Intro: LendUp Reviews | Is LendUp Legit? Is it A Scam? What You Need to Know about LendUp.com

Peer-to-peer lending sites offer convenient ways for people to borrow money without going through traditional financial institutions. LendUp is a relatively new peer-to-peer lending website and is making waves in the area of small, short-term loans.

LendUp loans are marketed to help people with poor credit, while mitigating the risk of entering a detrimental high-interest loan cycle.

While there appears to be many advantages to LendUp loans over other peer-to-peer lending sites, many potential customers remain skeptical. Key questions being asked are “Is LendUp legit?” and “Is LendUp a scam?”

While there are dozens of LendUp reviews available online, this article will offer a concise, yet detailed objective LendUp review to help you make the right choice.

Image Source: LendUp

We will provide a brief look at peer-to-peer lending sites followed by an overview of LendUp as a company. We will then present a detailed review of the company’s product offerings—in particular, LendUp loans.

See Also: Grants and Loans for Minority Businesses and Minority Women

Peer-to-Peer Lending Sites

The concept of peer-to-peer lending sites is nothing new, and they have been used as an alternative to traditional bank loans for the past decade. From cash advances and payday loans to large business loans, peer-to-peer lending sites cut out the middle man to benefit both the borrower and lender.

Payday loan companies are an increasingly popular choice for people who are unable to borrow from other institutions.

However, these easy access loans come at a cost, and interest rates are usually exorbitantly high compared with loans and credit from traditional banks. Most payday loan companies maintain the same or similar rates, no matter how long you borrow from them.

They also often allow loan rollovers, and borrowers pay high fees for these extensions.

Most payday loan customers are people with poor credit who are unable to secure loans from traditional banks or qualify for a credit card. Regular borrowers can get stuck in a cycle of taking out loans simply to pay off the last, with fees continuing to accrue.

Overview of LendUp

LendUp was founded in 2012 and is headquartered in San Francisco. LendUp states that their mission is “to provide anyone with a path to better financial health.” The company claims to be an alternative to traditional payday lending companies.

LendUp’s marketing campaign is heavily geared toward highlighting its social responsibility.

Image source: LendUp

Although LendUp positions itself as an alternative to payday loan companies, it can still be classified as such. Most LendUp personal loans are high-interest and short-term (two weeks to one-month loans) as opposed to long-term (one-year to five-year loans), as offered by traditional banking institutions.

However, the major way in which LendUp differs from other payday loan companies is in their model.

A LendUp payday loan is easy to qualify for even if you have a low credit rating. LendUp offers a points system in which more points lead to qualification for larger LendUp loans and lower rates. Customers can earn additional points by taking LendUp’s free online educational courses. Some of the currently available 13 course titles include:

- Build Your Credit: Ladder to Success

- Know Your Credit Rights

- The True Cost of Credit

- Pay Yourself First

LendUp currently operates in 23 states, though their full range of services is limited to eleven states: CA, KS, LA, MN, MO, NM, OK, OR, TN, TX, and WY.

Don’t Miss: Best Small Business Grants and Loans for Women Starting a Business

LendUp Loans (LendUp Review)

On its website, LendUp talks about how difficult it is for so many Americans to escape the spiral of bad credit. The company proposes that utilizing LendUp personal loans can help those with poor credit to re-establish their reputation.

Essentially, it is setting itself apart from other payday lenders by offering LendUp loans as a more temporary option.

Once customers have taken out enough loans to start improving their credit scores, they should be more likely to qualify for credit at traditional institutions. They will then be less likely to need high-interest, short-term loans such as LendUp loans.

How Does LendUp Work?

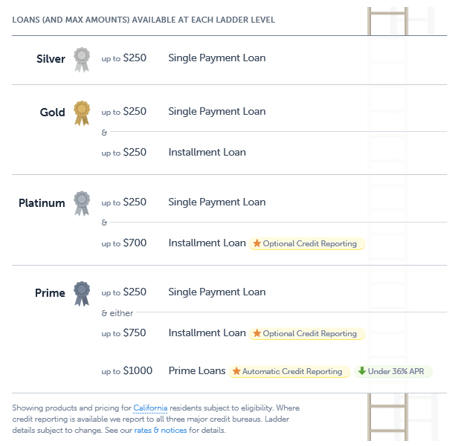

Borrowers apply online in a quick and easy process, and can find out instantly if they are approved. Maximum loan amounts range from $250 to $1,000, depending on status. Repeat LendUp borrowers progress through a points system so that the more LendUp personal loans they take out and repay on time, the more points they accrue.

As they earn points, they climb the LendUp ladder shown (for California residents) in the image below.

Image source: lendup loans

Related: Best 6 Private Student Loan Providers – Best Place for Student Loans

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

LendUp’s educational courses complement the LendUp loan system in two ways. They teach consumers how to be smarter with money and how to rebuild good credit, which has obvious benefits. Additionally, completion of the courses gives the customer extra points to help them climb the LendUp ladder to better rates and larger LendUp loans.

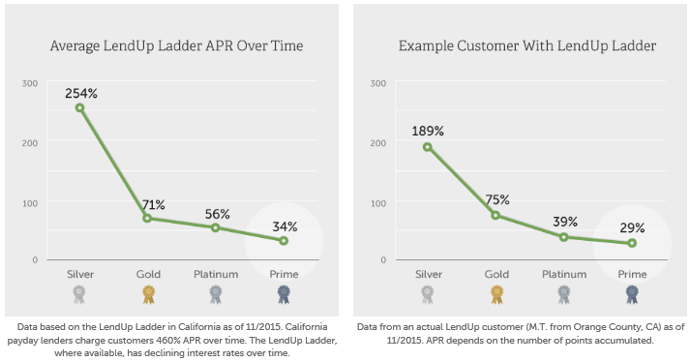

You can also earn points by referring friends and submitting testimonials. The following image illustrates how average rates change as customers progress up the ladder.

Image source:lendup payday loan

Although LendUp loans offer a lot of advantages over other peer-to-peer lending sites, it should be noted that customers still need to exercise good credit management in order to make LendUp personal loans work for them. Missed or late payments will still result in lowered credit rating as with other peer-to-peer lending sites.

LendUp Loan Rates

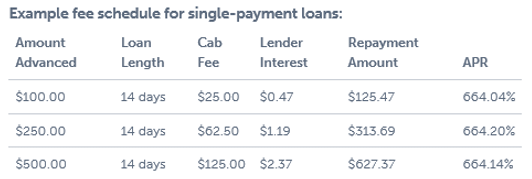

Rates are heavily dependent on your location as well as your position on the LendUp ladder. Some of the highest rates are in Texas, where, for example, the interest on a 14-day $100 LendUp payday loan is currently 664.04% APR.

However, once you reach prime status (if available in your state), rates can drop as low as 29% APR. To see examples of rates in your state, you can go to the Rates and Notices page of the LendUp website. The following is an example of rates for California.

Image source: lendup reviews

Is LendUp Legit or Is LendUp A Scam?

Some of this sounds too good to be true, and for some people it is. A good place to find out about the legitimacy of LendUp and LendUp loans is in LendUp reviews. We examined the vast array of LendUp reviews on sites like Trustpilot, Credit Karma, and Better Business Bureau.

The company scores very well with Trustpilot reviewers (9.7/10 in 675 LendUp reviews), but less so with Credit Karma reviewers (3.3/5 in 491 LendUp reviews).

It should be noted that the majority of negative Credit Karma LendUp reviews pertain to rejected LendUp payday loan applications. While clarity in the application process is a concern, these are not necessarily considered representative of the intended service provided by the company.

However, it does bring us to an important point. Consumers should be wary that just because the company advertises being able to help with poor credit scores, this does not mean it will accept every application.

Another important thing to note when applying for a LendUp payday loan, which many consumers seem to miss, is that the positive effect on credit rating is not immediate. Rather, each consumer has to climb the ladder to reach Prime status before LendUp will provide reports to the three major credit bureaus.

Additionally, it should be noted that access to Prime status is only available in select states: CA, KS, LA, MN, MO, NM, OK, OR, TN, TX, and WY.

Summary of Important Notes Regarding LendUp Loans:

- Poor credit history can hinder application approval.

- Credit rating does not improve until Platinum (in select cases) or Prime status is reached.

- LendUp services are not available in all states.

- Credit bureau reporting is not available in all states, even some that LendUp does operate in.

So, ultimately in answer to the questions “Is LendUp legit?” and “Is LendUp a scam?” we can say that yes, it is legit and very unlikely to be a scam. However, before applying for a LendUp payday loan, consumers should make sure they are aware of all of the facts. The FAQ section on the LendUp website is a good source of more detailed case-by-case information.

Pros and Cons of a LendUp Payday Loan

Taking into account all of the LendUp reviews available, here is a summary of the pros and cons of LendUp loans:

Pros (Positive LendUp Reviews)

- Quick and simple process

- Points system to access larger loans and lower rates

- Approve many people with poor credit rating

- Opportunity to rebuild credit (only for Platinum (in select cases) or Prime status)

- No loan rollovers (but extensions available upon negotiation)

- Quick response to online queries

- Finance education courses, which also earn LendUp points

- Potential to earn points through referrals and testimonials

Cons (Negative LendUp Reviews)

- Very high interest rates, especially for new customers

- No live chat on website

- Difficult to contact by phone

- Still essentially a payday loan company

LendUp App

LendUp did appear to make it easier than ever to apply for a LendUp loan with the free LendUp app. With the LendUp app, repeat or new customers could instantly apply for LendUp loans of $100 up to $1,000. However, amidst a slew of poor reviews, the LendUp app was made unavailable, and the last update was made two years ago.

Popular Article: Federal Student Loan Forgiveness | How to Get Rid of Your Federal Loan

While several LendUp app reviews cited that the app was working well, most LendUp app reviewers were unable to even log in. Most successful peer-to-peer lending sites in LendUp’s market offer easy-to-use apps, so let’s hope LendUp can come up with a new and improved LendUp app soon.

Conclusion: LendUp Review Summary

Overall, LendUp loans have a positive reputation, and the company offers many advantages over other peer-to-peer lending sites. Those considering a payday loan, especially regular users of payday loans, should definitely consider a LendUp payday loan.

As long as you intend to pay the amount back on time, a LendUp payday loan can be a great way to get extra cash fast. Customers can also improve their financial knowledge for free, and long-term customers in eligible areas can boost their credit scores.

However, consumers should be wary that just because this system is easy to use does not mean it should be abused. The interest rates on LendUp loans are still incredibly high and can result in even higher fees if not paid promptly. Consumers considering a LendUp payday loan should also be aware that only residents in certain states are eligible for LendUp credit reporting.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.