2017 RANKING & REVIEWS

TOP SMALL BUSINESS LOAN CALCULATORS

Discovering the Best Business Loan Calculator

Opening up your own small business is a huge part of the America ideal. However, many people often wonder if they can afford a small business in the first place.

Whether you’re starting a new business from scratch or you’re hoping to expand your current one, a small business loan calculator can prove to be an incredibly useful tool.

With a business loan repayment calculator, you’ll be able to easily figure out your finances.

Award Emblem: Top 6 Best Small Business Loan Calculators

An online business calculator can be used to help you estimate how much money you’ll wind up paying on your monthly payments.

This fantastic feature of a business loan calculator can help you determine how much money you need to save in order to comfortably pay off your loan.

Since the decision to open up a small business is indeed important, especially financially, choosing the best business loan calculator can assist you enormously.

The Benefits of Utilizing a Top Business Loan Calculator

A business loan payment calculator can be of great service for those of you looking to open your very own small business.

With a small business loan calculator, you’ll be given the opportunity to determine the best financing options for your loan.

Offering the ability to adjust the rates and loan terms you’ve been offered from various lenders, with a business loan repayment calculator, you can better decide which lender is presenting the best proposal.

In the long run, a business finance calculator can help you save money and even clarify whether you would qualify for the loan based on your annual income and other variables.

Planning your finances and saving money are just a few of the benefits you’ll enjoy by using a loan calculator for business.

See Also: Top Credit Cards for Fair Credit | Ranking & Reviews | Best Fair Credit Credit Cards

AdvisoryHQ’s List of Top 6 Small Business Loan Calculators

List is sorted alphabetically (click any of the loan calculator names below to go directly to the detailed review section calculator):

Top 6 Best Business Loan Calculators | Brief Comparison

Business Loan Calculators | Full Amortization Schedule Provided? | Extra Payment Option? | Loan Comparison Available? |

| Citizens Bank | Yes | No | No |

| Fundera | No | No | Yes |

| MortgageCalculator.org | Yes | No | Yes |

| NAB | No | Yes | Yes |

| Shopify | No | Yes | No |

| TD Bank | No | No | No |

Table: Top 6 Best Small Business Loan Calculators| Above list is sorted alphabetically

FAQ Section

What information do I need to provide in order to use a business bank loan calculator?

In order for the business loan calculator to best determine your monthly payments, you’ll have to provide your loan amount, interest rate, and loan term.

Image Source: Pixabay

For a more intricate business loan interest calculator, you may be asked to input some added variables, such as the security type and loan type.

How much money can I borrow?

An incredibly useful feature of a top small business calculator is that many of them can help you understand how much money you’ll be qualified for.

By entering your annual income and comparing it to a loan amount that you are considering, the business calculator online can then determine how good of a chance you have to be approved.

Which small business loan calculator is best for me?

With so many choices in terms of online business calculators, it can feel a bit overwhelming to decide which one is best for you.

If you’re looking for a detailed review of how much your monthly payments will be throughout your entire loan term, then your best bet is to go with a business finance calculator that features an amortization schedule.

However, if you just want a simple output of what to expect with your payments, then following through on a business loan payment calculator that is simple in use would be a perfect choice.

Am I able to play around with the inputs on the business loans calculator?

Yes, in fact it is encouraged. Adjusting the rates on the business loan repayment calculator is a great way to compare rates offered by various lenders.

Using your business loan calculator to compare these rates will help you to choose the most affordable loan repayment plan.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Business Loan Repayment Calculator

Below, please find the detailed review of each card on our list of the top ranking small business loan calculator. We have highlighted some of the factors that allowed these business loan calculator and business loan interest calculator to score so highly in our selection ranking.

Don’t Miss: Which is the Top UK Mortgage Calculator? HSBC? Santander? NatWest? RBS?

Citizens Bank Review

The Citizens Bank business loan calculator is an incredible business loan repayment calculator that can help you plan around your new business loan.

Specifically designed for small business owners who are hoping to expand on their business, this business calculator online will guide you toward your next big business goal.

Image source: Lendio, Inc

Factors the Citizens Bank Business Loan Calculator Utilizes:

- New loan amount

- Interest rate

- Amortization

- Annual income

Key Factors of the Citizens Bank Business Loan Calculator

Loan Qualification Guide

With this loan calculator for business, you can quickly find out the likelihood of being approved for the loan amount you have in mind.

By simply putting all of your income information into the small business loan calculator, you’ll be shown a graph will two variable outcomes.

If your debt service coverage falls in line, this small business loan calculator will let you know that you are more than likely to be approved.

Enter Existing Debt

Another unique aspect of this business loan payment calculator is the ability to take your current debt into consideration.

With this business loans calculator, you can count your current debt and your new loan offer together. This will help you better prepare your business financially for the new monthly repayment schedule.

You can further determine whether this new expansion to your business is a financially sound decision.

Related: Which Is the Best Mortgage Calculator? Google vs. Trulia vs. Bank of America

Fundera Review

The Fundera small business calculator offers borrowers an intricately detailed loan calculator for business.

With a wide variety of calculator choices and an easy-to-use system, the Fundera online business calculator will quickly work out your APR rates and monthly repayment plan.

Highlights of Using the Fundera Business Loan Calculator

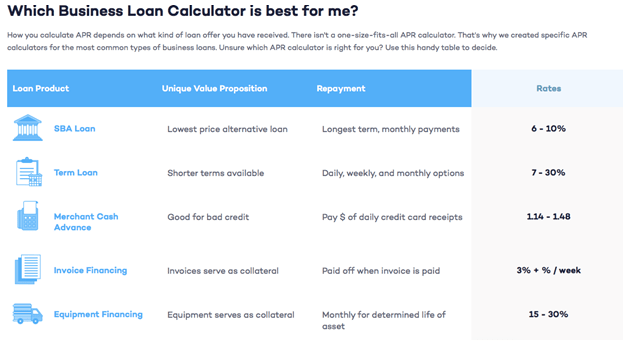

Choose a Calculator Based on Loan Type

Unlike a few of the top select business loans calculators, the Fundera small business calculator gives you the option to choose between calculators.

Some of the calculator loan options offered are:

- Medium-term loan

- Merchant cash advance

- Invoice factoring

- SBA loan

- Short-term loan

- Kabbage business loan

Image source: Fundera

Fundera then explains each type of business loans calculator, assisting you in making the best decision. You’ll be given information on the rates associated with each loan as well as the repayment schedule associated with it.

Loan Option Feature

Along with the Fundera business loan payment calculator is their loan options feature.

With the loan options feature, simply answer some basic questions about your business and credit score, and you’ll be redirected to a page with various loan prices and options to choose from.

You can then take these rates and compare them with the Fundera business loan interest calculator to find the best terms for your business.

Mortgage Calculator Review

For new business owners hoping to gather an accurate estimate on a business loan, the MortgageCalculator.org business finance calculator can help you plan ahead.

Relatively simple to use, this business loan repayment calculator offers a selection of payment amounts along with a fully detailed amortization schedule.

Brief Outline of the Mortgage Calculator Small Business Loan Calculator

Payment Amounts

With the Mortgage Calculator business finance calculator, you can see your various payment options.

These options include:

- P & I payment

- Interest-only payment

- Balloon payment

With these payment options, you can simply figure out your monthly principal and interest payments, your interest-only payment, and your balloon payment.

Having these payment amounts laid out where you can see them can give you a clear indication of the interest rates you’re being offered from various lenders.

Detailed Amortization Schedule

The Mortgage Calculator amortization schedule offered by their business loan repayment calculator is surprisingly useful.

For many small business owners, a detailed overview of how much money will be going into their monthly loan payments can help them better budget their finances.

This small business loan calculator will track month by month your payment, principal, and interest payments. This business bank loan calculator will even show you your balance statement after each payment has been made.

Popular Article: Which Is the Best Mortgage Calculator? Chase? Wells Fargo? CNN?

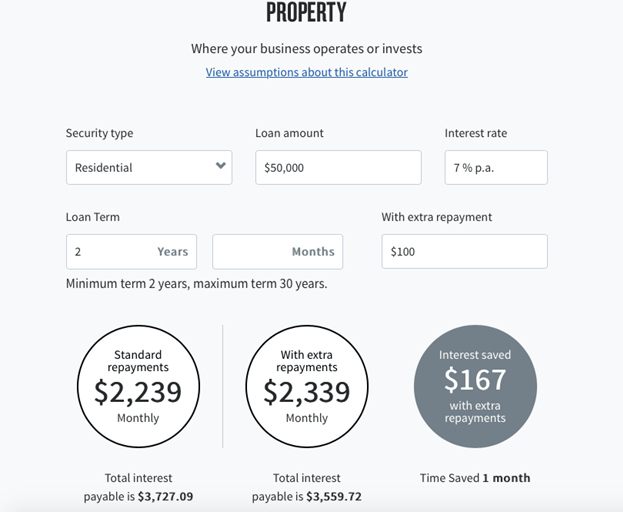

NAB Review

The National Australia Bank offers first time and experienced business owners an intricate business bank loan calculator.

The NAB business bank loan calculator has six different calculators to choose from, all of which interact with keeping your business afloat.

For business owners who are looking to separate their financial payments based on their use, the NAB business loan repayment calculator will certainly come in handy.

Overview of the NAB Business Loan Repayment Calculator

Business Loan Repayment Options

With the NAB business loan payment calculator, you have the choice between a few loan payment options.

These options include:

- Equipment

- Vehicle

- IT

- Stock

- Property

- Other

Each small business calculator option is defined and explained so that you may best understand how to utilize them.

Whether you’re looking to take out a loan in order to purchase some new equipment for your business or are looking to expand your building space, the NAB online business calculator has an option for you.

Extra Payments

Image source: NAB

Each payment option offered by the business loans calculator features an extra payment section.

In the extra payments section, simply add in the dollar amount that you expect to pay extra. The business loan repayment calculator will then add that extra payment into your overall loan term.

The business loan calculator will tell you how many months’ worth of payments you’ll save based on your extra payment.

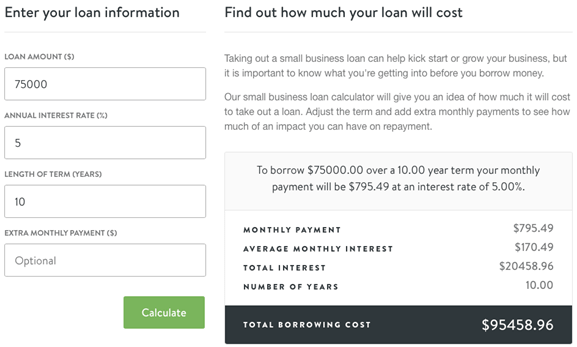

Shopify Review

The Shopify small business loan calculator is a wonderful tool for first-time business owners who want to securely budget their finances.

Their business calculator online is one of the most straight-forward and simple to use. Unnecessary calculator gimmicks won’t badger you with the Shopify business loan interest calculator.

Simply input your loan information, and you’ll be given an estimate in seconds.

Factors Taken Into Consideration with the Shopify Business Loan Calculator:

- Loan amount

- Annual interest rate

- Length of terms (years)

- Extra monthly payment (optional)

Top Aspects of the Shopify Small Business Loan Calculator

Straightforward Calculations

Image source: Shopify

After plugging in all of your information into the business loan repayment calculator, you’ll receive an easy-to-comprehend analysis of your expected monthly payments.

You’ll clearly see your estimated monthly payments along with your average monthly interest and total interest.

All of the computations done by the small business loan calculator take your term amount and interest rate into account.

Read More: Which Is the Best UK Mortgage Calculator? BBC? Halifax? Barclays? Nationwide?

TD Bank Review

Although far from the most multifaceted business loan calculator, the TD Bank small business loan calculator makes up for it with its customer service appeal and simplicity.

With the TD Bank business loan calculator, you’ll have in front of you one of the most uncomplicated business loans calculators that will unlock your monthly payments for you.

Overview of the TD Bank Small Business Loan Calculator

Ease of Use

While making use of the TD Bank business bank loan calculator, you’ll notice that there are only three input options for you to fill out.

These three options are:

- Loan amount

- Interest rate

- Term (months)

Once you’ve completed the rates, you’ll quickly receive your estimate monthly payments from the business loan calculator.

In fact, it is quite rare to find a business finance calculator that has so few steps. You can then adjust the rates according to various offers that you receive.

You can finally make the best business decision after comparing the different monthly rates.

Speak with an Expert

After the business loans calculator gives you a clear indication of your monthly payments, you can then choose to speak to an advisor.

The advisors from TD Bank can give you a clearer understanding of the monthly payments and financing that will be required to start up your small business.

All of this is made available on the page of their business loan calculator.

Conclusion—Top 6 Business Loan Calculators

This concludes our detailed review of the top choices for small business loan calculators.

As you can see, there are a lot of fantastic reasons to make use of a business loan repayment calculator.

No matter if you’re a novice business owner or a more experienced one, a business finance calculator can help you better budget your finances to keep you from missing a payment or taking out a loan that you can’t realistically afford.

With the right loan calculator for business, you’ll be able to compare rates to find the best terms for you and your business.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.