2017 Comparison Review: Chase Slate Card vs Capital One® Platinum Credit Card vs PNC CORE VISA® vs BankAmericard® Credit Card

Over 167 American adults have a credit card. With countless options for a credit card, it often isn’t easy to find the best credit card for you.

There are many credit card issuers, and each of these issuers has multiple credit card offerings. Choosing whether to consider a credit card from Bank of America or browse through the Capital One credit cards offers is not always an easy decision to make.

With numerous credit card issuers offering so many credit cards, each with distinct features, it may seem impossible to choose just one.

At AdvisoryHQ, we like to make things easier for you. That is why we break down four different credit cards for you, doing a detailed review of each.

Throughout this article, examine the different features of each credit card. We compare how some cards stand out against the others, so that you can decide, based on your individual needs, which credit card to choose for your wallet: the PNC CORE VISA®, BankAmericard® Card, Capital One® Platinum Credit Card, or Chase Slate® Credit Card.

See Also: The Best Credit Union Credit Cards with Good, Bad, or Average Credit | Guide

Why Open a Credit Card Without Cash Back?

There are many positives to opening a credit card like the Slate from Chase. Many credit cards offer cash back or rewards programs, but the Chase Slate card, Capital One® Platinum card, BankAmericard® Credit Card, and PNC CORE VISA® do not.

Source: Fast Credit Card Approvals

People often hunt for credit cards with cash back, but there is more to a credit card than rewards offers. The Capital One® Platinum MasterCard benefits and PNC Bank credit card benefits have other rewarding features that can be hard to find in rewards credit cards.

Aside from allowing you to partake in the world of e-commerce, cards like the PNC Bank credit card and Chase Slate card have special features. Some cards, like the PNC credit card, have introductory APR periods, while others, like the Chase Slate® Credit Card and Capital One® Platinum Card, have lower fees. One of the Capital One® Platinum MasterCard benefits is that the card has no balance transfer fees.

Every card in our comparison of Chase Slate® Credit Card vs Capital One® Platinum Credit Card vs PNC Bank Credit Card vs BankAmericard® Credit Card has unique features that you should take a moment to consider.

2017 Comparison Reviews

The list below is sorted alphabetically:

- BankAmericard® Credit Card

- Chase Slate® Credit Card

- Capital One® Platinum Credit Card

- PNC CORE VISA®

2017 Comparison Table

Credit Card Names | Annual Percentage Rate (APR) | Annual Fee | Type of Credit Needed | Sign-Up Bonus |

| BankAmericard® Credit Card | 11.24-21.24% | None | Average – Fair | None |

| Chase Slate® Credit Card | 13.24-23.24% | None | Fair – Excellent | None |

| Capital One® Platinum Credit Card | 24.99% | None | Average – Fair | None |

| PNC CORE VISA® | 10.24-20.24% | None | Fair – Excellent | $100 if you spend $1,000 in 3 months |

Table: 2017 Comparison Table: Chase Slate® Credit Card vs Capital One® Platinum Credit Card vs PNC CORE VISA® vs BankAmericard® Credit Card

Chase Slate® Credit Card vs Capital One® Platinum Credit Card vs PNC CORE VISA® vs BankAmericard® Credit Card

When you are comparing credit cards like the PNC credit card and Slate from Chase card, there are certain things that need to be considered.

The most important points to consider when comparing credit cards are:

- Fees

- APRs & introductory offers

- Type of credit needed

- Cash back rewards & sign-up bonus

Source: The Telegraph

Though we detail these features in the sections below, it is important to remember to choose that card that best fits your needs. Just because a card has many benefits doesn’t mean it is the correct card for you.

Whether you choose a credit card from Bank of America, look at the Capital One credit card offers, decide on the Slate from Chase, or read through the PNC credit card offers, choose a card that best meets your needs.

Don’t Miss: Top Best American Express Card Offers & Benefits | Ranking | Compare Top AMEX Card Offers

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Fees

Credit card companies make some of their profits by charging fees on credit cards like the Capital One® Platinum Card. Some of these fees are avoidable, while others you might be charged regardless. It is always important to have an understanding of the fees that are associated with the credit card that you choose.

One fee that some companies charge is an annual fee. You get charged this fee every year on your card anniversary date. Though it is a funny way of thanking you for another year of loyalty, credit card companies charge these nonetheless.

Thankfully, none of the credit cards on our list has an annual fee. Whether you get the Capital One® Platinum Card, BankAmericard® Credit Card, or one of the others, you will never see an annual fee charged to your account.

A balance transfer fee is another fee to consider, especially if you are planning to transfer a balance from another loan or credit card. It is rare for a credit card not to have this type of fee, but the Capital One® Platinum Credit Card does not. This is a great feature to have if you need to transfer a balance onto your new card.

The Chase Slate® Credit Card comes in second, with no balance transfer fee for the first 60 days, before it jumps up to 5%. The PNC CORE VISA® card and BankAmericard® Credit Card each have a 3% balance transfer fee. If you are going to complete balance transfers in the first 60 days, the Chase Slate® Credit Card is not a bad option, but any time after that, you would be better off with one of the others.

Another fee to look at is cash advance fees. The BankAmericard® Credit Card has a variable fee between 3% and 5%, while the Capital One® Platinum Card has a set fee of 3%. The PNC and the Chase credit card have cash advance fees of 4% and 5%, respectively.

Finally, if you are looking for a credit card to use internationally, it is important to look at foreign transaction fees. This is a percentage that you are charged on your purchase if you card is used outside of the country.

The PNC CORE VISA®, BankAmericard® Card, and Chase Slate® Credit Card each has a foreign transaction fee of 3%. This is on the lower end of foreign transaction fees, but it is still better to have no fee at all.

When you are going through all of these credit card offers, be sure to pay close attention to the fees. Determine which are most important to you and single out the cards that have the best – or no – fees for what you want to do.

Related: The Best Business Credit Cards | Citi vs Wells Fargo vs U.S. Bank vs Chase Business Credit Card

APRs & Introductory Offers

An annual percentage rate (APR), is the annual rate charged if you do not pay your credit card balance in full every month.

When you are looking for a credit card, it is better to select one with a lower APR. This is especially important if you regularly carry a balance on your card. If you pay your bill in full each month, this is less of a concern, but you never know when a financial crisis will hit.

The PNC CORE VISA® has the lowest APR on our list, with a variable APR between 10.24 % and 20.24%. Only slightly higher, the BankAmericard® Credit Card has a variable APR between 11.24% and 21.24%. These are good options for a credit card if it looks like you will be carrying a balance over from month to month regularly.

The Chase Slate® Credit Card is also a good card, but it has a slightly higher variable APR at 13.24% – 23.24%. With a set APR of 24.99%, the Capital One® Platinum Credit Card is not a good card to carry a balance on. You will accrue a lot of interest that may take you a while to pay off.

Some credit card companies offer introductory APR periods on cards like the Chase Slate® Credit Card. During this time, you will see a low APR – often zero percent – for purchases, balance transfers, or both. This entices you to use their credit card, but the benefit is all yours.

A card like the PNC CORE VISA® with a zero percent introductory APR offer means that you can make big purchases and pay them off over time without accruing interest. It is important to be responsible and never charge more than you will be able to pay off, but this is a great feature to have.

Unfortunately, the BankAmericard® Card and Capital One® Platinum Card do not have introductory offers for purchases. However, the BankAmericard® Credit Card does offer 0% APR on balance transfers for 18 months. This is great if you want to transfer a large balance from another card to bail yourself out of some debt.

The PNC CORE VISA® and Chase Slate® Credit Card both offer 0% introductory APR periods that last for 15 months for both purchases and balance transfers. Although this is less than the period that the BankAmericard® Credit Card offers, you will get the benefit of 0% APR for purchases as well as balance transfers.

When looking at APR offers, it is important to know what you are looking to do with a credit card. If you want to transfer a balance, the BankAmericard® Credit Card might be a good option. If you have larger purchases coming up, you might want to apply for the PNC CORE VISA® or Chase Slate® Credit Card.

Type of Credit Needed

When considering applying for a card like the Capital One® Platinum Card, it is important to know your credit score and how it compares to the credit needed to qualify for a card.

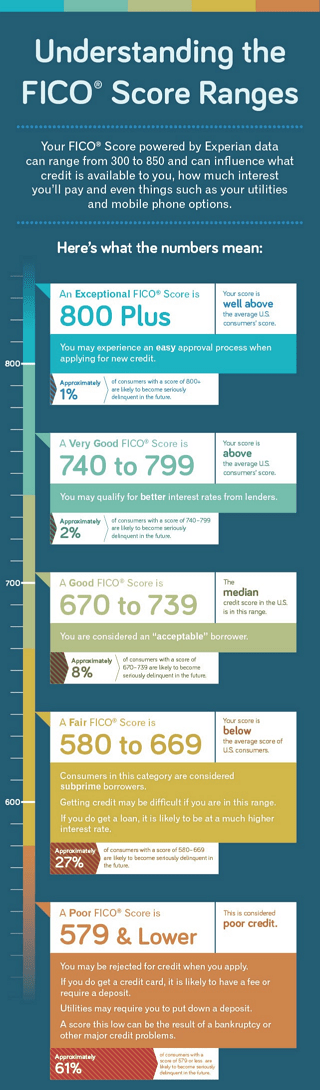

Before getting into card specifics, you must know how credit score ranges work, and what constitutes good credit. The chart below from Experian gives a breakdown of FICO credit scores. Anything over a 670 is a good score, and anything lower than a 579 is generally considered a poor score.

Source: Experian

You do not want to apply for a credit card that you will not qualify for, so it is a good idea to know what the credit requirements of a specific credit card are beforehand. There are credit cards that you can get with a bad credit score, but not on our list (if you have bad credit, we recommend checking this list).

However, with average credit, which is assumed to be just below 600, you may qualify for the BankAmericard® Credit Card and Capital One® Platinum Credit Card.

To get the PNC CORE VISA® or Chase Slate® Credit Card, you will need to have fair to excellent credit. Fair credit is generally above 600, while excellent credit tops the 800 mark.

Credit scores are not the only factor that companies look for when approving you for their credit card, but it is definitely an important factor that they consider. Having a credit score below a certain threshold will likely disqualify you immediately for a card like the Capital One®Platinum Card.

If you have a credit score that falls well below the 600 mark, you can consider a secured credit card, or work to improve your credit score so that you can qualify for the Capital One® Platinum Credit Card, BankAmericard® Credit Card, Chase Slate® Credit Card or PNC CORE VISA®.

Popular Article: Top Best Canadian Credit Cards | Ranking | Best Canadian Rewards and Low Interest Credit Cards

Cash Back Rewards

The average number of credit cards held by Americans who have credit cards is 3.7. That is why credit card issuers offer rewards to entice customers to use their cards over the competitors. Unfortunately, none of the credit cards in our comparison has cash back or rewards.

While other Capital One credit card offers include cash back rewards programs, the Capital One® Platinum Credit Card does not. Another credit card from Bank of America could have cash back rewards as well, but the BankAmericard® Credit Card does not.

Again, cash back rewards are a great feature to have, but the cards on our list have other features that make them stand out.

Sign-Up Bonus

Though none of the credit cards on our list offer regular cash back rewards, one offers a sign-up bonus. A sign-up bonus is an incentive that companies offer – generally in cash back, points, or miles – to get you to sign-up for their card.

Of the four cards, only the PNC CORE VISA® has a sign-up bonus offer. This card offers $100 cash back. To earn this sign-up bonus of $100, you must spend $1,000 in the first three months.

It is important to remember that just because the PNC credit card offers a sign-up bonus does not mean it is the best credit card for you. Keep in mind all of the other features of each card, and the Capital One® Platinum MasterCard benefits, and benefits of the other cards as well.

Conclusion: Chase Slate® Credit Card vs Capital One® Platinum Credit Card vs PNC CORE VISA® vs BankAmericard® Credit Card

When choosing between the credit card from Bank of America, the Chase Slate® Credit Card, or any of the Capital One credit card offers, it is important to know what you are looking for in a credit card.

The main features to look at in each credit card are:

- Fees

- APRs & introductory offers

- Type of credit needed

- Cash back rewards & sign-up bonus

Though it is important to take these things into consideration when deciding between a credit card from Bank of America and one of the others on our list, make sure you choose the credit card that has the features you are looking for specifically.

Do you want a credit card that has a long introductory APR period? Do you need a credit card that has no foreign transaction fee, since you often travel internationally? Do you want a credit card that has a sign-up bonus like the PNC credit card?

Questions like these are important to ask yourself. Be sure that you decide what you need most in a credit card and choose accordingly.

Read More: Best Starter Credit Cards | How to Find the Best Credit Cards for Young Adults

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.