2017 Ranking & Comparison: Chase Ink Card vs. Citi Business Credit Card vs. Delta Skymiles Card vs. Wells Fargo Business Card

If you are searching for a good business credit card for your company, you may quickly realize that there are quite a few options out there. To help you with the research process, we have created a comparison guide to compare four business credit cards. We will look at:

- A Delta Skymiles credit card for business

- A Citi business credit card

- The Chase Ink Business card

- One of the Wells Fargo business credit cards

While there is no single perfect credit card for every company, there can be the perfect credit card for what yours needs. For example, our Delta Skymiles credit card may have the ideal perks for another business, but perhaps the Chase Ink Business card will work better for you.

Image source: Freeimages

First, we will give you a Citibank business credit card review, then a Gold Delta Skymiles® credit card review, then a Chase Ink card review, and finally a Wells Fargo business credit card review. Then, we will show you side-by-side comparisons.

By gaining this information and then comparing our four options, you will know the optimal cash business card for you in 2017.

See Also: Ways to Get the Best Credit Cards to Rebuild Credit | Best Secured & Unsecured Credit Cards for Rebuilding Credit

Comparison Review List

The list below is sorted alphabetically (click any of the names below to go directly to the detailed review section):

- CitiBusiness® / AAdvantage® Platinum Select® World MasterCard®

- Gold Delta SkyMiles® Business Credit Card

- Ink Business Preferred℠ Credit Card

- Wells Fargo Business Platinum Credit Card

High Level Comparison Table

Credit Card Names | Annual Percentage | Intro | Annual | Foreign Transaction | Perks? |

| CitiBusiness® / AAdvantage® Platinum Select® World MasterCard®

| 15.49% | $0 | $95 | None | Travel |

| Gold Delta SkyMiles® Business Credit Card

| 15.49% | $0 | $95 | None | Travel |

| Ink Business Preferred℠ Credit Card

| 16.24% | N/A | $95 | None | Rewards Points |

| Wells Fargo Business Platinum Credit Card

| 10.49% | $0 | $50 | None | Cash |

Table: Business Credit Cards | Above list is sorted alphabetically

CitiBusiness® / AAdvantage® Platinum Select® World MasterCard® Review

Citi offers a Citi business credit card that can earn companies serious travel rewards. The CitiBusiness® / AAdvantage® Platinum Select® World MasterCard® charges a $95 annual fee (waived the first year), but offers great rewards benefits when you use this Citi business credit card, including:

Image Source: American Airlines

- Earn 1 mile on every dollar spent

- Earn 2 miles on every dollar spent on American Airlines purchases

- Earn 2 miles on every dollar spent on business categories, including gas

- BONUS: Earn 50,000 bonus miles after spending $3,000 within the first three months of using this Citi business credit card

Since employees can receive a Citi business credit card for free, they can quickly add up these miles. Other perks from this Citibank business credit card include:

- Free checked bag on domestic flights

- Group 1 boarding on domestic flights

- No foreign transaction fees

Don’t Miss: Top Best Credit Cards with No Annual Fee | Ranking & Reviews | Best No Annual Fee Credit Cards

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Gold Delta SkyMiles® Business Credit Card Review

Next up on our list is the Gold Delta SkyMiles® Business Credit Card from American Express. This Delta Skymiles credit card also charges a $95 annual fee, but it offers great travel rewards through Delta Airlines each time you use your Gold Delta Skymiles® credit card.

Here are the ways to earn on your Delta Skymiles credit card:

- Earn 1 mile on every dollar spent

- Earn 2 miles on ever dollar spent on Delta purchases

- BONUS: Earn 30,000 bonus miles after spending $1,000 within the first three months of using this American Express business credit card

The Delta Skymiles credit card allows your employees to receive extra card copies for free, which means your business can earn miles more quickly, as well as these extra American Express business credit card perks:

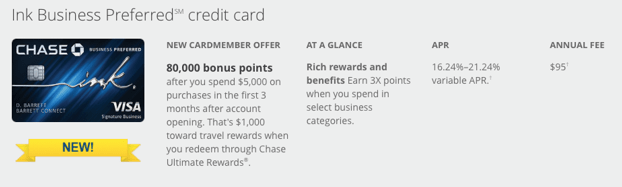

Ink Business Preferred℠ Credit Card Review

Next up on our list is the Ink Business Preferred℠ Credit Card by Chase. Though this card has the highest APR on our list, this Chase Ink business card offers a wonderful rewards points program that focuses on all business-related purchases.

Image Source: Chase

You can earn points on this Chase Ink card like so:

- Earn 1 point on every dollar spent

- Earn 3 points on every dollar spent on the first $150,000 combined purchases on travel, shipping, Internet, cable, phone services, advertising, social media sites, and search engines each account year

- BONUS: Earn 80,000 bonus points after spending $5,000 within the first three months of using this Chase Ink business card

In addition, if you redeem your points for airfare, hotels, car rentals, or cruises through Chase Ulimate Rewards, your points from this Chase Ink business card are instantly worth 25% more.

Related: The Best Prepaid Credit Cards | Guide to Finding Top, Free, Online Prepaid Credit Cards

Wells Fargo Business Platinum Credit Card Review

Finally, we get to the Wells Fargo Business Platinum Credit Card. These Wells Fargo business credit cards offer the lowest fees and interest rates on our list: a $50 annual fee and interest rates as low as 10.49%.

On top of that, these Wells Fargo business credit cards also have nice rewards offerings. With this Wells Fargo business credit card, you can choose between the cash back rewards or the points rewards.

- Cash back rewards earn 1% back on every dollar spent on these Wells Fargo business credit cards — plus, a $10 bonus when the company spends $1,000 for the month.

- Rewards points earn 1 point for every dollar spent on these Wells Fargo business credit cards. Plus, earn 1,000 bonus points when the company spends $1,000 for the month. Rewards can be redeemed for gift cards, flights, merchandise, or more.

Since you can receive up to 99 employee cards at no additional cost, these Wells Fargo business credit cards are a wonderful option for many business.

Rates and Fees Comparison

When it comes to the rates and fees of these four credit cards, two cards offer similar interest rates and annual fees, one card offers significantly lower options, and the other is slightly higher.

- The Wells Fargo Business credit cards offer the lowest interest rate ranges, between 10.49% and 19.49%. On top of that steep drop in APR, the Wells Fargo Business credit cards also offer an annual fee $45 less than the other three cards.

- On the other end of the spectrum, our Chase Ink Business Preferred℠ card has the highest APR, along with the $95 annual fee.

- When it comes to our other two cards, they each have similar APR ranges and the same annual fee ($0 first year, $95 thereafter). But the Citi business credit card has one low variable rate (15.49%). The Delta Skymiles credit card could be that low, but you could end up with a higher APR (19.49%) if your credit worthiness is not as great.

Purpose Comparison

All four of these cards are intended for business, so they share one joint purpose. Since they all also offer rewards, they share that purpose as well.

The only difference between the four is what type of rewards you would like to earn.

- The Delta Skymiles credit card and the Citibank business credit card both earn you travel miles.

- The Chase Ink business card and the Wells Fargo business credit card both earn you rewards points.

- Note that the Wells Fargo business credit cards can also earn you cash back if you would like to choose that option instead.

The real difference here is whether your business will better benefit from travel miles or rewards points.

Popular Article: Top Best Cash Rewards Credit Card Offers | Ranking | Best Cash Back Rewards & Money Back Credit Cards

Rewards Comparison

Since how you earn rewards is one of the only major differences between these four business credit cards, let’s compare them.

The Gold Delta Skymiles credit card and the American Airlines Citi business credit card both earn you 1 mile on every dollar spent and 2 miles on every airline purchase from their respective airlines. The only major difference is the Citi card also offers 2 miles on eligible business categories.

- The Wells Fargo Business Platinum card and the Chase Ink Business Preferred℠ card will both earn you 1 point on every dollar spent. The huge differnce here is that the Chase Ink card will also earn you 3 points on all the business categories listed above.

- The Wells Fargo business credit card is the only option that allows you to choose a cash back system instead at 1% per dollar spent.

As you can see, all four options offer nice rewards programs. But the American Airlines Citibank business credit card and the Ink Business Preferred℠ Credit Card do offer more options to gain awards.

Online Reviews Comparison

Now we will compare what online review websites say about each of these four business credit card options. These are not always indicators of how well these cards will work for your business exactly, but it can be beneficial to compare.

Also, click on each of these links to see what reviewers say about each card option:

Citi Business Credit Card:

- 3 out of 5 on WalletHub

- 3 out of 5 on CreditCards

Gold Delta Skymiles® Credit Card:

- 4 out of 5 on WalletHub

- 4 out of 5 on Credit Karma

Chase Ink Business Preferred℠ Card:

- This card is brand new and has limited feedback on consumer online reviews.

Wells Fargo Business Credit Cards:

- 3 out of 5 on WalletHub

- 2.9 out of 5 on CreditCards

- 2 out of 5 on Credit Karma

Read More: The Best Credit Card for Airline Miles | Guide | How to Find and Get the Best Credit Cards for Miles

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Delta Skymiles Credit Card, Citi Business Card, Chase Ink, or Wells Fargo Business Credit Cards?

Now that you have a more detailed look into these four credit cards for business, let’s take a look at which would work best for you and your company.

Since there are great pros and a few cons to each of these options, one is not necessarily better than the other. But there will be one that is best for your needs.

Here are the types of businesses that may benefit from each card:

- CitiBusiness® / AAdvantage® Platinum Select® World MasterCard®: This credit card works best for companies that would like travel miles, and possibly for those who have just good or great credit (opposed to excellent) due to their one variable rate.

- Gold Delta SkyMiles® Business Credit Card: This American Express business credit card would be best for companies that would like travel miles and prefer the Delta lines. The Delta Skymiles credit card also reviews nicely on online financial websites, as seen above.

- Ink Business Preferred℠ Credit Card: This card is best for those who want to earn massive rewards points on business categories. The Chase Ink business card is also better if you do not often carry a balance, as the APR is higher.

- Wells Fargo Business Platinum Credit Card: This card is best for companies who want low fees and may carry a balance from month to month, as these Wells Fargo business credit cards have the lowest APR. It is also great for those who prefer cash back.

With this information, you can now make a confident decision about the business credit card that is just right for you in 2017.

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.