Overview: Saving for College (Parents & Students) | Best Ways to Save for College

Saving for college can be a huge stressor for parents who want to help their children further their education but are struggling to find the best ways to save for college. Possibilities for how to save money for college are endless. Saving money for college doesn’t have to be laborious or time-intensive.

There are plenty of ways to save for college with just a few clicks of the mouse.

Saving for College (Parents & Students)

While parents and teens try to figure out the best way to save for college together, there are many possible avenues to explore. First and foremost, they must decide how much to save for college and find the best way to save for college for their personal needs. Saving for a kid’s college future and saving for a rising senior’s college fund will require different methods.

Join us as we delve further into how to save money for college by answering your key questions.

See Also: Average Financial Advisor Fees

How Much to Save for College

You know you need to learn how to save for college, but first, you need to answer an important question: do you know how much to save for college?

If a university is in the near future for you or your child, you probably have some idea of what sort of school might be considered, even if it isn’t a specific one just yet. Saving money for college and knowing how much to save for college are easier if you are able to narrow down this field. However, others might be saving for their kid’s college education with no idea of how much to save for college just yet.

The College Board created a survey to help rising college students and their families understand not only how to save for college but also how much to save for college. It declared that a moderate college budget for the previous academic year was $26,820 for an in-state public college and $54,880 for a private college. That number encompasses a few categories:

- Tuition

- Housing

- Meals

- Books and school supplies

- Personal or transportation expenses

With the rates for higher education continuously on the rise, saving for college is becoming increasingly difficult. According to TIME, if the trend continues, a public in-state school will cost approximately $130,000 while a private school will cost $235,000. Deciding how much to save for college can be staggering when you consider those statistics. Figuring out how much to save for college and the best way to save for your kid’s college future are imperative in light of those numbers.

Financial advisors recommend attempting to save for college by planning to pay for roughly one-third of the expected cost. Footing the bill for one-third of your child’s college education is still daunting, but there are a number of ways you can save for college to make that goal more achievable. So, how should you plan to save for college for the remaining two-thirds?

Best Way to Save for College

Experts suggest that the best way to save for college for the remaining portion is not to save at all. Instead, consider allowing your child to cover one-third of his/her education through employment during college, scholarships, and financial aid. The very last portion can be financed through student loans, which will eventually be paid off by either you or your child.

Don’t Miss: Overview of Professional Liability Insurance Companies

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Starting Early: Ways to Save for Your Kid’s College Education

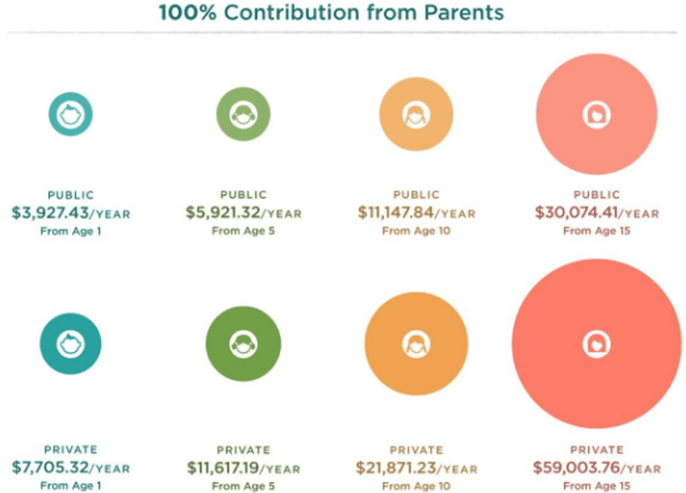

If you already know that you need to start saving for college, you might want to consider the current age of your children. The best method for saving for your kid’s college education is to begin saving as early as possible. NerdWallet, a personal finance site, created a wonderful infographic to demonstrate how much you should expect to contribute in order to save for college and for your child to be fully funded by his/her high school graduation.

As you can see, the best way to save for college is to start early. Saving for your kid’s college fund can begin while your child is still an infant or before he/she is even born. If you’re looking for ways to save for college and want to start small, here are a few tips to get you started:

- Create an accurate budget: If you want to know how to save for college, you need to know how much you currently spend. Drafting an accurate budget and allocating leftover funds is the best way to save for a kid’s college education.

- Lower your monthly bills: Whether you cut back on the cable channels you subscribe to or set your thermostat slightly higher in the summer, reducing your bills frees up extra money to contribute towards saving for your kid’s college education.

- Have a yard sale: Contributing one lump sum upfront can be one of the best ways to save for college and clear up the clutter in your garage at the same time.

- Set up automatic withdrawals: If the money automatically comes out of your account each month, you’re more apt to carry through with remembering to contribute as you’re saving for college.

- Get help: Consider asking family members to help save for college with contributions to a 529 plan on holidays.

How to Save for College

Great resources abound on the Internet for finding tips on how to save money for college. All experts can agree that one of the best ways to save for college is to start saving for college early. Studies show that saving for kid’s college vastly increases a child’s chance of graduating. Kids whose parents started saving for college early on were three times more likely to attend college and four times more likely to graduate, even if the account held less than $500.

Best Ways to Save for College

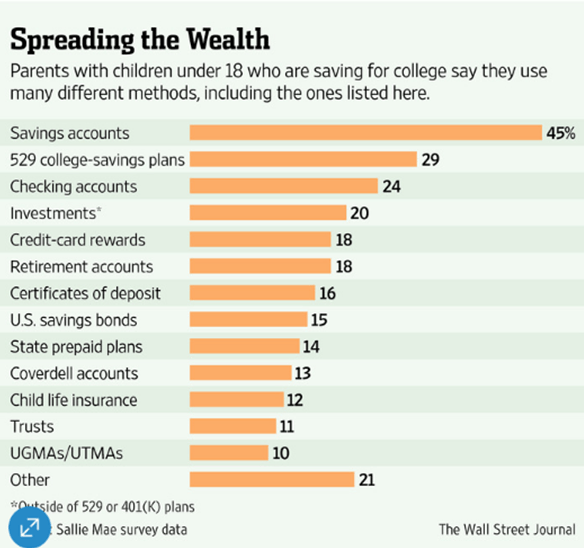

You’re saving for college and the dollars are really beginning to stack up, but do you know the best way to save for college? There are a number of ways to save for college, but the best way to save for a kid’s college fund partially depends on the age of your child and the length of time you will spend saving for college.

Related: Investing in Gold, Silver – Buy Gold?

Here is a brief overview of the best ways to save for college:

- Open a savings account. Figuring out how to save for college can be as simple as opening a savings account. For one of the best ways to save for college, look for an account that accrues interest to watch dollars stack up faster. Consider accounts like Barclays Dream Account for Minors, which offers a high-interest rate for leaving money untouched for long periods of time – perfect for saving for college.

- Invest in a certificate of deposit. A certificate of deposit (CD) is another great starting point for those learning how to save money for college. You select the amount of money you want to invest to save for college, decide on a length of time, and then collect your deposit plus interest – one of the easiest ways to save for college.

- Open a Coverdell education savings account. This type of savings account is one of the best ways to save for college. Much like a 529 college savings account, a Coverdell account allows families to figure out not only how to save for college but also education expenses prior to college. You can withdraw money tax-free for any educational purchase that qualifies. However, if you’re looking for the best way to save for college, this might not be it. Contributors can only add $2,000 each year before having to pay a 6-percent excise tax which can take a hefty chunk out of saving for college.

- Open a 529 college savings account. This is often touted as the best way to save for college. A 529 college savings account is a state-sponsored account that allows your savings for college to grow interest while being a potential tax deduction for your accounts. A 529 account is great for someone who is just figuring out how to save for college because it is simple and offers a number of benefits, including tax-deferment when used to cover education costs.

529 College Savings Account: The Best Way to Save for College

With so many families wondering what the best way to save for college is, a 529 college savings account has a lot of benefits that leave it at the top of the list. This type of account is a wonderful way to make saving money for college easy, but you have to make sure to do some research first. What makes a 529 account the best way to save for college? Let’s take a look before you decide which type of account to open.

There are two major ways to save for college with 529 plans: prepaid tuition plans and college savings plans. Which is the better account type for someone wondering how to save for college?

Prepaid tuition plans: Prepaid tuition plans allow you to select a specific school and purchase “units” to cover the cost. This locks in tuition prices at their current rate, meaning you won’t have to figure out how to save for college with the inflation rate. Not all universities will offer this program, and there may be more requirements and restrictions for enrollment periods, ages of children, and residency requirements.

If you might be interested in how to save for college using a prepaid tuition plan, you want to consider what will happen to your investment if your child decides to enroll at a different university. Some plans will allow you to transfer the money to another institution so you don’t waste the money you invested into saving for college.

Popular Article: How to Build Credit Fast

College savings plan: The prepaid tuition plans are a good starting point if you are learning how to save money for college, but the 529 college savings plan offers more flexibility for saving for college. The best way to save for college is with the 529 college savings plan because the benefits include the following:

- Covers all expenses: If you’ve already spent time looking into ways to save for college, you know how important it is to cover not just tuition but all expenses. This type of account gives you a great way to figure out how to save for college expenses, such as books, room and board, meals, and other mandatory fees.

- No age limits: Saving for college isn’t limited to children. You can use 529 college savings account for adults or children interested in ways to save for college.

- No enrollment dates: You can start saving for college whenever you’re ready with always-open enrollment.

The downside to the college savings account is that it will not be backed by the state. It might be one of the best ways to save for college, but any investment carries a certain level of risk. Your investment may remain stagnant, increase or decrease in value. Saving for college is stressful, and no one can guarantee a particular return on your investment with a 529 college savings account.

Read More: Quick Tips to Budget and Manage Your Money Better

Free Wealth & Finance Software - Get Yours Now ►

Conclusion

Setting money aside today can make saving for your kid’s college education in the future significantly easier. While it seems that opening a 529 college savings account is the best way to save for college, there are a number of ways to save for college that could work for your family. You’ll want to figure out how to save for college (and decide how much to save for college) sooner rather than later.

One of the best ways to save for college is to start saving for college today, even if you’re only making small contributions. Saving for your kid’s college fund can be easier than you think if you start letting the dollars add up now rather than later on.

Image Sources:

- https://pixabay.com/photos/piggy-bank-saving-money-young-woman-850607/

- https://www.businessinsider.com/how-much-to-save-every-year-for-college-2015-4

- https://www.wsj.com/articles/the-best-ways-to-save-for-college-1423854503

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.