Guide: How to Find the Best Car Insurance Quotes (Auto Insurance Quotes Comparison)

Obtaining a complete listing of all the possible car insurance quotes available is a daunting and tedious task.

Unfortunately, you probably already recognize the importance of being able to save a few dollars where you can, and finding lower auto insurance quotes can go a long way toward helping your monthly budget.

The problem is that there are so many auto insurance companies that it’s difficult to know where you can go for an auto insurance quotes comparison.

AdvisoryHQ acknowledges the task that’s been set before you and wanted to develop a comprehensive and objective car insurance quotes comparison to help you find the best deal.

Best Car Insurance Quotes

We’ll walk you through a few tips and tricks for getting the best car insurance quotes as well as dive deep into the various companies that offer car insurance quotes online or free car insurance quotes.

If you’re ready to trade your expensive auto insurance premiums for newer and cheaper car insurance quotes, then it’s time to take a look at our auto insurance quotes comparison.

See Also: Northwestern Mutual Reviews | What You Need to Know about Northwestern

Getting the Lowest Auto Insurance Quotes

Before you begin to take an in-depth look at car insurance quotes comparison, you probably need to know a few tips and tricks to help you find the lowest rates around. Take a look at this brief list of possible ways that you could uncover lower online auto insurance quotes before you even get started:

- Improve your credit. You’ve likely heard this piece of advice apply to any number of financial items from mortgages to auto loans, but most people don’t realize it applies to auto insurance quotes as well. Insurance companies believe that there’s a connection between your credit score and the likelihood that you will file a claim. The higher your credit score is, the more likely it will be for you to find less expensive auto insurance quotes. Monitor and improve upon your current credit score, and you could see lower rates.

- Opt for older cars. New cars and more expensive luxury vehicles will bring higher online auto insurance quotes. The cost to repair or replace your vehicle in the event of a major collision or accident is a huge factor when determining your insurance quotes. Older and less expensive cars will have a much smaller premium.

- Be a safe driver. Having an accident can raise your rates as much as 40 percent, and speeding tickets can equally raise your rates. Drivers with an extensive history of accidents and traffic tickets are likely to encounter higher car insurance quotes. The longer you can maintain a clean driving record with no at-fault accidents, the lower your insurance quotes are likely to be.

- Ask for discounts. This is a huge factor to consider in an auto insurance quotes comparison. You may qualify for any number of discounts that differ from company to company. For example, you may receive a discount at one company for going paperless and a rate reduction at a different company for having a specific type of membership. By far, the biggest and most common discount comes from bundling your services. Keeping your home insurance, renters’ insurance, auto insurance quotes, and any other type of applicable insurance together can help you find lower car insurance quotes online.

There are nearly endless ways to uncover discounts on auto insurance quotes. By following a few of these top tips and tricks for finding cheaper insurance quotes, you’ll be in a much better place to begin taking a look at an auto insurance quotes comparison.

Coverage and Car Insurance Quotes Comparison

Coverage is a deciding factor when you are trying to compare car insurance quotes.

First of all, you always need to make sure that no matter which companies you are viewing in a car insurance quotes comparison, the policies you are being offered are apples to apples. Compare car insurance quotes according to their coverage and deductible to make sure you’re getting the best possible deal and the right coverage for your car.

Many people automatically assume they want full coverage for their vehicle. If you drive a car that’s a little more of a clunker, you may want to rethink it. If your car is worth less than ten times your premium, it might not be worth the expense. Opting for something less than full coverage and complete replacement from your car insurance quotes could save you a bundle.

The other largest factor in auto insurance quotes comparison is the deductible. Higher deductibles will help you to find the lowest auto insurance quotes. This option is better for safe drivers who have a clean driving record and no history of accidents, though anyone can really take advantage of it.

Be sure that you can afford the additional jump in up-front costs before make the switch and requesting online auto insurance quotes that reflect a high deductible plan.

Auto insurance quotes with a high deductible will cost you more in the event of an accident but less on a monthly or annual basis. Switching from auto insurance quotes with a deductible of $500 to $1,000 can save you $200 each year, while a bigger jump to a $2,000 deductible could save you just under $400 annually.

On an average basis, Consumer Reports found that switching to a higher deductible plan could save you up to 40 percent on car insurance quotes.

Factors Affecting Price

As with all things where price is subjective, an auto insurance quotes comparison shows that car insurance quotes depend on a number of factors that may or may not be outside of your control.

When we dive deeper into which companies you should consider for free car insurance quotes, keep in mind that you will want to do the research yourself as well. Prices may be different for your circumstances or area.

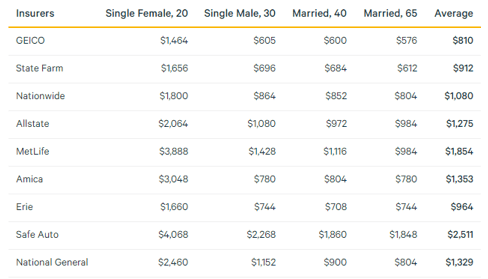

Online auto insurance quotes can be affected by your gender and age by a pretty significant amount. For example, one quote for a single female in her twenties could run in the ballpark of almost $1,500 annually.

Younger individuals, especially teens and new drivers, can expect higher rates until they prove that they are responsible drivers and have more experience under their belts. These rates could be lessened by proactive actions such as good student discounts or taking a driver’s education course.

A married individual two decades later may only cost $600, and at age 65 that person may experience another reduction to just $576 annually. Similar quotes and examples can be found from almost every company that offers online insurance quotes.

Auto Insurance Quotes – Factors Affecting Price

Your insurance premiums will also be influenced by your location. In an area where repairs and vehicles may be more expensive than another, you can expect to find higher online auto insurance quotes than you would in cities where vehicles, repair, and maintenance is relatively inexpensive.

This is why your zip code is often one of the first questions asked when obtaining free car insurance quotes or using an auto insurance quotes comparison tool.

This may be affected by the minimum insurance coverage necessary for your area. For a convenient list of the minimum requirements when it comes to auto insurance quotes by state, see this compilation from The Simple Dollar. It details exactly what types of insurance are required as well as the minimum required liability insurance by state.

Don’t Miss: New York Life Insurance Reviews | Is NY Life a Reliable Company? (Ratings, Pros & Cons)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Major Companies for Cheap Insurance

Knowing how to qualify for cheap online insurance quotes is only half the battle. You need to examine all of the major players in a side-by-side car insurance quotes comparison to determine which company may be the best fit for you.

Auto insurance quotes online are typically dominated by the four major players: GEICO, State Farm, Allstate, and Progressive. Those four companies alone comprise half of all auto insurance coverage in the nation.

Of those four companies, which one offers car insurance quotes online and provides the best value and service? In an auto insurance quotes comparison, GEICO typically ranks toward the top of the list. Value Penguin labels it as a “well-rounded package of coverage protection” and other experts claim that it has some of the least expensive free car insurance quotes around. It’s one of the most affordable selections more than three-quarters of the time, ranking as the cheapest in 19 out of 50 states in one survey.

Allstate is better known for offering extensive coverage options with personal agents in almost every locale. They have more customer-oriented features such as a claim satisfaction guarantee, accident forgiveness, and safe driving bonuses as well. You can find an abundance of free car insurance quotes online, but if local and personal customer service is a priority for you, Allstate ranked as Value Penguin’s best company with agents.

State Farm comes in slightly higher in price in a direct car insurance quotes comparison, averaging between $30 and $50 more than some of its closest competitors. However, it is also considered one of the best agencies for above average customer service. This is quite a feat for a company that continues be the nation’s largest auto insurer according to their market share.

Last but not least, Progressive didn’t have much to offer in a direct auto insurance quotes comparison. It frequently came in very close to the lowest car insurance quotes for specific states but rarely came in at less. In the few instances where it did come in as the least expensive option, it wasn’t by much (sometimes just by $20 annually). However, it does offer some features (loyalty discounts, mobile claims fling, and low-mileage discounts) not included by GEICO which specializes primarily in minimum and basic coverage.

A car insurance quotes comparison will only help you to determine which company is best for a specific segment of the market. You’ll have to determine what features are the most important to you when it comes to car insurance quotes. Do you value personal customer service, advanced discounts, or local agents? Depending on which features are the most important to you, you may find yourself leaning toward one of these major players.

Related: Average Life Insurance Cost | Average Cost of Whole Life and Term Life Insurance

Selecting a Smaller Company

Just because those four major companies are the most heavily advertised and the most well-known doesn’t necessarily mean that they are your best bet when it comes time to compare car insurance quotes. Don’t forget that there are plenty of smaller companies out there that are pleased to provide you with low auto insurance quotes online or in person as well. Consider smaller companies such as Auto Owners Insurance or Erie Insurance, popular yet still lesser-known counterparts to the major companies that have become commonplace in most households.

In some instances, these smaller companies can promote a healthier feeling of increased customer satisfaction ratings compared to being lost in the shuffle at larger companies such as GEICO or Allstate.

You may find that you are not only happier with the more individualized attention that they are able to provide you with, but they also can sometimes offer lower auto insurance quotes than major companies can as well.

Make sure to choose a reputable company though. Just because they’re small and local doesn’t necessarily mean that they are legitimate. Be sure to do your research. Talk to friends and family to see if any of them have used that company and been pleased with the service and coverage they were able to offer. A personal recommendation can sometimes go a long way with car insurance quotes and coverage.

Tools for Auto Insurance Quotes Comparison

It can be incredibly time consuming to pursue and gather information on auto insurance quotes online from even just four companies, much less researching smaller companies as well.

The good news is that you can save yourself some time when you start doing your auto insurance quotes comparison. You no longer need to hop onto each individual company’s website and input all of your information to be given accurate auto insurance quotes.

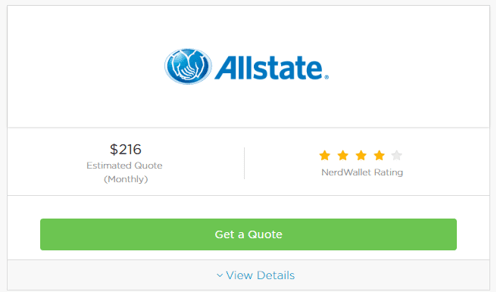

Instead, you can opt for comparison tools that make your car insurance quotes comparison significantly easier for you and your wallet. By entering all of your information in just one screen, auto insurance quotes comparison from Nerd Wallet or the Zebra can quickly spit back the information and rates from main providers in your area for quick auto insurance quotes comparison.

Auto Insurance Quotes Comarison

Enter the information for just a handful of questions (make, model, year, style, and current insurance status) to receive a quote back in seconds. In our own trial of the Nerd Wallet auto insurance quotes comparison tool, we received quotes from six companies (including Progressive, GEICO, State Farm, Farm Bureau Insurance, Allstate, and Nationwide) that were accompanied with their five-star rating scale.

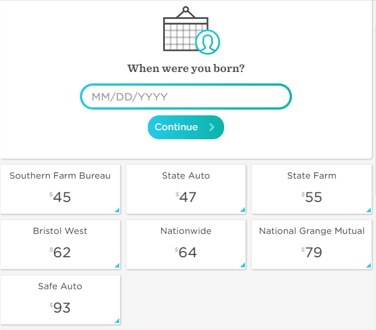

The Zebra car insurance quotes comparison tool is more thorough, requesting your age, gender, and more, and it provides a wider range of quotes. They advertise ten quotes in ten seconds, but our own trial resulted in only seven providers. You can also call for free quotes as well.

Auto Insurance Quotes Online

We would recommend verifying the rates with each specific company that you are interested in before becoming too committed. You may still find additional discounts if you can speak to a company representative. However, the auto insurance quotes comparison tools are a useful first step in eliminating overpriced options right at the beginning.

Popular Article: Top Best Life Insurance Companies | Ranking | Term Life & Whole Life Insurance Comparison

Conclusion

With so many companies on the market today, conducting a thorough car insurance quotes comparison is necessary to help you make the best choice. You need to compare not only the cost of the online insurance quotes that are put before you but also the coverage and customer service that you will come to expect from them.

Your personality and priorities will help you to determine which auto insurance quotes are the best fit for you and your family. Some individuals would feel more comfortable paying more on a monthly basis for additional features and coverage, while others are looking for the lowest car insurance quotes around. Bear in mind what is a priority for you before committing to any one particular company.

Car insurance quotes online are a handy option to perform your shopping from the comfort of your own home at your own convenience. Be sure to do enough research so you can rest assured that you made the best possible decision after reviewing a car insurance quotes comparison.

Read More: Best Life Insurance Rates & Charts | Tips to Get the Best Life, Term, and Whole Life Rates

Image Sources:

- https://www.bigstockphoto.com/image-55112816/stock-photo-insurance-or-assurance-concept

- https://www.valuepenguin.com/best-auto-insurance

- https://www.nerdwallet.com/insurance/compare-car-insurance-rates

- https://www.thezebra.com/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.