2017 RANKING & REVIEWS

TOP RANKING BEST CAT INSURANCES

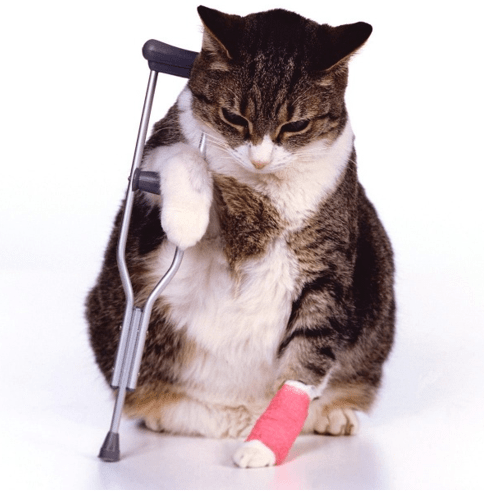

2017 Guide: Protect Your Furry Friends and Bank Account with the Best Pet Insurance for Cats

From the moment they come home with us, our furry feline friends become part of the family. They’re there in the good times and the bad. They spend hours snuggling in laps, and sometimes ripping apart furniture with their razor-sharp claws, we love them unconditionally.

When it comes to taking care of our furry companions, isn’t the goal to give them the best care possible? Unfortunately, that goal often comes with a lofty price tag.

We’re not just talking about food, toys, and litter, either. Veterinarian bills can quickly pile up and leave you worrying over stressful options.

A recent study showed that almost half of pet owners are somewhat or extremely worried about being unable to afford medical bills for their sick or injured cat or dog. You want to do everything possible to keep your kitty cat healthy and happy, but what if you cannot cover thousands of dollars of medical expenses?

Award Emblem: Top 6 Best Pet Insurance for Cats

There is nothing more heartbreaking than having to euthanize a beloved family pet because you cannot afford the life-saving medical treatments. That is where pet insurance for cats can come into play.

The issue is first deciding whether cat health insurance is something that you are interested in, and if so, which cat pet insurance is right for you. When looking for the best cat insurance, you might have many questions, including:

- Where can you find can insurance reviews?

- Is cheap cat insurance legitimate?

- Can you get pet insurance for older cats?

- What are the best cat insurance providers?

Throughout this 2017 guide, we will answer questions you might have about pet insurance for cats. We will detail why insurance for cats might be a good idea and what to consider when reviewing cat insurance comparisons. If you’re wondering what the best sites are to compare cat insurance, we will provide cat insurance reviews of the six best sites to compare cat insurance.

See Also: Top Credit Cards | Ranking & Reviews

AdvisoryHQ’s List of Top 6 Best Cat Insurance Quote Sites

List is sorted alphabetically (click any of the pet insurance for cat sites below to go directly to the detailed review section for that cat pet insurance site):

Image Source: Nuzzle

Top 6 Best Cat Insurance Quotes Sites | Brief Comparison

Cat Insurance Quotes Sites | Best Feature | Deductible |

| AKC Pet Insurance | Affordable plans and coverage throughout the entire country | $75 – $125 |

| ASPCA Pet Health Insurance | Offers wellness coverage | $100 – $500 |

| Embrace Pet Insurance | Plans are customizable to fit your budget | $200 – $2,000 |

| Healthy Paws | Has a 98% customer satisfaction rating and the best customer service | $100 – $500 |

| Pet Premium | Quick online shopping for a plan | $100 |

| Trupanion | Offers custom riders to protect your furry friends | $0 – $1,000 |

Cat Insurance Quotes Sites | Annual Limit | Waiting Period |

| AKC Pet Insurance | $13,000 | 0 – 30 days |

| ASPCA Pet Health Insurance | $2,500 – Unlimited | 1-14 days |

| Embrace Pet Insurance | $5,000 – $15,000 | 14 days |

| Healthy Paws | Unlimited | 15 days |

| Pet Premium | Unlimited | 0 – 30 days |

| Trupanion | Unlimited | 5 – 30 days |

Table: Top 6 Best Sites to Compare Cat Insurance / Above list is sorted alphabetically

Detailed Overview: What to Consider in a Cat Insurance Comparison

There are many different options for cat insurance out there. Over ten companies provide pet insurance for cats, though not all are created equally.

Cat health insurance policies vary in price and coverage. You need to consider many aspects when you compare cat insurance policies. The most expensive plan might not always be the best pet insurance for cats, and the least expensive plan might not always offer poor coverage.

You will need to look at the overall health of your cat, the breed and age of your cat, and your own financial situation. When you compare cat insurance quotes, pay close attention to the following:

- Waiting Period: The period of time that you need to wait before your cat insurance kicks in.

- Physical Exam: Some policies require a physical exam to get coverage to check for pre-existing conditions and overall health.

- Co-Pays: Some plans require that you pay a set sum each vet visit.

- Prescription Drugs: Does the plan you are considering cover prescription drugs?

- Payment Caps: Is there a maximum annual or overall amount that your cat pet insurance will pay out?

- Deductibles: For surgeries and more expensive visits, there might be a set amount that you pay before the insurance kicks in.

- Pet Insurance for Older Cats: Does the policy exempt older felines with already declining health?

- Choice of Vet/Hospital: Be sure that your preferred (or at least a quality) vet in your area is included in the “network” if there are any limitations.

- Pre-Existing Conditions: Some policies will not cover pre-existing conditions, which could increase your costs.

These are key features of any cat insurance policy, and you should take the time to compare cat insurance quotes in regard to these variables.

It is important to compare cat insurance policies and quotes closely. You don’t want to be caught surprised that there is a $500 deductible when you get the bill from your cat health insurance provider. The same is true for pre-existing conditions.

The best cat insurance for your furry felines will be the policy that meets your needs and their needs the best.

Don’t Miss: Top Zero Interest Balance Transfer Credit Cards | Ranking | Interest Free Balance Transfer Cards

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Advisory HQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Pet Insurance for Cats

Below, please find the detailed review of each cat health insurance option on our list of insurance for cats. We have highlighted some of the factors that allowed these cat insurance comparison sites to score so highly in our selection ranking.

AKC Pet Insurance Review

The American Kennel Club offers pet insurance under the name AKC Pet Insurance. On their site, you can compare cat insurance policies.

They offer two policies: the Companion Select and the Companion Plus plans. The Select cat health insurance plan only covers accidents, while the Plus plan covers accidents and illnesses.

A great thing about AKC Pet Insurance is that you can get coverage anywhere in the country. This is often considered some of the best cat insurance because there is no lifetime benefit limit.

The drawback here is that this provider does not offer pet insurance for older cats. The age limit is nine, which limits your benefits.

Bottom Line

If you are not looking to cover an older cat, the AKC Pet Insurance plans might be the best cat insurance for you. The prices are lower than cat insurance quotes from some other providers, but you get nationwide coverage.

Related: Top Airline Credit Cards | Ranking | Best Airlines Miles Credit Cards (Reviews)

ASPCA Pet Health Insurance Review

ASPCA Pet Health Insurance provides medical, accident-only, and wellness coverage for cats as well as dogs. This is one of the most trusted names in the industry, providing some of the best cat insurance and dog insurance.

Their main plan has recently been updated, now called Complete Coverage℠. Designed to be easy to use and understand, each type of coverage includes exam fees, diagnostics, and treatment.

A great thing about the ASPCA Pet Health Insurance is that you can receive coverage throughout all 50 states, and you can easily search for state-specific coverage.

With annual limits ranging from $2,500 to unlimited, pet owners can expect a deductible between $100-$500, depending on the plan.

The ASPCA is also a great site to compare cat insurance. They display their plans as well as others, so you can run your own cat insurance comparison and choose the best pet insurance for your four-legged companion.

Bottom Line

Overall, the ASPCA is a great site to gather and compare dog or cat insurance quotes. The site is simple to use, and the ASPCA Pet Health Insurance is some of the best cat insurance available.

Embrace Pet Insurance Review

Embrace Pet Insurance is another site to get cat insurance quotes. You can easily obtain cat insurance quotes online and compare them to quotes received elsewhere.

When it comes to the best pet insurance for cats, this might also be a good option. There is only a 14-day waiting period for injuries and illnesses, and they will cover cats that are up to 14 years old.

Embrace also offers Wellness plans for cats, at three varying levels. You can have $200, $400, or $600 to spend on veterinary care of any type. This includes routine care, dental services, and even prescription diet food.

The varying levels and exemplary coverage is why this provider is considered to offer some of the best pet insurance for cats.

Bottom Line

If you are looking to compare cat insurance, Embrace Pet Insurance is one site to visit. With the possibility of a $15,000 annual maximum payout, chances are that you will always be covered.

Popular Article: Top Prepaid Debit Cards | Ranking, Including Prepaid Debit Cards With No Fees

Healthy Paws Review

Healthy Paws also offers cat insurance quotes online for those looking to compare cat insurance plans. You will just need to enter your pet’s name, type, breed, birthday, and some personal information about you before obtaining your cat insurance quotes.

Healthy Paws offers some of the best pet insurance for cats when it comes to coverage level. You can get unlimited benefits with no annual limits, as well as coverage for hereditary issues. This can be hard to come by with other best cat insurance providers.

The one drawback is that Healthy Paws cat insurance quotes will likely be a bit higher than other providers will. With the slightly more expensive price tag, you will get great coverage. The $25 enrollment fee also irks some policyholders.

Bottom Line

If you want the best pet insurance for cats and budget is a concern, Healthy Paws might be a good option for you. There is only a 15-day waiting period, and deductibles can be as low as $100 depending on your plan.

Pet Premium Review

Pet Premium is another good place to go if you want to compare cat insurance quotes. The site requires just a bit of information before offering you cat insurance quotes.

Though it is a relatively new cat pet insurance provider, the company was founded with customer service and updated technology in mind. They also have excellent customer service that can be reached at 1-800-935- 7280.

There is neither a lifetime benefit maximum nor an annual benefit maximum. That means that your pet will be covered in full – minus the deductible – for eligible procedures and treatments. This easily puts this on our list for best pet insurance for cats, as costs can add up over time.

Bottom Line

If you are tech-savvy cat and looking for a company with no maximum benefits and great customer service, Per Premium might be the best cat insurance provider for you.

Free Wealth & Finance Software - Get Yours Now ►

Trupanion Review

Trupanion is last, but not least, on our list of best cat insurance quotes websites. They offer care throughout the country, an easy claims process, the ability to pay your vet directly, unlimited payouts, and up to 90% coverage. If you want the best pet insurance for cats, Trupanion is certainly an option.

There is a per incident deductible, which will range from $0 to $1,000 depending on the plan you choose. Thankfully, you can compare cat insurance quotes on their site to choose the plan that meets your budget and coverage preferences.

If you need pet insurance for older cats, rest assured that Trupanion covers cats up to 13 years old. This is older than many other insurance providers cover.

As a bonus, Trupanion also offers additional coverage options. These range from acupuncture and chiropractic to physical therapy and behavioral modification.

Bottom Line

Trupanion is an all-around great provider of pet insurance for cats. If you want a middle of the road expense with good coverage, Trupanion might be good to look into.

Read More: Top Credit Cards for Low Credit Scores | Reviews | Best, Fastest Ways to Build Credit

Conclusion – Top 6 Best Cat Insurance Comparison Sites

The decision of whether to put down your pet or not should never be based on financial means to afford a life-saving surgery. Cat insurance policies exist to protect your furry friends, along with your bank account.

By purchasing insurance for cats, you can avoid the frustration and worry you face every time you take your feline to the vet. The knowledge that you will only be faced with a small co-pay, or no cost at all, can make a stressful time much easier to bear.

You do not want to become part of the 41 percent of pet owners reporting that they are at least somewhat worried about being unable to afford the veterinary bills for their pets. With cheap cat insurance, you can provide the best care for your kitty cat without breaking the bank.

While cat pet insurance is not ideal, or affordable, for everyone, it can definitely ease your burden to provide health care to your furry friend.

Image Source: Simply Cat Breeds

The task, then, becomes finding the best cat insurance for your cat and financial situation. Policies vary in price and coverage, so you have some things to take into consideration.

When reading cat insurance reviews to choose the best insurance for cats, you will need to consider the following:

- Is it a good idea to get pet insurance for older cats in your home?

- What is the budget that you have for cat health insurance?

- Is the breed of your cat known for having certain medical issues?

- Is it worth the risk settling for cheap cat insurance?

Take the time to consider different cat insurance quotes and plans before you make the final decision on a plan. With the health and longevity of your feline family member on the line, it’s worth thorough consideration.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.