Summary: Ditech Review | What You Should Know About Ditech Mortgage

This ditech review article examines ditech’s home loans services and features, the transparency of ditech home loan fees and costs, their website, and their digital savviness. This ditech review also outlines what customers are saying in the form of a number of online ditech reviews.

As they say, the home, for many of us, is our greatest purchase. It also comes with an emotional attachment, often like no other. We want to make sure everything to do with our home – including our mortgage – is safe and secure.

This ditech review touches on many of these requirements and characteristics that we expect from a modern-day home lender – such as, transparency, knowledge, trust, digital savviness and ease of use. This ditech mortgage review shows future and existing customers the types of services on offer at ditech home loans.

Since the global financial crisis of 2008, it has never been more important for transparency. And when it comes to our homes and our finances, we yearn for lenders that look after us and provide us with the knowledge we need to get the most from our money and our home loans. Ditech home loans are no different. This is where a ditech mortgage review can help.

In addition, many of us are now using computers, tablets, and smartphones to manage our finances and mortgages. We are seeking digitally savvy businesses that can make our lives easier and save us time and effort in our busy, hectic lives.

Image source: Big Stock

See Also: What Is the HARP Loan Program? Do You Qualify? Harp Loan Requirements

About ditech Home Loans

Ditech is a lender and servicer of residential mortgages and refinancing products. A member of the Walter Investment Management Corporation, ditech re-entered the national housing market in 2014.

Listed on the New York Stock Exchange as WAC, Walter Investment is “a diversified mortgage banking firm focused primarily on servicing and originating residential loans, including reverse loans.”

As this ditech review shows, ditech has some impressive statistics of its own, including:

- 126,000 ditech home loans purchased and funded in 2015

- more than 2.1 million ditech home loans have been serviced

- they also have over 4,500 employees in locations across the U.S.

In 2015, ditech merged with Green Tree, a leading U.S. home loan provider. This merger was undertaken in order to “drive efficiencies through the reduction of duplicative functions and cost structures and become a stronger, more unified end-to-end mortgage company.”

As a result of this purchase and a subsequent restructuring, there were a number of layoffs and redeployment offerings within the company in 2016, according to both ditech and HousingWire.com. Instead of this being seen as a business in trouble, it should be viewed as a growing and restructuring exercise in order to operate better.

Also in 2016, this ditech review found the business launched a wholesale lending channel: “Launching a wholesale channel is an important milestone for the company…With the success of our correspondent lending division, this was a logical next step for us to continue expanding our market presence.”

This ditech review shows that the business is in a state of growth and transition. Customers should be secure in the fact that layoffs and/or staff movements are more about the future success of the business than poor performance.

Don’t Miss: Bank of America Mortgage Reviews – Get All the Facts (Loan Help, Mortgage Payoff, Foreclosure…)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Services & Features: ditech Review

This ditech review found that ditech provides a range of services similar to many other home lending and refinancing institutions in the U.S., including pre-approval online. Ditech makes it as easy as 1, 2, 3 to gain approval at their “Get Pre-Approved” page.

As shown in this ditech mortgage review, there are a range of ditech home loan types to cater for their diverse customer base, including:

- Fixed Rate Mortgage –these mortgage rates are fixed for the duration of ditech loans

- Adjustable Rate Mortgage – at a lower rate for a certain amount of time and then adjusted according to then-current interest rates

- Jumbo Loan –these ditech home loans are higher than “current conforming limits”

- FHA Loan – a loan insured by the Federal Housing Administration (FHA)

- VA Loan – for veterans, those on active duty, and (in some instances) surviving spouses

- Manufactured Home ditech Loans – specifically for manufactured homes

Refinance loan options for the residential market are another service offered by ditech. Options include all of the above, as well as special options for those refinancing, such as the Home Affordable Refinance Program (HARP).

This ditech review also identified ditech as being a provider of insurance, including:

- Homeowners Insurance

- Manufactured Home Insurance – unlike many other policies, ditech’s manufactured home insurance affords the homeowner protection against “floods, hurricanes, earthquakes, landslides and mudslides”

- Home Warranty with TotalProtect – for failures of appliances and systems in the home

- Automobile Insurance

- Motorcycle / ATV Insurance

- RV / Trailer Insurance

- Boat / PWC Insurance

The first-time home buyers product is also a focus of ditech’s loans and products, helping those looking to enter the real estate market.

Ditech also offers Correspondent Lending and Wholesale Lending.

Ditech Mortgage Review: Fees and Costs

As found in this ditech review, ditech lists common fees and costs on their website. For the sake of transparency, they do state that that fees depend upon federal, state, and local requirements as to whether the fees and costs will be applicable to ditech loans and ditech mortgage rates.

The site lists two main types of fees and costs, including:

Mortgage-related fees and costs:

- Late fee

- NSF fee

- Annual fee

- Prepayment penalty

- Payoff quote fee

- Lien release fee

- Phone pay fee

- Subordination fee

Default costs:

- Valuations costs

- Inspection costs

- Property preservation costs

- Health & safety costs

- Foreclosure costs

- Title costs

- Bankruptcy costs

Ditech Review: Website

A standout of this review is that of the ditech loans website.

The website itself, and the number of customer resources located on the website, is simply staggering.

From calculators to the ditech blog to ditech mortgage rates information, the website is jam-packed with links, documents, images, and videos to assist the customer.

Apart from all the help online in the form of resources, this ditech mortgage review found that the website has really been set up well for the user experience. It is very user-friendly and makes it easy to find what you are looking for.

In terms of empowering the customer with knowledge, ease of use, helpfulness, and user-friendliness, the website gets a big 10 out of 10 from this ditech review.

Here’s why!

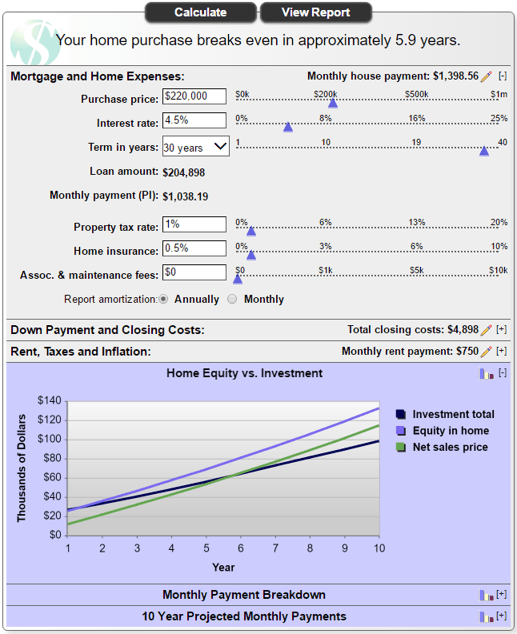

Ditech “Calculators”

These tools are extremely helpful for those looking to purchase or refinance their home, and the transparency that this affords the consumer is fabulous. Working out ditech mortgage rates and repayment options is easy.

The website calculators include:

- P&I payment calculator

- Purchase power calculator

- Rent vs. Buy calculator

- Refinance interest savings calculator

- Refinance breakeven calculator

- Fixed rate vs. ARM calculator

- Adjustable Rate Mortgage (ARM) calculator

Image: Ditech.com

Related: AmeriSave Reviews – What You Need to Know Before Using AmeriSave Mortgage

Ditech “Resources” Section

Of all the notable features on the ditech website, the “Resources” section really does arm the customer with a great deal of knowledge.

Ditech has broken down “Resources” into two sections:

- Learn More

- Get Help

The “Learn More” section has the usual Frequently Asked Questions and Glossary. It also includes such sections as Loan Modifications, Refinancing and HARP, All About Escrow, Understanding PMI, Payoff Answers, and Other Loan Topics.

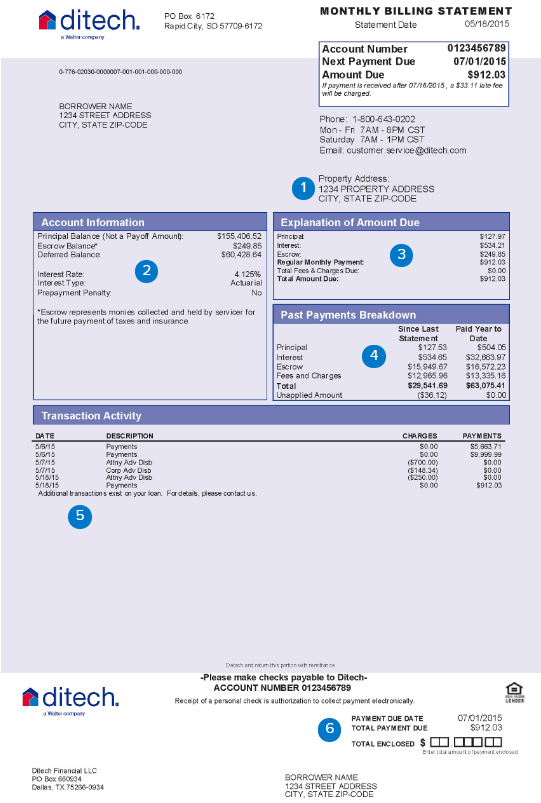

“How to Read Your Statement” section of the ditech website

The second “Resources” section of this ditech mortgage review is “Get Help.” This provides links to pages that really help the customer with information to make their home lending experience easier, safer, and more positive. For example, the “Get Help” section links to such information as How to Read Your Statements, Mortgage Assistance when a customer is struggling with their payments, Servicemembers Civil Relief Act (SCRA), and links to several Housing Counseling Services should the customer need help purchasing a home, renting, facing defaults, preventing foreclosure, dealing with homelessness, and/or addressing credit problems.

The “Resources” section also has information under Subordination Requests and one of the most important areas in today’s society – resources and links on how to “Avoid Scams and Phishing.”

Ditech “Blog”

Another exciting feature of the ditech website identified in this ditech mortgage review is the blog. With its highly visual interface, the blog is informative, easy-to-read, and helpful. Just like the main website, the blog has been set up to optimize customer experience.

Ditech’s Digital Savviness

Out of all of the features in this ditech review, the most revealing was that of the digital savviness of this home lender.

In terms of helpfulness, customer service, and user friendliness, ditech home loans’ digital home lending services are up there. For example, ditech provides:

- Digital Alerts –these let the customer know via email and SMS about account happenings

- Online Billing – customers are able to get their mortgage statements electronically

- AutoPay – customers are able to avoid late fees and damage to their credit record with automatic withdrawals

- MyAccount – customers are able to manage their account and become fully informed by using the ditech MyAccount feature

Although MyAccount does not have a ditech app, it is responsive and can be used on all types of devices.

Ditech’s Online Account Management Feature

With this online feature, customers can manage their ditech accounts online using their desktop computer, tablet, or smartphone. Some of the features included in MyAccount are:

- Dashboard – displays the customer’s account number, payment amount, and when the next payment is due

- Make a Payment – automatically or instantly

- Quick Links – provides more details, such as My Escrow, Payment History, Statements, and Payoff Quotes

- Message Center

There is no specific ditech app; however, as the website says, MyAccount can be used on desktops, tablets, and smartphones. As this ditech mortgage review shows, this business is certainly digitally progressive and gets a big thumbs up from this ditech mortgage review.

Free Wealth & Finance Software - Get Yours Now ►

Ditech Reviews Online by Customers

So, what do customers themselves think about ditech? There are a number of ditech reviews online. In fact, ditech displays their own ditech review upon their website.

In ditech’s reviews, they received a rating of 4.6 out of 5. At the time of writing, 1767 customer ditech reviews had been provided. The 4.6 rating included:

- Ease of obtaining ditech loans – 4.6 out of 5

- Speed of obtaining ditech loans – 4.4 out of 5

- Rate – 4.5 out of 5

- Fees & closing costs – 4.3 out of 5

- Customer service – 4.7 out of 5

- Responsiveness – 4.6 out of 5

The important point to note about these ditech reviews is their transparency. All ditech reviews are presented – the good, the bad and the ugly – even those that have given one star. Customers can filter results to see specific ditech reviews.

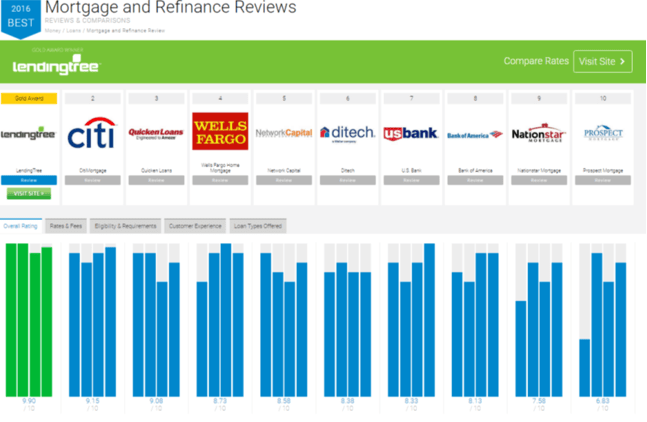

Another ditech review, conducted by TopTenReviews.com, gave ditech an overall rating of 8.38 out of 10. The negative for this review was that the “agency does not have local agents.” However, TopTenReviews.com also stated that:

“This lender doesn’t have local agents, but it does business out of four main branches. It has agents qualified to issue loans in 49 states plus Washington DC, but all your correspondence will be via phone or online. We never received a reply to our email inquiries, nor were we able to contact the corporate headquarters for general information. Nonetheless, we easily reached a loan officer when calling to apply for a loan. The loan officers we spoke to took time to fully answer our questions and run a quote for us.”

TopTenReviews.com ranked ditech 6th for Mortgage and Refinance companies, behind Lending Tree, CitiMortgage, Quicken Loans, Wells Fargo Home Mortgage, and Network Capital.

Image source: TopTenReviews.com

In another external ditech review, LendingTree.com gave ditech a total rating of 4.5 out of 5. This involved 101 ditech reviews and was rated on ditech mortgage rates, fees and closing costs, responsiveness, customer service, and overall experience. In terms of whether customers would recommend ditech, 89% of Lending Tree customers said they would (LendingTree.com).

In contrast to the above outstanding ditech reviews, an external review of ditech was conducted by ConsumerAffairs.com. Out of 320 ratings and 394 reviews, ditech was given an Overall Satisfaction Rating of one star out of five (ConsumerAffairs.com).

An overall picture gathered by these ditech reviews does show that ditech is achieving excellent customer satisfaction, with the exception of the ConsumerAffairs.com ditech review. This low performance is out of character to the other reviews, and further analysis needs to be conducted to see why such a deviation exists.

Popular Article: New American Funding Reviews | What You Need to Know (Pros, Complaints, & Rates)

Conclusion – What You Should Know About Ditech Mortgage

Ditech states on its website that “Our approach is helpful, responsive, efficient and fair” and “Our values are honesty, responsibility, transparency and creativity.”

Based on this review, it has far exceeded its helpful approach and the honesty and transparency values.

This ditech review found that ditech is a business on the move, is committed to great customer service, is helpful, and is digitally savvy. This review leaves one with a sense that the business is doing its best to make sure its customers are fully informed and have all the support they need to have a great home lending experience.

To view ditech’s website for yourself, go to ditech.com, or to search for an agent by name or by city, state, or zip code, go to FIND A HOME LOAN SPECIALIST.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.