Overview: How to Find the Best Construction Loan Rates

When building a new home, one of the biggest questions you will face is which construction loan rates you should look for in order to get the best value. This decision will not only affect your ability to build or renovate a home; it will have a major impact on your finances for years to come.

Before looking too deeply into construction loan interest rates, you should first understand the two types of construction loans available to you:

- Construction to permanent loans

- Stand-alone construction loans

Which loan is right for you? Construction to permanent loan rates will almost always give you the best opportunity to finance your home while also avoiding the long-term debt that sometimes follows. But don’t just take our word for it. Throughout this post, we will spell out the differences between the two types of construction loans as well as answer the following commonly asked questions:

- What are the best home construction loan rates?

- What are the best commercial construction loan rates?

- How do I acquire the best construction loan interest rates available?

While there is no scientific answer to all of your construction loan questions, this review will point you in the right direction for getting the best possible construction loan interest rates available.

Image source: Pexels

See Also: Home Interest Rates | Tips for Finding the Best Home Mortgage Interest Rates

Know the Two Types of Construction Loans

As previously mentioned, there are two types of construction loans: construction to permanent loan rates and stand-alone construction. There are some similarities between the two, but their long-term interest rates vary greatly.

If you acquire a construction to permanent loan, the lender you choose will advance the money in order to pay for the construction.

Once the home is fully built or renovated, the same lender will transition your loan balance into a standard mortgage. This takes a lot of the stress off of you. Once you have acquired the initial construction loan rates, the lender does the rest.

On the other hand, a stand-alone construction loan will leave you with a mortgage to pay off construction debts.

The lender will begin by advancing the money to build or renovate the house, but you will face many risk along the way. For instance, you have no way of locking down a maximum mortgage rate in advance. Therefore, if the construction loan interest rates go up, your mortgage will continue to get harder and harder to pay.

Construction to permanent loan rates, however, give you the chance to lock in the maximum mortgage rate the moment construction begins. You will be left with no surprises at the end. Additionally, you will be faced with only one closing, as opposed to two with stand-alone loans.

The following table is meant to show you the pros and cons of each type of construction loan. Unless you acquire a smaller down payment with a stand-alone construction loan, we firmly recommend pursuing construction to permanent loan rates instead.

Construction to Permanent Loan Rates | Stand-Alone Construction Loan Rates | |

Pros | Lender rolls loan balance into a standard mortgage Only one closing During construction, you only pay interest on loan balance You lock the maximum mortgage at the beginning | If you are lucky, you can get a smaller down payment Easier to qualify |

Cons | More difficult to get than a regular mortgage | Construction loan rates could rise steadily You do not have control over your future mortgage rate You pay for two closings Must re-qualify for the new loan once house is built Nearly impossible to qualify for a permanent loan |

Don’t Miss: How to Find the Highest Savings Account Rates | Guide | Highest Savings Rates

Get Pre-Qualified for Your Construction Loan

Once you have decided which type of loan is right for you, it is time to get pre-qualified for the best construction loan interest rates.

Getting prequalified will help you determine whether the loan you want is within budget and will reveal if the land and house you want is possible given the construction loan interest rates.

It is important to keep in mind that qualifying for the best residential construction loan rates is different than getting a personal loan or an auto loan.

When you pre-qualify, a lender will want to know your story, or what you plan on doing with the house once it is built. Part of the reason a lender needs to know this information is because a construction loan supports something that does not currently exist.

Therefore, to get the best construction loan rates, you have to explain what the house will be used for once it is built.

Be prepared to explain not only what you want to build, but why. Your construction loan interest rates will be adjusted depending on whether you intend to live in the home or immediately resell it once it’s been built. Some lenders will only consider you based on your answers to these questions.

If you are simply trying to build a house to resell it as quickly as possible, a lender might think the investment does not mean much to you and will be unwilling to offer you competitive construction loan rates. Here, it is important to always be truthful.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Calculate Your Home Construction Loan Rates

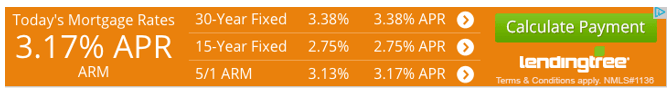

While you’re in the process of getting pre-qualified, take a look at a construction loan rates calculator available on the web.

The construction loan rates calculator will help you weigh a variety of options, including 30-year fixed, 15-year fixed, 1-year ARM loans, and the list goes on. Keep in mind that you will not be able to see which lenders will offer you a loan until you speak with one directly.

Source: Get Construction Loan (US) – Wikihow

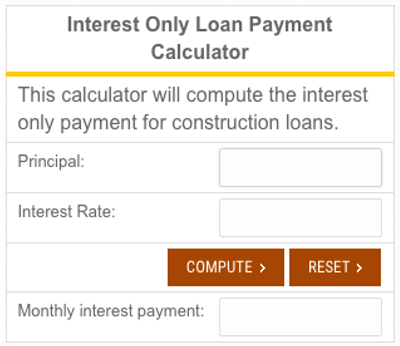

When you use the construction loan rates calculator to determine your construction loan interest rates, you should remember a couple of things:

- Almost all lenders use varying versions of the construction loan rates calculator.

- You will not arrive at the precise construction loan rates until you account for outside variables.

- The loan-to-value ratio is based on future projected values.

Source: Interest Only Calculator – Construction Loan Center

Therefore, the calculator will not determine your exact interest rates on construction loans, but you will get a good feel for what you’re looking for when talking to lenders. Why is this important?

Because construction loan interest rates range from the good to the bad to the downright ugly. Once you have a general idea of new construction loan rates, you are ready to shop around.

Do Not Settle: Shop Around for the Best Construction Loan Rates

Once you have decided on the type of construction loan you want and the construction loan rates you are shooting for, you should get in touch with local banks. Ask to meet with a construction loan officer so you can explain your story and the type of construction loan interest rates you want.

A lot of times, this will not result in the best possible residential construction loan rates. Banks tend to offer just one product, which may not be best suited for your needs. However, it is good to start with banks in case their one product offers the interest rates on construction loans you were hoping to find.

After meeting with local banks, talk to a construction loan broker. There are several reasons a construction loan broker can get you the best possible home construction loan rates:

- They have done all of the searching for you.

- They represent hundreds, if not thousands, of banks.

- They do not charge you for your services.

This last point is important to repeat: a construction loan broker will not charge you for finding the best residential construction loan rates. How is this possible? Brokers are offered construction loans at wholesale rates and will sell them to you at retail prices, thus making a profit. Since they make more money by increasing their number of clients, they will do everything they can to get you the best construction loan rates available.

Once the broker has sifted through the hundreds of available banks, you should have a good sense of which interest rates on construction loans you will choose. This will depend not only on the interest rate itself but also the amount of time you have to pay it back. After choosing one, it is time to submit a loan application and ultimately decide whether to lock in your interest rate now or let it float.

Related: Money Market Interest Rates | Ways to Find the Best Money Market Rates

To Lock in Your Interest Rate or Not to Lock: That Is the Question

As mentioned earlier, construction to permanent loan rates will typically work out better for you than stand-alone construction loans because you can lock in the construction loan interest rates at the beginning.

Some construction to permanent loans even give you the option of locking in the interest rate or letting it float throughout construction. Your decision to lock or not to lock the construction loan interest rates will depend on your answers to a few questions:

- Are the new construction loan rates on the rise? If so, lock it.

- Are the new construction loan rates stable? If yes, then wait before deciding.

- Have the construction loan rates been heading downward? Is so, then wait.

Here, you can see why there is no precise answer to which construction loan rates are best for you. After you have found a good loan, your decision to lock in the interest rate depends on the current trends. You will have to pay close attention to construction loan interest rates in order to make an educated decision. It will always be a bit of a gamble to let them float, but if you properly identify the trend, you will save more money in the long run.

A Brief Look at Commercial Construction Loan Rates

Getting the best commercial construction loan rates will take a similar amount of work and research, and in many ways, the only real difference between a residential and commercial loan is how a lender views your pursuits.

When building an apartment complex, an office building, or a retail center, you will have to tell a lender your story: essentially, what you hope to accomplish and how much of a profit you can make once construction is complete.

The construction loan interest rates you get will depend on the particular type of construction you pursue. For instance, your interest rates will generally be lower when constructing an office building than a golf course. Additionally, building a restaurant tends to get you some of the highest commercial construction loan rates, while apartments will get you some of the lowest. It will be important to know some of the average rates across the country before settling on a loan you find.

To get a better understanding of the best commercial construction loan rates around, consider the following table. Although these are not the only two types of loans available, they are the most common and tend to get the best interest rates available.

One-Time Close | Two-Time Close | |

Pros | You only pay one closing cost You are approved for construction and permanent financing at the same time You have multiple options for permanent financing | More flexibility to adjust the plan and increase the loan Mortgage rates tend to be lower You typically have options for permanent financing |

Cons | You may have to take out a second loan if you spend more than the construction mortgage Permanent rates could be higher than those for a two-time close | You must be approved twice You pay closing costs twice If you are not approved for permanent financing, you might face foreclosure The risks increase if your circumstances change |

Clearly, it will not be an easy decision between which of the two construction loan rates to pursue. While the mortgage rates are cheaper with a two-time close, your risks increase.

You will have to ask yourself: is a lower interest rate more important than peace of mind? In many cases, it is. If you feel that your circumstances will not change and you are willing to take a few risks, a two-time close is the way to go. If you would rather have peace of mind and pay just once, a one-time close is more aligned with your needs.

Popular Article: Mortgage Interest Rates Trend | Key Mortgage Rate Predictions, Trends, and Graphs

Conclusion: Pay Attention to Construction Loan Interest Rates

Whether you are looking for the best home construction loan rates or commercial construction loan rates, the most important thing you can do is pay attention to the building trends. This will not only help you determine which type of loan to pursue but will let you know if you should lock in the construction loan interest rates now or after the building process is complete.

Since construction loan brokers don’t charge fees for helping you get the best construction loan rates, you should consider them near the start.

It won’t hurt you to see what they can offer, and you will almost always get a cheaper interest rate through them than with a bank. While a review like this offers some of the most important information to look for, a broker is an expert in the field and will communicate directly with you to get the best construction loan rates possible.

Once you are ready to start building and have looked at the trends in construction loan rates, you are ready to secure your loan. Calculate your potential loan rates, do your research, and shop around. The rest will fall in place.

Read More: How to Find the Best VA Mortgage Loan Rates Today | Tips for U.S. Veterans

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.