Overview: FHA Credit Requirements & How You Reach the Credit Score Needed for an FHA Loan

With lending practices that are less strict and lower down payment options available, FHA loans have become a popular option among those looking to take out a home mortgage.

However, taking out an FHA loan means looking into the FHA credit requirements, regarding an FHA loan credit score, and being aware of the min. credit score for an FHA loan.

In order to help you find out the minimum credit score for an FHA loan, we’ve created an extensive review, breaking down the FHA credit score requirements. Throughout our review, you’ll find answers to some of the most asked questions regarding an FHA loan credit score, such as:

- What is the credit score needed for an FHA loan?

- What are the credit requirements for an FHA loan?

- How can I reach the minimum credit score for an FHA loan?

- Do I fall into the lowest credit score for an FHA loan?

- Can I still qualify for an FHA loan if I don’t meet the FHA credit requirements?

With these FHA loan credit score questions in mind, we hope to provide borrowers with the necessary knowledge of FHA loan credit score requirements. Our goal is to leave borrowers feeling confident in reaching the FHA loan minimum credit score.

See Also: Lender Paid Mortgage Insurance | What You Need to Know about LPMI

Benefits of Caring About Your FHA Loan Credit Score

Borrowers that reach the min. credit score for an FHA loan will reap the benefits of an FHA loan. Those who hit the FHA credit requirements can take advantage of lower closing and mortgage fees and lower home loan interest rates, and those who reach the FHA loan minimum credit score can also apply for the loan regardless of any past bankruptcies or foreclosures.

Another great aspect of hitting the minimum credit score for an FHA loan is the fact that you can borrow money for repairs on your home. A great advantage of this FHA loan is that the loan amount is based on the value of your home after the repairs have been completed.

Staying on top of the credit requirements for an FHA loan and maintaining the credit score needed for an FHA loan can help you achieve your dream of owning a home without the added financial worries.

FHA Loan Credit Score Requirements

Before applying for an FHA loan, it pays to take a look into the FHA credit score requirements. One of the most encouraging elements is that the minimum credit score for an FHA loan does not have to be perfect.

In fact, as long as you reach the FHA loan minimum credit score, you should find yourself eligible for the loan. Depending on the type of FHA loan you wish to borrow, you may want to hit above the lowest credit score for an FHA loan. While those who reach the minimum will still be approved for a loan, it will be at a higher down payment rate.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Credit Score Needed for an FHA Loan/Minimum Credit Score for FHA Loan

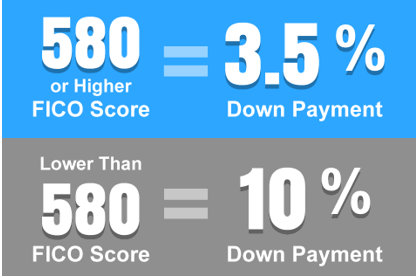

Image Source: FHA.com Credit Requirements

FHA credit requirements vary based on the kind of loan a borrower is looking to take out. With FICO credit scores ranging from 300 to 850, the present lowest credit score for an FHA loan is currently a 580 FICO score.

With this score, borrowers can hit the min. credit score for an FHA loan while still reaping the benefit of a low down payment.

An FHA loan credit score of 580 or higher will qualify the borrower for a low down payment of 3.5 percent.

Those who reach the min. credit score for an FHA loan can also use their savings to pay the down payment as well as other sources of income, like money from a family member, a grant from the state they reside in or even a local government sponsored down payment program.

However, those who do not reach the FHA loan requirements credit score can still qualify for a loan. Although the credit score required for FHA loan is 580, those in the 500 to 579 credit range may still qualify.

A borrower with an FHA loan credit score in the 500 to 579 ranges occupies the lowest credit score for an FHA loan. This FHA loan minimum credit score range qualifies you for a loan down payment of 10 percent in order to be eligible for the FHA loan.

With the original FHA loan credit score requirements hitting the 640 FICO minimum, this drop in 60 points has made meeting credit requirements for an FHA loan much easier and accessible for borrowers.

However, if you do not reach the FHA credit requirements, then you are generally ineligible for FHA loans.

Don’t Miss: Getting an Interest-Only Mortgage? What You Need to Know

How You Can Boost Your FHA Loan Credit Score

Although not reaching the FHA credit score requirements can be frustrating, it should not discourage you from attempting to reach the min. credit score for an FHA loan. After all, the benefits of working up to the credit requirements for an FHA loan are incredibly worth it for the homebuyer.

There are many ways you can improve your FHA loan credit score. Instead of wasting your time applying for an FHA loan without even hitting the FHA loan minimum credit score, your best efforts should be directed toward raising your credit score.

Getting your credit score back into shape to meet the FHA loan requirements credit score involves just a few key steps.

How to Meet the Minimum Credit Score for an FHA Loan

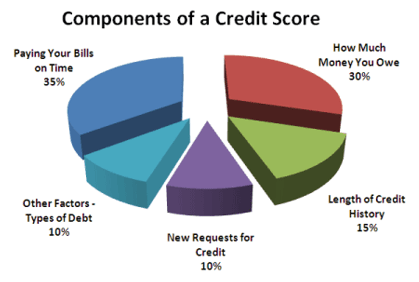

In order to raise your FICO credit score to meet the credit score needed for an FHA loan, it helps to know what makes up your credit score.

Each FICO credit score comprises:

- 35% payment history

- 30% total amounts owed

- 15% credit history length

- 10% new credit

- 10% type of credit in use

Image Source: FICO credit score

Being aware of each aspect of your FHA loan credit score can help initiate the improvement process of meeting the FHA loan credit score requirements. Take a look into each aspect of your credit score to see which area(s) is primarily keeping you from meeting the credit score needed for an FHA loan.

Related: US Bank Mortgage Reviews – What You Should Know (Home Mortgage, Complaints & Loan

The Steps to Take Toward Reaching the Credit Score Needed for an FHA Loan

Take a Look into Your Credit Report & History

One of the first steps borrowers should take to improve their FHA loan requirements credit score is to take a close look into their credit reports.

There are many great national credit bureaus where you can receive your FHA loan credit score at no extra cost, such as Experian, Equifax, and TransUnion.

When looking into your credit report, be sure to update any of your payment history accounts and make sure that there are no late or overdue payments present.

The more you stay on top of your payments, the easier it will be to meet the credit score needed for an FHA loan. After maintaining a clean credit report for 12 months, your credit score will move closer to or meet the FHA credit requirements.

Dispute Any Inaccuracies You Find in Your Credit Report

The next big step in improving your FHA loan credit score is to dispute any inaccuracies that you find within your credit history report.

Inaccuracies may include payments that you’ve made on time but are showing up late. Contacting the credit bureau to investigate these inaccuracies can mean a world of a difference in meeting the lowest credit score for an FHA loan.

Sometimes, certain creditors may be willing to overlook a late payment if you have an extensive history with them of always paying on time. Asking for a bit of help from these creditors can also help you reach the FHA credit score requirements.

Consider Getting Professional Help

If you still aren’t meeting the minimum credit score for an FHA loan, then you may want to consider getting professional help. To reach the min. credit score for an FHA loan, oftentimes, the FHA loan department will suggest borrowers look into getting advice from a credit counselor.

Image Source: Getting a Professional Help

What a credit counselor offers is help for borrowers by creating a debt management plan. In this debt management plan, all of your payments to creditors are consolidated into one monthly payment. After taking care of your interest rates and paying off your debt, you will instead pay the credit counselor.

By eliminating the amount of debt you owe to various different creditors, consolidating can have a positive impact on your ability to hit the FHA credit score requirements.

Improve Your Debt Utilization Ratio

Another great way to meet the minimum credit score for an FHA loan is to improve your debt utilization ratio. Your debt utilization ratio makes up a huge chunk of your FICO credit score. Debt utilization is the amount of money you owe creditors compared to the amount of credit available to you.

A debt utilization ratio that hits over 30% can make it extremely difficult for you to meet the FHA loan minimum credit score. Any debt utilization that is lower than 30% is great for your FICO score.

If you happen to have a debt utilization ratio that hits above 30%, then you may find it preventing you from meeting the credit score needed for an FHA loan. The best way to improve your chances of reaching the min. credit score for an FHA loan is to pay off all of your existing debt.

Establishing a lower debt utilization ratio may be the necessary step toward hitting your FHA loan minimum credit score milestone.

Only Open a New Credit Card If You Really Need to

A major tip to borrowers hoping to meet the FHA loan requirements credit score is to avoid opening up a ton of new credit cards, especially all at once. Every time you open up a new credit card, your credit score gets negatively impacted.

If you are constantly opening up new cards, your chances of meeting the FHA credit score requirements become more and more difficult.

When looking to meet the credit requirements for an FHA loan, it helps to avoid participating in practices that will only further lower your FICO score. Unless you find yourself in desperate need of a new credit card, it’s best to put it on hold until you reach your minimum credit score for an FHA loan.

Popular Article: PrimeLending Reviews – What You Want to Know (Prime Lending Complaints, Mortgage & Reviews)

Conclusion: What’s the Minimum Credit Score for an FHA Loan?

After going through a detailed review on the FHA loan credit score and what the FHA credit score requirements are, the answer to the question above is simple.

For borrowers looking to purchase their dream home, the lowest credit score for an FHA loan is 580. Those who meet the 580 FHA loan minimum credit score or higher are eligible for a much lower down payment of 3.5 percent. However, borrowers that fall into the 500–579 FHA loan credit score bracket are still eligible for an FHA loan with a 10 percent loan down payment.

If you do not happen to meet the required credit score, you shouldn’t feel discouraged. Boosting your credit score to hit the lowest credit score for an FHA loan requires just a few steps.

After working toward reaching the FHA credit requirements, you will finally find yourself qualifying for an FHA loan and on your way to becoming a homeowner.

Read More: Top Ways to Get a Pre-Approved Mortgage

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.