Overview: Credit Sesame vs. Credit Karma vs. Quizzle | Ranking Comparison

Whether you are looking to compare Credit Sesame vs. Credit Karma, Quizzle vs. Credit Karma or all three against one another, one thing is certain: you want to know which one is the best credit monitoring service to meet your needs.

Perhaps you want to know if Credit Karma or Credit Sesame receive information from a credit bureau that you are more familiar with or you want to find out the service with the best identity theft protection.

Image Source: Credit Sesame vs. Credit Karma vs. Quizzle

Whatever your needs from a credit monitoring service, this article seeks to accurately and precisely compare Credit Karma vs. Credit Sesame vs. Quizzle.

Credit Sesame, Credit Karma, and Quizzle: What Are They?

Credit Sesame, Credit Karma, and Quizzle are credit monitoring services. Each service has the same basic goals: to provide you with updated credit reports and help you manage your credit in ways that work for you.

Since they are all in business for the same reason, what are the differences between Credit Karma vs. Credit Sesame or Credit Sesame vs. Quizzle? There are actually significant differences among the services, but you have to do the research.

Even a quick first look on each of their websites shows many similarities between the three services. So, you may have to do some browsing around each website to understand more about how Credit Sesame vs. Credit Karma vs. Quizzle work. A good place to start is the “About” or “How It Works” sections.

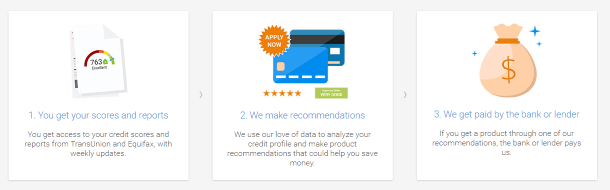

Image Source: Credit Karma

Let’s compare Credit Karma vs. Credit Sesame, for example. Credit Karma states on its “How It Works” page a simplified explanation of its service. You get your credit scores and reports from TransUnion and Equifax weekly. Then, Credit Karma gets paid by banks and lenders for recommending products or services to you that can help you save money.

Further comparing Credit Sesame vs. Credit Karma should lead you to Credit Sesame’s similar “How It Works” page. Credit Sesame’s page shows some different and more detailed information about what it does.

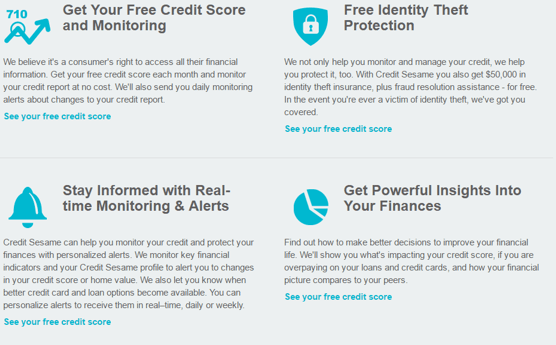

Image Source: Credit Sesame

For example, Credit Sesame checks and monitors your credit score and credit report from Experian daily and reports any changes to you with real-time alerts. Credit Sesame also provides insight into what impacts your credit score so you know what you need to work on.

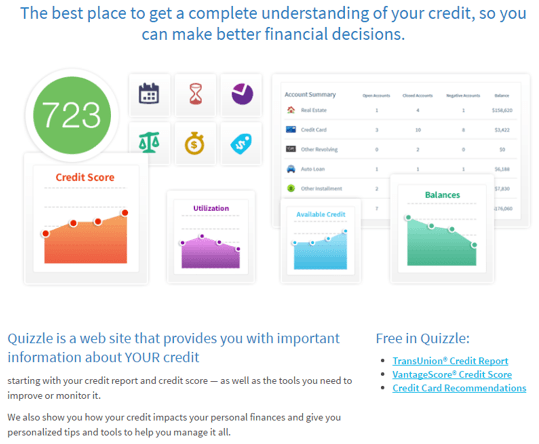

How about the differences between Quizzle vs. Credit Sesame? Quizzle offers a significant amount of information in its “What is Quizzle?” section. Here, you can find information about the services and plans that Quizzle offers, a resource center to help you understand your credit score and credit report from Equifax, and how Quizzle obtains your credit information.

Image Source: Quizzle

In short, the main differences between Credit Sesame vs. Credit Karma vs. Quizzle are in the ways they obtain your information and how they help you process that information to help you get on a stable financial path. Let’s take a deeper look into the services each company offers.

Available Services

When comparing Quizzle vs. Credit Karma or Credit Sesame vs. Karma, you should understand what extra services, besides obtaining credit scores and credit reports, each offers. These companies each provide a variety of other financial services to help you understand your credit report and meet your financial goals.

But you do not need all three services; you want the one that will best meet your needs. Will that be Credit Sesame or Credit Karma? Or will Quizzle give you everything you are searching for?

Identity Theft Protection

Does Quizzle, Credit Karma or Credit Sesame have identity theft protection? Although Credit Karma and Quizzle allow you to frequently check your credit report for fraudulent activity, they do not have identity theft protection services. Credit Sesame does, however, providing $50,000 in identity theft insurance with assistance in fraud resolution.

Identity theft protection is an important benefit to consider when searching for credit monitoring companies. Credit Sesame definitely wins in this area as the only company to offer this service.

Don’t Miss: Consumer Credit Counseling Service – What You Should Know Before Using Them

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Exclusive Credit Card and Loan Offers

Between Credit Karma vs. Credit Sesame vs. Quizzle, which services offer exclusive credit card and loan offers? All three of these services can help you find financial products that meet your needs according to your credit score and credit report.

What are the differences between Quizzle vs. Credit Karma in this area? They both offer many of the same types of loans, like personal, auto, and home loans. However, each service offers some products that the other does not. For example, Credit Karma offers student loans and business loans whereas Quizzle offers home refinancing options.

Comparing Credit Karma vs. Credit Sesame, we see a lot of similarities between what Credit Sesame and Quizzle offer and what they lack compared to Credit Karma. Credit Sesame offers home refinancing but does not have business loans. Credit Sesame, however, does offer student loans like Credit Karma.

So, Credit Sesame vs. Credit Karma vs. Quizzle: Which service takes the edge in credit cards and loan offers? Credit Karma seems to have the most options available for credit card and loan types, giving it a slight lead over the other two companies.

Credit Score and Report Monitoring

We know that whether you use Quizzle, Credit Karma or Credit Sesame, you can keep a close eye on your credit score and credit report through each service. But how often does each service pull your score and report for you to monitor? You should check that the frequency meets your needs.

Is Credit Sesame or Credit Karma more frequent in its information pulling? Credit Karma says that you will receive updates about your credit report and score once per week. Below your current score will be the date of your last update and the projected date of the next update. Credit Sesame, on the other hand, updates your credit score once every 30 days but sends you daily alerts about any changes made to your report.

Comparing Credit Karma vs. Quizzle and Quizzle vs. Credit Sesame shows a deficiency in Quizzle’s service. Unlike Credit Karma or Credit Sesame, Quizzle’s free service updates your credit score and credit report once every three months. Three months is a long time if you want to consistently check your report for fraud or progress with paying down debt.

So, it is Credit Sesame who takes the lead in credit score and credit report monitoring. Although Credit Sesame updates your score only once per month, its daily alerts are a great benefit to have in a credit monitoring service for consistent activity monitoring and fraud protection. Credit Sesame is the leader in this category.

Related: Credit Karma Complaints | What You Should Know Before Using the Site

Credit Tracking: What Bureaus and Scores Are Used?

Program Costs

When comparing Credit Karma vs. Credit Sesame vs. Quizzle, you may see that each company offers “no purchase or credit card required” or “free” credit score and credit report monitoring. But are they really free? Let’s take a look at the cost, if any, of each service and whether the cost is worth your time.

First, Quizzle vs. Credit Karma. Credit Karma advertises free credit score and free credit report monitoring weekly without the need for a credit card or purchase. A quick registration shows this is a legit claim. You can sign up for Credit Karma in just a few minutes and immediately have access to your credit score from TransUnion and Equifax and the factors that impact your score.

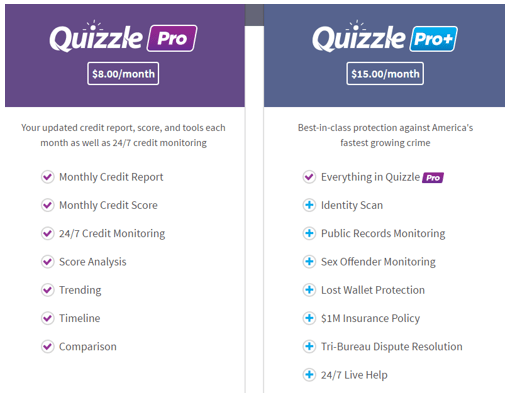

Image Source: Quizzle Plans

Quizzle also advertises a free credit score and free credit report, which is also true. However, Quizzle’s free service does not provide as many benefits as Credit Karma’s free service. With Quizzle’s free service, your score and report is updated every three months.

To monitor monthly, unlike Credit Sesame or Credit Karma, you have to sign up with Quizzle Pro for $8 per month or Quizzle Pro+ for $15 per month.

How do Credit Sesame vs. Credit Karma compare in this area? Like Credit Karma, Credit Sesame does provide a completely free credit score and credit report monitoring service.

A quick signup gives you immediate access to your information, like assets, debts, and credit report alerts.

Credit Sesame vs. Credit Karma vs. Quizzle: Which service gives you the most bang for no bucks? Credit Sesame has a lot to offer with its free service, including credit report alerts daily and identity theft protection up to $50,000. As far as a free service goes, Credit Sesame has the upper hand.

However, preference between Credit Sesame vs. Quizzle is all a matter of taste. If you don’t mind paying a few dollars per month for the extra features Quizzle offers that neither Credit Karma or Credit Sesame offer, Quizzle can be a great option for you. With its low-cost paid plans, Quizzle provides 24/7 credit monitoring, analysis of credit, trends in your credit behavior, and even a $1 million insurance policy to help restore your identity if needed.

Reviews & Accreditation

When choosing a credit monitoring service, you should check the company’s reviews and accreditation before signing up or you may find yourself in an identity-theft mess that you were trying to avoid in the first place! How do the reviews for Quizzle, Credit Sesame, and Credit Karma stack up?

Image Source: Better Business Bureau

A great place to view accreditation and reviews is the Better Business Bureau (BBB), which companies can choose to register with for accreditation. The Better Business Bureau hosts customer reviews for businesses whether or not the business has accreditation through the BBB.

Let’s compare Credit Karma vs. Credit Sesame vs. Quizzle with the information found on the BBB website.

We can first look at Credit Karma vs. Quizzle because these two companies have not been accredited by the Better Business Bureau. This is not a negative thing; it simply means the companies have not chosen to become accredited yet.

Credit Karma has a B- rating based on 392 complaints filed against the business, mostly in relation to problems with the service and billing issues.

However, Credit Karma has responded to and resolved all 392 complaints and has been in business since 2007, both positive factors that raise Credit Karma’s score. Credit Karma has an average review score: about 2.8 stars out of 5.

Now, let’s look at the rating for Quizzle vs. Credit Karma. Quizzle has an A- rating based on six complaints, mostly for problems with product or service. All six complaints have been responded to and resolved, however, which helps raise Quizzle’s rating. Quizzle has been operating since 1985, which also significantly raises its BBB rating. Quizzle has no review scores on BBB yet.

We can now compare Credit Sesame vs. Karma and Credit Sesame vs. Quizzle. Credit Sesame is the only service of the three to register with the Better Business Bureau, which gives it an edge. Registered since 2011, Credit Sesame has a B rating, with 47 complaints against the business. Most complaints were regarding problems with products or services and advertising and sales issues.

All 47 complaints have been responded to and resolved, raising its rating. Credit Sesame has an average review rating of 3.3 out of 5 stars.

According to the BBB, which service has the happiest customers? Between Credit Karma vs. Credit Sesame or Quizzle vs. Credit Karma, all three have respectable ratings. They have all been in business for several years and have taken the time to respond to and resolve their complaints with the BBB, which is a great quality for each company to possess.

Popular Article: Credit Karma Reviews | Is Credit Karma Accurate, Legit & Really Free?

The Best Service for You: Credit Sesame vs. Credit Karma vs. Quizzle

Now that you know more about each credit monitoring company, which one is the right one for you? Obviously, only you know your own needs. Are you stuck between Credit Sesame vs. Credit Karma? Or Quizzle vs. Credit Sesame?

Here is a quick overview of Credit Karma, Quizzle, and Credit Sesame so you can choose which company is your perfect fit for credit monitoring.

Credit Karma:

- Pros: In business since 2007. Credit Karma offers a free credit report and credit score monitoring service with weekly updates to your score. Has several types of loans and credit card offers and does offer business loans, unlike Credit Sesame and Quizzle.

- Cons: Credit Karma has 392 complaints with the BBB, which is a fairly large number, and average customer reviews. Credit Karma does not offer identity theft protection and does not provide daily credit report monitoring.

Free Wealth & Finance Software - Get Yours Now ►

Credit Sesame:

- Pros: In business since 2010. Credit Sesame offers $50,000 identity theft protection with its free service, which monitors your credit report daily and sends daily alerts. Has several types of loans and credit card offers.

- Cons: Credit Sesame has 47 complaints with the BBB and average customer reviews. Does not offer business loans.

Quizzle:

- Pros: In business since 1985, which is highly respectable. Quizzle offers a free credit score and credit report service as well as low-cost monthly options for added benefits, like 24/7 monitoring and a $1 million insurance policy. Unlike Credit Karma vs. Credit Sesame, Quizzle offer home refinancing options. Quizzle has had only six BBB complaints.

- Cons: Quizzle has no reviews with BBB, so it can be difficult to know how customers feel about the service. The paid plans can be a turn off for those who want the paid features for free. Quizzle does not offer student or business loans.

We hope this article, “Credit Sesame vs. Credit Karma vs. Quizzle (2016 Ranking)” gives you insight into the differences between these services and what each one can do for you.

Read More: Brief Review of Credit Sesame

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.