Intro: What Does Credit Karma Offer?

Like other credit services, Credit Karma provides users with information about their credit scores and offers advice for raising credit scores. According to the Credit Karma website, the company is kept running by money made from advertising financial services.

While Credit Karma.com reviews often criticize this method of generating income, the company is very open about their revenue model.

Users may wonder, “Is Credit Karma legit as a source of secure financial information?” Reports from Equifax and TransUnion provide the information. The information on the website is updated from those reports each week, according the Credit Karma website, so the numbers you see are always up to date.

Image Source: Is Credit Karma safe and legit?

The site also has features that allow you to determine how your credit score would change, based on hypothetical situations.

For example, you could put in the numbers for a loan you’re thinking about taking out, to see how the debt would change your score. While some may ask, “Is Credit Karma safe and legit?” most will appreciate the calculators and projections as a key feature from the site.

See Also: Is Credit Karma Safe to Use? What You Should Know

Common Credit Karma Review Pros and Cons

As with all online reviews, CreditKarma.com reviews include both positive and negative aspects.

These factors may help you decide whether you’ll use CreditKarma.com down the line, or if you’ll choose to monitor your credit score through another company.

We’ll go over a few of the most common pros and cons discussed in CreditKarma.com reviews, below.

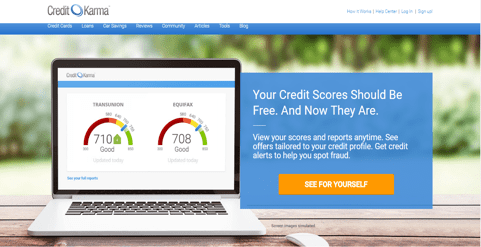

Image Source: Credit Karma

Pros

- Credit Karma is a free service that offers many helpful tools and resources for those who want to monitor and improve their financial situation. These tools include debt repayment calculators, loan calculators, and a credit score simulator to see how small changes can affect your score. Resources include articles about a wide variety of finance-related topics.

- Because the information used to generate credit scores comes from Equifax and TransUnion, it is accurate and reliable.

- Unlike other services that allow you to check your score for free once or twice a year, Forbes states in a Credit Karma review that the site offers a free weekly update. That can be a great benefit to those who are actively trying to improve their score through both big and small changes every day.

- Reviews of CreditKarma.com often list credit monitoring as a key feature. You can set alerts to give you a notice any time there is a change to your score, whether the change was spurred by you or a fraudulent action.

- The website itself is designed well and is easy to use. In fact, CreditKarma.com customer reviews often note that the user-friendly site is what drew them to the company.

- In addition to the company website, Credit Karma has an equally easy-to-use app, available from the app store. The app is free to download. While users might question “Is Credit Karma safe and legit to use through mobile devices?” the app has close to a five-star rating and hundreds of reviews from users who use and trust the service.

Don’t Miss: Credit Karma Complaints | What You Should Know Before Using the Site

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Cons

- In order to use the services offered by the site, you’ll need to enter your Social Security number when signing up for an account. While the site is secure and the company promises to keep information confidential, those who question “Is Credit Karma safe?” may take issue with providing that personal information.

Image Source: Credit Karma

- At one point, there was an investigation that looked into whether the Credit Karma app was protecting user information. There were no reported issues with user information being stolen, but the Federal Trade Commission put guidelines in place to ensure that the app would be secure going forward.

- Credit Karma uses VantageScore, rather than reporting your FICO score. According to Investopedia, lending institutions are likely to make decisions based on FICO scores. While VantageScore will give you a similar number, your score may be slightly different than the number banks or other lenders see.

- Any CreditKarma.com review will mention the ads that pop up on the site. The ads for financial services generate income for the site, which makes it free for users, but can be a nuisance when trying to navigate the site.

The Credit Karma Scam Rumor and Complaints

Due to the investigation with the Federal Trade Commission in 2014, there was a lot of talk of a Credit Karma scam.

Many CreditKarma.com reviews claimed that the company was stealing personal information from users through the website and the app. While the matter was resolved, you’ll still find plenty of CreditKarma.com customer reviews, like those found on Angie’s List, that mention the investigation and show distrust in the company.

Currently, the Better Business Bureau gives Credit Karma a score of B-. The BBB website states that the score is based on 13 factors, including 391 complaints made against the company. Some raised the question of “Is Credit Karma safe?” but others were complaints about everything from the company’s advertising to issues with the website.

It’s also worth noting that Credit Karma is not accredited with the BBB, but that could be because the company never chose to go through the accreditation process.

Image Source: Credit Karma

The ads, found all over the site, are one of the main sources of frustration and negativity in CreditKarma.com customer reviews. Many complain that the ads are placed throughout the website in a way that makes it appear that they are part of the services offered by the company itself. The ads appear as links, in banner ads, and on sidebars. As Investopedia explains, Credit Karma uses user information to tailor the ads, giving relevant offers that you’re more likely to click on.

Some claim that the Credit Karma scam includes the fact that the company uses personal information to make money. However, the company defends its position, saying that using personal information allows them to offer the best services to each individual, helping the company to make money while helping customers to save money.

Poor customer service is another issue that comes up frequently in reviews of CreditKarma.com. Many complain that the customer service team takes too long to answer user questions. Some say that they never receive an actual answer to their questions, while most note that it takes days to get any response at all.

A Credit Karma review from Next Advisor states that a support email didn’t receive a response for two days, and then gave only minimal information that was taken straight from information readily found on the website.

Related: Consumer Credit Counseling Service – What You Should Know Before Using Them

In Defense of Credit Karma

While there are certainly a number of negative reviews, questioning if Credit Karma is safe and legit, there are many other CreditKarma.com customer reviews that list the benefits and positive aspects of the company.

A post from Money Nation offers a positive look at Credit Karma and the benefits it offers users. The Credit Karma review starts by making it clear that the services offered really are free. When signing up for an account, you won’t be asked for a credit card number, so you won’t be charged for extra services or fall victim to charges after a “free trial” like many other companies offer.

The Credit Karma review goes on to justify the ads that are found on the site. You’ll find ads for credit cards, loans, refinancing options, and more. The ads are necessary in order to keep Credit Karma free for users. While some will consider this part of a Credit Karma scam, there’s no difference between the ads on the site and similar advertising found on all other commercial sites.

However, it’s important to keep in mind that these offers won’t always be the best choice for everyone.

In addition to giving you an up-to-date credit score, Credit Karma has features that will help you to improve your score and create a better financial future. Some CreditKarma.com reviews mention these benefits, while others get stuck on the most basic features. If you take the time to look through the site, you’ll find plenty of helpful resources.

Look at the Factors that Decide Credit Scores section to learn why your score is what it is, as well as areas that you can work on to improve your score. Factors include how many accounts you have open, whether you pay bills on time, and how many negative marks you have against you. Find out how certain actions will change your score by using the Credit Score Simulator tool offered by the site. Is Credit Karma legit as a source of financial advice? Absolutely.

Should You Choose Credit Karma?

Your financial situation and your personal information are important issues that should always be taken seriously. Before signing up for any financial service, it’s important to do your research and know what exactly you’re signing up for. Reading CreditKarma.com reviews is a great start.

For those who are looking for basic information about their credit score, with the understanding that the score may be slightly different than a FICO score, Credit Karma is a good place to start. While many question “Is Credit Karma safe?” the general consensus is that personal information is secure through both the website and the app, after the FTC put guidelines in place in 2014.

Free Wealth & Finance Software - Get Yours Now ►

The additional tools and resources provided by the company will be valuable to many users and can be a great start toward improving your credit score.

You’ll probably want answers to questions about each potential credit score service. Is Free Credit Score safe? Is Credit Sesame the best site? Is Credit Karma legit? By reading reviews, looking at BBB scores, and learning about any potential issues with each company, you’ll be able to form your own opinion and determine which service will give you the information you need, without putting your security at risk.

Popular Article: Experian Reviews – What Is Experian? What You Need to Know (How to Read & Get a Free Credit Report & Review)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.