Federal Student Loan Forgiveness | 7 Things to Know If You Want to Get Rid of Your Federal Loan

Have you heard of the federal loan forgiveness program? If you are like many Americans living in the post-recession era, you have student loans you can’t afford to pay.

Perhaps you have kids to feed and clothe, past-due bills, or a job that doesn’t pay as much as you had hoped. Maybe you’re disabled and living on a fixed income or some other difficult circumstance you never anticipated back in those optimistic college days.

If that is the case for you, federal loan forgiveness might sound like a fantasy that’s too good to be true. You’ll be relieved to know that there are several types of federal loan forgiveness programs, and they are actually very real.

In this article, we’ll give you seven ways you can access federal loan forgiveness to improve your financial situation.

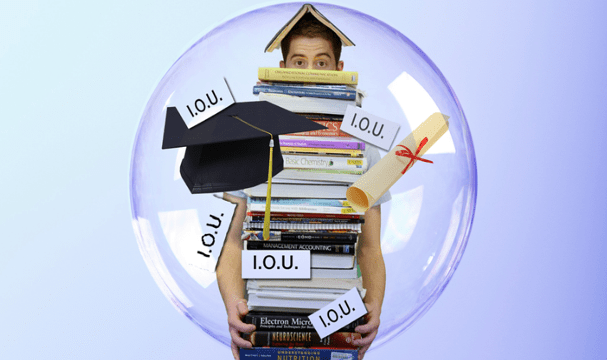

Image Source: Pixabay

Closed School Loan Discharges

According to the Federal Student Aid website, you have to repay your loans “even if you don’t complete your education, can’t find a job related to your program of study, or are unhappy with the education you paid for with your loan.” But what happens if your school closed down while you were still working on your degree? Are you required to pay for your student loans then?

The surprising answer is that you may be eligible for a type of federal student loan debt forgiveness called Closed School Loan Discharge. You can have one hundred percent of your student loans discharged if your school closed while you were working on your degree and you were thus unable to finish your education. You can even obtain federal student loan debt forgiveness if you withdrew from classes up to one hundred and twenty days before the school’s closure.

Under circumstances in which you are finishing your degree or certificate at another school or if you finished all of your coursework before the school closed, you would not be eligible for this federal loan forgiveness program.

If this federal student loan forgiveness program sounds like a dream come true, you can contact your loan servicer to find out how to apply. You can also get more information here.

See Also: PersonalLoans.com Reviews – Get all the Facts before Using PersonalLoans.com

Total and Permanent Disability Discharge

When you were in college, you may have assumed you would be making plenty of money to live on once you finally graduated. Repaying you student loans didn’t worry you because your financial future was bright. Federal student loan forgiveness was something you never considered.

But after graduation, something unexpected and terrible happened. You were totally and permanently disabled due to some illness or injury. Your bills are piling up and you aren’t sure what to do about those student loans you thought you could afford when you made it into your chosen career. Suddenly, a federal student loan forgiveness program seems like your only hope.

In order to access federal loan forgiveness for total and permanent disability, you will need to submit paperwork showing you do, indeed, have a disability. According to the Federal Student Loan website, the following types of paperwork are acceptable:

- Veterans: “If you are a veteran, you can submit documentation from the U.S. Department of Veterans Affairs (VA) showing that the VA has determined that you are unemployable due to a service-connected disability.”

- SSDI Recipients: “If you are receiving Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) benefits, you can submit a Social Security Administration (SSA) notice of award for SSDI or SSI benefits stating that your next scheduled disability review will be within five to seven years from the date of your most recent SSA disability determination.”

“You can submit certification from a physician that you are totally and permanently disabled. Your physician must certify that you are unable to engage in any substantial gainful activity by reason of a medically determinable physical or mental impairment that: can be expected to result in death, has lasted for a continuous period of not less than 60 months, or can be expected to last for a continuous period of not less than 60 months.”Physician Notice:

For more information about this federal student loan forgiveness program, check out the Total and Permanent Disability page at the Federal Student loan forgiveness program website.

Don’t Miss: Best Small Business Grants and Loans for Women Starting a Business

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Discharge in Bankruptcy

Maybe you’ve run into hard times lately. Maybe the times are so bad that you have had to file for bankruptcy, and continuing to pay for your student loans would keep you from putting food on the table for your family. This federal student loan forgiveness program isn’t a sure thing, but based on your circumstances, you may be able to obtain federal school loan forgiveness if you are filing for bankruptcy.

If you are filing Chapter 7 or Chapter 13 bankruptcy, you will need to prove in bankruptcy court that paying the loans would keep you and your family from maintaining a minimum standard of living before you can receive federal school loan forgiveness. Your creditors will be allowed to go to the proceedings and speak on their own behalf. You must also prove you have made good-faith attempts to pay the debt, which means you must have been making payments for at least five years.

If this sounds like you, then the court may decide to allow you to discharge your student loans and grant you federal school loan forgiveness. That means you would not have to pay the loans back and all collections activities would cease.

For more information about this federal student loan forgiveness program, take a look at the Federal Student Loan Website here.

False Certification of Student Eligibility or Unauthorized Payment Discharge

If your school of choice falsely represented your ability to benefit from the program in which you were enrolled, you may be eligible for federal school loan forgiveness. This basically means that if you were not eligible to receive the loan due to your program’s unhelpfulness to you, but the school accepted federal money on your behalf anyway; you will not be expected to repay that loan and could be granted federal student loan debt forgiveness.

This type of discharge is for people who have been victims of identity theft. If someone stole your identity and used your credit to obtain federal student loans, you qualify for federal school loan forgiveness.

You can also qualify if your school certified that a loan would be useful to you and you are unable to find work in your chosen field due to your mental or physical status. Also, this federal loan forgiveness program would apply if you are unable to obtain work in your trained field because of your age or criminal record. Those circumstances might make you eligible for one of the many federal loan forgiveness programs.

Lastly, this type of federal school loan forgiveness is for people who had their loans stolen by their school and never saw benefit from this money.

If you think you might qualify for this federal student loan forgiveness program, this website can give you more information.

Teacher Loan Forgiveness

Are you a full-time teacher in a low-income school district? If so, and your student loans were taken out after October 1, 1998, you may be eligible for a federal student loan forgiveness program. If you have been teaching for at least five years, you may be eligible to be forgiven up to $17,500 of your student loans. This applies to your FFEL loans, but PLUS loans cannot be included. You can even have Perkins loans forgiven if you meet the criteria.

Learn more about the federal student loan forgiveness program for teachers here.

Related: Trusted Payday Review – Get All the Facts! (Payday Loan Reviews)

Public Service Loan Forgiveness

One of the most-searched phrases on the internet about federal student loan forgiveness is “student loan forgiveness for federal employees.” That shows that many public servants out there are hoping to have their loans forgiven. If you are one of those, you may be in luck. There is a federal student loan forgiveness program for you.

Are you an employee of a non-profit company or a government agency? If so, student loan forgiveness for federal employees may be just what you need to get your student loans under control. If your loans are not in default, and if you have made 120 qualifying payments to your loans since October 1, 2007, you could qualify to have the remainder of your student loan debt completely forgiven.

According to the Federal Student Loan website, the types of full-time employees that can take advantage of this federal loan forgiveness program include:

- “Government organizations at any level (federal, state, local, or tribal)

- Not-for-profit organizations that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code

- Other types of not-for-profit organizations that provide certain types of qualifying public services”

says, “There are special rules that allow borrowers who are AmeriCorps or Peace Corps volunteers to use their Segal Education Award or Peace Corps transition payment to make a single ‘lump sum’ payment that may count for up to 12 qualifying PSLF payments.”The Federal Student Loan websiteEven Americorp and Peacecorp employment counts toward this federal student loan forgiveness program.

For more information, check out this web page.

Popular Article: Myinstantoffer.com Reviews – Get All The Facts! (Is myinstantoffer.com Legit? & Review)

Borrower Defense to Repayment

If you feel that you have been defrauded by your college or university, you could be eligible for the Borrower Defense federal loan forgiveness program. If your school misrepresented something or in some other way violated state laws regarding your loans, it might behoove you to look into federal loan forgiveness.

You might be eligible for federal student loan debt forgiveness whether your college is open or has closed. If you qualified for this type of forgiveness, you would not only be eligible for cancellation of your debts, but also to receive reimbursement for an amount that you’ve already paid in.

To learn more about this type of federal loan forgiveness, click this link.

These are seven ways the average person struggling with student loan debt can access federal student loan debt forgiveness. If you haven’t done so yet, please visit the Federal Student Loan website for more information about types of federal student loan forgiveness you might qualify for.

Don’t delay! Call your student loan provider or go online to find more about the federal student loan forgiveness programs today. If you’re having difficulty paying your student loans, it could change your life.

Read More: Best 6 Private Student Loan Providers – Best Place for Student Loans

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.