Overview: Comparison of CSRS FERS Retirement Calculator, CalPERS Retirement Calculator, and the AARP Retirement Calculator

Planning for retirement is something that needs to be taken very seriously.

You may think that you have all the time in the world, but retirement often approaches quicker than you anticipate. If a FERS retirement calculator, CSRS retirement calculator, or other free retirement calculator is the last thing on your mind, it’s time to get serious about planning for retirement.

People who begin planning for retirement know there are many options. There are stocks, 401ks, IRAs, Roth IRAs, and more to consider.

On top of the number of options for saving money, you need to consider how much you will need or be eligible for when you retire. That is why knowing how to use a retirement pay calculator and how to calculate FERS retirement and other benefits is so important.

If this is the first time that you’ve thought about planning for retirement, chances are that you are feeling overwhelmed with the various options for a retirement pay calculator. Do you need to use a FERS disability retirement calculator, a CSRS retirement calculator, or another type altogether? You likely have many questions, including:

- Where you can find a free retirement calculator?

- What is a CSRS retirement calculator?

- Is an online retirement pay calculator actually accurate?

- What are the benefits of using a FERS retirement calculation?

- How to calculate FERS retirement?

- Is there a separate FERS disability retirement calculator?

- Do you qualify for a CalPERS retirement calculator?

- Is the AARP retirement calculator the most accurate?

Do you know what you need to save for retirement? Do you know how to calculate FERS retirement? Or how to use a free retirement calculator? If you answered no to any of those questions, then this article is extremely important to read.

In this comparison article, we will look at the different types of retirement pay calculators out there today. We will discuss doing a FERS retirement calculation, the benefits of the AARP retirement calculator, and whether that is different from a FERS disability retirement calculator.

See Also: The Best Retirement Calculators Guide | Top Retirement Savings & Income Calculator

CSRS and FERS Retirement Calculator Overview

The United States government has two retirement systems for employees. There is the Federal Employees Retirement System (FERS) and the Civil Service Retirement Systems (CSRS).

Image Source: Pixabay

These two retirement systems have a few significant differences between them, including how retirement benefits are calculated. Thus, using the FERS retirement calculator will differ from a CSRS retirement calculator.

On January 1, 1920, the CSRS was established. In 1986, Congress created the Federal Employees Retirement Systems (FERS). At the time that FERS was created, federal workers had the option to convert their CSRS to FERS, but now all new federal employees are enrolled in FERS.

The only employees who have access to the CSRS, are employees that were enrolled in it before 1987 and chose not to switch over.

FERS is a retirement plan that provides retirement benefits through three sources—Basic Benefit Plan, Social Security, and the Thrift Savings Plan (TSP). Of the three, only Social Security and TSP can follow you to another job if you leave the Federal Government before you retire. The Social Security and Basic Benefit parts require you to pay into them every pay period. This amount is withheld from your paycheck, but your agency pays in as well.

With all of these different variables and programs, it is difficult to know how to calculate FERS retirement pay. Doing a FERS retirement calculation is complex, and there are many different things that you need to take into consideration.

Don’t Miss: The Best Military Retirement Calculators for Active & Reserve Military Personnel

How to Calculate FERS Retirement Pay and CSRS Benefits

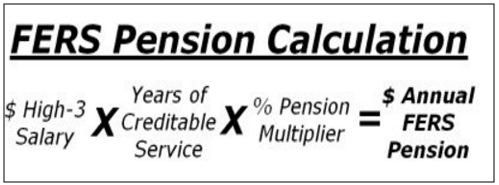

When using the CSRS or FERS retirement calculator, your basic annuity is calculated based on your duration of service and “high-3” average salary. So, for a FERS retirement calculation, you need to know three things:

- Years of Service

- High-3 Salary

- Pension Multiplier

Your years of credible service is based on your Retirement Service Computation Date (RSCD). This estimated number can be found on your Personal Statement of Benefits. Keep in mind that this number is merely an estimate. If you cannot find your statement, you can also estimate it by counting the number of whole years from your RSCD to the date you plan to retire.

Your high-3 salary is another important number for the FERS retirement calculator. This is the highest average basic pay that you earned for 3 consecutive years. This number includes locality pay and shift rates but does not take into account overtime, COLA, or any bonuses.

When using the FERS retirement calculator, your pension multiplier will likely be 1%. However, if you are over the age of 62 and have more than 20 years of credible service, this number increases to 1.1%.

Once you have these numbers, you are able to do a complete FERS retirement calculation using the following formula:

Image source: PlanYourFederalRetirement.com

With this FERS retirement calculator, you multiply your High-3 salary by your years of credible service and your pension multiplier. This FERS retirement calculator will determine your annual FERS retirement pay. To determine what this amounts to monthly, you simply divide the number by 12.

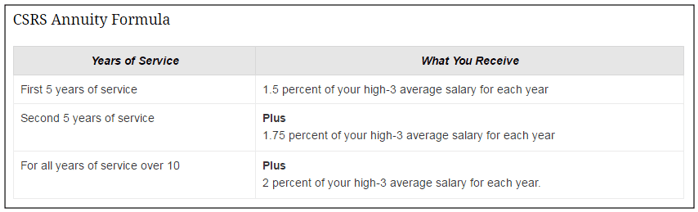

To use the CSRS retirement calculator, you use similar components. As the chart below shows, you multiply your High-3 salary by different percentages depending on how long you have been in service.

Image source: US Office of Personal Management

While this does seem rather straightforward, the FERS retirement calculator and the CSRS retirement calculator, become much more complex if you retired under certain special provisions, such as law enforcement, congressional employee, or a disability. There are other retirement pay calculators available for anyone retiring under a special provision.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Pros and Cons of the CSRS and FERS Retirement Calculator

The CSRS retirement calculator is a unique retirement pay calculator that you need to carefully utilize. The CSRS and FERS retirement calculators have both positives and negatives associated with them.

Pros:

- Gives you a very accurate number

- The formula is simple to use

- You only need 3 pieces of information

Cons:

- Only available to federal government employees

- It can be difficult to determine accurate input numbers

- Strict limits on minimum retirement age

- No “big picture” financial outlook planner

While the FERS retirement calculator and the CSRS retirement calculator may seem simple, the real frustration is finding the correct input numbers for them.

They give you an accurate yearly retirement benefits calculation, but there is no way to determine how this number combines with other sources of retirement funding.

Related: Best Retirement Communities in Florida to Retire to

CalPERS Retirement Calculator Overview

The California Public Employees Retirement System (CalPERS), is an agency in the California executive branch that is tasked with managing the health benefits and pensions of California public employees, former employees, and their families. For those of you who do not fall into this category, you do not need to know how to use the CalPERS retirement calculator and can skip ahead to the retirement calculator provided by AARP.

How to Use the CalPERS Retirement Calculator

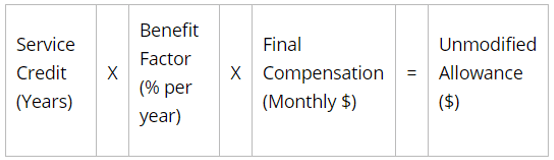

The CalPERS retirement calculator is slightly similar to the CSRS retirement calculator and the FERS retirement calculator. To use the CalPERS retirement calculator, you need the following information:

- Service Credit Years

- Benefit Factor

- Final Compensation

Your service credit years is the first number that you need to determine for the CalPERS retirement calculator. This is the total amount of years that you have been employed by a CalPERS employer. To find this amount, you can log on to your My CalPERS account.

The next number you need is your benefit factor. This is a percentage of final compensation for each service year that is based on your age at the time of retirement. It varies by age and you can also find it on your statements.

The final compensation component is the highest average monthly pay rate for 12 or 36 consecutive months. Note that if you also pay into social security, you will need to deduct $133.33 from this amount. With this number, you can then use the CalPERS retirement calculator.

Once you have these three numbers, apply them to the CalPERS retirement calculator formula as shown below:

Image source: CalPERS

This formula will give you the maximum unmodified allowance. This is the maximum amount that you are entitled to when you retire.

Pros and Cons of the CalPERS Retirement Calculator

Any retirement pay calculator will have benefits and drawbacks. The CalPERS retirement calculator is no exception.

Pros:

- Need only three pieces of information

- Straightforward formula

- Assistance offered by CalPERS

Cons:

- Only available to California public employees

- You will need to check your benefit factor every time you calculate

- Does not show an overall financial outlook

Popular Article: Can I Retire Now? Find out If You Can Afford to Retire Now

AARP Retirement Calculator Overview

Do you wonder if you have saved enough for retirement? Are you on track to retire at the age that you want to? These are questions that are difficult for anyone without a strong finance background to answer. However, by using the free AARP Retirement Calculator, you can determine if you are on track with your retirement savings.

Through the AARP Retirement Calculator, you can see a snapshot of what your financial outlook may be as you head into retirement. When you seriously start to consider retirement, you’re likely to ask questions like:

- When can I afford to retire?

- How long will the money I have saved up last?

- Am I saving enough money right now for retirement?

If this sounds like you, then it is definitely time to use the AARP Retirement Calculator. This free retirement calculator is available to anyone in the United States and requires you to answer only a few questions.

How to Use the AARP Retirement Calculator

Using the AARP retirement calculator is very simple. There are only three steps.

About You

This section is the first step of using the AARP retirement calculator. Here you will enter the following information:

- Marital status

- Age

- Current gross salary

- Percent of savings

- Current retirement savings

- Estimated pensions

- Social security estimate

- Lifestyle

Once this information is entered using your best estimate, the AARP retirement calculator will do some backend calculations. You will then be taken to step 2.

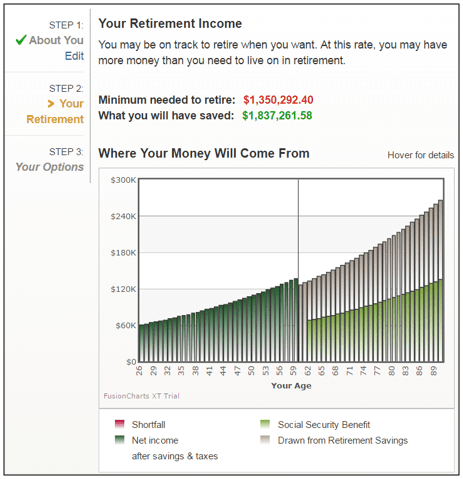

Your Retirement Income

Once the information in the “About You” section is entered, the AARP retirement calculator will calculate the amount of money that you will need saved up to retire. It will also show you what you will have saved up by retirement.

The chart below shows a screenshot of the Your Retirement Income section of the retirement pay calculator. The AARP retirement calculator will also show where the money will be coming from, and if and when you may experience shortfalls.

Source: AARP

Your Options

After going through the first two steps of the AARP retirement calculator, you may get some shortfalls appearing on the retirement income chart. In this step, you have the ability to adjust sliders for retirement age and lifestyle to determine how you can meet any shortfalls. If you have red bars in the outlook chart, you will either need to retire later, save more now, or adjust the lifestyle you will be living after retirement.

Pros and Cons of the AARP Retirement Calculator

As with any free retirement calculator, the AARP retirement calculator has positives and negatives associated with it.

Pros:

- Easy to use

- Available to all U.S. residents

- Includes different sources of retirement income (social security, pensions, savings)

- Can adjust variables to see how to cover shortfalls

- Shows the overall retirement picture

- Results are printable

Cons:

- The social security benefits calculator is not detailed

- There is no longevity prediction built into the model

- Assumes lower life expectancies

- Does not take into account home equity

- No option to plug in specific rate of returns

- Cannot separate information for a spouse

All in all, the retirement calculator provided by AARP is a great way to get a quick snapshot of your financial future. It takes only a few minutes to enter the information and does not require you to have extensive knowledge of the financial markets or retirement. While there are some drawbacks to using the free retirement calculator, it is a great starting point for determining if you are on track for retirement.

Don’t Miss: Ways You Can Retire Early (Detailed Early Retirement Planning Guide)

Conclusion: Retirement Pay Calculator Comparison

Which type of retirement pay calculator is the best? The AARP retirement calculator? The FERS or CSRS retirement calculator? The CalPERS retirement calculator?

The answer to that question is not straightforward, because different retirement calculators are better for certain people. Some people do not even qualify for certain retirement benefits, so they cannot use those retirement pay calculators.

The type of retirement calculator that you use is mostly dependent on your job:

- Federal employees employed after 1987 will use the FERS retirement calculator

- Federal employees employed before 1987 who did not switch programs will use the CSRS retirement calculator

- California public employees will use the CalPERS retirement calculator

- Anyone can use the AARP retirement calculator

For those Californian public employees and those in the federal government programs, it is still beneficial to use the AARP retirement calculator in conjunction with the others. The AARP retirement calculator gives you a big picture financial outlook that the other retirement pay calculators do not. Whichever retirement plan you fall into and whatever retirement pay calculator you choose to use, just be sure to take retirement planning seriously.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.