2017 RANKING & REVIEWS

TOP RANKING BEST PERSONAL FINANCE APPS

Try One of These Best Personal Finance Apps to Take Control of Your Finances Today

Managing money is hard. That is why only one-third of Americans have a financial budget, and probably why 80% of Americans are in debt. Fortunately, today’s world offers some fabulous personal finance apps to make managing your money significantly easier.

If you want to take advantage of one or more of these finance apps, keep reading!

This is your 2017 ranking of the six best personal finance apps for iPhone and Android. And it just so happens that all of these best finance apps are free.

![]()

![]()

![]()

Award Emblem: Top 6 Best Personal Finance Apps

We will highlight six finance tracking apps that do the following:

- Finance management apps that help you budget

- Financial planning apps that help with investments and portfolios

- Financial management apps that help you spend money safely

- Best personal finance apps that help you know where your money goes each month

- And more

After you read through this list of finance tracker apps, try downloading the personal finance app that will work best for your finances. If you don’t like it, at least it was free! You can try another financial management app that may work better for you.

See Also: Top Frequent Flyer Credit Card Offers | Ranking | Best Credit Cards for Travel Rewards

AdvisoryHQ’s List of the Top 6 Best Personal Finance Apps

List is sorted alphabetically (click any of the finance app names below to go directly to the detailed review section for that finance management app):

Top 6 Best Financial Management Apps | Brief Comparison & Ranking

Finance Apps | iPhone | Android | Web App? |

| GoodBudget | Free | Free | Free |

| Mint | Free | Free | Free |

| Personal Capital | Free | Free | Free |

| Spendee | Free | Free | Free |

| Venmo | Free | Free | No |

| Wally | Free | Free | Not yet |

Table: Top 6 Best Finance Management Apps | Above list is sorted alphabetically

Things to Look for When Choosing Personal Finance Apps

Before we start reviewing each of the best personal finance apps for 2017, let’s talk about what makes a financial management app go from okay to “the best.”

Image Source: Pexels

The best finance apps will offer you:

- Security: After all, finance apps are dealing with sensitive information. This means choosing finance tracking apps with a record of top security is paramount.

- Premium options: Many of these best personal finance apps below will offer paid monthly service options as an upgrade. None of them require these premium options to function. But some people may not mind spending a small amount each month on their finance tracker for better financial help.

- Free options: If you are struggling with managing your money, chances are you do not have any extra money to spend on a financial management app. All the basic, necessary functions should be free.

- Simple technology: The point of a finance management app is to make your life easier. The process of using a finance tracker app should not be difficult. All of these apps have simple technology that anybody can learn how to use.

- Good reviews: You will want to make sure that your financial management app has good reviews from other users. All of the best finance apps on this list do.

Now, let’s go through the reviews of each best personal finance app to see which one may be right for you!

Don’t Miss: Overview of Top Financial Planning Software and Tools – Reviews and Overview

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Personal Finance Apps

Below, please find a detailed review of each best personal finance app on our list of personal finance apps. We have highlighted some of the factors that allowed these best finance apps to score so highly in our selection ranking.

GoodBudget Review

The first personal finance app on our list of best personal finance apps is GoodBudget. This finance management app is the modern version of the envelope system style of budgeting.

Envelope budgeting is where you set aside money for many categories and cannot spend any more in that category once you have met the monthly budget. Often this is done with cash set aside in envelopes, but this finance management app does it electronically.

Here is what this financial planning app allows you to do:

- Create a budget

- Save for big expenses by planning ahead

- Sync between the mobile devices of the same family, so all members can keep up with the financial budget

This finance management app is a free download for all devices. The finance tracker services are free, but you can upgrade to the “Plus” membership. The differences are:

- 10 envelopes vs. unlimited envelopes

- 10 “more” envelopes vs. unlimited “more” envelopes

- 1 account vs. unlimited accounts

- 2 devices vs. 5 devices

- 1 year of history vs. 5 years of history

- Community support vs. email support

Using this financial management app with the “plus” services costs $5 a month or $45 a year.

Related: Mint Alternatives – Most Popular Alternatives to Mint.com

Mint Review

Without a doubt, one of the more popular best personal finance apps is Mint. This is a simplified finance management app that helps you through almost every aspect of personal finance.

Image Source: Mint

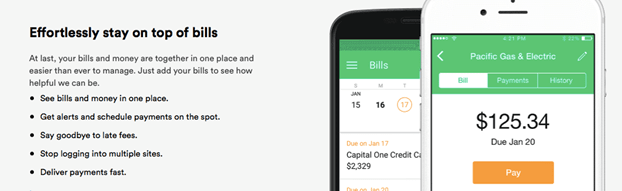

As one of the top personal finance apps, Mint offers the following:

- Bill pay and tracking

- Simplified budgeting

- Free credit score reporting

- Alerts and advice throughout the month

- Simple categorizing

- Investment tracking

- Security

By helping you to make a financial budget that makes sense for today and sets you up for tomorrow, by allowing you to see bills and money together, and by offering alerts for changes or reminders, all of your main activities can be done on this finance tracker.

Since so much of your financial information will be stored on this financial management app, the company takes security seriously.

Mint is “Norton Secured,” uses “VeriSign,” and uses multi-factor authentication, so you can use their finance tracker with confidence.

Personal Capital Review

Where some of the other best personal finance apps focus on basic personal finance (like a financial budget), Personal Capital is a finance tracker for your financial holdings. If you keep investments, this is one of the best finance apps for you.

This financial management app helps you keep track of:

- Net worth

- Cash flow

- Portfolio balances

- Portfolio allocations

- Key holdings

- Top gainers and losers

- Account balances and transactions

- Spending by account

- Spending by category

- Income reports

- Spending reports

- Upcoming bills

- Investment returns

- Projected investment fees

As one of the top finance tracking apps, Personal Capital does everything you need it to for wealth management. This finance management app will even give you an investment checkup and compare your portfolio to the target portfolio.

The retirement planning function of this financial planning app lets you assess your readiness for retirement, helps you anticipate big expenses, and adds income events like the start of your Social Security.

More than 1.3 million people are already using this Personal Capital app over other finance apps to track more than $312 billion.

Popular Article: Best Small Business Accounting Software in Australia

Spendee Review

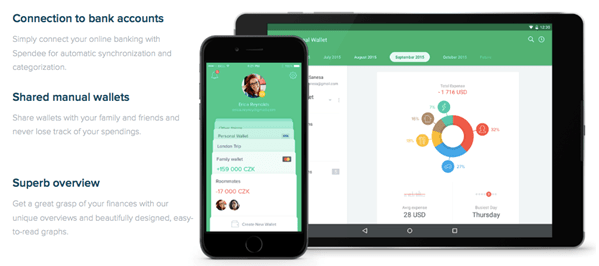

The next personal finance app on our list of the best personal finance apps of 2017 is Spendee. This financial management app has a simple mission: “See where your money goes.” Essentially, this is a finance tracker to know how you are spending each month.

Image Source: Spendee

As one of the best finance apps, Spendee does the following:

- Allows you to personalize your spending categories

- Keeps track of multiple currencies if you travel

- Helps you create a financial budget

While downloading this financial management app and using their basic services is free, you can upgrade to Premium. The premium version of this finance tracker includes:

- Bank account synchronization

- Shared wallets (so you can share with friends or family)

- Unlimited wallets (vs. only one with the free version)

- Unlimited budgets (vs. only one with the free version)

The premium version of this best personal finance app is $2.99 a month.

Venmo Review

Up until now, we have been focusing on finance tracking apps on our list of best personal finance apps. But what about finance apps that help you spend money safely and securely?

Venmo is the popular finance app that allows you to pay money with confidence. Here are some examples of how this personal finance app can help you:

- If you need to send money to a friend or family member, you can do so securely

- If you would normally send a gift in the form of check or cash, you can now do it more safely through this finance app

- If you want to make purchases in mobile apps, you can choose your Venmo account instead of a credit card for extra precaution

- If you want to accept money from a friend or even from your own small business, this finance app can do that

As one of the best finance apps, Venmo is changing how people exchange money. This plays a large part in your personal finances.

Since Venmo is run through the popular and trusted PayPal, you can have confidence in its security.

Read More: Personal Capital vs. Mint – Detailed Ranking & Comparison

Free Wealth & Finance Software - Get Yours Now ►

Wally Review

The final financial planning app on our list of best personal finance apps is Wally. This is another finance tracker for money management. This is a new app, and they are currently working on adding premium options like a currency converter.

The company of this finance tracker wants to give app users a “360 view” of their money, which includes:

- What is coming in

- What is going out

- What is being saved

- What is being budgeted

You can go in and see what is left of your financial budget for the day or for the month. You can see what you have been spending and add that money to different categories, including business expenses.

You can also put in particular financial goals into this finance management app. It will help you achieve those goals step by step. Plus, all data from this best personal finance app can be exported to Excel.

Conclusion – Top 6 Finance Tracker Apps

Now that you have seen the best personal finance apps for 2017, you can download one or two to see if you can take control of your money and financial budget this year.

Which financial management app is right for you?

- If you are mostly looking for a simple and general finance management app that can help you with budgeting and saving, try GoodBudget, Mint, Spendee, or Wally.

- If you are mostly looking for a complex financial planning app that allows you to manage investments, try Personal Capital or Mint.

- If you want a finance app to help you spend money safely, try the Venmo app.

- If you want inexpensive premium options, try Spendee.

Once you have downloaded your finance management app or finance tracker, you will be on your way to more easily managing your money both this year and for years to come.

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.