates will be the prime rate in combination with an additional percentage to be collected by the bank or lender.

For example, if the prime rate is three percent, but your variable construction loan rates are “prime plus two,” you would be paying five percent interest on your residential construction loans.

In the overall scheme of things, calculating construction loan rates is significantly different than receiving interest rates for any other type of loan.

Lenders have a lot more freedom to look at the overall scope of the home construction project and issue construction loan rates specifically designed for the new home construction loans that they are issuing. This may depend on your personal credit history, the equity in the project itself, the timeline of the project, and your income, among other variables.

Qualifications

Wondering what it takes to have your lender approve you for new construction loans or to qualify for the best construction loan interest rates?

Lenders can be hesitant to issue home construction loans due to the uncertainty involved in the construction process. A poor builder may not be able to complete the project on time or may not finish the home well enough for it to appraise at the estimated value.

There is also the risk that a borrower may qualify for home construction loans now and great construction loan rates, but their credit or financial situation could change during the building process, leaving them unable to get a permanent mortgage.

In short, the bank is afraid of making a bad investment in construction loans.

That fear leads them to make stricter standards for those who are interested in obtaining construction loans. Before you’re approved, you should expect to have all of the following in order:

- A qualified builder: The bank is taking a risk by investing in a new real estate project, and they will want to know that it is being completed well. Seeing a well-known and well-qualified builder’s name attached to your new construction loans makes your real estate project more appealing. Owner-builder construction loans are possible, but expect to need a stellar credit score and to search a little harder for a lender that offers this type of loan.

- Specifications: Building a custom home using construction loans doesn’t allow you the freedom to make up the plan as you go along. Before the lender is going to issue you any sort of loan, they want a very detailed set of the specifications for the entire home. Sometimes, this is referred to as a “blue book.” It should include every major and minor detail (insulation types, roof details, ceiling heights, window sizes, etc.).

- Appraisal: Even though the house has yet to be built, an appraiser must still look over the specifications and lot to appraise the value. They will compare the amount requested for the loan with the value of other similar homes in the area to help the bank determine if they are making a wise investment. This is part of the reason why your detailed specifications are so significant.

- Down Payment: Unlike some mortgage programs where you can qualify for zero money down or just 3.5 percent with an FHA loan, construction loans typically require significantly more money down. Most lenders will require at least 20 to 25 percent in a down payment. You may qualify for better construction loan interest rates if you are able to supply an even larger down payment.

While all of those are necessary requirements to qualify for home construction loans, you must still meet normal criteria for a conventional mortgage. Lenders will check your credit score to make sure you are trustworthy to lend to. The higher your credit score is, the more likely you are to receive better construction loan interest rates.

They will also ask for detailed information regarding your income (paystubs, W-2 forms, etc.) to make sure that you can afford the construction loan payments and the mortgage on the property when it is finished. This is especially significant if the bank is going to be issuing a construction to permanent loan.

Related: How to Buy a House with No Money Down | Guide | Buying a Home with No Down Payment

Finding Home Construction Loans

Finding sources for construction loans can be more complicated than finding lenders for a conventional mortgage product.

Online lenders are leery of handing out construction loans because they are subject to so many factors. While it is possible to find online lenders, you will likely need to consider a brick-and-mortar location for your construction loan.

Image Source: Wells Fargo – Loans Programs

Local financial institutions such as regional banks or credit unions typically have the best gauge on the local market. If you are interested in new construction loans, you may want to check with some of these places in the area where you are looking to build.

While you can expect higher interest rates when it comes to construction loan rates compared to conventional mortgage rates, you may find success at credit unions as well. They typically have the lowest interest rates for conventional products and may be able to offer very competitive construction loan rates as well.

If you are interested in larger financial institutions for your home construction loans, here are a few places you may want to consider:

- Wells Fargo: Wells Fargo does an excellent job of outlining the necessary items they need in order to qualify homeowners for construction loans. While they don’t publicize their construction loan rates, they do offer the ability to lock in rates while your home is being built. Paying a lock fee up front can allow you to keep your interest for between five and twenty-four months, depending on what type of loan you are looking at. You may even qualify for a “float down” if interest rates drop during this period.

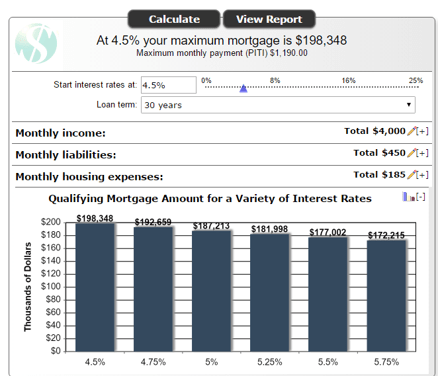

- TD Bank: TD Bank offers an easy construction to permanent loan that features just one closing at the beginning of the construction process. They will finance your project for 12 months, during which time you will be responsible only for the interest due according to your construction loan rates. TD Bank also offers a number of calculators where you can adjust the loan amount with the construction loan rates to ensure you can afford a home of the scope you are interested in building.

Image Source: TD Bank – Mortgage

- Regions Bank: Regions Bank, like TD Bank, offers a great construction to permanent loan option with only one set of closing costs. You pay interest only according to your construction loan rates during the twelve months of construction that your home will undergo. They review your specifications, builder, income, appraisal, and more before issuing a decision. For more specific details on their home construction loans and how they work, they have a thorough three-step process that they walk homeowners and builders through in regards to draws, interest, inspections, and more.

As mentioned earlier, you will also want to check with local and regional banks or credit unions in your area. We could never list all of the potential lenders for construction loans or all of the possible construction loan rates from each lender. This list is intended to give you a great starting point for the qualifications and information necessary for a lender to issue home construction loans on your behalf.

Popular Article: Private Mortgage Insurance: What You Need to Know about PMI Insurance

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Managing Construction Loans

Before you begin applying and seeking approval for home construction loans, it is imperative that you consider the cost during home construction.

Most individuals will be paying for their initial mortgage or rent payment in addition to the ever-increasing interest amount for your construction loan rates. After you put down a sizeable chunk of money for your down payment, will you still have wiggle room in your budget to pay for the monthly construction loan rates?

Building your own home, especially the home of your dreams, is an exciting and wonderful adventure.

Obtaining home construction loans can be trickier than a conventional or traditional mortgage product. Once you find a builder and receive a solid estimate of the cost of the home, you can use calculators like those available at TD Bank to see if you can afford to continue.

After that, you will want to search for the best construction loan rates to keep your monthly payments low.

Whether you opt for a stand-alone construction loan or a construction to permanent loan will be up to you. Each individual’s unique financial situation dictates what works best for them, but there are plenty of options available for home construction loans to choose from.

Read More: Spot Loan Reviews—Get the Facts Before Using (Pros, Complaints, & Review)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.