Guide: The Best Places to Open a Roth IRA | How & Where to Open an IRA

Is it time for you to open a Roth IRA? Roth IRAs are named after Delaware Senator William Roth and were established by the Taxpayer Relief Act of 1997.

As an individual retirement plan, the Roth IRA is similar to a traditional IRA, but there are differences between the two in terms of taxation.

A Roth IRA is a great choice for saving for your retirement if you’re working and if you believe you’ll face higher taxes when you retire than you’re paying now. Contributions are made with after-tax dollars, but if you open a Roth IRA, when it comes to making withdrawals, they’ll always be tax-free.

Another good reason to open a Roth IRA is that you don’t face the mandatory withdrawals of a traditional IRA. If you continue working past 70 years of age, you can also keep contributing to your Roth IRA. So if it’s the right choice for you, where’s the best place to open a Roth IRA?

See Also: Can I Retire Now? Find Out If You Can Afford to Retire Now

How to Open a Roth IRA

You can open a Roth IRA with pretty much any broker, although you want to ensure that the one you choose is reputable. You can also open a Roth IRA with a bank, a mutual fund company, or even a robo advisor. Each choice has its own advantages and disadvantages, depending on how you like to manage your money.

If you want to trade in stocks, the best place to open a Roth IRA is with a broker offering low commissions. For a more hands-off approach, a managed account with a robo advisor could be the best place to open an IRA. Robo advisors use a computer to manage your investments according to your goals in return for a small additional management fee.

Target-date funds are another simple option. These are diversified funds that are automatically rebalanced to reduce the risk as you get older and approach retirement age.

Another good reason to open a Roth IRA is that they are very flexible in terms of the assets they can hold. Some deal in real estate or precious metals, but the easiest choice for most consumers is to open a Roth IRA that concentrates on Exchange Traded Funds (ETFs) or stock-and-bond index funds. Easy to understand, these assets are low cost and easy on the red tape.

If you’re not the kind of person who remembers to make regular investments, when you’re choosing the best place to open a Roth IRA, it will be helpful to look for a provider that offers an automatic investment option. Once you’ve told them how much to invest, where to invest, and on what timescale, the rest happens automatically.

Do You Already Have a Roth IRA?

When you’re thinking about the best place to open an IRA, the first thing to do is to check whether you already have one. For most, it makes more sense to add to an existing IRA than to open a Roth IRA. It’s easier to manage one set of investment allocations, and it will mean less paperwork when you’re ready to retire and start making withdrawals. You may also choose to open your Roth IRA with a provider you’re already using for other products—this can help to keep life simple.

Once you’ve decided on where to open a Roth IRA, your chosen provider will be happy to guide you through the process of opening your account. It’s usually a simple process involving a visit to the provider’s website. You fill in your personal information, including your social security number, date of birth, contact details, and information about your employment.

The final step when you open a Roth IRA is just a case of adding funds to your new account, which can be transferred from a bank account, existing IRA assets, or a 401(k). You’ll need to have account numbers and possibly routing numbers on hand.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Where to Open a Roth IRA

While you’re investigating where to open Roth IRAs, you’ll discover that many providers offer a sign-up promotion or bonus to new customers. There may be a minimum deposit required for you to qualify.

Remember to look out for such offers as you’re shopping around, but they shouldn’t be the sole factor involved when you make your decision. Here, we’ll look at some of the other important considerations to take into account when choosing the best place to open a Roth IRA.

There are many companies with whom you can open a Roth IRA account, and we will cover just a few of them below.

However, there may be others, so be sure to do your own research when conducting searches for the best places to open an IRA. When selecting your broker there are a few things to look out for. The best place to open an IRA is with a provider that:

- Has strong customer service and provides plenty of educational material to help you make the best investment choices.

- Offers an IRA with zero or low account fees.

- Provides a large selection of commission-free ETFs and mutual funds without transaction fees.

- Has both a low account minimum and low fund minimums, two separate values that affect the minimum amount you can deposit into your IRA.

Don’t Miss: Best Places to Retire In Florida (What You Should Know Before Choosing Florida)

The Best Places to Open a Roth IRA

We’ve compiled information on just a few of the companies that really stood out during our research in finding the best places to open a Roth IRA.

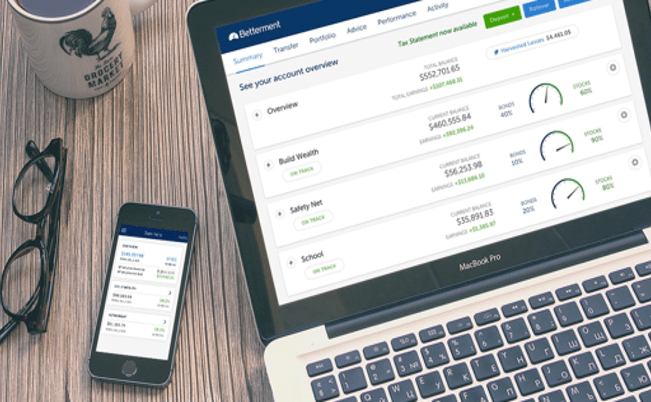

Betterment

Betterment is worth a stop in your search for the best place to open a Roth IRA. This robo advisor is extremely easy to use. You can open an account online and make deposits via bank transfer. An online questionnaire guides investors through deciding how much to invest in bond ETFs and how much in stock ETFs. A best place to open an IRA for hands-off investors, Betterment has no minimum investment and uses a system of tiered fees.

Betterment – Open a Roth IRA

Charles Schwab

Continuing our search for where to open Roth IRAs, we visit Charles Schwab. With commissions of $8.95 for stock and ETF trades, Charles Schwab offers more than 200 commission-free ETFs and more than 3,000 mutual funds with no transaction fees. There is an account minimum of $1,000, but this is waived when there are auto-deposits of at least $100.

Charles Schwab may not be best place to open a Roth IRA if you’re looking to build a portfolio of mutual funds—they have a $76 charge for those.

E*TRADE

Why is E*TRADE one of the best places to open a Roth IRA? It has a $0 account minimum for Roth IRAs. Charging $9.99 per trade, this company also offers volume discounts.

Other reasons to consider E*TRADE when researching where to open Roth IRAs? Investors love E*TRADE for the user-friendly experience you get on the website and in its mobile app. E*TRADE is one of the best-known online brokers.

Cdn.etrade.net – Where to Open an IRA

Cdn.etrade.net – Where to Open an IRA

Fidelity

Fidelity is a massive mutual fund company, offering funds directly to investors and through brokerage firms. They may be the best place to open a Roth IRA, if you can meet their $2,000 minimum investment. There are no ongoing minimum contributions once you have met the minimum.

What are some other reasons you may want to consider Fidelity when you’re looking into where to open an IRA? They have zero fees for IRAs, and if you only invest in Fidelity mutual funds, there are no commission fees. Competition for customers means Fidelity offers very competitive expense ratios.

Firstrade

Firstrade is another low-cost option to consider when you’re on the hunt for the best place to open an IRA. This is a discount brokerage, offering value investing with flat fees under $7. Firstrade even offer some of the lowest fees for mutual funds.

Other factors that make Firstrade a good place to open a Roth IRA include their easy-to-use website, which is perfect if you’re new to investing online. They also offer lots of information and research into mutual funds, ETFs, and stocks.

Related: How Much Money Do You Need to Retire By Age 40, 50, 60, 65?

Lending Club

Lending Club stands out as one of the best places to open a Roth IRA due to its unusual nature. In contrast to other brokers, Lending Club is a top peer-to-peer lender, allowing you to invest in loans that are made to other people. You get to be the bank!

When you’re looking into where to open Roth IRAs, keep in mind that Lending Club partners with another company that sets up a self-directed Roth IRA. These accounts need little maintenance, whilst not limiting you to just stocks.

Motif

For consumers interested in how to open a Roth IRA, Motif offers a different option. They take the time and effort out of choosing which companies to invest in, by offering a choice of ‘Motifs’ that contain 30 different ETFs or stocks in the same industry.

What could make Motif the best place to open a Roth IRA for you is that you can buy a Motif in one simple trade for $9.95. There’s no account minimum, but you’ll need to invest $300 to begin with.

OptionsHouse

If you want trade options, OptionsHouse may be the best place to open a Roth IRA for you. With them, trading options isn’t the only option! If you’re in a position to open an IRA account with a minimum of $5,000 within 60 days, OptionsHouse gives you 100 commission-free trades for stocks or options executed within 60 days of funding.

Ongoing fees are an important consideration when you’re deciding where to open an IRA, and OptionsHouse charge only $4.95 for a stock or ETF trade. Mutual fund trades are a little more expensive, at around $20.

Scottrade

Scottrade is considered to be the best place to open a Roth IRA in terms of customer support. Offering many of the same account features and investment products as full-service brokers, this company also charges lower commissions at $7. Its unique Flexible Reinvestment Program™ means you can invest dividends from stocks or ETFs into other eligible stocks or ETFs, commission free, and there is no minimum investment requirement.

As well as being an online provider, Scottrade has a real world presence. With 500 branches around the country, Scottrade makes it very easy to pop into a branch and discuss how to open a Roth IRA with an experienced advisor. A wide range of investment options and upgraded investment tools are other factors that help Scottrade to stand out against its competition.

Source: Scottrade.com

Free Wealth & Finance Software - Get Yours Now ►

TD Ameritrade

TD Ameritrade offers a $0 account minimum and commissions of $9.99 per trade. One of the best places to open a Roth IRA, it has more than 2,000 transaction fee–free mutual funds and more than 100 commission-free ETFs.

The company has more than 40 years of experience in helping clients pursue their financial goals. It provides experienced, licensed representatives for in-person or one-on-one support via phone, email, and online.

Another factor in making this a good place to open a Roth IRA is that its downloadable platforms give you everything you need to research stocks, place trades, and manage your portfolio.

Source: TDameritrade.com

TradeKing

If cost is the most important consideration when you’re deciding where to open Roth IRAs, take a look at TradeKing. This company has one of the lowest stock trade commissions—just $4.95 per stock trade or ETF trade. That’s ideal if you’re anticipating trading a lot.

More reasons to consider TradeKing when you want to open a Roth IRA include the company’s collection of no-fee funds and its $9.95 fee per no-load mutual fund trade.

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

T. Rowe Price

If you want to play it safe when you open a Roth IRA, it pays to consider an industry leader. T. Rowe Price offers mutual funds directly or through a broker with very competitive expense ratios—meaning your invested dollars will benefit from maximum growth.

Other reasons you may find T. Rowe Price the best place to open a Roth IRA for you include their clear fee structure. You’ll pay no fees if you opt for their electronic statements and confirmations. Their minimum required investment is $1,000 with a $100 minimum subsequent investment.

USAA

For military personnel and their families, the United Services Automobile Association (USAA) could well be the best place to open a Roth IRA. Because they offer a wide range of insurance and financial products, you could choose to have all of your accounts and policies with this one provider.

Since they have been in business since 1922, USAA is a choice that will give you no worries about financial stability when you’re in the market to open a Roth IRA. USAA also has no account set-up or maintenance fees, and there’s no account minimum.

Vanguard

While you’re considering where to open a Roth IRA, check out Vanguard. This company has a wide range of low-cost index mutual funds and ETFs. Its funds do not have sales charges, and you can purchase Vanguard ETFs and funds without paying a commission fee. And their customer service is top-notch.

Vanguard may be the best place to open a Roth IRA if you’re looking for clear cut fees. They’re the industry leader in low cost investments, with easy-to-navigate online account access.

Read More: Saving for Retirement | What You Should Know about Saving for Retirement

Free Wealth Management for AdvisoryHQ Readers

Conclusion: Best Places to Open a Roth IRA

There are many reputable companies offering Roth IRAs, and so it will be possible to find one that matches your saving requirements. Given the differences in fund management techniques, fees and charges and approaches to customer service, it really pays to do your research. Thoroughly check online reviews to draw up a short list, and contact each provider directly to check you’re happy with them managing your money.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.