Guide to the The Best ARM Calculators (How to Find Top 5, 7, 10 Yr Adjustable Rate Mortgage Calculators

Mortgage calculators are one of the handiest tools to use if you are trying to figure out what type of loan or rate is the right one for you.

Prospective homeowners sometimes struggle between a fixed or adjustable rate mortgage. But this is where an adjustable rate mortgage calculator is helpful.

An adjustable rate mortgage calculator (ARM) can help you compare the amount of interest you will pay over the life of your loan to a loan with a fixed interest rate. Most ARM calculators can be used for different loan terms, like a 5-year ARM calculator, a 7-year ARM calculator, or a 10-year ARM calculator.

An adjustable rate mortgage is excellent for those who might consider moving in a few years or who have less to spend monthly now but could have more later. This is because the adjustable rate is typically lower than a fixed rate.

Source: NerdWallet

A 5-year ARM mortgage calculator will show you how much your interest rate will affect your loan after five years, whereas a 10-year ARM mortgage calculator will show its effects after 10 years of an adjustable rate.

The terms 5/1, 7/1, and 10/1, in relation to an adjustable rate mortgage, refer to the number of years of an adjustable rate and how often the rate will change after that.

If you are considering a 7/1 adjustable rate mortgage, therefore, you should consider using a 7-year ARM mortgage calculator to see the impact of your interest rate in the first 7 years and each year after.

This article will point out some of the main differences between an adjustable rate mortgage and fixed rate mortgage so you can understand your results when you use an ARM calculator.

Our guide will also explain why using a mortgage calculator for ARMs is important in understanding your interest rate over the life of your loan.

Finally, we will highlight a few of the online calculators that can be used as 5-year ARM calculators, 7-year ARM calculators, or 10-year ARM calculators based on certain criteria you may be looking for.

See Also: Home Interest Rates | Tips for Finding the Best Home Mortgage Interest Rates

Adjustable vs Fixed-Rate

Before searching for a 10-year ARM mortgage calculator, you should know the key differences between an adjustable and fixed-rate mortgage.

Some adjustable rate mortgage calculators actually compare the adjustable rate to a fixed rate mortgage, but the results can be confusing if you do not understand how the two rates differ.

Adjustable rate mortgages come with different terms. Usually, they are 3, 5, 7, or 10 years. For this time period, say five years, your interest rate will be a low introductory fixed rate.

After the five years, your rate will adjust to a higher amount, usually once per year. A mortgage calculator that is 5-year ARM specific will show you how much interest you will have during the fixed period and then for the remainder of the loan.

Source: Gud Finance

A fixed rate, on the other hand, remains the same through the life of your loan. Although this keeps your monthly payments more steady over time, as you can see if you compared the rate using an ARM calculator, your rate can be much higher than an adjustable rate mortgage during its initial period.

The downside of adjustable rate mortgages is that your monthly payments can become unpredictable in the future. A 5-year ARM mortgage calculator may show an affordable rate for you for your initial period, but make sure you look at how your rate increases after the five-year period as well.

Why Should You Use a Mortgage Calculator for ARMs?

The best way to see the difference over the life of a loan is to use an ARM calculator that compares specific fixed rate loan terms to specific ARM loan terms, like a 7-year ARM mortgage calculator.

If you are considering a house that may be out of your price range now, but you are expecting a salary increase in the future, you might want to consider a 10-year ARM mortgage calculator to determine if you will be able to afford your mortgage payments after the initial period of a lower fixed rate.

Although most mortgage calculators are extremely helpful in determining what loan options and terms you can afford, a mortgage ARM calculator is especially beneficial because figuring out your interest with an ARM can be tricky, since your interest rate changes through the life of your loan.

Your adjustable rate mortgage might also offer a payment cap, which limits how much your interest rate can increase over the course of your loan. A mortgage ARM calculator with a rate cap feature can more accurately help you determine your monthly payment and the interest you will pay.

Don’t Miss: How to Find the Highest Savings Account Rates | This Year’s Guide | Highest Savings Rates

What to Look for in a Mortgage ARM Calculator

Although ARM calculators are not specifically labeled as 5-year ARM calculators or 7-year ARM mortgage calculators, some do provide special features that can help you determine costs regardless of the initial fixed-rate period of your ARM.

Most adjustable rate mortgage calculators are very different, but there are a few key features you should make sure your ARM calculator has before you begin to use it:

- Amount of loan

- Loan term

- Amortization frequency

- Initial interest rate

- Initial fixed-rate period length

This is the pertinent information you will need if you want the most accurate information specific to your loan from an adjustable rate mortgage calculator.

Also, take note that not all adjustable rate mortgage calculators take into consideration every ARM initial period length. Some only provide options for a few ARMs, like a 3- or 5-year ARM mortgage calculator. Make sure the ARM calculator you choose covers the type of ARM you are interested in.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

The Best Mortgage Calculator 5-Year ARM Information

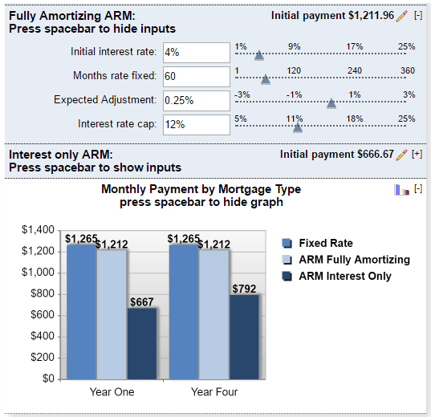

Bankrate mortgage calculator for ARMs is a detailed calculator that covers a wide variety of adjustable rate mortgage terms. However, if you are looking for an adjustable rate mortgage calculator that offers information for one type of ARM at a time rather than a comparison, this is an excellent choice.

Source: Bankrate

For the purpose of this guide, we will use this calculator as an example of a 5-year ARM calculator. If you want to check your rates for a 5-year ARM, change the “months rate fixed” section to 60, for 60 months. Adjust the initial interest rate, expected adjustment, and interest rate cap to match your prospective loan terms.

Then, the 5-year ARM mortgage calculator will update your information to provide you with your initial payment in comparison to a fixed rate loan. Although you cannot compare this information side-by-side with, for example, the information from a 7-year ARM calculator using this calculator alone, you can use the calculator again to see how the information changes for a 7-year ARM.

The Most Informative 5-Year ARM Calculator, 7-Year ARM Calculator, or 10-Year ARM Calculator

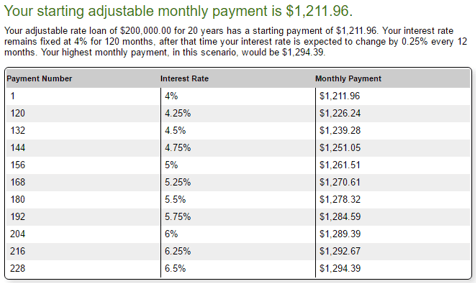

Nationwide’s ARM calculator is one of the most informative adjustable rate mortgage calculators you will find. Since you can input any initial rate period you want to match your loan, this ARM calculator works as either a 5-, 7-, or 10-year ARM calculator.

The adjustable rate mortgage calculator lets you input basic loan information, like the length and amount of loan, and then allows you to adjust the cap rate, frequency of rate change, and expected rate adjustment of your ARM.

Source: Nationwide

The best part of this calculator, though, is the information provided in graphs and charts to further help you understand your mortgage ARM calculator results. For example, below the calculator are two bar graphs: One that shows your total payments divided into interest and principal payments and another that shows how your principal balance decreases each year.

You can also find out how much your ARM payments are likely to increase over the course of your loan based on the information you provided in the adjustable rate mortgage calculator. Click on “View Report” below the bar graphs and your 5-, 7-, or 10-year ARM mortgage calculator report will be displayed in a table by monthly payment number and amount.

Related: Money Market Interest Rates | Ways to Find the Best Money Market Rates

The Best ARM-Detailed Mortgage Calculator for ARMs

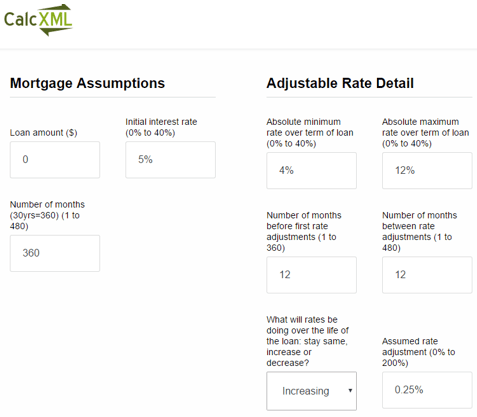

CalcXML is a simple ARM calculator that lets you pinpoint the ARM details specific for your adjustable rate mortgage. Some adjustable rate mortgage calculators only offer default, common options for ARM details, but this can make it difficult to provide you with an accurate picture of your specific loan.

Source: CalcXML

A mortgage calculator for ARMs should allow you to change the details to match your adjustable rate mortgage terms. CalcXML’s calculator lets you change the original fixed rate period, the number of months between adjustments, the assumed rate adjustment, and the cap rate. This calculator even allows you to choose whether your rates will stay about the same, increase, or decrease over the life of your loan, whereas other 5- or 7-year ARM mortgage calculators typically do not provide this important option.

After inputting your information into the ARM calculator, you can choose to view your results as a graph detailing your interest, payments, and balances over the life of your loan, or click on “Detailed Report” for a detailed results table with interest rate and payment increases over time.

Popular Article: Mortgage Interest Rates Trend | Key Mortgage Rate Predictions, Trends, and Graphs

The Best Mortgage Calculator for 5-Year ARM, 7-Year ARM, or 10-Year ARM vs Fixed

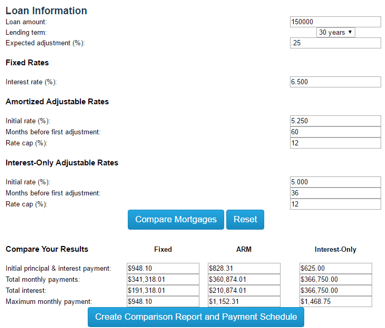

If you are still torn between a fixed-rate or adjustable rate mortgage, you should consider using a mortgage ARM calculator that will help you compare a loan using both types of interest rates. Mortgage Calculator provides an excellent, detailed adjustable rate mortgage calculator that allows you to do just that.

Source: Mortgage Calculator

This calculator provides much of the same information as other ARM calculators, but this mortgage calculator for ARMs is one of the few that compares fixed and ARM interest rate results side-by-side for easy comparison.

Once you plug in your information, take a look at the comparison table below the information you inputted into the adjustable rate mortgage calculator. Here, you will find the differences between your initial principal and interest payment, total monthly payments, total interest paid, and maximum monthly payments for fixed-rate and ARM loans.

You can also click “Create Comparison Report and Payment Schedule” to view a pop-up with your tentative ARM and fixed-rate payment schedule and amounts based on the information you provided the mortgage ARM calculator.

Conclusion

An ARM calculator in an invaluable tool for calculating interest and monthly payments on a somewhat confusing type of loan. An adjustable rate mortgage calculator is also helpful in comparing ARMs to other types of mortgages, like a fixed-rate mortgage, so you can more easily determine what type of loan is best for you now and in the future.

When searching for a reliable 5-, 7-, or 10-year ARM calculator, make sure it asks for the important information needed to accurately calculate your monthly payments during and after the fixed rate period. You should also consider an ARM calculator that provides detailed information based on your loan terms so you can better understand how that loan will affect you in the future.

Read More: How to Find the Best VA Mortgage Loan Rates Today | Tips for U.S. Veterans

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.