Why Open A Savings Account For Your Child?

Opening a children’s savings account is rarely a priority for a parent. The very thought of a savings account for children seems counterintuitive. Why does someone who cannot even write their name need savings?

The answer is simple: bank accounts for children offer them the tools to capitalize on their single greatest characteristic, their youth.

When you open a bank account for a child, you are opening opportunity. When you start saving and investing at a young age, you are optimizing the power of growth and compounding.Opening a savings account for a child offers a real world tool for them to learn the least understood concept of our time: personal finance.

The findings from a survey conducted by the University of Washington and The Aspen Institute underscore this truth. Their findings revealed that, “The financial literacy of high school students has fallen to its lowest level ever.” As a result, the responsibility to teach these skills by opening a savings account for a child falls to the parents.

Even those who do enroll in financial literacy programs rarely benefit from the experience. The authors of the study summarize, “We have long noted with dismay that students who take a high school course in personal finance tend to do no better on our exam than those who do not.”

If the education system is failing in this task, how can the simple concept of savings accounts for children yield better results? The answer: they’ll have a genuine, non-textbook experience. Real dollars will be reflected in real accounts that earn real returns.

A child’s educational experience extends beyond the classroom. As the previously referenced study proves, parents must be active educators themselves. Debt is becoming the plague of the 21st century.

It is a burden that can easily become lifelong. Bank accounts for children can be the cure — and it’s free. In fact, it’s better than free; it’s a cure that pays you and your child not just in knowledge but in fiscal growth.

In this article, we’ll review how to open a bank account for a child. Every child is different and yet every child can benefit from this lesson. To start, the parent must first know what questions to ask.

See Also: How to Choose a Bank | Guide on Choosing the Right Bank for You

Identify Your Goals

Savings accounts for children can be optimized for different goals. While the primary goal is education, there is always a more long-term underlying goal. This is where styles can differ. Children’s saving accounts should be suited to the ultimate lesson intended. For this reason, ask yourself what you want to get out of opening a savings account for a child. No matter what your individual goal, the experience of children’s savings accounts should consist of these six key concepts:

- Learning the concept of yields

- Capitalizing on long-term investing

- Understanding the magic of compounding

- Gauging the risks involved with money management

- Measuring the value of different financial services

The beauty of these components is their universal nature. These concepts can be applied to lifelong personal finance experiences. Whether starting a business later in life or managing a retirement savings account, these skills will see practical application well beyond childhood.

Image Source: Savings Account for Children

When opening a savings account for a child, you’ll need to make your intent clear. The consistency of the lesson is critical as this ties to the discipline that is the foundation of personal finance. The very practice of opening a bank account for a child with clear goals is itself part of the lesson.

Without this set list of goals in mind, the destination will be obsurced. Measuring success will become difficult. Savings accounts for children are roadmaps to be followed over an extended period. The longevity is what will build value. This is seen particularly in investment accounts.

To align your child with these goals, be sure to make the account in their name. An account for your child in your name squleches the “realness” of the exercise. Without a children’s savings account that bears their name, the sense of responsibility is lost. The deposits and benefits will be theirs.

Don’t Miss: Finding the Best Student Accounts | What You Should Know

Getting Started with Yields

The act of opening savings accounts for children should be accompanied by this phrase: “first you work for your money, then your money works for you.” Your child should carry this message throughout life.

Generating cash through an annual perceantage yield (APY) underscores the critical concept of value dervived from the postponement of consumption. When you open a savings account for a child and leave money untouched in an institution, you are resisting the urge to spend. Your children’s savings accounts will be rewarded for this in the form a return on the investment. Granted, this APY will be low. However, the greater value lies in the concept the experience provides. Save your money and the reward will be threefold:

- You’ll earn money on your savings (APY)

- You’ll exercise self discipline

- You’ll become incentivized to save more

APYs vary among institutions. Put simply, an APY is the return you can expect on your savings account balance. In some cases, this percentage can be as high as 6%. However, more commonly the APY will land closer to 1% or 0.75%, as the higher rates are usually seen with certain credit unions that have membership requirements. Later in this article, we’ll look at which banks offer the best APY and how opening a bank account for a child can maximize this return.

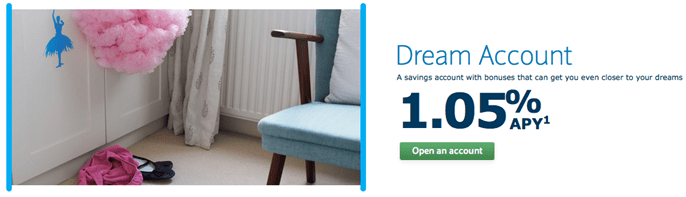

Image Source: Children’s saving accounts

Nearly all banks offer strong cutomer service and a simple user interface. Often, the major differentiating factor is the APY. When asking how to find the best bank account for a child, start with the APY.

Be sure to avoid confusion with APR, which is more applicable to credit cards and compounds differently. Be prepared to meet the required minimum deposit (reviewed later) in your children’s savings accounts. These amounts can vary.

Long-Term Investing

This is where the real money will be made. Savings accounts for children offer a prolonged time horizon unavailable to parents. With a long-term commitment to saving and the potential of decades of growth, bank accounts for children can generate incredible returns.

This return can come in the form of an APY. However, even greater returns can be seen with savings that are invested.

Consider the difference that comes from starting early with savings accounts for children. A $1,000 investment made at the age of 5 will more than double, reaching $2,397 by the age of twenty. If this same parent were to open a bank account for a child at the age of 10 the value at 20 would only reach $1,791. This scenario assume the reasonable annual rate of return of 6% from an investment in mutual funds and ETFs, but your actual mileage may vary.

This key principle illustrates the value of self-control. The longer a child is willing and able to exercise retraint, the more money they will make.

The greatest impacts of children’s savings accounts are seen later in life when the growth gains speed. Opening a bank account for a child accesses the power of long-term growth. This restraint should come easy as children at such a young age will rarely seek an ATM withdrawal. Out of sight will be out of mind — a wonderful way to let savings mount unfettered.

Grandparents can be an equally powerful support for this practice. Opening savings accounts for grandchildren can boost the savings and thus boost the growth. If your children’s grandparents are interested in playing a role in their financial literacy, ask if they’ll offer to contribute a sum to the children’s savings accounts. The participation of the wider family sends a more compelling message to the child.

Related: MySavingsDirect Review – What You Need to Know Before Using MySavingsDirect (Reviews)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Compounding

Savings accounts for children are the most efficient tool for capitalizing on the magic of compounding. Put simply, compounding is the benefit of earning a return on your previous returns.

The benefits of youth promise wonderful riches simply because a young saver and investor has the ultimate asset of time.

The science behind this powerful force has been clearly etched in history. Author Jeremy Siegel in his book Stocks For The Long Run explains that over the past 200 years, investors in the U.S. have experienced compound annual returns on stocks of almost 7%.

At this rate, children’s savings accounts will see the investment double every 10 years. The earlier they start, the more 10-year increments they’ll have to enjoy.

The best way to achieve this value is with one single investment made upfront. While some will advocate a dollar cost average approach, history has decided the clear winner. Making investments as the money becomes available is a fine idea. However, if you’re able to manage a lump sum strategy, it will be well worth it when you open a bank account for a child.

Vanguard conducted a 2012 study exploring this phenomenon. They compared the benefits of dollar cost averaging to a more aggresive lump sum approach. Their findings: “lump sum investing approach has outperformed a dollar cost averaging approach approximately two-thirds of the time.”

The study proved that the superior cost basis of an early investment yielded greater value over time.

The most important takeaway here is that children’s savings accounts should be started as early as possible. Compounding is that tumbling snow ball rolling downhill. With a longer slope, you can expect a larger mass when you reach the bottom. Low-cost mutual funds and ETFs make a simplified, passive approach to opening savings accounts for children easy and fast.

This can be done with a simple Uniform Transfers To Minors Act account (UTMA). With this option, a parent or guardian manages the child’s account. This tax-friendly savings account for children allow children to grow savings without a tax burden later in life. The assets will become the legal property of the child upon reaching adulthood (usually defined as 18).

Understanding Risks

The risks are low compared to the benefits when opening savings accounts for children. However, there are some that should be noted. When opting for a UTMA when you start a bank account for children, you need to remember that upon reaching 18 your child will have complete control over the assets. This can be a dangerous age to take responsibility for a sum that has had the opportunity to grow over the years.

Even though you, as a parent, opened the account, you will not be able to influence how the money is used once it is the property of your child. Understanding how to open a savings account for a child means understanding how your child will grow and mature over the years. Bank accounts for children offer enormous power, so be sure to instill financially responsible behavior early so the funds are used appropriately.

If opting to invest when creating a savings account for your children, remind yourself that some years you are likely to lose money. This is the natural cycle of stock markets. This inevitable event is an important component of the educational process. Sticking to a plan and remembering your stated goals in the face of adversity is critical to lifelong financial success. Don’t open a bank account for a child if you are unable to weather the storm.

The game will change. It is fine to make some changes to the plan, but keep them minimal. Rebalancing an account will have limited downsides, yet changing course dramatically will become a temptation at times. Avoid this.

Unexpected expenses will arise. Your resolve to leave the account untouched will be tested. Remember the wise advice of former U.S. Federal Reserve Board Chairman Ben Bernanke who offered, “In our dynamic and complex financial market-place, financial education must be a life-long pursuit that enables consumers of all ages and economic positions to stay attuned to changes in their financial needs and circumstances and to take advantage of products and services that best meet their goals.” Children’s savings accounts are an exercise in responsibility for the parents as well.

Popular Article: GE Capital Bank Reviews – Is GE Bank Safe? GE Capital vs. GE Retail Bank

Best in Class Ranking

Going for APY:

Incredible APY rates for children’s savings accounts are possible, but restrictions apply. The Junior Airsavings account offered by Main Street Bank offers an almost unheard of 4.00% APY. However, the account must be opened at one of only a few branch locations located in Virginia only.

The Barclays Dream Account is specially designed for children. Anyone interested in opening a savings account for a child will find this to be an easy option. The respectable 1.05% APY allows for deposits up to $1,000 per month. A 2.5% bonus is rewarded to those who make consecutive deposits in their children’s savings accounts for six months.

Image Source: Barclays Dream Account

Explore credit unions for competitive APY rates. If you belong to a credit union, inquire about their offerings. If you don’t belong to a credit union, don’t be dissuaded. Many have very relaxed requirements for entry. Getting in for a children’s savings account that offers a good APY will be worth the paperwork.

Going for Low-Cost Investing:

If you prefer to play the investing game and forego APY rates, consider Vanguard. This is a great place to open savings accounts for children. Funds can be easily invested through the use of low-cost mutual funds. UTMAs are a breeze, and other basic options are available. Customer service is impeccable, and your child will get the double advantage of money management experience and real world investing exposure.

Fidelity also offers a similar range of options in this field. Costs here are low and savings accounts for children are often referred to as custodial accounts.

Going For Educational Value

Look carefully at the wealth of information offered by the Corporation for Enterprise Development. The Children’s Savings Account (CSA) resource page offers solutions for parents interested in opening savings accounts for children in all states. The value here extends beyond APY and compounding. The site works as a directory for educational resources suited for youth.

Savings accounts for children are among the best gifts you can give. They never get old; they are never outgrown or fall out of fashion. The rewards are lifelong and foster a deeper connection between parent and child.

Read More: Go Bank Reviews – Everything You Want to Know (Review of GoBank.com)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.