About Lending Club

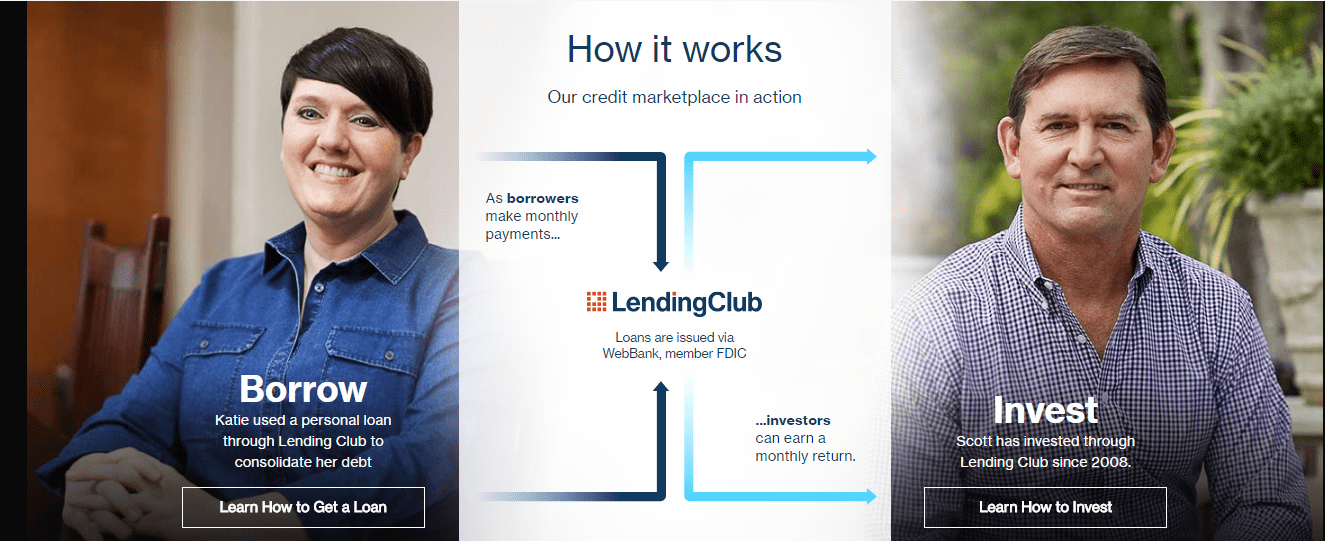

Lending Club represents a financial resource that is designed for borrowers and lenders alike.

Nearly every American will need to engage in a loan sooner or later. Sometimes borrowing is planned, and other times it’s the result of unforeseen circumstances.

Lending Club reviews illustrate the value of a speedy solution to these unexpected needs.

Lending Club is also a marketplace for those looking to build returns on an investment. In this Lending Club review, we’ll look at both sides of the equation. Additionally, by looking at Lending Club complaints, we’ll attempt to answer the questions: “Is Lending Club legit?” and “Is Lending Club a scam?”

A Lending Club review is important for any prospective borrower or lender because it brings the risks and rewards to the forefront of the conversation. In essence, a Lending Club review is a peer-to-peer lending review because the loans are funded by other users. Our Lending Club review will remain focused on the facts, the numbers, and the customer testimonials.

The model offered is still reatively new, and—understandably—this leaves people skeptical and cautiously seeking reasons to understand the truth to the inquiry, “is Lending Club legit?” Read on to learn what we found, so you can decide for yourself the value and the answer to your question: “Is Lending Club a scam?”

See Also: Affirm Reviews | What Is Affirm, and Is It Safe to Use? (Affirm.com Loan Reviews)

Choosing Lending Club For A Personal Loan

Our Lending Club review takes a careful look at this personal loan service, which represents the core of their business. When customers ask, “Is Lending Club legit?” they’re concerned about the cost of borrowing. Like a conventional loan, the cost is tied to one key metric—your credit score. Those asking, “Is Lending club a scam?” are often referring to the common practice of online lenders commanding exceedingly high interest rates. In some cases, this is tantamount to the unscrupulous act of “payday loan” lending. A misunderstanding about the nature of Lending Club loans occasionally leads to unfounded Lending Club complaints and concerned borrowers asking, “Is Lending Club legit?”

Before we review the various rates and costs in our Lending Club review let’s take a look at the value of this truly twenty-first-century option. The site offers an approachable interface that makes the application process fast and easy. Personal loans of up to $40,000 are available to qualified borrowers.

Image source: LendingClub

Loan payments are automated. Funds are available at varying speeds (a source of some Lending Club complaints). A fast approval can yield funds in as little as seven days. More complicated financing will require 30 to 45 days.

Those who make regular, on-time payments will enjoy the long-term benefits of an improved credit score. This is a critical point for those asking, “Is Lending Club a scam?” and “Is Lending Club legit?” As the site claims, “By consolidating debt or paying off credit cards, you may improve your credit score.

75% of borrowers experience a FICO score increase three months after obtaining their loan.” Our Lending Club review shows that this claim comes from an analysis covering two years of borrowing data (2013–2015).

Qualified borrowers will receive a variety of loan offers based on their credit score. After the Lending Club borrower reviews the offers, the borrower can then complete an application.

When the application is submitted, Lending club reviews potential investors and makes a match. During this process, applicants can periodically check on the status of their loan. Once approved, the funds are wired to the receipient’s account.

Don’t Miss: Best 6 Private Student Loan Providers—Best Place for Student Loans

Understanding Lending Club Rates

This is where our Lending Club review attempts to answer the questions: “Is Lending Club a scam?” and “Is Lending Club legit?” Learning about the Lending Club rates also helps draw a comparison to more conventional loans aquired from a bank.

This is a critical measure for any peer-to-peer lending review.

Later, we’ll take a look at how a review of Lending Club complaints reveals broad-based sentiment on their offerings.

The most important aspect of a Lending Club review should be cost. This is where the true, most meaningful value of any lender is concentrated. If there is concern around the question, “Is Lending Club legit?” the answer is found by first looking at costs. When an applicant engages in a loan, Lending Club reviews their credit score.

This score will yield a ranking for the individual. This ranking extends from “A” to “G”, with each letter having a cooresponding 1 through 5 ranking. The higher the letter and number combination, the better the rate.

Remember, those questioning “Is Lending Club a scam?” should remember that the loan is not coming from Lending Club. Rather, the loan is sourced from another investor using the Lending Club interface.

Compared to the above averages, Lending Club has comparable and even competitive rates (though Lending Club complaints exist on this issue, often due to misunderstandings on the part of the borrower). The challenege of a true Lending Club review is matching up where a score like 690 or 580 would land on their scale.

This makes a fair comparison difficult; however, the general information seems to indicate that the answer to “Is Lending Club a scam?” is probably no. As for the question, “Is Lending Club Legit?” the remainder of our Lending Club review will explore this broad question.

Related: Myinstantoffer.com Reviews—Get All The Facts! (Is myinstantoffer.com Legit? & Review)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What Are the Risks And Fees?

All loans carry risks for both parties. Our Lending Club review is focused on both sides of the transaction. Therefore, we’re considering both the borrowers and the lenders. Let’s begin by considering the risk for the borrowers. The three main fees and penalties are:

- Late payment fee

- Unsuccessful payment fee

- Origination fee

- Check processing fee

The immediate risk is missing a payment. Fees are often the origin of many Lending Club complaints, however, the responsibility of these fees falls to the borrower. In a case like this, a 15-day grace period is applied.

Once this period has expired, late fees will apply. A “late payment fee” applies when payments are made on the sixteenth day following the grace period upon which the borrower is charged 5% of the missed payment, or $15.00. The fee is charged once per late payment.

Again, the answer to “Is Lending Club a scam?” is no, as long as you equip yourself with all the facts regarding penalties and fees before starting.

If an automatic installment payment yields as an insufficient funds notice on your account, an “unsuccessful payment fee” is generated—this fee is $15.00. However, the total cost could be as high as $45.00.

Why? Lending Club will attempt the payment up to two additional times before abandoning the attempt. This catch is missed in many Lending Club reviews. Finally, a check processing fee of $7.00 is charged to those who opt out of the automatic payment plan and choose to write and mail a check for each payment.

Consider these fees when reviewing your options. While there are few Lending Club complaints, many are based in a failure to read this fine print.

Origination fees also apply no matter how strong your credit score is. This also works on a scale system. This scale references the same letter and number combination used to determine the interest rate applied. Again, this arouses Lending Club complaints, but only when a borrower doesn’t read the fine print.

The origination fee will defray the value of your loan. An example provided by Lending Club illustrates this: If you take loan of $6,000 with an origination fee of 3.5%, equaling $210.00, your true loan value is $5,790.

Investors face fees as well. The service fee for a lender is equal to 1% “of the amount of any borrower payments received within 15 days of the payment due date. If borrowers miss a payment, investors do not pay a service fee.”

Fees like this are not uncommon in the conventional world of bank loans. Additionaly, any peer-to-peer lending review will uncover similar fees.

Popular Article: Trusted Payday Review—Get All the Facts! (Payday Loan Reviews)

Business Loans With Lending Club

As seen in many other peer-to-peer lending reviews, a business loan in this area makes less sense, and some may have Lending Club complaints with this arm of the business. Any established business normally has an existing line of credit or a good relationship with a bank, which can be used for a loan.

Image source: LendingClub

Our Lending Club review isolates these key attributes for obtaining a business loan with Lending Club:

- $300,000 maximum loan value

- Interest rates ranging from 5.9% to 26%

- Terms ranging from 1 to 5 years

- Personal guarantee required

- Collateral required on loans more than $100,000

The best advertised offer promises values up to $300,000 with rates as low as 5.9%. How does this compare, and is Lending Club legit with their rates? The U.S. Small Business Association (SBA) offers loans to business also.

With this option, a loan more than $50,000 with a repayment rate under 7 years has an interest rate of 5.75%. If the repayment term is greater than 7 years, the repayment rate is 6.25%. These rates are the maximum values permitted by the association.

There may be some Lending Club complaints here. The business loans are not particularly competitive and lack the oversight and tighter regulation offered by a bank. Is Lending Club legit for business owners?

Yes, but this doesn’t necessarily make it a wise choice. The comparison with SBA loans, however, is a bit uneven; Our Lending Club review should remark that the terms here are shorter, just 1 to 5 years.

Lines of credit can be as low as $5,000 and also extend to a maximum of $300,000. To qualify for a line of credit with Lending Club you must meet the following:

- Two years or more in business

- A minimum of $75,000 in annual sales

- No recent bankruptcies or tax liens

- You must own 20% or more of the business

- Personal credit must meet a minimum standard

Each draw on the line can be paid back over 25 months without prepayment or additional fees. While these are reasonable prerequisites, they should be considered carefully before securing a loan and asking oneself “Is Lending Club legit?”

Understanding Lending Club Complaints

Some users will be disappointed to learn that their application has been denied. This not an uncommon Lending Club complaint. Just because the process is streamlined and entirely online doesn’t mean the review process is without rigor.

Lending Club complaints of this type often originate from the individual’s poor credit score.

Others posit the misguided Lending Club complaint that the organization is in fact out to defraud investors and extort borrowers. This is not true. A deep Lending Club review makes clear that the company is built on a sound approach to lending and reasonable tiered interest rates.

Is Lending Club legit? Yes, they are, however, some refuse to trust a modern system such as this.

Lending Club reviews on the BBB are stellar. The company enjoys an “A+” rating.

Interestingly, some complaints actually underscore the desire for the service. Case in point: some potential customers in states like Maine and Idaho (where the company doesn’t operate) are vocal with their Lending Club complaints about being left out.

Is Lending Club a Safe Choice?

Lending Club reviews on the BBB are clear as is the rating. With more than $18 billion loans funded to date, the company stands on a firm bedrock of success. This enormous sum is the most concise answer to the question, “Is Lending Club a scam?”

Futhermore, those asking “Is Lending Club a scam?” will be pleased to learn of the transparent process that governs all transactions.

All fees and costs are made clear and well-defined with examples. The Lending Club reviews are overwhelmingly positive as well as Lending Club borrower reviews. This is in contrast with what you’ll find on other peer-to-peer lending reviews.

Lending Club offers the flexibility of using the core services and transactions within the Lending Club app. The surprisingly robust offering allows borrowers and lenders to perform all the key tasks on their phone.

In learning about Lending Club, some may be surprised to discover they offer loans for medical expenses. Those seeking funds for medical reasons can borrow up to $32,000 at a 0% APR for up to 12 months. Of course, if timely payments aren’t made, a painful 23.23% APR kicks in.

The Final Verdict

A pure peer-to-peer lending review illustrates that Lending Club is likely one of the best online lenders available today. Take time to understand what your true loan value will be and how a failure to pay will impact your total costs and fees.

The broad appeal and satisfaction among more than 12,000 reviews quell any concerns from those pondering, “Is Lending Club a scam?”

Make Lending Club your first stop when comparing options for affordable borrowing.

Read More: Best Small Business Grants and Loans for Women Starting a Business

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.