Overview: Finding a Financial Advisor You Can Trust

You’re ready to start making a few plans for your financial future, but you aren’t quite sure how to invest your resources wisely. In order to put your affairs in order, you need to know how to find a financial advisor that has experience in handling investments and creating individual financial plans based on what you want your future to look like.

When it comes to finding a financial advisor, you could be looking at several different types of individuals In this article, we will focus on the two major types of financial professionals you might consider hiring.

A financial advisor is a broad term for a professional who offers advice or guidance related to your finances. A financial planner looks more specifically at creating a plan to help you meet your long-term (and short-term) goals.

Knowing how to find a financial planner you can trust is exhausting when you consider how many individuals exist without the proper training or qualifications to perform their job well.

Finding a financial planner doesn’t have to be difficult. AdvisoryHQ is here to help you figure out how to find a financial planner, how to choose a financial advisor, and how to figure out where to find a financial advisor. So, let’s dive right in to identify what any good financial advisor should be able to offer you before you start creating a future financial plan with them.

How to Choose a Financial Planner

If you want to know how to find a good financial planner, you have to know what to look for. You need to find a financial advisor that has real qualifications to perform the work you are hiring him/her for. If you’re struggling with how to find a financial advisor, the first step would be to find someone who is a Certified Financial Planner.

When you look at the individual’s business card, you want to see the letters “CFP” right behind his/her name. Certified Financial Planners, or CFPs, have completed a two-year course on creating financial plans and managing investments. Additionally, they are required to take continuing education credits to stay current on new information in their field.

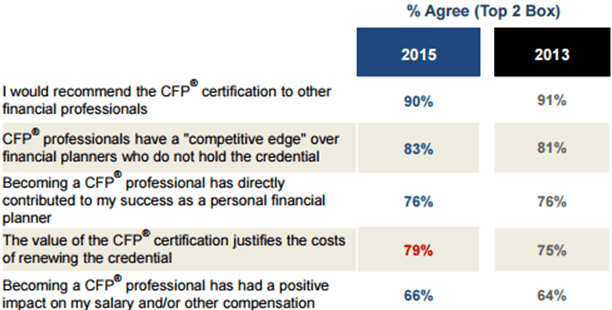

Consumers are so interested in how to find a Certified Financial Planner that 83 percent of certified individuals believe that their training gives them a competitive edge over planners who do not carry the same qualification.

Image from CFP survey

See Also: American Home Shield Warranty Reviews | What Does the Warranty Cover?

The other benefit to hiring someone with a certification is that individual’s fiduciary-level responsibility. One of the most important steps for how to find a financial advisor (especially for how to find a financial planner you can trust) is to find someone who identifies with this title.

A fiduciary obligates oneself to selling products and making recommendations that are in your best interest instead of being just suitable for your goals. There can be a world of difference between what is best and what is simply acceptable. A Certified Financial Planner who operates as a fiduciary pledges to do what is best for your investments and not necessarily what gives him/her a higher fee.

If you aren’t sure how to find a Certified Financial Planner in your area, you can search the CFP website for professionals located near you. If you think that you may already be well on your way to finding a financial planner, this search feature will give you a few leads. Even if you’ve already found someone, always be sure to double-check that individual’s certification through the official website to make sure the advisor is current with his/her education.

How to Find a Good Financial Advisor with Low Fees

There are several different ways for how to find financial advisor that receives payments on an ideal schedule for you. There are two common ways that you might pay a professional for the services rendered: fee or commission.

If you want to know how to find a financial advisor that charges fairly, Suze Orman recommends searching for a Certified Financial Planner who charges by fee. Other payment structures, including commissions, may encourage a professional to spend more time trading stocks or making short-term investments when a longer-term and more stable investment would better suit your needs.

The Wall Street Journal agrees that commission-based payment structures have a tendency to be less about your best interests than other payment methods. An advisor might receive a larger percentage for selling one product over another, regardless of which would be better for your portfolio. While not all commission-based advisors would fall into this category, there is a greater risk associated with it. Knowing how to find a financial advisor that charges fairly can help you avoid hiring someone who isn’t looking out for your best interests.

However, figuring out how to choose a financial planner based on his/her payment structure isn’t as simple as always hiring someone who charges by fee. A fee-based payment schedule might cause an advisor to encourage you to maintain assets even when it would behoove you to sell them. If the advisor’s fee is based off a percentage of your annual assets, liquidation would lead to decreased earnings for him/her even if it was more beneficial for you.

Be sure to look for “fee-only” payment structures instead of “fee-based” payment structures. Fee-based structures typically include a set fee in addition to commission. A fee-only payment structure might be based on an hourly rate or a total percentage of your annual assets but does not include commission.

Don’t Miss: Top Management Consulting Firms – Best Financial Consulting Firms

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Image Source: Pexels

Image Source: Pexels

How to Find a Financial Planner for the Middle Class

While the payment structures in the above section typically work well for individuals and families who have a lot of assets, learning how to find a good financial advisor for the middle class can be a different story. Some firms look more towards high-net-worth clientele and charge higher annual fees for accounts that invest less than $500,000.

Due to the extensive fees sometimes imposed on these smaller accounts, some middle-class families are figuring out how to find a financial advisor outside of the traditional venues. Several online outlets now offer financial planning services with real financial planners on staff at lower rates than you could receive through corporate financial planning. Examples of online financial planning programs include:

Image from Mint

Another thing to consider would be how to find a financial advisor that offers separate rates depending on your needs. Firms might offer one rate for suggestions and investment advice and a separate rate for managing your money. You get the opportunity to ask questions at a lower hourly rate than you would otherwise.

Hourly rates work out well for middle-class families who do not have a lot of assets to invest right away. The Wall Street Journal advises that if you are looking for how to find financial advisor to meet simple needs, an hourly rate works best. There are usually two scenarios when financial planners will charge an hourly rate:

- They are just getting started: When you think of how to choose a financial advisor, you probably don’t consider going to someone who’s just getting started. On the contrary, these individuals are usually willing to try extra hard to make your experience ideal so they can benefit from your future recommendations.

- They enjoy working with younger clients: Professionals who have been working in the financial planning field for any period of time know that the typical younger client cannot afford much more than an hourly rate. You may be able to find a financial advisor who enjoys this type of work and charges accordingly.

Where to Find a Financial Advisor

If you aren’t sure where to find a financial advisor, you don’t have to stress. Top rated financial advisors can be found all over the country. Finding a financial planner you can trust is easier than you might think.

To help get you started, AdvisoryHQ has compiled a list of some of the very best in order to help you figure out how to find a financial planner you can trust. This list includes firms from across the United States, and several within the United Kingdom as well, making it easy to find a financial advisor near your location.

Related: Is Gold a Good Investment Right Now? Investing in Gold, Silver – Buy Gold?

The financial advisors and firms on this list went through extensive research and due diligence before being reviewed. They were evaluated based upon fee structure, fiduciary duty, independence, and innovation first and foremost. After meeting those standards, they were then ranked on seven other criteria, including:

- Resource availability

- Experience

- Transparency

- Customized services

- Website quality

- Open-door policy

- Audience

While this is not an exhaustive list of every certified financial planner and financial planning firm available, it does provide a great starting point for how to find a financial advisor that you can trust to meet your needs.

Conclusion

Learning how to find a financial advisor does not have to be complicated. Financial planners you can trust are located all over the world if you know how to look for them, and they aren’t difficult to find. In fact, you can learn how to find a financial planner in just a few simple steps:

- Check the individual’s qualifications and certifications. Is he/she a Certified Financial Planner?

- Verify his/her fee structure. Will you be making hourly payments, fee-only, fee-based, or commission-based payments?

- Hear the financial planner’s recommendations for how to reach your financial goals. Have you done your own research to verify that what he/she is saying is true?

Once you know how to find a good financial planner, how to choose a financial advisor, and where to find a financial advisor that suits your needs, you will be well on your way to future financial freedom.

Finding a financial planner is as simple as checking a few boxes and finding the right person to help you achieve your goals, whether that person happens to communicate with you via email, phone or in-person. There is no wrong way to work with someone, as long as you know how to find a Certified Financial Planner and fiduciary that will look out for your best interests.

Popular Article: Overview of Professional Liability Insurance Companies. What Is Professional Liability Insurance?

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.