Enhanced Due Diligence Process for High-Risk Clients

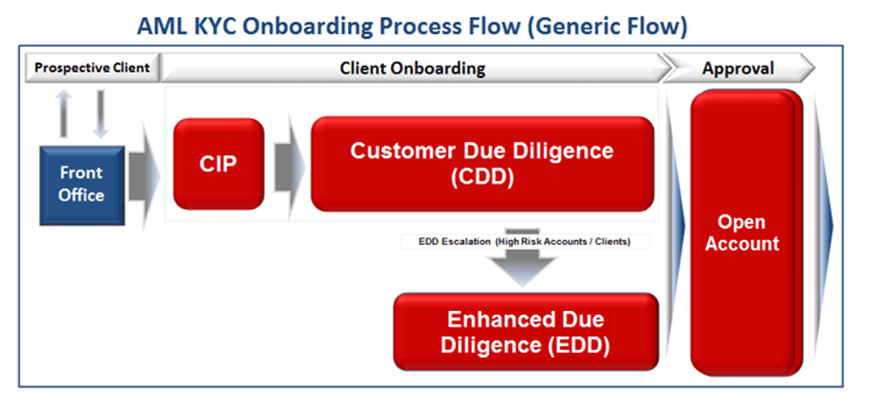

During the AML onboarding lifecycle, EDD (Customer Enhanced Due Diligence) is performed in situations when a new client is deemed to pose a higher money laundering risk.

EDD is also performed when an existing client is escalated from a low/medium risk level to a high-risk status

Enhanced Due Diligence Definition

After collecting a client’s information and documentation, financial firms perform CDD (Customer Due Diligence) to verify the customer’s identify and to determine the customer’s money laundering risk (i.e., low, medium, or high risk).

In a situation where a client is deemed to be a high-risk client, the firm might choose to end the relationship or escalate the case for further investigation.

Most firms choose to investigate further and have processes and procedures in place for escalating high-risk clients.

This further investigation is defined as enhanced due diligence.

High-Risk Customers

New or existing clients that pose higher money laundering or terrorist financing risks tend to increase the overall risk exposure to a financial institution.

As such, financial firms must have well-defined escalation and EDD processes and procedures in place.

Most especially, it is important that firms are able to forecast the anticipated future transactions that will be performed by their high-risk clients and implement a detailed monitoring plan to mitigate the banks’ overall risk exposure, compliance and reputation risk.

Factors/Variables that Merit High-Risk Status

There are various AML factors that can cause a client to be classified as high risk. A customer may pose a higher AML risk because of any of the following:

- Customer’s name is identified on a restricted person list (i.e., OFAC’s SDN List)

- Customer originates from a high-risk country

- Customer does business in a high risk or sanctioned country (i.e., Cuba)

- Customer does business in a high-risk industry

- Complex business and ownership structure

- Suspicious behavior or activities

- Transactions to/from higher-risk countries

Don’t Miss:

- Best Banks to Bank With – No Fees, High-Yield Savings, Largest Banks, and Credit Unions

- How Personal Capital Reviews

- How Much Does a Financial Advisor Cost?

Escalating High-Risk Clients

Across the financial industry, whenever a customer has been identified as posing a higher money laundering risk, the customer is normally escalated to the AML Compliance Officer or Team responsible for conducting enhanced due diligence, so a more extensive verification or monitoring can be performed.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Components to Assess When Conducting EDD

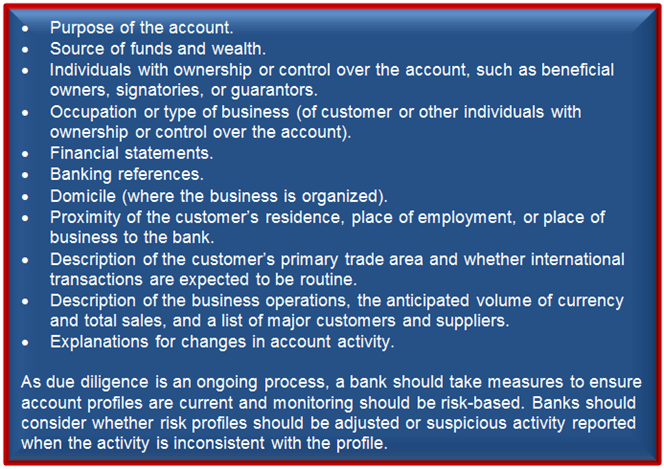

As specified by the Board of Governors of the Federal Reserve System, when conducting EDD, financial firms should review the below elements during the onboarding phase and also throughout the life of the relationship:

In addition, the AML staff can perform the below additional reviews:

1. Additional name screening/negative news search

2. Site visit: visit the customer’s place of business to confirm that it is an actual business

Periodic Reviews

Most financial services firms review their high-risk clients every six months or on an annual basis. In addition to periodic EDD reviews, firms also have ongoing or real-time AML monitoring programs in place to monitor transactions for low, medium, and especially high-risk customers.

Automatic High-Risk Clients

As required by sections 312, 313, 319(b), and other sections of the USA PATRIOT Act, some customers/accounts are automatically rated high risk regardless of their initial CDD risk rating and assessment.

Such clients/accounts include:

- Correspondent accounts for foreign financial institutions

- Private banking accounts for non-U.S. persons

- Any foreign bank correspondent account in the U.S. for which a legal summons or subpoena has been issued

See Also:

- Top 5 Best Personal Loan Companies – Ranking and Comparison

- CompleteCase.com Reviews – Get all the Facts before Using CompleteCase

- Lexington Law Reviews – Get all the Facts before Using Lexingtonlaw.com

Approving EDD for High Risk Clients

After performing enhanced due diligence, a financial firm has at least two options:

1. End the relationship and do not open the account (this option is normally taken when the risk outweighs the benefit of having a relationship with this client)

2. Accept the high risk relationship but implement a detailed monitoring plan and risk mitigation activities that can mitigate the bank’s risk exposure

Compliance teams across financial firms are normally responsible for performing EDD.

After reaching a decision (option 1 or 2 above), Compliance normally reaches out to the Front Office/Business team with their recommendation as to which action should be taken in regards to this new relationship.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.