Intro: What Is a Home Equity Loan and Line of Credit?

If you’re like most homeowners, each month, you cut a sizeable check to your mortgage company. You know that your money is paying off the principal and interest on your home, but you sure do wish that money was available to help you with a few remodels.

You’re not alone in that sentiment. Plenty of homeowners are asking questions about a home equity line of credit to tap into the equity of their home that they’ve already invested in. They are asking good questions, like, how does a home equity loan work? Exactly what is home equity?

Image source: Bankrate

Home equity lines of credit are fairly common. To help you better gain access to your largest investment, we want to help you to learn the basics. What is the difference between a home equity loan and a home equity line of credit? And most importantly, how does a home equity loan work?

Join us as we cover the basics of what a home equity loan is and what you can expect from either a home equity loan or a home equity line of credit.

See Also: How To Get Rid Of PMI Mortgage Insurance | Ways to Get Rid of PMI

What Is Home Equity?

One of the main questions that seems to be of particular consumer interest is, how does a home equity loan work? We would love to answer this question, but we need to first take a few steps back all the way to the very beginning. What is equity in a house?

It’s hard to know exactly how the loan will work if you don’t understand the main principle upon which it’s based.

Each month, you fork over what is likely a large chunk from your bank account to your mortgage lender to pay down the principal and interest on your loan. As a result, your mortgage lessens each month until your home is paid off in full. What is home equity, and what does that have to do with anything?

Well, home equity is what you get when you take the current appraised value of your home, less the balance remaining on your mortgage. Your mortgage decreases, the property value tends to increase over time, and so your home equity increases.

What is home equity, simply put? It is the difference between your appraised value and the amount you owe.

It sounds simple enough. Now that you know what home equity is, why would you want to tap into it? What are the benefits of utilizing the equity in your home?

Image source: verveacu.com

Don’t Miss: New American Funding Reviews | What You Need to Know (Pros, Complaints, & Rates)

What Do You Use a Home Equity Line of Credit For?

Now that you can answer what is equity in a house, we can take a look at a few situations where you may consider using it. Let’s say that you have a lot of equity built into your home already. Under what circumstances to most people tap into that financial resource with a home equity line of credit or a home equity loan?

Good reasons exist for using a home equity line of credit to assist with your current financial situation. By the same token, there are also plenty of less-than-ideal reasons to withdraw money from the equity on your home.

Let’s take a look at some of the ideal reasons to utilize a home equity line of credit or home equity loan. What is a home equity line of credit or loan good for?

- Remodels: The primary reason most individuals will investigate a home equity line of credit is to remodel their current home. If your home has already appreciated in value since your initial purchase, you may consider doing additional remodels to considerably boost the value of your home even further. An updated kitchen, an addition, finishing another portion of your home, or just making significant minor cosmetic changes can all increase the value of your home overall and are worthwhile investments for a home equity line of credit.

- Major purchases: The next most common reason that people will access a home equity line of credit or loan is to make major purchases, according to the senior vice president of home equity from Wells Fargo. This may apply to appliances, vehicles, or other items that will last for years to come.

- Investments: Bankrate advises individuals to use caution when it comes to using a home equity line of credit for investment purposes—whether that means in the stock market, a new business venture, or even student loan debt. Those could all be risky endeavors that may not pay off in the long run, but your home equity line of credit means that you are using your home as collateral for those funds.

Not many withdraw the initial investment and home equity from their home for desires that could otherwise be satisfied through saving. For example, an extravagant vacation may not be a wise investment. Even using the money to pay off previous credit card debt is sometimes frowned upon because new debt can be acquired so quickly.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How Do Home Equity Loans Work?

How do you know exactly how much money you can access from the equity you’ve built into your home? Knowing how home equity loans work can help you to determine exactly what you can budget for your remodel, upcoming purchase, or next investment.

How does a home equity loan work? First, you need to know how much your home will appraise for. For the sake of simplicity, let’s say that your home appraises at $100,000, and you only have $50,000 remaining on your mortgage with your lender.

The bank or other lender that will assess you for a home equity loan or a home equity line of credit will use this information to determine what your loan-to-value ratio is (LTV).

They will take the amount that you owe ($50,000) and divide it by the amount your home is worth ($100,000) to give you an LTV of 50 percent.

Each lender will have different policies of what they will allow that ratio to be. If your lender will allow a 70 percent LTV, you may qualify for a home equity line of credit or loan amount of $20,000. If they allow an 80 percent LTV, you may qualify for a home equity line of credit or loan amount of $30,000.

This amount can be given to you in two different ways: a home equity loan or a home equity line of credit. In the upcoming sections we will address the two primary consumer questions of how does a home equity loan work and what is a home equity line of credit?

Related: What Is the HARP Loan Program? Do You Qualify? Harp Loan Requirements

How Does a Home Equity Loan Work?

We’ve spent a lot of time discussing what equity in a house is and which situations you can and should consider using a home equity line of credit or a home equity loan. Now it’s time to dive into the specifics of each situation: what is a home equity loan, and how does a home equity loan work?

If you’ve been wondering how does a home equity loan work, they are typically issued in one lump sum. Situations like this can be helpful if you need a significant amount of cash upfront to pay a contractor for an upcoming remodel or for a one-time expense (like the purchase of a new vehicle or a set of kitchen appliances).

How does a home equity loan work in terms of repayment? You typically receive a fixed interest rate upfront that will remain throughout the term of your loan. This allows you to create and plan for recurring payments each month with no surprises, as interest rates may fluctuate.

It’s important to keep in mind that you will be making these recurring payments each month alongside your original mortgage payment. Before you proceed with a home equity loan, understanding how home equity loans work allows you to make sure that you can afford the additional monthly expense of the remodel, purchase, or investment that you may be considering.

Image source: Bigstock

This is sometimes referred to as a second mortgage because it is secured by the value of your home, just like your primary mortgage is secured by the value of your home.

What Is a Home Equity Line of Credit?

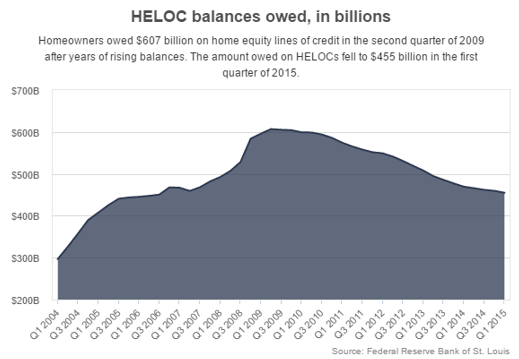

A home equity line of credit is slightly different from a home equity loan. Sometimes referred to as a HELOC, a home equity line of credit is issued sort of like a new credit card account. You may receive a separate checkbook or a new card to use with the account, but you are able to make multiple withdrawals from the funds available.

How does a home equity line of credit work? While a home equity line of credit can be set up multiple ways, many of them are structured to have you pay interest during your draw period and have principal and interest payments set up after this period ends.

If you’ve been wondering, how does a home equity line of credit work, and it all sounds pretty simple, that’s because it is. However, there is one major disadvantage to a home equity line of credit: variable interest rates.

Without the fixed rates that are common when we discussed what a home equity loan is, a home equity line of credit will have payments that vary from month to month as the interest rate fluctuates. It makes it difficult to budget for upcoming payments because they could be either higher or lower than your previous contributions.

How does a home equity line of credit work in terms of repayment? You can either make monthly payments that are equal through the set term of your loan or you may choose to make minimum payments but the entire principal plus interest is due immediately upon the end of your term. Terms can be as short as five years, or as long as fifteen, with many options in between.

How does a home equity loan work is a significantly easier question to answer than how does a home equity line of credit work. A home equity line of credit has a lot more variables to weigh in terms of repayment, rates, and the method in which you receive the funds.

Home Equity Loan Requirements

Now that you understand the basics of what a home equity loan is and what a home equity line of credit is, it’s time to review what the home equity line of credit requirements are. The home equity loan requirements and the home equity line of credit requirements will be mostly the same.

Before you dive too far into the home equity loan requirements, it is important to make sure that you can comfortably afford an additional loan payment each month. Whether you opt for the home equity line of credit or the loan, you will have a payment to make each month alongside your current mortgage payment. Take a close look at your budget to make sure you can afford this.

Once you know that you and your family can finance this additional expense, you can take a closer look to see if you meet the home equity line of credit requirements or the home equity loan requirements:

- Credit score: Many lenders will first review your FICO credit score to see if you have a decent credit history. In order to meet the home equity line of credit requirements, you usually must have a score of 660 or higher. However, lenders like Wells Fargo point out that credit scores above 760 will give you the best interest rates and options on a home equity line of credit or a home equity loan.

- Debt-to-income ratio: Your debt-to-income ratio is a close second when it comes to a home equity line of credit requirements. Officially, Freddie Mac and Fannie Mae say the magic number is 45 percent, meaning that your debt should not exceed 45 percent of your gross monthly income. That being said, many lenders prefer it to be closer to 36 percent.

Those are the two major home equity loan requirements that are considered for approval. Keep in mind that student loans (even those not currently being repaid), child support, credit card debt, auto loans, IRS payments, and installment loans will all count toward your monthly debt-to-income ratio.

Popular Article: LoanDepot Reviews | Details: Pros, Cons, Complaints & Mortgage Review

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: How Does a Home Equity Loan Work?

Now that you can confidently answer how do home equity loans work, it’s time to evaluate whether choosing to tap into the equity you’ve built up in your house is a worthwhile endeavor for you. Even if you meet the home equity loan requirements for either a loan or a home equity line of credit, it may not be the best choice.

By evaluating what you need the funds for and how home equity loans work, you can examine whether you would be able to make good use of the equity in your home this way. Making a large purchase or aiming to increase the value of your home can be great uses for a home equity line of credit or loan. Decide whether you would need the money in one lump sum with fixed payments (a home equity loan) or an available home equity line of credit you can tap into with multiple withdrawals over time and fluctuating payments.

Once you know the basics of what a home equity loan is and can answer how do home equity loans work, it’s time to start communicating with lenders regarding whether you meet their minimum home equity loan requirements or the home equity line of credit requirements.

Ask questions of your lender, including how does a home equity loan work through your institution? Repayment plans and terms may differ by location so make sure you are comparing each product.

Read More: Freedom Mortgage Reviews—Get All the Facts! (Customer Service, Complaints & Review)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.