Overview: How to Get Bad Credit Student Loans

Enrolling in college may be a stressful time in your life, but paying for it is a whole different ball game.

For some students, bad credit scores often prevent lenders from offering loans with reasonable interest rates. Since lenders do not profit as much from bad credit student loans as they do from auto or personal loans, it may be difficult for you to find one altogether.

Some people who choose to pursue tertiary education will require bad credit student loans for one of the following two reasons:

- They are too young to have built up high credit scores.

- They are returning to school due to some financial difficulties along the way.

Therefore, if you are looking for school loans with bad credit options, you are not alone. Millions of others will be searching just like you, and it’s best to understand the basics of student loans for bad credit before initiating your search.

The following review is intended to give you the information you need to make an educated decision as well as help point you in the right direction. We will answer many of the most commonly asked questions, including:

- What type of lender might offer me student loans for bad credit?

- What is the difference between governmental loans and private student loans for bad credit?

- How do I begin looking for bad credit private student loans?

Maybe the best thing for you to do now is slow down, take a deep breath, and think about all of the wonderful things that college has in store for you. After all, you are enrolling in school so you can better your life.

While looking for bad credit student loans may be burdensome, always remember that the results will pay off. Through this review, we will help you get started.

See Also: Saving for College (Parents & Students) | Best Ways to Save for College

Beginning Your Search for Bad Credit Student Loans

One of the most dreaded acronyms associated with college loans is FAFSA. Provided by the Department of Education, FAFSA, or the Free Application for Federal Student Aid, is a way for financial aid offices to understand your family’s financial standing as well as what kind of financial aid you can be offered.

You will be asked to enter accurate information about your ability to pay for college, and you must do so before the yearly deadlines. Although the form takes time and energy, it will be the best way to begin when looking into student loans for bad credit.

If your credit score is low due to financial difficulties, most colleges will be willing to offer you a bigger grant or government-backed gift aid. Thankfully, these grants do not have to be paid back. While you will have to fill out a new FAFSA form each year, your grants will reduce the amount you have to pay upfront and in the long run. How will this affect your student loan for bad credit? The more grant money you receive, the less you will need to borrow when applying for bad credit student loans.

Additionally, an accurate FAFSA form will be your gateway to pursuing government-engineered student loans. There are several governmental funds established to help you with student loans for bad credit, but the two we will focus on throughout this review include:

Your First Destination: Federal Direct Student Loans

Perhaps the best part of needing student loans for bad credit is that loans backed by the government do not require your credit score. You will notice, when filling out your FAFSA form, that the information you enter covers your finances but will not ask you about your ability to build credit.

Student Loans for Bad Credit

If you are unfamiliar with federal direct student loans, you may have previously heard of them as Stafford Loans. This funding source has become one of the most common for bad credit student loans because they will never surprise anyone with a credit check.

To qualify, make sure you meet the following criteria:

- You have filled out an accurate FAFSA form

- You are a U.S. citizen

- You have demonstrated that you need financial help

- You are enrolled at least half-time in a qualified school

As long as you meet the criteria, you can begin to apply. There are several benefits to getting a federal direct student loan, compared to a private student loan with a bad credit option, such as the fact that interest rates generally hover around 3.4%. Additionally, your loan will apply to all college expenses, and you will not have to pay a cent until after you have graduated.

You should keep in mind that while the federal direct student loan may seem like the way to go, you will only be offered a limited amount of money.

Therefore, you will likely have to apply for additional school loans with bad credit options in order to make ends meet. Needless to say, you should try to get the most out of these non-credit-based loans by looking at both subsidized and unsubsidized direct loans.

Don’t Miss: Discover Bank Reviews – What Is Discover? (Student Loans, Saving & Checking Review)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Subsidized Versus Unsubsidized Direct Loans

To limit the amount of your student loan for bad credit, try applying for both subsidized direct loans and unsubsidized direct loans. Both come with many advantages, but not everyone will qualify for both.

If you believe your bad credit student loans will be high due to a heightened level of financial need, you may qualify for a subsidized loan. Subsidized loans are only given to those who truly need the funding and cannot afford many costs in college. If you receive one of these loans, the Department of Education will pay the interest while you are in school, which will keep the loan at a reasonable price when you graduate.

An unsubsidized direct loan, however, is available to all students. Interest rates are generally around 6.8% – much higher than a subsidized loan due to the lack of need. However, the benefit of an unsubsidized loan is that rates are fixed, so you will never be surprised by the amount you have to pay back.

Your Second Destination: Perkins Loans

Many of those who look for school loans with bad credit options think their credit scores will make paying off college impossible; however, similar to federal direct loans, Perkins Loans also do not care about your credit score.

This is why you should look here before even thinking about bad credit private student loans. You may be able to get many of your expenses covered before even entering your credit score.

Before you apply for a Perkins Loan, you should know that they are only offered to students who have the highest levels of financial need. In general, families who have incomes under $25,000 per year will qualify. The other factors include:

- When you apply (your loan will depend on the needs of others)

- The amount of available funding at your school

Undergraduates are eligible for $5,500 each year, and the interest rates are kept low, thanks to governmental action. Therefore, if you qualify, take out a governmental student loan before going with private student loans for bad credit. You will be sure of the interest rates ahead of time and won’t risk any unforeseen expenses later.

Private Loans for Students with Bad Credit: Find a Cosigner

As mentioned earlier, there are many differences between a student loan for bad credit and a personal or auto loan. One of the biggest differences is that college students cannot typically settle on just one loan.

Since there are limits on the amount of governmental assistance you can receive, you will probably find yourself looking at bad credit student loans from private lenders.

Private student loans for bad credit students are often daunting because most lenders will not consider you if your credit score is below a certain number. This number is generally in the low 600s – typically between 580 and 619. So, how can you get bad credit student loans when the lender does not accept your credit score? Get a cosigner.

The cosigner will typically be a parent or guardian who is comfortable with putting his or her name on a loan. You will also want to make sure the cosigner has a much higher credit rating than yours. Simply because a person agrees to cosign your loan does not necessarily mean that his or her credit score will be high enough.

Once you know that your cosigner’s FICO score qualifies for a private student loan with bad credit, you can apply together.

The most important thing to remember throughout this process is that lenders are only willing to offer private loans for students with bad credit because they have a fallback plan. Lenders may not trust your ability to pay back the loan, but they will trust someone who has good credit, making the risk much lower for them.

If you find that you cannot pay back your private student loan with bad credit, the financial burden will fall onto your cosigner and will negatively affect his or her credit score.

You should learn the risks ahead of time and be willing to take full responsibility when the loan is ready to be paid back. While it may be scary to ask someone to cosign your loan, it is often the only way to secure one with low interest rates.

Related: Top Best Credit Cards for Students with No Credit or Bad, Poor or No Credit History

Know the Risks of Private Loans for Students with Bad Credit

It is unfortunate that tuition costs have risen so high that federal loans do not always cover our expenses, but this is the reality of the world we live in. When switching your search from federal loans to private student loans for bad credit, you should know the downsides as well as the benefits.

Once you get a cosigner on your student loans for bad credit, it may seem like you are in the clear, but there are risks you need to recognize. Unlike federal loans, private student loans for bad credit students do not come with many protections.

For instance, loan forgiveness does not usually apply when you get help from a private lender. This means that the lender will not forgive your student loan for bad credit no matter how dire your circumstances may be. Loan forgiveness is when an individual is no longer expected to pay off the remainder of his or her loan, depending on certain circumstances.

Additionally, private student loans for bad credit students do not allow you to make payments based on your income. If you graduate college and do not immediately get a job or if you do not make enough to support yourself, you cannot adjust your monthly payments.

This is another reason why you should heavily pursue student loans for bad credit through federal resources. Unlike private lenders, federal loans will allow you to adjust your payments if you cannot make ends meet otherwise.

Private Student Loans for Bad Credit Students

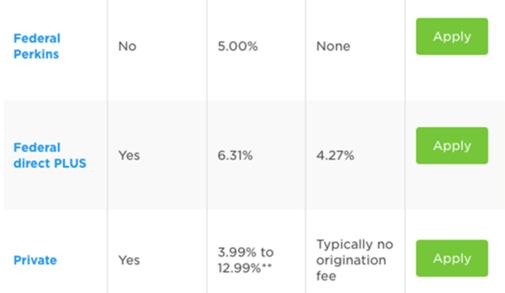

Once you know these risks, however, private student loans for bad credit students will always be available options. As seen in the image below, interest rates vary between 3.99% and 12.99%. This is typically higher than a federal student loan, but you should look at all available options to get your rates as close to 4% as possible.

Popular Article: How to Get a Student Loan | Quick Guide to Get Money & Apply for Student Loans

Private Options for Bad Credit Student Loans

While your search for student loans for bad credit will greatly depend on your specific financial situation, some of the biggest lenders to look for include banks like Wells Fargo and Sallie Mae. Your other options are local credit unions, regional banks, and even online lenders like College Ave.

To give you a sample of some of the best private options for bad credit student loans, we have compiled the following table:

Lender | APR Ranges (Fixed) | Borrower Protections |

| Citizens Bank | 5.25%–11.75% | Defer payments or only pay interest while enrolled |

| College Ave | 4.99%–11.24% | Defer payments while enrolled and financial hardship forbearance |

| Sallie Mae | 5.74%–12.87% | Defer payments while enrolled, financial hardship forbearance, option for interest-only payments for 12 months after grace period |

| RISLA | 3.99%–5.93% | Defer payments while enrolled and income-based repayment similar to government’s |

These are not the only private lenders you should contact about student loans for bad credit, but they are some of the best. Private student loans for bad credit will not be able to offer you the same interest rates as subsidized federal loans; however, there is a wide variety of options available depending on your situation.

Talk to lenders about the amount of time you will need after college to pay off your bad credit student loans, and you may be able to get your interest rates on the lower end of the spectrum.

Also, consider the borrower protections that each lender might offer. Sallie Mae, for instance, offers some of the best borrower protections for bad credit private student loans because it is one of the biggest financial institutions around. On the other hand, its interest rates will sometimes reach nearly 13%.

Therefore, it will be important to consider your future earnings before committing to bad credit student loans. If you think that you will be able to pay off your loans after college, then go for the lowest interest rate possible. On the other hand, if you feel that something may interfere with your ability to pay off your student loans for bad credit, stick with a lender who will offer some kind of forgiveness.

Read More: Federal Student Loan Forgiveness | How to Get Rid of Your Federal Loan

Conclusion: Always Look for Governmental Student Loan Assistance First

When you begin your search for bad credit student loans, your first step should be to fill out a FAFSA form and look into applying for governmental assistance to get through college. As previously mentioned, governmental student loans do not care about your credit score.

Since most incoming students do not have high credit ratings, this will greatly improve your chances of getting funding.

Governmental student loans will also keep your interest rates low while enforcing many borrower protections.

Some bad credit private student loans will offer similar protections, but you should remember that private companies see you as more of a risk than a reward. Unless you have a cosigner, your credit score will often prevent you from getting low interest rates with private lenders.

In reality, many students will take out multiple loans while in college, and governmental assistance can only go so far. Keep in mind that student loans for bad credit come with higher interest rates and less protections, but there are many available.

The most important thing is that you get the loans necessary to attend the school of your dreams. Hopefully, the rewards of attending college will outweigh the stress of finding your loans.

Image Sources:

- https://pixabay.com/photos/document-education-hand-knowledge-2178656/

- https://www.nerdwallet.com/best/loans/student-loans/bad-credit-student-loans

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.