Intro: How to Find a HELOC Loan or Rate Today

Many homeowners reach a point when they have enough home equity to use for a HELOC loan. You may be wondering exactly what is a HELOC loan? It is simply a home equity line of credit used for cash access purposes.

It is also commonly known as a second mortgage and allows a homeowner more flexibility to access cash than other traditional loan methods with better interest rates than credit cards.

In this article, we will identify the current HELOC rates and where you can find the best HELOC interest rates.

There are a number of sources you can use to find the best HELOC deal, and we will cover those as well as talk about some of the helpful calculator tools you can access and what exactly the HELOC requirements are before you can get a HELOC loan.

If you’ve ever thought of getting a second mortgage to fund a dream vacation, home improvement project, or just to get through a difficult time, then you should find lots of useful information below on the best HELOC rates, the answer to, “How does a HELOC work?” and details on the HELOC loan rates you can expect to pay.

See Also: Apply For FHA Loan – How To Apply (Online, Home Loan & FHA Mortgage)

What Is a HELOC? | Overview

When you own a home, you have a few distinct options for tapping into your equity when you need extra cash. Most people look to use either a home equity loan or a home equity line of credit (HELOC). So, let’s take a look at the main difference between the two and exactly what is a HELOC loan.

How does a home equity loan work? You typically receive a lump sum and then make designated monthly payments on the total amount you’ve borrowed, much like a mortgage payment or car loan payment.

How does a HELOC work? Instead of having to decide on a locked-in sum upfront, you are opening a line of credit with the lender, similar to a credit card, that you can access when you need it for as much as you need up to the preset limit. You only pay interest at the HELOC rates on the amount you use, not the total amount approved for the loan.

You may be wondering, “What is a HELOC typical term?” and “What are the best HELOC rates?” A HELOC loan normally has a 25-year term, with a draw period (usually the first 5-10 years) and repayment period (usually 10 to 20 years).

HELOC interest rates are typically determined by a combination of the daily balance and the prime rate in addition to a margin designated by the lender.

Now, let’s take a look at the HELOC rates today and which lenders you can go to for HELOC rates that are the most attractive.

Image Source: PNC.com

Don’t Miss: Freedom Mortgage Reviews – Get All the Facts! (Customer Service, Complaints & Review)

Where to Find a HELOC Loan and Get the Best HELOC Rates

As you can imagine, there are a plethora of lenders out there that you can use to open a home equity line of credit. But not all lenders offer the best HELOC options, and there is a difference between a variable and a fixed rate HELOC.

We will give you a rundown of your best options for securing a home equity line of credit.

In our listing of lenders providing great rates, we will also note which offer a fixed rate HELOC option in addition to variable financing at HELOC rates today. When you begin your search for a loan and review HELOC requirements, you’ll want to review all the options to see which type of HELOC loan is best for you:

- Variable HELOC Loan Rates: The rate can change over the life of the loan, and is typically based upon the current Federal Funds rate plus a margin added by the lender.

Disadvantage: The rate can increase, becoming unaffordable.

Advantage: The overall interest rate is typically less than a fixed-rate HELOC.

- Fixed-Rate HELOC: The rate is locked in and won’t fluctuate, so you know exactly what the cost of borrowing will be throughout the lifetime of the loan.

Disadvantage: The rate is usually higher than the variable HELOC rates option.

Advantage: No worries about the interest rate increasing unexpectedly.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Lenders Offering the Best HELOC Rates:

BB&T – Variable: As low as 2.24% for 12 months, then 3.49%, up to $25,000 draw. They offer a fixed rate option as well but don’t list the rate on their site. You can also have up to three loans at the same time of at least $5,000 each.

PNC – Variable: As low as 3.79% HELOC loan rates when borrowing at least $100,000. Their fixed rate option begins as low as 4.35% for a 15-year term. You will need to enter your zip code on the site before they show you their HELOC rates today for your area.

Alliant – Variable: As low as 4.0%, they offer both a standard and an “interest-only” HELOC loan option. They only note a fixed rate option for a home equity loan, not a home equity line of credit.

U.S. Bank – Variable: Theirs is one of the best HELOC rates; they have a limited time introductory rate offer as low as 1.50% for the first 6 months, then going to 4.24%. They also offer a fixed rate option, but only with a home equity loan.

TD Bank – Variable: As low as 3.0%, with a rate of -0.50% of the prime rate. They have a fairly detailed table of HELOC rates options after you enter your city and state. They include fixed-rate options and loans with or without an annual fee.

Wells Fargo – Variable: Ranges between 3.875% to 4.75%, and they mention on their site that the variable HELOC interest rates will never increase more than 2% annually or 7% higher than when your loan began. They have a limited time promotional fixed rate which is currently as low as 1.99%.

Bank of America – Variable: As low as 3.68%, and they offer a few discount options; -0.25% for automatic payments, -0.125% to -0.375% for Preferred Rewards clients, and -0.10% to -1.00% on initial draw. They do offer fixed HELOC loan rates, but they’re not listed on the site.

Regions – Variable: Ranges from 4.50% to 10.99% for their non-discounted rates, and they also mention a minimum variable rate of 3.75%. Their best HELOC rates for a fixed loan is 2.99% for 12 months.

Image Source: Regions.com

Related: New American Funding Reviews | What You Need to Know (Pros, Complaints, & Rates)

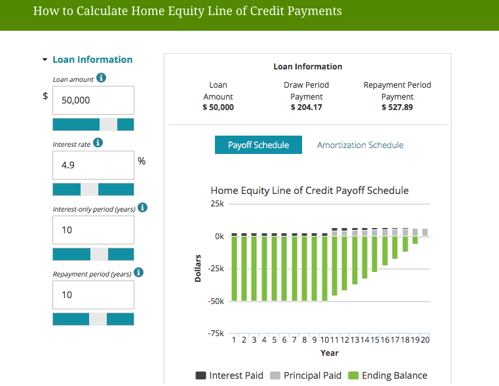

How Does a HELOC Work? Calculating Rates and Payments

Once you’ve gone past the question, “What is a HELOC loan?” and have decided you want to apply for a home equity line of credit, it’s a good idea to use one of the free online HELOC rates calculators to get an overview of the type of HELOC interest rates to expect for a particular loan term or loan option.

Here are some of the best HELOC calculators you can use to answer, “What is a HELOC payment that I can expect?”:

- U.S. Bank Calculator

- Citizens Bank Calculator

- Bank Rate Calculator

- Regions Bank Calculator

- Bank of America Calculator

- Money-Zine Calculator

Once you’ve done the upfront homework to answer “What is a HELOC loan payment, and what are the best HELOC rates I can expect?” then you’ll want to go over a few more details relating to overall pros and cons and what to look out for when getting a HELOC loan.

What Is a HELOC Loan? The Pros and Cons

With any type of loan, and especially one that is tied to your home equity, you will want to educate yourself not only on how does a HELOC work and what are the best HELOC rates, but also some of the pros and cons you should know before signing your HELOC loan.

How Does a HELOC Work? The Pros:

- HELOC rates are typically lower than credit card interest rates.

- You only pay interest on the amount you draw from the total available.

- You can usually have up to three fixed-rate HELOC loans at the same time.

- If you have enough equity, then they are usually easy to open.

- Some HELOC loan offers to allow you to waive closing costs.

- The HELOC rates of interest paid may be tax-deductible.

- Easy-to-use line of credit when you need it.

How Does a HELOC Work? The Cons:

- Even the best HELOC rates on variable loans can become too high to be affordable.

- You often have to pay an early closure fee and an annual fee.

- There are closing costs with a HELOC loan, which include many of the same types of costs as a mortgage.

- HELOC interest rates can have minimums on the amount you draw out at a time.

- There may be no periodic caps on the HELOC rates increases of a variable loan.

- If your home declines in value, you could end up owing in total more than it is worth.

- If you default on a HELOC loan, you can be forced into a situation where you have to sell your home.

Popular Article: Caliber Home Loans Reviews – What You Need to Know Before Using Caliber

How Does a HELOC Work? Six Things You Need to Know Before You Sign:

Here are a few more things that you need to know after you’ve found the best HELOC rates and before you sign on the dotted line:

- Getting one of the best HELOC rates can make it attractive to use for debt consolidation, and help you get out from under higher interest rate loans or credit debt.

- When converting credit card debt to a HELOC loan, understand you are converting unsecured debt, which can be discharged in bankruptcy, into secured debt, on which you cannot default.

- Identity theft criminals who already know the answer to “What is a HELOC loan?” have targeted them for theft. Here are some tips to stay safe.

- Under federal law, you have three days to cancel a HELOC loan agreement should you change your mind.

- Many consumers choose an adjustable-rate because the HELOC interest rates look more attractive than the fixed-rate, but it may not be the cheapest long-term option.

- Options, discounts, and overall HELOC rates through the life of the loan can vary widely, so be sure to shop around to get the best HELOC rates and deal you can find and see if your own bank gives discounts for having other accounts.

What Is a HELOC Loan? The Recap

In the final analysis, a home equity line of credit, or HELOC loan, can give you the opportunity to tap into your home equity for easy cash when you need it. Whether you have unexpected medical expenses or simply want to do a home addition or major improvement, it’s a safety net that is there when you need it. HELOC rates are typically less than other types of loans and significantly less than credit cards.

Image source: Pexels

We would advise that you do your research on exactly what a HELOC loan is going to do to your finances and utilize some of the online calculators that will help you calculate what the monthly expense will mean for your budget and how variable rates for a HELOC loan would impact your overall family financial health.

With HELOC rates being very low and the ease of finding the best HELOC for your needs, this type of loan gives families a great opportunity to access a significant amount of cash when they need it. But as with any loan, you want to make sure you explore all options, research ahead of time the HELOC requirements, and figure out what a HELOC loan is going to mean for your family in terms of a monthly payment. If you answer all those questions ahead of time, then you should have no worries when it comes time to securing a HELOC loan when you need it.

Read More: Mortgage Loan Officer Job Description and Review (Compensation, License, and Requirements)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.