Guide: Finding the Best Commercial Mortgage Rates & Real Estate Loan Rates

A commercial mortgage is one that is used for properties that produce income or businesses, such as hotels or shops.

Just as you would if you were house hunting, business owners seek the best commercial mortgage rates for their loans to keep overhead costs as low as possible for their businesses.

Commercial real estate loan interest rates are typically higher than residential loan interest rates. So, it is especially important for business owners to shop around for the lowest commercial mortgage loan rates so they do not get stuck with mortgages that will create unnecessary debt for their businesses.

The headache of higher commercial building loan rates is only made worse by the sometimes difficult process of qualifying for a commercial mortgage. The process can be stressful and requires several steps; however, the end result can get you into the business location of your dreams with the commercial property loan rates you want.

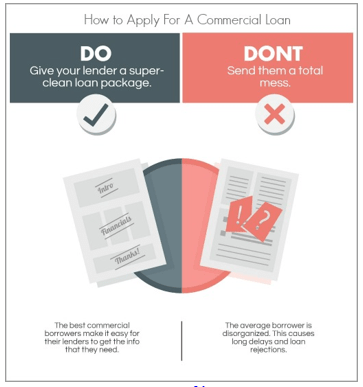

Source: Whista

The best way to score your dream commercial real estate mortgage rates when meeting with a lender is to come prepared.

Bring every piece of organized paperwork about your business with you: tax returns, income and expense statements, current lease, bank statements, business license, etc. Preparation will give you a better chance at qualifying for the best commercial real estate loan rates.

This article will explain some of the main differences between home mortgage rates and commercial property loan interest rates, how commercial real estate loan interest rates differ per loan type, and how to find the best commercial mortgage rates for your business.

We will also introduce you to a few financial institutions that offer competitive commercial building loan rates, like Wells Fargo, Bank of America, and PNC, to help you narrow down your search.

See Also: How to Find the Best VA Mortgage Loan Rates Today | Tips for U.S. Veterans

How Are Commercial Property Mortgage Rates Different from Home Loan Rates?

Commercial mortgage interest rates are typically higher than residential mortgage rates – usually between 0.5%–1% higher. However, if you choose an SBA loan to finance your commercial property, you could be looking at a 2.00%–2.50% increase for commercial real estate lending rates.

The reason for higher commercial mortgage loan rates is that most commercial mortgage loans are usually shorter term than residential loans. Commercial mortgages are typically given for a term of five to ten years, and then the borrower makes a final balloon payment for the remainder of the loan.

Source: Investopedia

Lenders set up commercial mortgage loans this way because they expect businesses to continue to raise profits each year and be able to pay off the loan quicker than borrowers of residential loans.

However, since you pay less in interest for a commercial mortgage rate over the life of your loan, lenders charge higher commercial real estate loan rates so they can still profit.

Additionally, commercial real estate mortgage rates hinge on the creditworthiness and credit history of a company, rather than a person, which can prove to be difficult for lenders. Lenders take more of a risk when issuing commercial mortgages, so they need to make commercial property loan rates higher to lower some of the risk.

Don’t Miss: Home Interest Rates | Tips for Finding the Best Home Mortgage Interest Rates

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How Do Commercial Real Estate Mortgage Rates Differ Per Loan Type?

Commercial real estate mortgage rates also differ according to loan type, so it is important to understand some of the most common types of commercial loans before searching for the best commercial mortgage rates.

Below are the most common types of commercial mortgages and information about their commercial real estate lending rates:

- Conventional: Conventional commercial loans offer terms of up to 15 years with an amortization period of 10–30 years. The commercial real estate interest loan rates for conventional loans usually fall below other commercial real estate loan rates.

- SBA 504: The Small Business Administration 504 loan has higher commercial real estate mortgage rates than the current market rate for five and ten-year loans, but it offers 90% financing of property value, which is much higher than what many other types of commercial loans offer.

- Commercial mortgage-backed securities (CMBS): CMBS loans are usually given for five to ten years with amortization periods of 25–30 years. After the five to ten-year term, you have to pay a balloon payment of the remainder of the loan. CMBS loans have fixed commercial property loan interest rates that are usually higher than conventional commercial property mortgage rates, but they have been decreasing in 2016.

Finding the best commercial mortgage rates for you depends on the best type of commercial loan for you and your business. Take into consideration the terms for each type of loan and how much of your property you will be able to finance. Decide on the best loan option and then research the commercial mortgage rates from lenders for that type of loan.

How to Find the Best Commercial Mortgage Rates

A busy business owner may not know where to start nor have the time to look for competitive commercial real estate loan rates. Fortunately, there are two ways to save time and find the best commercial mortgage rates efficiently.

One way to look for the best commercial building loan rates is with the use of a commercial mortgage broker. A mortgage broker acts as a middleman between you and lenders to find the best commercial mortgage interest rates for your loan.

Source: Debt Attorneys

Not only does a commercial mortgage broker save you time in your search for commercial mortgage loan rates, but he or she can save you a lot of money on your loan. Mortgage brokers have access to more lenders and loan information than you do, and they benefit from exclusive discounts from lenders they work with regularly.

This can translate into competitive commercial real estate loan rates that you would not find on your own and possibly lower fees. A mortgage broker could even waive certain fees if he or she has an especially good relationship with a particular lender.

However, if you do not have or want to spend extra money for a mortgage broker, you can take some time to locate commercial real estate mortgage rates on your own. A good way to find the best commercial mortgage rates is by searching online to gather and compare information.

Use your favorite web search to locate financial institutions that offer commercial loans. Visit each institution in a new browser tab so you can easily switch back and forth to compare their loan options. Remember to look for commercial property loan rates, fees, terms, and amortization schedules.

Related: How to Find the Highest Savings Account Rates | Guide | Highest Savings Rates

Wells Fargo Commercial Property Mortgage Rates

Wells Fargo is a leader in many of the financial products it offers, including commercial purchase and refinance loans. Wells Fargo’s commercial real estate mortgage rates are some of the most competitive in the industry.

It offers fixed or prime-based commercial real estate loan rates. Fixed commercial real estate loan interest rates do not vary through the life of your loan. Prime-based commercial mortgage rates vary according to the Wells Fargo prime rate – remaining fixed for the first 12 months and adjusting once per year after.

Like most commercial real estate loan rates, Wells Fargo’s commercial mortgage interest rates are based on creditworthiness and credit history. An unsecured commercial loan begins at 8.5% for excellent credit. Your Wells Fargo commercial real estate mortgage rate can be lowered with a secured loan.

Bank of America Commercial Real Estate Lending Rates

Bank of America considers your current relationship with its company as a basis for providing added benefits to you should you choose to borrow with a Bank of America commercial loan. So, if you currently have a business bank account or credit card through Bank of America, you might be able to qualify for more competitive commercial real estate mortgage rates on your loan.

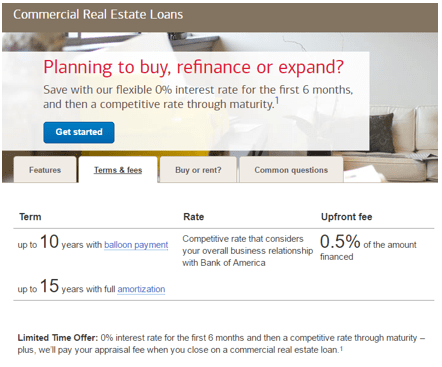

Source: Bank of America

Source: Bank of America

Currently, Bank of America is offering one of the best commercial mortgage rate promotions when you close on one of its commercial loans. You will receive an interest-free commercial real estate loan rate for the first 6 months and one of the best commercial mortgage rates it offers after.

Even without this offer, Bank of America offers some of the lowest commercial real estate loan rates available, especially if you are a current customer. If you are in search of additional commercial loan options and commercial mortgage loan rates, consider Bank of America’s SBA loan financing options.

PNC Commercial Property Loan Interest Rates

PNC Bank offers competitive commercial property loan interest rates for owner-occupied commercial property loans. This means that you can borrow from PNC Bank for a commercial property for your business, but not for commercial real estate rentals.

Source: PNC Bank

PNC Bank offers fixed or variable prime rate-based commercial real estate mortgage rates. A variable prime rate interest rate will be based off the highest prime rate in The Wall Street Journal for each calendar month.

Collateral is required for a PNC Bank commercial loan through equity in your commercial property, but collateral can actually equate to some of the best commercial mortgage rates. Unsecured commercial loans tend to impose higher commercial building loan rates.

Popular Article: Money Market Interest Rates | Ways to Find the Best Money Market Rates

Free Wealth & Finance Software - Get Yours Now ►

J.P. Morgan Chase Commercial Mortgage Interest Rates

J.P. Morgan Chase is known for its dependable and quick loan process for commercial loans. Like most other commercial loan lenders, it does not advertise its commercial real estate loan rates on its website but rather through contact with a loan expert. This is so the loan expert can customize a loan that is best for you and offer the best commercial mortgage rates depending on your business and credit history.

Source: J.P. Morgan Chase

J.P. Morgan Chase offers both fixed and adjustable commercial real estate mortgage rates. Currently, the fixed rate is for a 15-year term and the adjustable rate is for longer-term loans. With adjustable commercial property mortgage rates through J.P. Morgan Chase, you can have a fixed rate up to the first 10 years and an adjustable rate thereafter.

U.S. Bank Commercial Property Loan Rates

U.S. Bank considers commercial loans for those who are looking to purchase a new property or refinance or improve their current commercial property. Depending on the type of U.S. Bank commercial loan you need, your commercial real estate loan rate will differ.

Source: U.S. Bank

U.S. Bank offers both variable and fixed commercial real estate mortgage rates with terms between 5 and 15 years. If you are unable to provide collateral or have a less-than-perfect credit history, you might consider applying for a SBA loan through U.S. Bank, which provides more flexible financing options.

Conclusion

If you are currently in search of the best commercial mortgage rates, remember to first determine what type of commercial loan is right for you. SBA loans are better for those with less credit history or a lower credit score but can have higher commercial real estate lending rates than conventional loans.

Consider hiring a mortgage broker who can help you determine your borrowing needs and score competitive commercial mortgage interest rates and fees for you. You can also search online for commercial loan lenders and compare their rates by contacting each financial institution.

Finally, consider the five commercial loan lenders that we have covered in this article. These lenders have been proven to deliver excellent commercial loan options customized to your business needs as well as competitive commercial property loan rates that will help you afford your loan.

Read More: Mortgage Interest Rates Trend | Key Mortgage Rate Predictions, Trends, and Graphs

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.