Guide to Compare Health Insurance Plans and Rates

With health insurance costs on the rise again, the time is perfect to compare health insurance options to find better rates.

Even with the implementation of the Affordable Care Act in 2010 (also known as Obamacare), which opened up more health care options to individuals and families, it’s still important to research all your insurance options if you want to find the best prices and coverage.

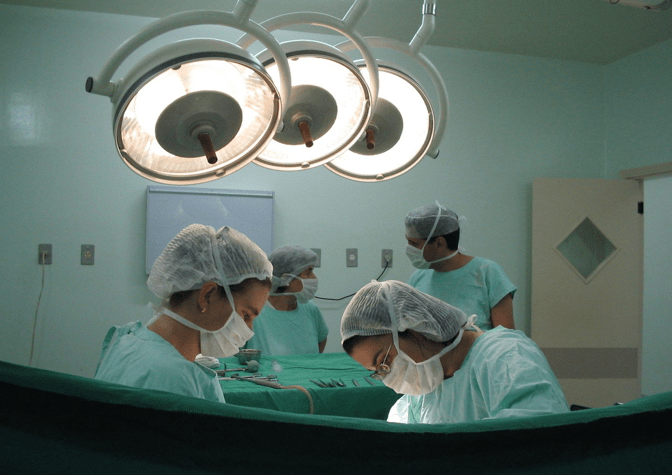

Image Source: Health Insurance Comparison

One significant rule that came along with the implementation of Obamacare was the requirement for most people, unless exempt, to sign up for one of their health insurance options or else pay a fee when filing taxes.

The penalty in 2016 for not choosing one of your health care coverage options, thus having no health insurance, is 2.5% of household income.

The ACA penalty makes it more important than ever to look at a health insurance comparison to see what your insurance options are so you can avoid the penalty and have the benefit of health insurance.

When you take the time to compare health insurance plans carefully, you can end up saving a lot on either the monthly payment or out-of-pocket expenses.

In this year’s guide to compare health insurance plans and rates, we are going to drill down into the different types of health insurance options and compare private health insurance as well as the marketplace and exchange health care options and also help you compare health insurance rates by breaking down the different fees and coverages.

See Also: Average Life Insurance Cost | Average Cost of Whole Life and Term Life Insurance

Compare Health Plans—Health Insurance Options Overview

Before we get into the details that provide private health insurance comparison of each of the different types of insurance options and plans, let’s look at an overview of the main sectors where you find health care options to buy. Our overview will include a look at how each fits into the government insurance requirements, and we’ll compare health insurance benefits that each provides.

Image Source: Private Health Insurance Comparison

Health insurance comparison of the types of insurance available:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Point-of-Service (POS) Plans

- High-Deductible Health Plan (HDHP)

- Health Savings Account (HSA)

- Critical Illness Insurance

- Cancer or Disease Specific Insurance

- Hospital Insurance

- Fixed Benefit/Indemnity Insurance

When you do a health insurance comparison, you should know which of the above are considered “major medical” and qualified under the Affordable Care Act (ACA) and which are not, but may possibly offer other health care coverage options that would benefit you and your family. We’ll take a look at each of the types of insurance above to compare health insurance plans.

Health Insurance Comparison—Major Medical Insurance Options

Health Maintenance Organization (HMO) | Compare Health Insurance

With an HMO, you will usually have a lower out-of-pocket expense and will also give up some of your flexibility in the choice of doctors or hospitals you can use.

Image Source: Health Insurance Comparison

They will also usually require you to choose a primary care physician who must be the one to make a referral before you can see a specialist. When you compare health plans, the HMO will typically come in less than most others and give you less flexibility.

Is this one of the health care options qualified under ACA?: Yes

Preferred Provider Organization (PPO) | Compare Health Insurance

With a PPO, you still are encouraged to use a network of preferred doctors and hospitals, but you are usually not required to go through a primary care physician for a referral, but rather you can see any of the doctors in the network. When you compare health plans, the PPO may come in higher for out-of-pocket expenses as a result of having more provider choice.

Is this one of the health care options qualified under ACA?: Yes

Exclusive Provider Organization (EPO) | Compare Health Insurance

The EPO is very similar to the HMO. You will have a specific network of doctors or hospitals you can use, but there is generally no coverage for any out-of-network physicians you want to see.

Like the HMO, you have a primary care physician who must make a referral before you can see a specialist. When you compare health care options, the EPO also has lower rates, but no out of network coverage.

Is this one of the health care options qualified under ACA?: Yes

The POS is a hybrid of features from the HMO and PPO plans. You may be required to choose a primary care physical, but usually services rendered by them aren’t subject to a deductible.

If you use an out-of-network physician, you may have to pay up front and be reimbursed later and have less coverage. When you do a health insurance comparison, the POS can be a good option if you get most of your care from one primary physician.

Is this one of the health care options qualified under ACA?: Yes

High Deductible Health Plan (HDHP) | Compare Health Insurance

A HDHP is a plan with a higher deductible that you have to pay before the insurance begins paying for any medical expenses.

The IRS defines “high deductible” as any health care options plan with a deductible of at least $1,300 for an individual or $2,600 for a family. It can be used along with a health savings account. When you compare health insurance plans, the HDHP will generally have significantly lower premiums, but you pay a larger portion of your health expenses up front.

Is this one of the health care options qualified under ACA?: Yes

Don’t Miss: Best Life Insurance Policy | Tips to Finding the Best Term & Life Insurance Policies

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Health Insurance Comparison—Other Types of Insurance Options

This next group of health insurance options from our list are not qualified under the Affordable Care Act and are in the group either considered as supplemental insurance or may not be an insurance at all in the traditional sense.

Image Source: Private Health Insurance Comparison

When you compare private health insurance plans, you do want to keep these types of supplemental insurance in mind because they can often offer you choices and more flexibility than you get when you do a private health insurance comparison against the major medical plans.

Health Savings Account (HSA) | Compare Health Insurance

The HSA is not actually one of the insurance options; it is a special type of savings account that allows you to set aside money on a pre-tax basis to pay for certain medical expenses.

A requirement to use the HSA is to have a High Deductible Health Plan, and it can be used to pay deductibles and co-payments, but not insurance premiums. The funds in the account can be rolled over year to year. They can be opened at a bank or other financial institution.

Is this one of the health care options qualified under ACA?: Not Applicable

Critical Illness Insurance | Compare Health Insurance

Critical Illness Insurance pays you a lump sum, tax-free, cash benefit if you are diagnosed with a critical illness, such as Alzheimer’s disease, kidney failure, Parkinson’s disease, and others. The money can be used on any expenses.

When you compare private health insurance, this policy is a supplemental, with typically lower rates and a one-time-only payout.

Is this one of the health care options qualified under ACA?: No

Cancer/Disease Specific Insurance | Compare Health Insurance

Cancer and Specific Disease Insurance is similar to Critical Illness Insurance with a few differences. There is a more specific disease or diseases tied to the policy, the payout can be paid in a lump sum or an annually restorable policy.

When you compare health insurance plans, this type of supplemental insurance will also have lower payments than major medical but will be tied to specific disease diagnosis.

Is this one of the health care options qualified under ACA?: No

Hospital Insurance | Compare Health Insurance

Hospital Insurance pays you cash for emergency room treatment, hospital confinement, and outpatient surgery. A lump sum benefit from HumanaOne can range from $250–$2,000. The money can be used for other expenses as well like childcare during recovery and transportation. When you compare health insurance rates, Hospital Insurance will typically come in with very low premiums, but limited payout as well.

Is this one of the health care options qualified under ACA?: No

Fixed Benefit/Indemnity Insurance | Compare Health Insurance

Fixed Benefit or Indemnity Insurance is similar to the Critical Disease and Disease Specific insurance types, but it can cover more options.

It pays a fixed dollar amount benefit for items such as outpatient or inpatient medical stays or procedures, doctors office visits, prescription drugs, or accident benefits from injuries. When you compare health insurance rates, this is another type of supplemental insurance that can have low rates and also has a fixed, flexible payout amount.

Is this one of the health care options qualified under ACA?: No

Related: Northwestern Mutual Reviews | What You Need to Know about Northwestern

Next, you’ll want to use the best resources online to compare health plans to see which might be the best ones for your family’s needs.

There are several resources below that can help you do a health insurance comparison on all the types of insurance options available and to compare health insurance rates.

Compare Health Insurance Plans | Marketplace Insurance Options:

- Healthcare.gov Health Insurance Comparison

- eHealth Compare Health Insurance Plans

- Premium Health Quotes Health Insurance Comparison

- HealthInsurance.org Compare Health Insurance Plans

- HealthCare.com Private Health Insurance Comparison

- State-Based Marketplaces to Compare Health Insurance

Compare Health Insurance Plans | Best Companies Lists & Ratings

- Insure.com Best Health Insurance Comparison

- The Top Ten Best Companies Private Health Insurance Comparison

- US News Top Health Insurance Comparison

- Life Health Pro Consumer’s Compare Health Insurance Plans

- Forbes Biggest Providers of Health Insurance Options

- Credit Sesame Compare Private Health Insurance Companies

Compare Health Insurance Plans | Sites that Compare Health Insurance Rates

- ValuePenguin Average Cost Compare Health Insurance Plans

- Kaiser Family Foundation Compare Private Health Insurance Premiums

- eHealth Compare Health Plans Daily Price Index

- FedSmith Compare Health Insurance Rates

Private Health Insurance Comparison | Things to Consider

There are some key things you’ll want to consider when you begin shopping for health insurance options to ensure you find the best coverage for your money.

Whether you are using an employer-provided plan or planning to compare health insurance that you purchase on your own, many of these factors will still be a relevant consideration when looking at health insurance options.

Considerations when you compare private health insurance include:

- Cash you have to cover deductibles and out-of-pocket expenses

- How much choice you want to have choosing physicians and specialists

- Your understanding of a Summary of Benefits and Coverage statement

- Any family history of particular diseases

- Lifestyle and whether it puts you at more risk of accidents

- Prescription drugs and whether you take any regularly

- Whether the health care options qualify under the Affordable Care Act

- Whether a supplemental insurance or health savings account would be beneficial to you

- Affordability of the monthly premiums

Popular Article: Top Cash Rewards Credit Card Offers | Ranking | Best Cash Back Rewards & Money Back Credit Cards

Compare Health Insurance and Rates Guide | Conclusion

It can seem like a challenging task to go through a comprehensive health insurance comparison, but the time you take to understand all the health insurance options and compare health plans and coverage types can ensure your family doesn’t get caught under covered in time of medical need.

Once you understand and compare health care coverage options, you can make an informed decision to be certain you are covered with a major medical plan that meets the Affordable Care Acts standards, thus saving you from paying a penalty.

By examining the “Best of” websites that review and compare private health insurance companies, you can also get a better feel for how the company follows through on paying benefits and whether their customers are happy.

No matter where you choose to buy health insurance once you do a health insurance comparison, it’s one of the most important decisions that you and your family can make because it ensures not only your immediate health and wellness, but can also positively impact your financial family health should an unexpected illness or injury happen in the future.

So be sure to carefully compare health insurance for your family to make certain you know all the best health care coverage options available.

Read More: Best Life Insurance Rates & Charts | Tips to Get the Best Life, Term, and Whole Life Rates

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.