Complete Guide: What Credit Score Is Needed to Buy a House?

One of the first things that you should consider when you plan to purchase a home is what you need as a credit score to buy a house.

Many people go house hunting first and then suffer disappointment when they don’t qualify for their dream home because they did not look up the credit score needed to buy a house before they began looking.

So, if you want to have the smoothest home buying process possible, building up a good credit score to buy a house before you start going out to those open houses is a very good idea.

Knowing your credit score and the minimum credit score for mortgage acquisition gives you important information that can help you in a lot of ways if you are considering purchasing a new home.

This allows you to know what type of interest rate you will qualify for and how much a bank will lend you, which depends on what credit score is needed to buy a house in the range you’re looking for.

What Credit Score is Needed to Buy a House?

In this year’s guide for the credit score needed to buy a house, we will review what a credit score to buy a house should be, what is considered an average credit score, what’s a good credit score to buy a house, and what is the lowest credit score to buy a house.

We will also offer some steps you can take to build up your credit if you have no credit or a lower credit score than needed for mortgage loans.

See Also: Ditech Review | What You Should Know About Ditech Mortgage (Reviews)

What’s a Good Credit Score to Buy a House? | The FICO Score

What should your credit score be to buy a house? You may be starting out either with no credit; for example, if you are newly divorced and your credit was in your spouse’s name, or if you’re new to living on your own and haven’t yet built up a credit score for buying a house.

By “credit score,” most lenders are referring to your FICO Score. According to Investopedia, the word FICO comes from the company that created this credit score, Fair Isaac Corporation.

The score is widely used by lenders to assess a borrower’s creditworthiness to decide whether they should approve them for a loan and under what interest rate and other loan parameters.

The FICO score uses key categories to calculate the score, and each is weighted slightly differently.

Credit Score Components:

- Payment history – 35%

- Amounts owed on credit and debt – 30%

- Length of credit history – 15%

- New credit – 10%

- Types of credit used – 10%

The score ranges from 300 to 850 — the higher the score, the better. Generally, scores above 700 indicate a “good” FICO score.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

CafeCredit.com, a website that provides free credit tools, has a useful scale that gives you an idea of what’s a good credit score to buy a house and where you fall in a range from excellent to very bad.

- FICO of 800-850: Excellent

- FICO of 750-799: Very Good

- FICO of 700-749: Good

- FICO of 650-699: Fair

- FICO of 600-649: Poor

- FICO of 300-599: Very Bad

Credit Score to Buy a House

Of course, you will typically get a much better interest rate and may get a better overall loan offer if you have a good credit score to buy a house rather than a poor one.

Credit Score to Buy a House | How Do I Find My Credit Score?

Before we get into the details of what credit score is needed to buy a house, we’ll first give you a few places you can find your credit score. It doesn’t help to know the minimum credit score to buy a house if you don’t know your own credit score.

There are some free sites to find your score and some that charge you and offer other services, so you’ll want to read any fine print on the websites carefully.

Also, be sure you’re getting a FICO score, which is the one most used by lenders, and not a different type of score that falls into the “educational score” category; these are made to help educate consumers about their creditworthiness when they search for what your credit score should be to buy a house, but they aren’t typically used by lenders. Some of these “educational scores” include PLUS Score, TransRisk Score, VantageScore, Equifax Credit Score, and CE Credit Score.

Here are a few places you can find your credit score when you’re researching the credit score for buying a house:

- AnnualCreditReport.com – Free

- CreditKarma.com – Free

- FreeCreditReport.com – Free

- CreditSesame.com – Free

- Quizzle.com – Free

- Equifax.com – Paid

- Experian.com – Paid

- TransUnion.com – Paid

Don’t Miss: The Best HELOC Rates & Loans Guide | What Is a HELOC? How Does it Work?

What Is the Lowest Credit Score to Buy a House?

When most people begin house hunting, one of the first questions they ask is, “What kind of credit score should I have to buy a house?” and “What is the minimum credit score for mortgage loans?”

Knowing where you stand with your credit and what the lowest credit score to buy a house is, gives you the information you need to decide your next step, either to start house hunting or to do some work rebuilding to a credit score needed to buy a house.

When learning what kind of credit score to buy a house is required, there are some guidelines from government agencies and other lenders you can use. According to Credit Sesame, here are some key guidelines for the minimum credit score to buy a house according to your FICO score:

- FHA Loan: You need a 580 or higher credit score to buy a house.

- Fannie Mae or Freddie Mac Loan: You need a 620 or higher credit score for buying a house.

- VA Loan: You need a minimum credit score of 620 to buy a house.

- Other Lenders: Typically, 620 is the lowest credit score needed to buy a house, but you can get a much better interest rate if you have a score of 720 or higher.

Credit Score Needed for Mortgage Loans | How Your FICO Score Affects Your Loan

You may have checked your FICO score and were pleased to see that you had the minimum credit score for mortgage shopping, but what if your score was a little higher? Would it make much of a difference? The answer is yes.

Your credit score to buy a house can greatly affect the interest that you pay on the loan, whether you can make a lower down payment, and the amount that you can borrow. Having the lowest credit score to buy a house and having one that is considered a good credit score to buy a house can make a big difference.

Credit Score Needed for Mortgage Interest Rate Savings

When you are researching what’s a good credit score to buy a house, you want to understand how just a slight savings on a better loan interest rate can save you a lot of money over the life of a mortgage and lower your monthly payment.

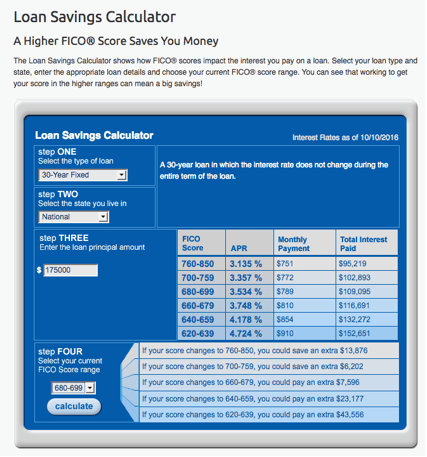

For example, if you visit MyFICO.com, you can use their handy Loan Savings Calculator that shows you the credit score needed to buy a house and what range your FICO score is in, which can change your monthly and total interest payments.

What’s a Good Credit Score to Buy a House

Using the calculator with a $175,000 loan and a FICO score of 680-699, it shows that a typical annual percentage rate (APR) offered is 3.534%, with a $789 monthly payment and total interest paid over 30-years of $109,095.

But just another point or two going from the fair range to the good credit score to buy a house range could save you $6,202 in the total interest paid and lower your monthly payment to around $772.

Credit Score to Buy a House Down Payment Reduction

Another bonus of raising your credit score a few more points is that this could allow you the option to make a lower down payment. That can be a huge benefit, especially as other moving expenses come up, and it can definitely make it worth the effort to reevaluate what kind of credit score to buy a house is needed before you jump into the housing market.

This Washington Post article explains in detail how down payments and FICO scores are tied together. Basically, when you pay less than 20 percent down on a conventional mortgage loan, private mortgage insurance is needed to limit some of the risk to the lender.

The lower your credit score and the lower your down payment, the higher some of the add-on fees charged by entities such as Fannie Mae and Freddie Mac can be. If you have a great FICO credit score to buy a house, the risk for the lender is less, and what you’re charged for the private mortgage insurance is typically discounted.

Related: Buying a Home with Poor Credit | Guide to Buy a House with Bad Credit

Minimum Credit Score for Mortgage | How to Raise Your Credit Score

After seeing how a higher FICO score can make it less expensive to buy a home, you may be wondering, “What credit score is needed to buy a house easily, and how can I get there?”

If you have some leeway with the timing of your move, there are some things you can do first to either repair or simply raise your FICO score so you can get to the credit score needed to buy a house that will get you the best loan rates.

Minimum Credit Score for Mortgage

Here are a few things you can do to raise your credit score to buy a house:

Correct Credit Errors. Order the government-mandated free annual credit report at AnnualCreditReport.com and review it for any errors that need disputing. You may not realize erroneous information could be hurting your credit score needed to buy a house.

Pay Down Credit Card Balances. Make sure you aren’t maxed out on too many credit cards and are paying them down regularly. If you’re always at the limit of your cards, it can make your score lower than the credit score needed for mortgage loans.

Pay Your Bills on Time. This is an obvious one, but in this day and age, it’s easy to forget a payment and pay a bill a few days late, not realizing how much it can really hurt your FICO credit score to buy a house.

Get a Credit Card. This one may seem counterintuitive, but if you have no or very little credit history built up, then having a credit card and making payments on it regularly can help you build that history and reach the credit score needed to buy a house.

Settle Old Debts. Old debt collections, judgments, and liens can damage your FICO score. If you’ve asked what should your credit score be to buy a house and found it is lower than you like, many times you can contact a creditor to make a settlement arrangement with them and get a bad mark off your credit report.

Keep Your Credit Utilization Ratio at or Below 30%. While this is not a rule written in stone, it is typically a good idea, according to this article at NerdWallet, and will benefit your credit score needed to buy a house. Credit utilization ratio is the amount you owe on credit cards compared to the limit of the cards.

Popular Article: How Your Debt-to-Income Ratio Impacts Your Chances of Getting a Mortgage

Free Wealth & Finance Software - Get Yours Now ►

What Credit Score Is Needed to Buy a House? | Conclusion

As you can see, your credit score can make a big impact when you want to know, “What’s a good credit score to buy a house?” While you can still get an FHA loan with a FICO score as low as 580, most other lenders, including the VA, Fannie Mae, and Freddie Mac, require 620 as a minimum credit score for mortgage loans.

The higher you can get your FICO score, the less you’ll end up paying over the life of your loan.

But even if you find that you’re below the minimum credit score to buy a house, you’re not locked into that FICO score forever. There are quite a few things you can do to raise your credit score to buy a house and put yourself into a much better situation.

Some of the items may take time, like reviewing your credit reports and disputing any charges, but the steps you take can benefit you and your family for a lifetime.

We hope that this year’s guide on what’s a good credit score to buy a house was helpful and provided you with some great resources to review your credit score for buying a house. Now, you understand exactly what kind of credit score to buy a house is needed to get the best loan, and you’ll be in great shape to find the home of your dreams in the future.

Read More: Guild Mortgage Reviews – What You Need to Know (Company Reviews & Complaints)

Image Sources:

- https://pixabay.com/photos/new-home-for-sale-home-house-1530833/

- https://www.annualcreditreport.com/index.action

- https://www.myfico.com/credit-education/calculators/loan-savings-calculator/

- https://pixabay.com/photos/house-keys-key-the-door-castle-1407562/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.