2017 RANKING & REVIEWS

TOP RANKING TAX CALCULATOR CHOICES

What Do You Owe the IRS?

When tax time rolls around, most people want to know how much money will be returned to them. While we all hope for that number to be a positive one, we prepare ourselves to see it dip into the negatives as we shell out money owed to the federal government.

An online tax calculator can help you to figure out your income taxes and your deductions based on your income. A taxable income calculator can help you to determine the correct filing status based on your income and expenses. If you need to anticipate the upcoming tax season, a free tax calculator can help.

Award Emblem: Top 6 Best Tax Calculators

You will need to gather up some of your personal information including filing status, information regarding your dependents, your yearly income, and the expenses you had this year. A good online tax calculator (and even a simple tax calculator) will take all of these things into consideration to provide you with the information you need.

Here at AdvisoryHQ, we understand how much stress can be associated with tax season. To alleviate of some of the stress, we compiled this list of online tax calculator choices to help you do the math.

Save yourself the headache of reading lengthy IRS documents and doing calculations by hand. Let one of these free tax calculator choices do some of the work for you this season.

See Also: Top Good Credit Cards for Excellent & Good Credit | Ranking & Reviews | Top Rated Best Credit Cards

AdvisoryHQ’s List of the Top 6 Best Tax Calculator Choices

List is sorted alphabetically (click any of the calculator names below to go directly to the detailed review section for that tax calculator):

- Bankrate Income Tax Calculator

- H&R Block Free Income Tax Calculator

- Liberty Tax Tax Estimator

- SmartAsset Federal Income Tax Calculator

- Turbotax Free Income Tax Calculator

- TaxAct Tax Calculator

Top 6 Best Tax Calculator Choices | Brief Comparison & Ranking

Tax Calculators | Highlights | Best for |

| Bankrate Income Tax Calculator | Very detailed questionnaire regarding deductions | Detailed Information |

| H&R Block Free Income Tax Calculator | Can be used for self-employment Only answer questions that apply to you | Fast Information |

| Liberty Tax Tax Estimator | Simple to use Basic deduction options | Steady Employment |

| SmartAsset Federal Income Tax Calculator | Requires you to know which deductions you qualify for Very short questionnaire | Pre-Organized Deduction Information |

| TurboTax Free Income Tax Calculator | Shows projected taxes as you progess Only answer questions that apply | Understanding Deductions |

| TaxAct Tax Calculator | See your forecasted refund as you go Good for popular deduction choices | Common Deductions |

Table: Top 6 Best Tax Calculator Choices | Above list is sorted alphabetically

Determining Income Tax

For many individuals, understanding the intricacies behind the taxes demanded by the Internal Revenue Service is beyond complicated. The math behind it can be confusing, but that is where a good IRS tax calculator can come into play.

However, we believe that you should have some idea of the reasoning behind the various tax calculator choices that are available. Why is certain information critical to have? What do you really need to know in advance in order to use a simple tax calculator efficiently?

Image Source: Pexels

The federal government determines your taxes and withholdings in large part based on your annual gross income. This is the starting point for many of the other qualifications that are used by a tax income calculator. Getting your annual income down to the penny isn’t necessary, as these are mostly calculated in ranges.

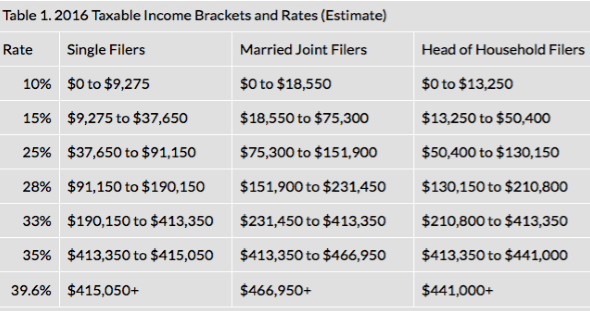

From there, a free tax calculator will look at your filing status. Each year you must select a filing status: married filing jointly (or qualifying widower), single, head of household, or married filing separately. The income ranges for each filing status determine your current tax rate.

Your tax calculator will take your tax rate into account when determining what you should owe at the end of the year. These rates range from as low as 10% all the way to 39.6% based on how much you earned. The lowest tax rates correspond with the lowest income ranges on the chart.

For more information on which filing status and income tax rate you qualify for, see the chart below:

Image Source: taxfoundation.org

Any U.S. tax calculator should take these income brackets and rates into account when calculating your income tax and expenses. Beware of any IRS tax calculator that does not work take your income and filing status into account. It will be next to impossible to make any calculations with a free tax calculator without these numbers in mind.

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Tax Calculator Choices

Below, please find the detailed review of each calculator on our list of free tax calculator choices. We have highlighted some of the factors that allowed these taxable income calculator choices to score so highly in our selection ranking.

Don’t Miss: The Best Retirement Calculators | Guide | Top Retirement Savings & Income Calculator

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Bankrate Income Tax Calculator Review

For those who have the time to input and wade through their data, the Bankrate Income Tax Calculator provides a detailed taxable income calculator. Their tax estimate calculator covers eight separate categories in order to give you a projected dollar amount for what you will owe the IRS at tax time.

You’ll need information regarding your exemptions, income, tax credits, deductions, and more in order to get an accurate number from their free tax calculator.

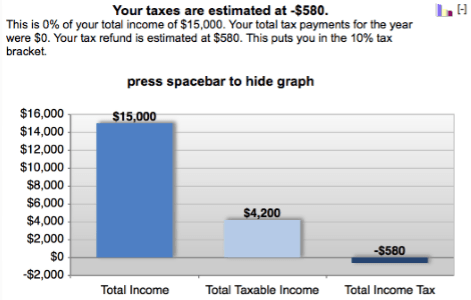

This Bankrate free tax calculator is based on the income brackets set out by the IRS. With these numbers in mind, it assembles a small bar graph displaying your total income alongside your taxable income. All the way to the right is a third column that represents the total income tax owed to the government.

Image Source: Bankrate

Best for Detailed Information

The only way this online tax calculator can work accurately is with all of your tax information at the ready. You’ll have to know upfront which deductions you intend to take and any exemptions you qualified for throughout the year. If you plan to itemize your deductions, this needs to be available as well.

Without a detailed record, the working tax calculator cannot produce accurate numbers regarding your bill or refund for the 2017 tax year.

This income after tax calculator will work best for individuals who keep detailed records and notes on their tax status throughout the year. Information that is readily available makes this free tax calculator simple to use and provides a very thorough report.

H&R Block Free Income Tax Calculator Review

With a sleek interface that doesn’t overwhelm you at first glance, the H&R Block Free Income Tax Calculator walks you through the most important questions. This simple tax calculator feels more user-friendly than the option available through Bankrate but still gives you a fairly detailed result.

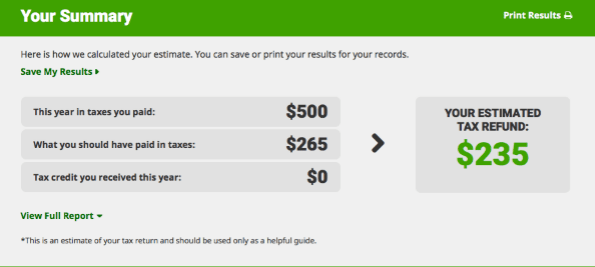

You’re walked through the process screen-by-screen for a total of six overall questions. You won’t need to wade through questions that don’t apply. Instead, you tell H&R Block which of the income options and expense options will apply to your taxes this year.

Image Source: hrblock.com

From there, their simple tax calculator can show you what you have paid in taxes, what the government should have been paid in taxes, and an estimated refund overall. It even allows for self-employment and accounts for any quarterly taxes already paid.

The downside to the H&R Block Free Income Tax Calculator is the sales pitches that surround their website. If you are using their simple tax calculator solely to get your information, you may be bothered by the extensive advertisements about having them file your taxes for you.

Best for Fast Information

The H&R Block Free Income Tax Calculator is ultimately best for individuals who don’t have much time to devote to using an online tax calculator. Their simple tax calculator can walk you through all of the steps in just a few minutes.

It does require you to have plenty of information handy, including your W-2 and any information required to prove your deductions and expenses. However, it is overall a very simple tax calculator that gets the job done quickly with little effort on your part.

Related: The Best UK Mortgage Payment Calculators | Lloyds vs TSB vs Tesco vs Woolwich

Liberty Tax Tax Estimator Review

The Liberty Tax Tax Estimator allows consumers to estimate their tax refund quickly and efficiently in just six screens. They tell you in advance to have pertinent forms and documents ready, including your W-2 and other investment, income, or property information.

While there are a lot of questions to go through on these screens, it is relatively simple and easy to follow. Skip the questions that do not apply to you and keep moving on. It can account for deductions including:

- Child and dependent care credit

- Education credit

- Retirement contribution credit

- Child tax credit

Overall, it provides a thorough after-tax pay calculator to help you determine what should have been paid to the federal and state governments throughout the year. This information is compiled to estimate what you will owe or receive back at the end of the year.

Best for Steady Employment

The Liberty Tax Tax Estimator works best for individuals who are steadily employed by one employer throughout the year. While you can add your wages, salaries, and tips together from a number of W-2s, it creates an extra step on an otherwise simple tax calculator for those who have several jobs.

It also lacks the detailed information and questions available for individuals who are self-employed, information that is available through some of the other online tax calculator choices.

Overall, the Liberty Tax Tax Calculator is a thorough and quick option to read through when you have all your information at the ready. You may prefer a different option if you have several jobs or are looking for a detailed online tax calculator for self-employment taxes.

SmartAsset Federal Income Tax Calculator Review

If you don’t have the time or the information available to answer the longer questionnaires provided on some online tax calculator choices, the SmartAsset Federal Income Tax Calculator is the best choice.

The only financial details you are required to have available are your:

- Household income

- Location

- Filing status

You have the ability to move under the advanced section to look at possible deductions. These sections include your 401(k) contributions, IRA contributions, itemized deductions, and dependents. With just these questions, their income after tax calculator allows you to see specifically what is owed to the government.

Specific rates can be viewed in the chart beneath the questions, demonstrating a marginal and effective tax rate. With your after-tax pay calculator figured out, it’s easier to determine your overall tax burden for the year. The rest of your taxes are configured into a colorful graph to demonstrate where all of your taxes are allocated.

Best for Pre-Organized Deduction Information

If you already have your itemized deductions organized for the year, the SmartAsset tax calculator will be significantly easier to use. Unlike options such as the Bankrate or H&R Block tax calculator programs, the SmartAsset after-tax pay calculator expects you to already have this number tallied up.

Individuals who don’t need to be walked through all of the potential deductions will like the simplicity of the SmartAsset taxable income calculator. Those looking for a tax deduction calculator will be disappointed with the general questions posed by this simple tax calculator.

Popular Article: Which Mortgage Calculator Is the Best? Yahoo? Bankrate? Dave Ramsey Mortgage Calculator?

TurboTax Free Income Tax Calculator Review

The TurboTax Free Income Tax Calculator should be in a format familiar to many individuals who file their taxes through the program. This tax estimate calculator has the same clean interface and design as the purchased program and is very simple to use.

It allows you to answer only the questions that pertain to you. Select from categories including self-employment, homeownership, childcare, education, and several others. In this way, you are walked through the most common deductions taken on their tax estimate calculator.

Image Source: intuit.com

As you go, you can see how your federal taxes change on their simple tax calculator. When you qualify for deductions and exemptions, the red number may change to green. It’s always easy to know where you stand with the IRS tax calculator from TurboTax.

Similar to the H&R Block tax calculator, it is laden with advertisements to purchase the program for yourself. Fortunately, these ads are mostly located at the bottom of the page and can be ignored if you prefer. At the time of this tax calculator review, they were offering discounts on the programs that matched your profile.

Best for Understanding Deductions

For those who really want to understand how their deductions affect their federal taxes, the TurboTax Free Income Tax Calculator is a good choice. Most of the other U.S. tax calculator choices will only show the amount owed or refunded at the very end of the questionnaire.

The TurboTax tax estimate calculator allows you to see what effect they have as you go. It could be a great way to make use of some additional retirement contributions or charitable giving to minimize your tax bill. This tax income calculator allows you flexibility to understand how deductions affect your bottom line.

Read More: Which is the Top UK Mortgage Calculator? HSBC? Santander? NatWest? RBS?

TaxAct Tax Calculator Review

For individuals in need of a simple tax calculator that dives into the specifics, the TaxAct Tax Calculator is likely to be a good fit. You’ll cover all of the basic categories, including your information, income, deductions, and credit before being given a thorough results page.

Their credits and deductions are not as detailed as many of the other free tax calculator choices from other programs. However, they do include the most popular ones:

- IRA contributions

- Education tax credits

- Mortgage interest

- Charitable contributions

The TaxAct Tax Calculator works well for individuals who want to fill out the information as they have it available. Many of the other tax income calculator choices only allow you to input information on the screen currently available. The TaxAct online tax calculator allows you to flip through the tabs as you see fit.

Best for Common Deductions

The TaxAct Tax Calculator will work best for those who know that their taxes are relatively basic to complete. Their tax deduction calculator is easy enough to use but lacks some of the more rigorous questions available through programs like the Bankrate tax calculator.

If all of your deductions are relatively normal and fall into the common categories, the TaxAct Tax Calculator will allow you to work quickly and efficiently. You’ll even be able to see your forecasted refund on the side of their income after tax calculator. Those searching for a more detailed tax deduction calculator may walk away disappointed, though.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion—Top 6 Best Tax Calculator Choices

Are you prepared for your taxes this year? Having all of the information out and at the ready can give you a head-start on what you will earn or owe at the end of the year.

Most of us lack the ability and know-how to figure our own taxes with nothing but the IRS worksheets. These taxable income calculator programs provide a solution that requires very little math on the part of the user. All you need to do is type the numbers available on your documents to move forward.

This is a great time and place to experiment with what additional charitable contributions or retirement account contributions could mean for your end-of-year tax bill. A good online tax calculator can help to answer questions and leave you feeling more prepared for the upcoming tax season.

Which one of these free tax calculator programs will be the best choice for you? It depends on how detailed your taxes will be and how thoroughly you’re already prepared. We’re confident that you’ll find at least one program on this list to help you enter into the coming season confident and prepared.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.