2017 Guide: How to Find the Top Direct Payday Lenders (Direct Lenders for Payday Loans)

For those living paycheck to paycheck, an unexpected emergency can throw off their financial balance for weeks, months or even years.

Some turn to credit cards, others to friends or family, and some choose to use payday lenders as a quick way to access cash for getting over a financial hurdle.

When would you need cash advance lenders for extra money? Imagine you just resigned from your current position as assistant manager of a restaurant to pursue a different career path.

You have two weeks until you begin your new job, which means a few weeks with no pay.

Unfortunately, a couple of days after leaving your restaurant position, your car breaks down and requires about $500 in repairs. One of your best options might be to search for payday loan lenders that will lend you the money until your next payday.

There are several options when it comes to finding guaranteed payday loans direct lenders online, but how can you locate the most reputable lenders? This article will provide useful tips to help you find the best online payday loan lenders without breaking your bank.

See Also: Lending Club Reviews | Is Lending Club Legit or a Scam? What You Need to Know!

What Is a Payday Loan?

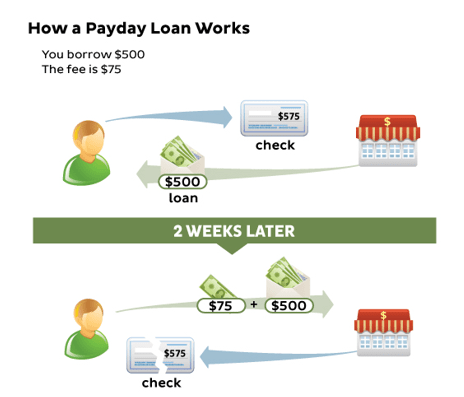

A payday loan, or cash advance, is a type of short-term loan that is given by direct payday loan lenders in exchange for a quick payback with interest.

They are usually for small amounts of money to cover small financial needs until your next payday.

Payday loan lenders typically expect you to pay off the loan and interest with your next paycheck, hence the name “payday loan.”

Source: Payday Loans and Cash Advances

How does a payday loan work? Usually, direct payday lenders require a check in the amount of the loan plus interest when they give you the loan money.

This acts as collateral for the loan. Online payday loans direct lenders may ask for your checking account information for an electronic transfer of funds instead.

At the time of your next paycheck, payday lenders can cash the check or make the transfer.

There are a few ways to pay off a payday loan, which can vary by direct payday loan lenders:

- Lump sum payment: The majority of cash advance lenders require a lump sum payment of the full amount of the loan plus interest on your next payday.

- Renewal or rollover payment: If you are struggling to make the full payment on your payday loan, a direct lender for payday loans may allow you to make a partial payment, like just the interest on the original loan. However, direct payday lenders can impose hefty fees each time you renew your loan.

- Payment installments: Sometimes, an online payday loans direct lender allows a borrower to pay in installments. These installments usually line up with the borrower’s paycheck schedule and may be set to pay from a checking account automatically.

Payday loan rates are different in each state because states can impose their own laws as long as they adhere to federal guidelines. Not all guaranteed payday loans direct lenders are created equal, and, therefore, this article will help to guide you to the most reputable direct payday lenders.

Don’t Miss: LendUp Reviews | Is LendUp Legit? A Scam? What You Need to Know about LendUp.com

Is Using a Direct Lender for Payday Loans a Good Idea?

For those with bad credit or few emergency finance options, online payday lenders can provide a fairly easy and quick way to get cash when it is needed most.

Sometimes referred to as direct lenders for bad credit loans, lenders of payday loans usually do not require credit information because they only lend small amounts of money that will likely be paid back quickly.

However, if you have bad credit, direct lenders for bad credit loans are not always a wise choice to use for your financial situation.

If you have a history of not budgeting well and are unsure if you will be able to pay back the cash advance lender by your next paycheck, you could put yourself further into a debt funnel that you might not be able to pull out of.

An in-store or online payday loans direct lender can charge outrageous interest rates for you to secure your loan. Remember that, when you are ready to pay back payday loan lenders, you will have to pay the amount of the loan plus interest. This can be difficult to do if you borrowed the full amount of your paycheck and have no extra funds to cover the interest.

Rather than turning to online payday lenders just to gain some extra cash, keep them in your back pocket in case of true emergencies that could arise before your next paycheck, such as:

- Car repairs

- Medical bills

- Home repairs

- Childcare costs

- Unexpected bills

- Traffic tickets

Be financially responsible and exhaust your other options before turning to payday lenders. Then, keep in mind the following tips to find the best online payday loans direct lenders, should you need one in the future.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Tip#1: Check the Interest Rates for Online Payday Loan Lenders

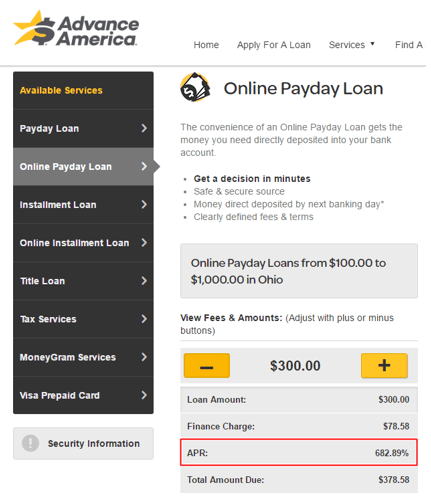

It is no surprise that a direct lender for payday loans charges more interest on a short-term loan than for other loan options or credit cards. Direct payday loan lenders charge fees that range, on average, from $10–$30 per every $100 of a loan.

Online payday loan lenders charge an average APR of 400% whereas credit card APR averages about 12%.

No matter what guaranteed payday loans direct lenders you choose to borrow from, you stand to receive an extremely high interest rate. Direct payday lenders need to make money from short-term loans, and this is how they can do that.

However, this does not mean you should settle with the first lender you find. The more reputable online payday loan lenders will outline their terms clearly so you can compare interest rates.

Source: Advance America – Available Services

Advance America, for example, clearly displays the information for an online payday loan according to the amount you need to borrow. If you find online payday loan lenders that provide little to no transparency about their fees and APR, you should consider looking elsewhere for your loan.

Related: How to Get a Small Business Loan for a New or Growing Business

Tip #2: Find out the Fine Print from Online Payday Loan Lenders

Payday lenders do not always clearly disclose the terms of their loans. Before considering any payday loan, you should look for and review the fine print of the loan to ensure that you fully understand the loan agreement.

If direct payday loan lenders do not willingly provide you with answers to your questions, then they should not be considered reputable providers.

Aside from interest rates, the most important information to look for when choosing among direct payday lenders is:

- Origination and non-sufficient funds fees: Some direct payday loan lenders impose an origination fee for setting up the loan, which will not be returned when you pay back the loan. A non-sufficient funds fee can also be placed on your loan if your check bounces when the lender attempts to cash it.

- Privacy policy: Will your online payday loan lenders sell your personal information to other companies? This is sometimes the case and can result in your information being shared with other loan providers.

- Payment method and due date: When is your loan due and what methods do the direct payday loan lenders use to collect your payment? Check the direct payday lenders’ terms to find out if you can pay off the loan early and what your other repayment options are.

- Loan default. If you are unable to repay your loan, cash advance lenders will outline terms for their process of collecting the money. Lenders might impose extra fees or take legal action, so make sure you are aware of all possible consequences.

If the online payday loans lenders you are considering do not clearly outline this information on their websites and you cannot find out their terms by contacting the lenders, you should not consider borrowing from them.

Tip #3: Make Sure Direct Lenders for Bad Credit Loans Adhere to Usury Laws

Usury laws are laws specific to different states that regulate the actions of payday loan lenders. These laws typically regulate the fees a lender can charge a borrower, how much the lenders can loan, and how often a borrower can secure a payday loan.

Some direct payday lenders become involved with banks from other states to skirt around the laws for their particular states. Check with your state’s regulations on payday loans before securing a loan with direct payday loan lenders, and contact the lenders for more information on their cooperation with usury laws.

Tip#4: Check with the CFSA for Reputable Direct Payday Loan Lenders

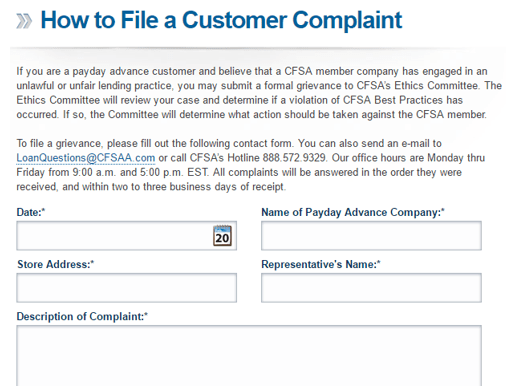

If you are considering a few online payday loan lenders, check if they are members of the Community Financial Services Association of America (CFSA). The CFSA backs short-term loan lenders that adhere to usury laws and provide responsible lending practices to its customers.

Source: How to File a Customer Complaint

Should you become a victim of questionable business practices involving a CFSA lender, the CFSA allows you to file a complaint against the online payday loans direct lender. Ensuring that the lender is a member of the CFSA helps protect you if you feel that the lender was unlawful or deceitful in its practices.

Popular Article: How to Get Student Loans with Bad Credit | Things to Know Before You Apply for Student Loans

Tip #6: Stay Away from Lead Generators of Online Payday Lenders

There is added risk to searching for online payday lenders compared to in-store payday lenders. You may get caught on websites that lead you to believe you can get a quote for a particular payday loan. Instead, it turns out to be a lead generator website.

Source: Principles of Lead Generation Websites

Lead generators take the information you provide, like your name, address, e-mail address, and financial information, and forward it to direct payday loan lenders. In turn, lenders can contact you to try to promote their loans. You could end up with several calls or e-mails every day from direct payday lenders you have no interest in.

It is better to visit the websites of payday loan lenders directly so you are in control of who has your personal information. Be cautious of the words “matching you with” or “connecting you to” lenders if you are not sure if you found a lead generator website for direct payday lenders.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion

There are reputable online payday loan lenders, but finding them is not always a simple process. Ensure that you are careful with your personal information and only provide it to the online payday lenders you are most comfortable with.

Thoroughly check online customer reviews before settling with any lender, and contact the lender for a further explanation of the loan terms.

Read More: How to Get Small Loans – Bad Credit Borrower | Tips| Small Loans for People with Bad Credit

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.